Today’s inflation print was another classic divide between pragmatists and purists.

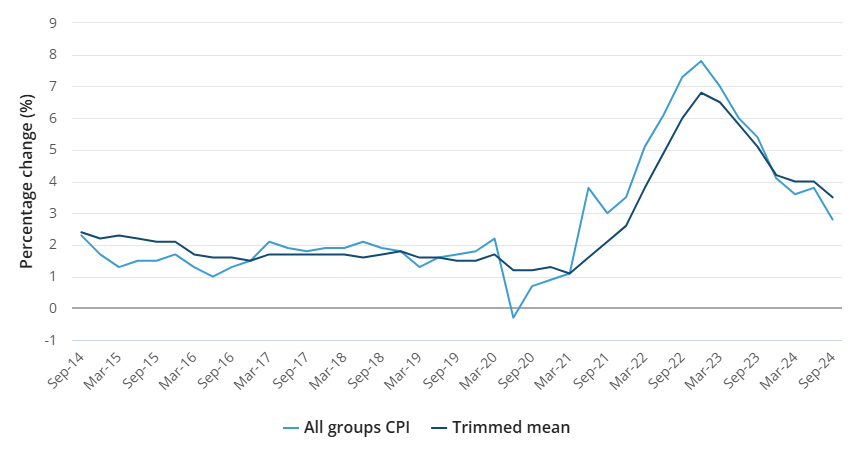

Headline inflation is falling fast and will keep doing so as rents, goods, food, energy and administered prices all cool. The RBA needs to cut.

However, trimmed mean inflation is still stubbornly above target at 3.5% because it does not include cost-of-living rebates. The RBA will want to hold on that.

The RBA has so far focused on the latter over the former on the presumption that the rebates will be temporary.

But they aren’t. Assuming the rebates will be removed is politically naive, even stupid, and the RBA should get off its high horse and accept the energy relief payments are here to stay.

Unless or until the East Coast gas cartel is addressed, at which time energy prices will tumble anyway.

A little game theory urges immediate rate cuts.