JPM notes that markets are pricing for Trump trades.

1. All in on Trump Themes? Hedge Fund flows have shown a strong preference for Republican themes with Rep Winners (JPREPWIN) bought over the past few weeks, putting positioning near ~2yr highs, while Dem Winners (JPDEMWIN) were sold throughout the year and positioning at multi-year low. The relative Rep vs. Dem flows have shifted from -2z a few weeks ago to +2z over the past 10 days. Renewables (JP11RNEW, a clear proxy for a Dem win) have been sold a lot in the past couple weeks and positioning is turning more bearish again.

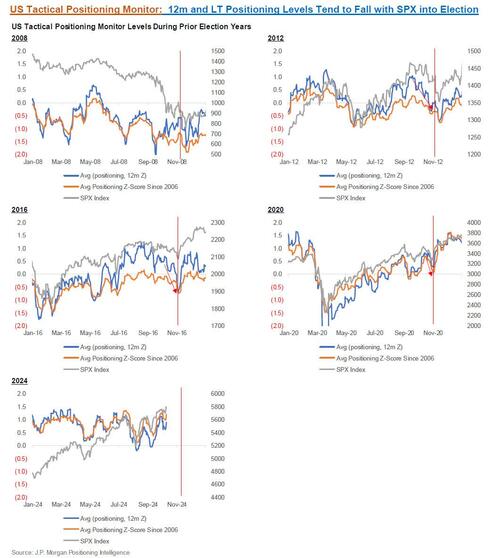

2. Flows Turning Positive & Positioning Relatively High Ahead of Election (vs. Prior Cycles). HF and ETF flows have been turning more positive lately and 4 week HF net flows have shifted materially from -2z in early Sep to +1z most recently. Overall positioning level for US equities remains somewhat elevated (+1.0z, >90th %-tile) and in prior election years since 2012, both positioning and SPX returns have tended to trend lower in the weeks heading into the election.