Earlier this week, The Australian’s James Kirby used Victoria’s property tax reforms as a cautionary tale of why negative gearing should not be reformed.

“Victoria is a test case of what happens when investors face tax changes – a recent string of new state-based property taxes has triggered an investor exodus from the state prompting Kelly Ryan of the Real Estate Institute of Victoria to suggest “investors are leaving the Victorian market right now like nothing we have ever seen before”.

“Ironically, investors are leaving Melbourne even when the city has a vacancy rate of less than 2%”.

“Like it or not, the rental market is run by investors who depend on the current tax regime. If the terms change, then investor behaviour changes quickly, as Victoria is finding out the hard way”, Kirby said.

Ray White chief economist Nerida Conisbee also claimed that burdensome taxes have stifled investment, which will push up rents.

“The more taxes you put on, the more of a handbrake it is for the economy, but also for development in Melbourne”, she said.

“Whatever you do to taxation, there are always winners and losers; if you tax investors more, that means more paying for renters, but tends to be better news for first-time buyers”.

Meanwhile, PropTrack economic research director Cameron Kusher explained that Victoria’s property changes have benefited first-home buyers.

“Landlords are exiting the market; this is giving first-time buyers some opportunities to enter the market as well”, Kusher said.

CoreLogic’s latest monthly chart pack illustrates in no uncertain terms how Victoria’s property tax reforms have benefited first-home buyers.

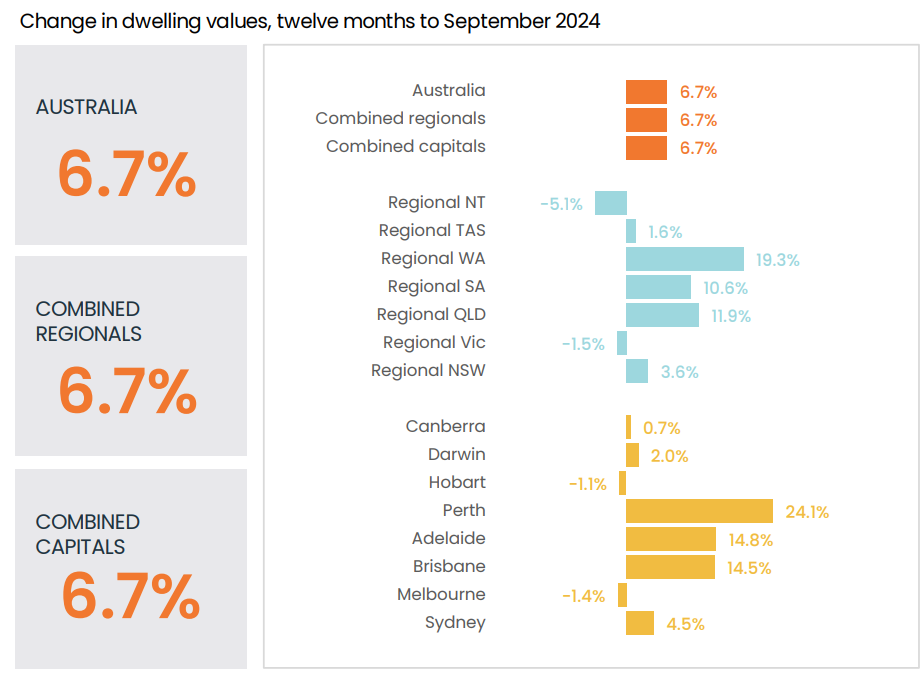

First, dwelling values in Melbourne and Victoria have lagged well behind the other major jurisdictions:

Source: CoreLogic

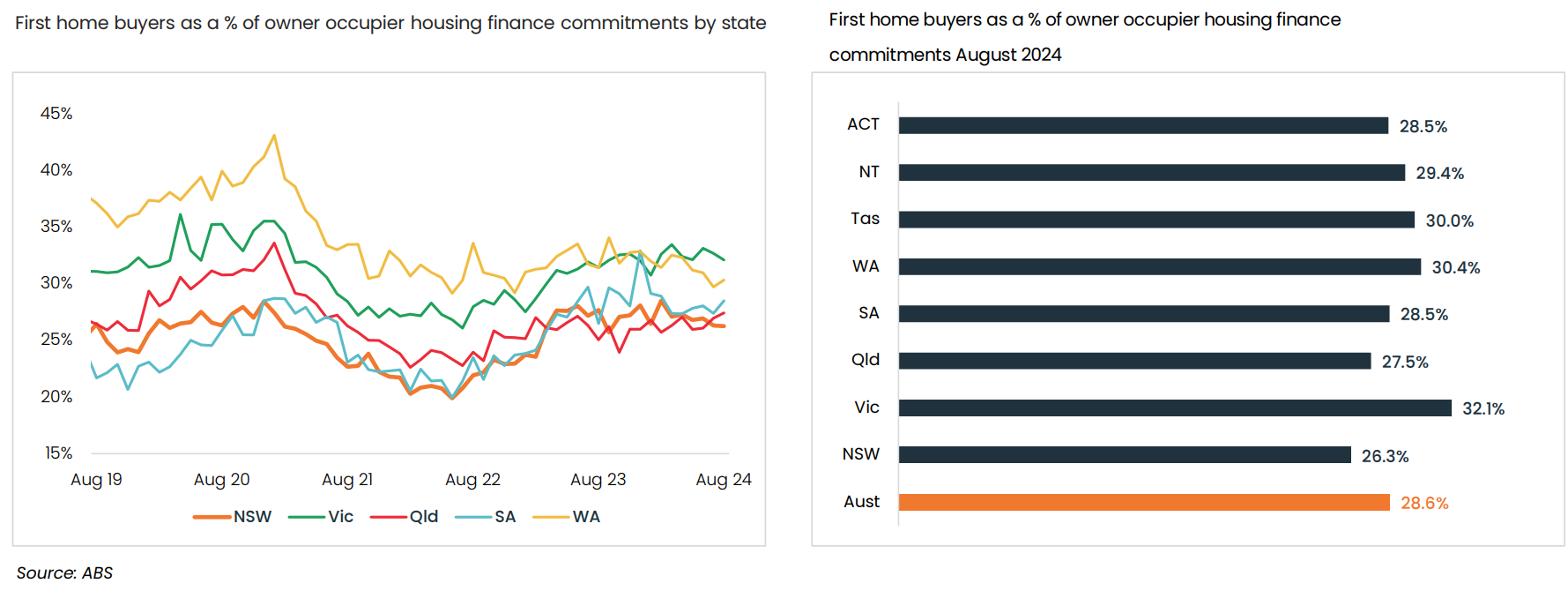

Second, the share of mortgages going to first-home buyers is easily the highest in Victoria (32.1%) compared with the rest of the nation (national average = 28.6%):

Source: CoreLogic

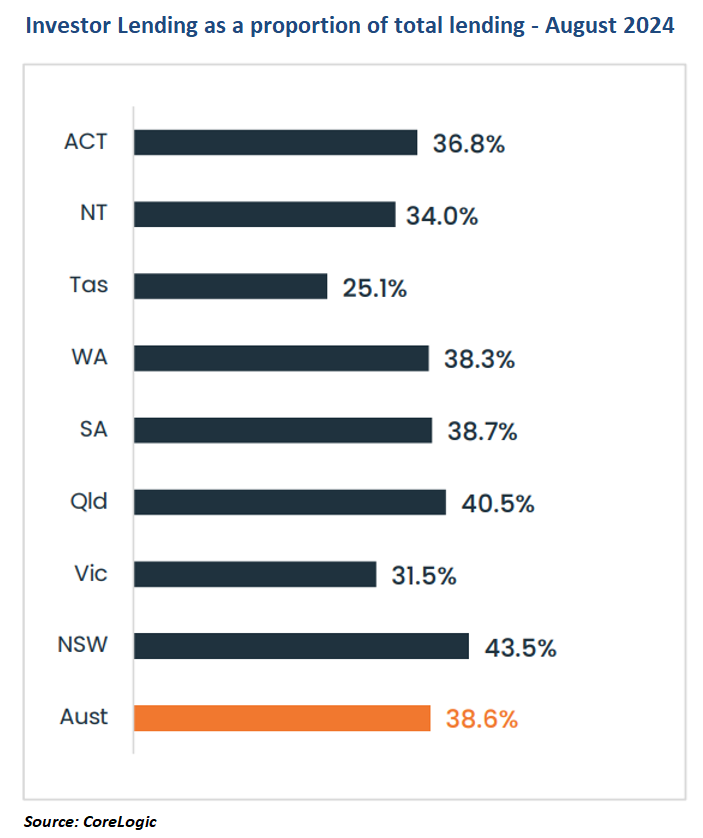

The flipside is that the share of mortgages taken up by investors is also far lower in Victoria (31.5%) than the other major jurisdictions (national average = 38.6%):

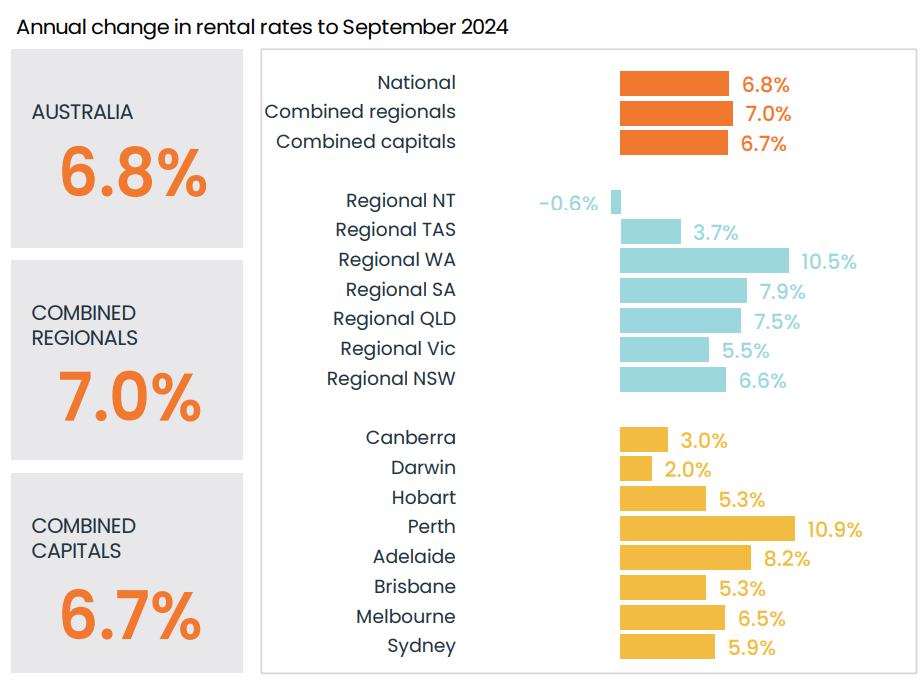

Finally, there is no proof that the ‘exodus’ of investors from Victoria is raising rents.

Victoria’s rental growth has also lagged the national average:

Source: CoreLogic

Logically, curbing property tax concessions like negative gearing would have a similar impact as what is being experienced in Victoria.

It would place some moderate downward pressure on house prices, lift the share of first-home buyers in the market, and increase the overall home ownership rate.