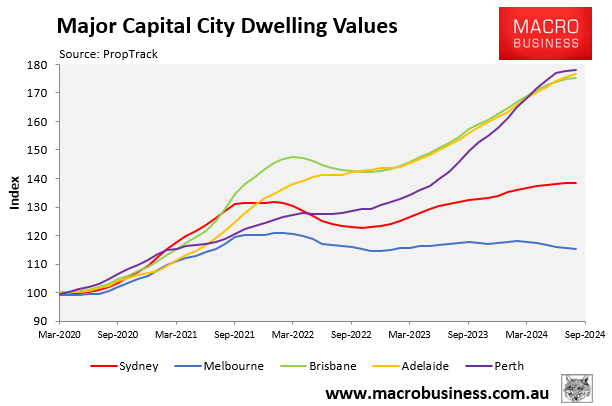

According to PropTrack, Western Australian home values have risen the most since the beginning of the pandemic in March 2020, rising by 78%:

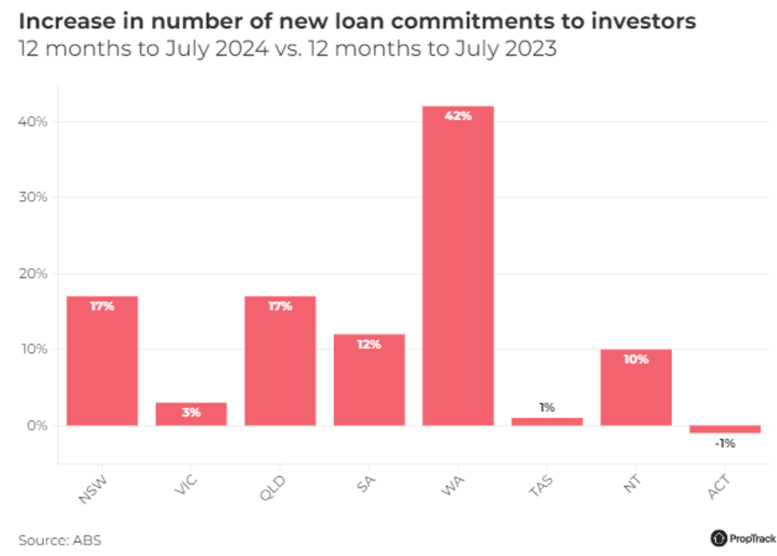

A boom in investors has driven part of this price increase.

The following chart from PropTrack shows that the number of loan commitments to investors surged by 42% in the 12 months to July 2024:

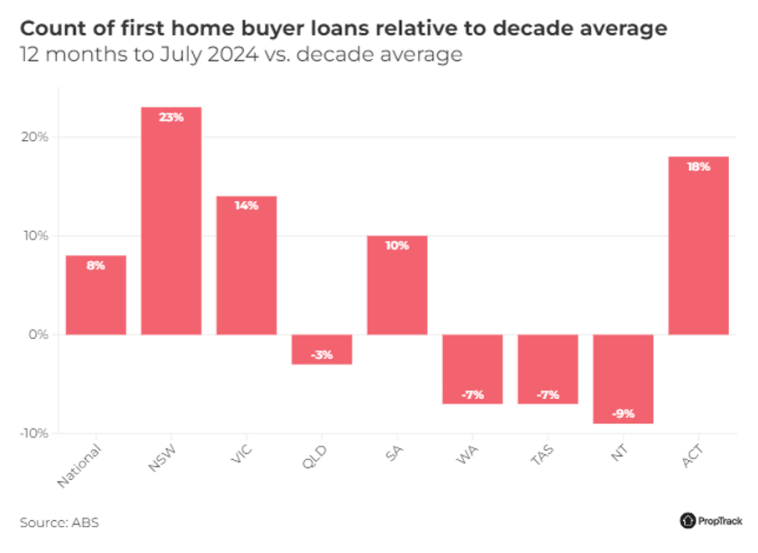

At the same time, the number of first home buyer mortgages was tracking 7% below the decade average in July 2024:

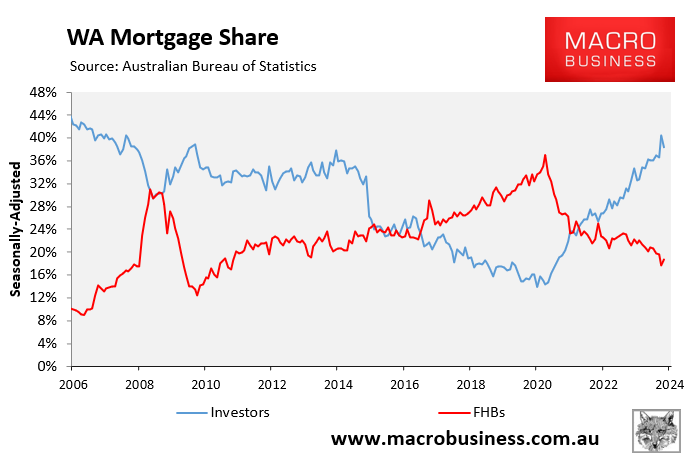

The following chart shows that investor and first home buyer mortgages are negatively correlated in Western Australia, with the former crowding out the latter:

The other factor negatively impacting first home buyers in Western Australia is the state’s explosive immigration.

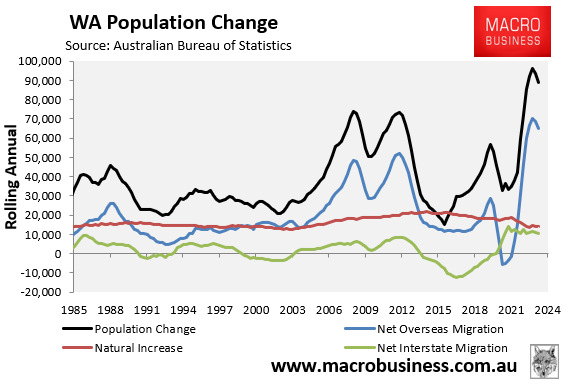

As illustrated in the following chart, Western Australia’s population grew by 89,000 in the year to March 2024, with 64,900 coming from net overseas migration and 10,700 coming from net interstate migration:

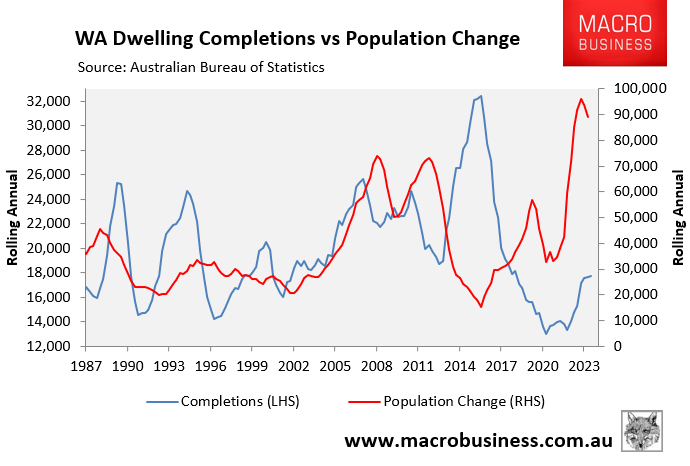

This extreme immigration has overwhelmed housing supply, with only 17,700 dwellings built in Western Australia in the year to March 2024:

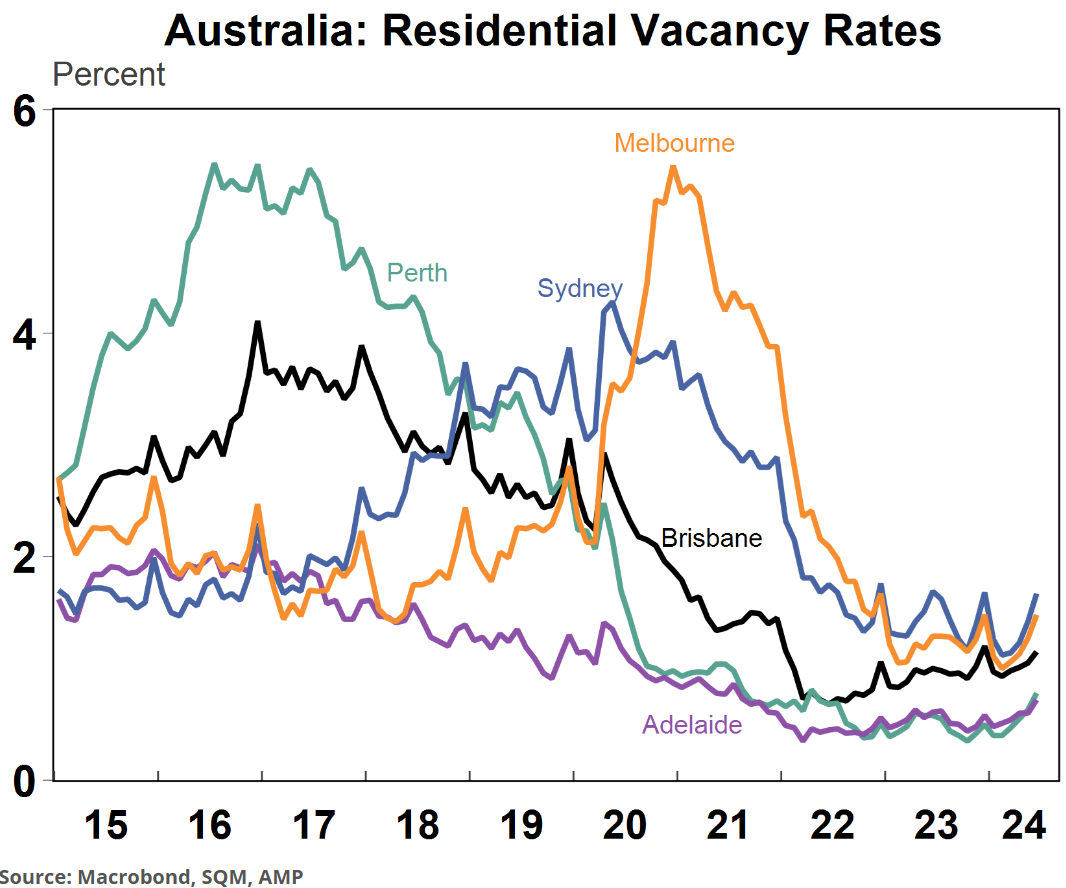

This surge in population has driven Western Australian rental vacancy rates below one percent:

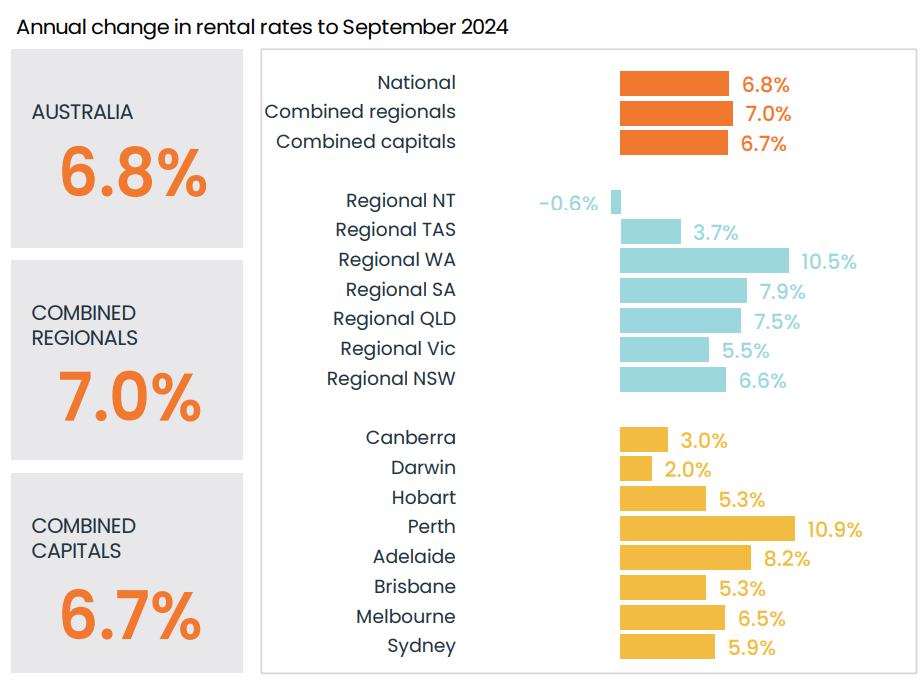

As a result, Western Australia recorded double-digit rental growth in the year to September, easily the strongest growth in the nation:

Source: CoreLogic

Prospective Western Australian first home buyers have, therefore, been shafted by a perfect storm of forces, namely:

- A surge in competition from investors, which has crowded them out.

- A record surge in immigration has driven up prices and rents, making it harder to save a deposit and increasing the purchase cost of housing.