Sometimes reading the AFR is like shooting fish in a barrel:

Local borrowers are getting restless and wondering why Reserve Bank of Australia governor Michele Bullock says the RBA board does not expect to cut interest rates this year based on its economic outlook.

There is both a simple and more technical explanation.

The simple reason is Australia’s interest rates rose later and by less than comparable advanced economies.

But it is now taking longer to squeeze inflation in Australia than in countries that raised interest rates more aggressively.

…Hence, the RBA will take longer to cut interest rates.

This is just plain wrong.

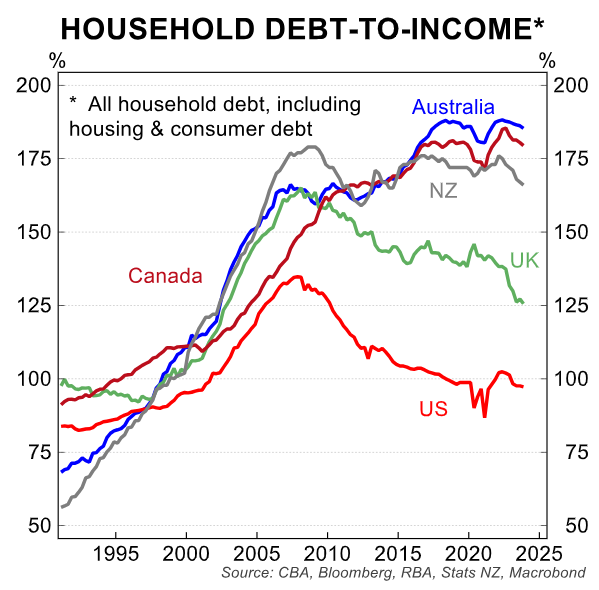

Australia is a consumption driven economy and it has the highest household debt in the world.

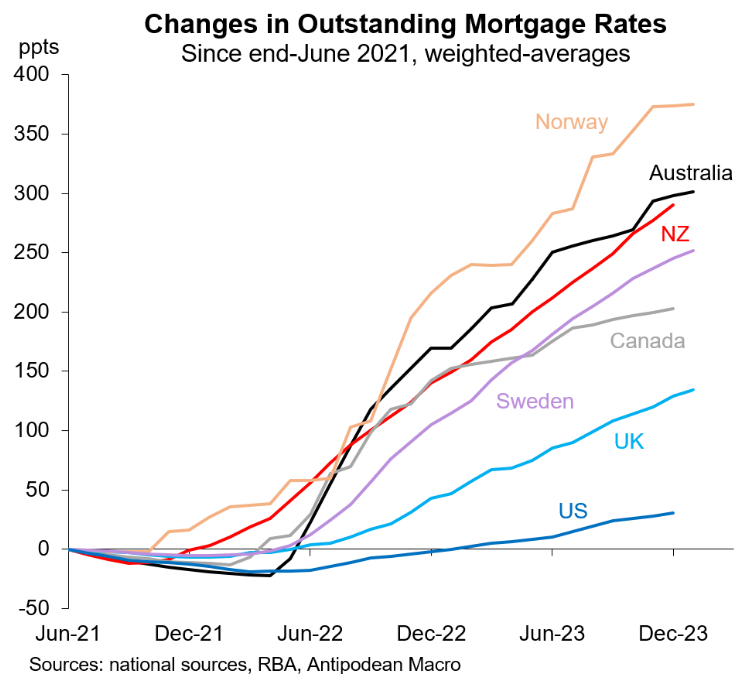

This makes the Aussie economy uniquely sensitive to interest rates because its floating mortgage tighten the screw on household disposable income much faster than elsewhere.

In real economic terms, this means the RBA tightened more than everywhere except Norway:

There are several other factors to consider.

Australia had a second wave of inflation that nobody else had, thanks to huge blunders by Treasurer Jim Chalmers in failing to tackle the gas cartel, and unleashing a massive immigration shock.

Utility bills and rents went nuts.

But both of these are now in reverse and will continue to be so.

Inflows of the students that gobble up rental properties are slowing, even the stock is supported by visa scamming.

Bill rebates are crashing energy inflation.

The RBA argument that higher trimmed mean inflation matters more than lower headline inflation is about to collapse as the government renews energy rebates and persists with student visa cuts.

This means headline inflation is already well within the RBA’s target band and is about to weaken further.

Moreover, roughly 20% of the CPI is administered prices such as grog, tobacco, education, health, award ages, pension etc.

All of these are benchmarked to collapsing headline inflation not trimmed mean and will also collapse over 2025.

With award wages slowing, Aussie wage growth will get slashed below 3% over 2025.

We never had a wage-push inflation cycle and now the growth of pay is going retrace.

Finally, the Chinese stimulus path remains weak and national income will be pressured across 2025, with worse to follow in 2026.

The RBA probably won’t go 50bps in December like the RBNZ did yesterday.

Regardless, not only is the RBA going to pivot and cut hard before Xmas, it will be forced to cut much deeper than other economies over the next two years.

Hapless AFR hawks will doubtless screech all the way down.