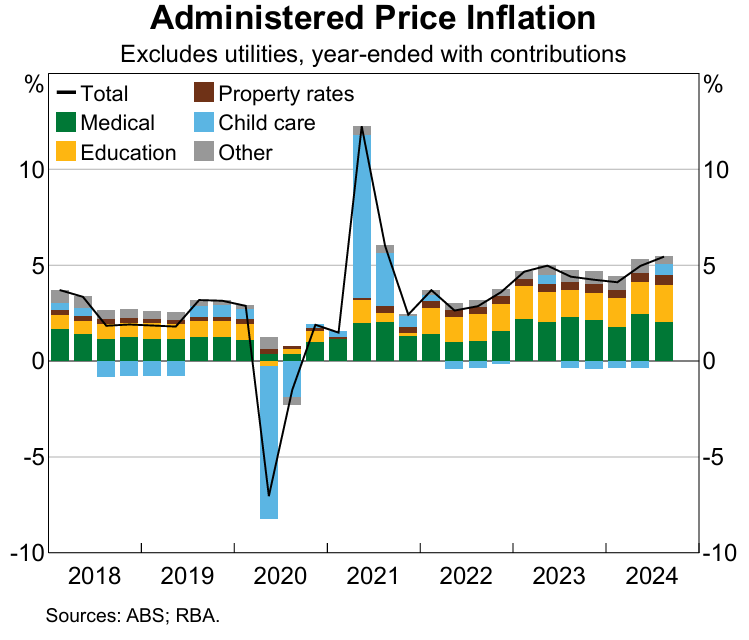

The November Statement of Monetary Policy (SoMP) from the Reserve Bank of Australia (RBA) included the following chart showing so-called “administered price inflation” with utilities removed, which are those prices that are (at least partly) regulated or relate to items for which the public sector is a significant provider.

These prices are largely unaffected by changes in monetary policy.

As you can see, the administered price series has momentum, running above 5% in annual growth terms, meaning they will continue to place upward pressure on overall CPI for now.

The RBA SoMP explained the chart as follows:

The recent increase in year-ended inflation largely reflected the 2023 changes to the Child Care Subsidy no longer having an effect.

The earlier strong pace of headline inflation continues to place some upward pressure on year-ended administered price inflation, as some administered prices are indexed to lagged CPI.

Looking further ahead, the news is better. The Albanese government’s energy and rent subsidies artificially lowered headline CPI to just 2.8% in Q3 2024.

Given that administered prices are typically set against headline CPI, this means that administered price inflation will eventually fall sharply as well.

The same applies to fuel and tobacco excise, which are indexed to headline CPI, as are government-provided pensions and JobSeeker allowances.

Therefore, the Albanese government’s energy and rent subsidies will eventually help to lower broader inflation via reduced indexation. However, the impact will be lagged.