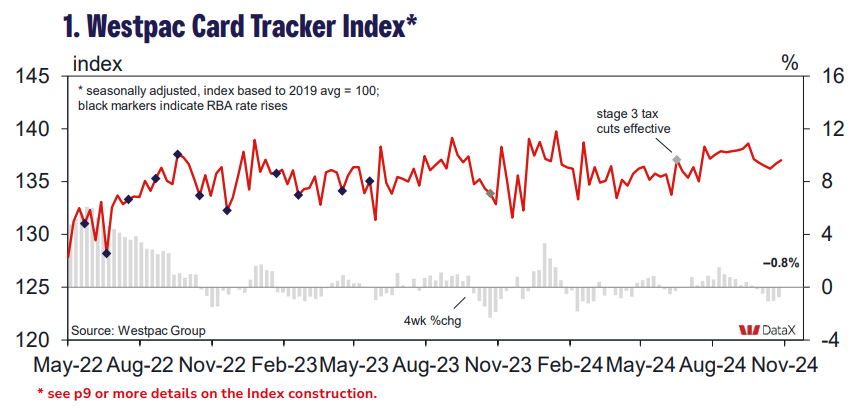

Westpac’s credit card index is going absolutely nowhere.

The Westpac Card Tracker Index* saw a modest improvement over the last fortnight, rising +0.8pts to 137 for the week ended November 16. This keeps the Index broadly aligned with October levels, but slightly below the Q3 print.

Despite the modest lift, the quarterly growth pulse has eased back to +0.9%qtr, down from +1.1%qtr recorded two weeks ago, which was tracking in line with the Q3 pace. That reflects a pull-back through most of October, with monthly growth momentum still tracking in the –0.4-0.8% range.

The category breakdown shows spending on discretionary goods, particularly housing-related goods, gathering momentum over recent months. In contrast, discretionary services has been losing steam; a further moderation expected given the negative monthly growth pulse recorded across all of the detailed sub-categories.