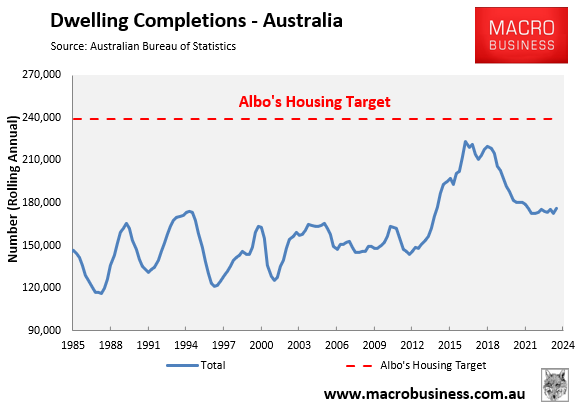

The hits keep coming for Australia’s housing construction industry, which is failing dismally to meet the Albanese government’s target of building 20,000 homes a month, 60,000 homes a quarter, 240,000 homes a year, and 1.2 million homes over five years.

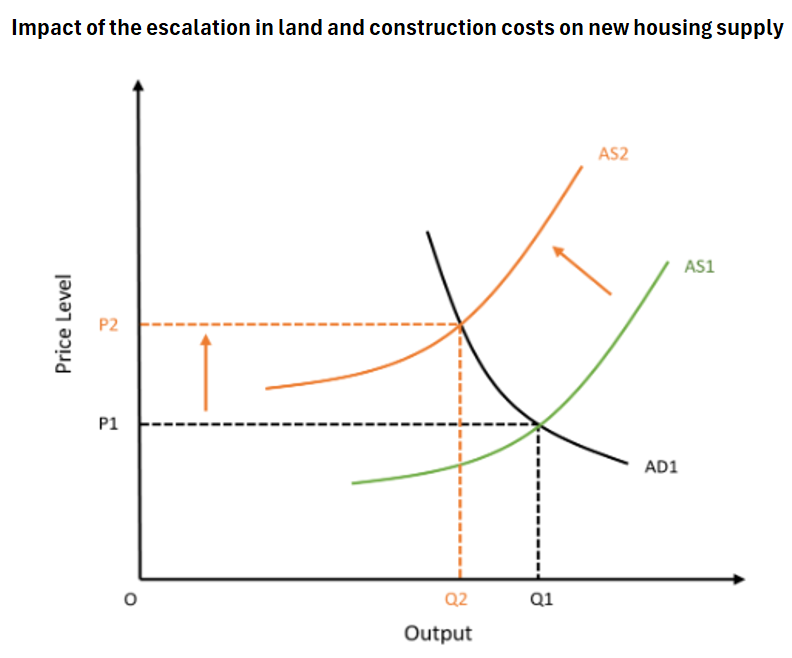

Various forces are impacting the home-building industry, reducing capacity and effectively shifting the supply curve to the left, making it more expensive to build homes at each price point.

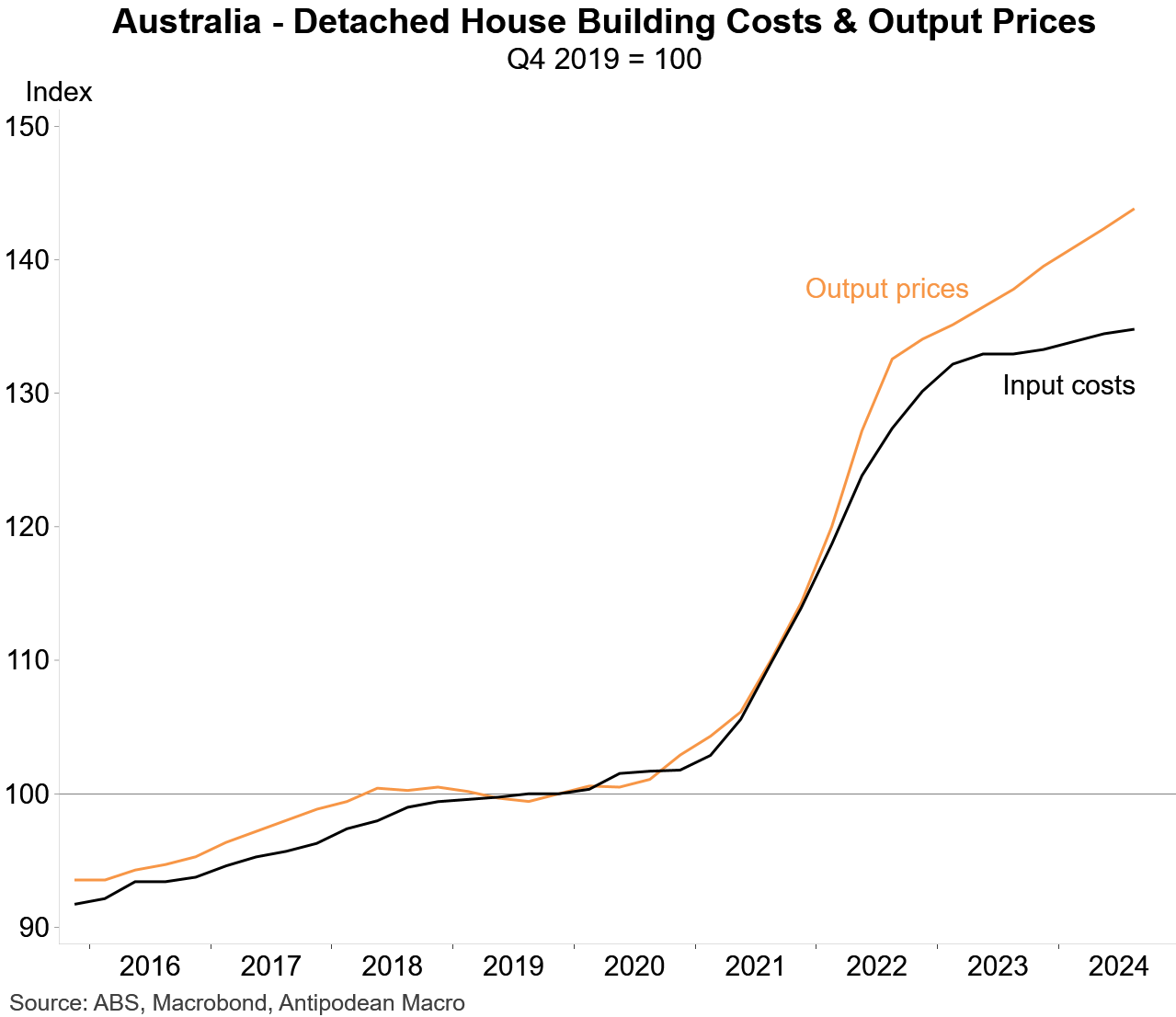

First and foremost, materials and labour costs have risen by around 40% since the start of the pandemic. This cost-push inflation has significantly raised the price of newly built homes, choking buyer demand.

Second, interest rates are structurally higher today and will remain so for the foreseeable future, further increasing the cost pressures facing developers and buyers.

Third, thousands of home builders have collapsed over recent years, reducing capacity across the industry to supply new housing.

Finally, much of Australia’s construction capacity has shifted to government big build infrastructure projects, offering workers higher pay for less risk.

The result is that it costs far more today to build a home than before the pandemic.

Indeed, Lendlease’s Tony Lombardo told the Australian Financial Review’s housing roundtable that building a high-rise apartment block costs 25% to 30% more than it did only three years ago. Half of the cost increase is labour, and the other half is materials, according to Lombardo.

Stockland’s Tarun Gupta said that the developer had decreased its average block size by 15% to 330 square metres to make them more affordable for first-home buyers. However, interest from those buyers has still plummeted.

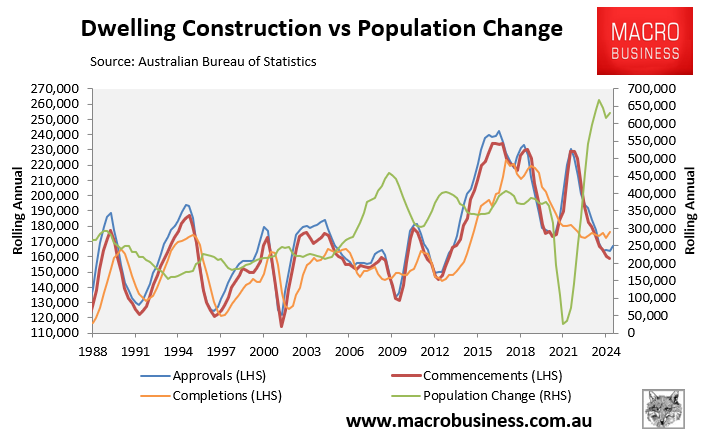

Macroeconomic dwelling construction data from the Australian Bureau of Statistics (ABS) shows that approvals, commencements, and completions are each tracking near-decade lows while Australia’s population continues to rise strongly via net overseas migration.

For example, only 159,000 dwellings commenced construction in the year to 30 June 2024, 81,000 fewer than the Albanese government’s 240,000 housing construction target.

Only 167,300 dwellings were approved for construction in the year to 30 September 2024, 72,700 fewer than the Albanese government’s 240,000 housing construction target.

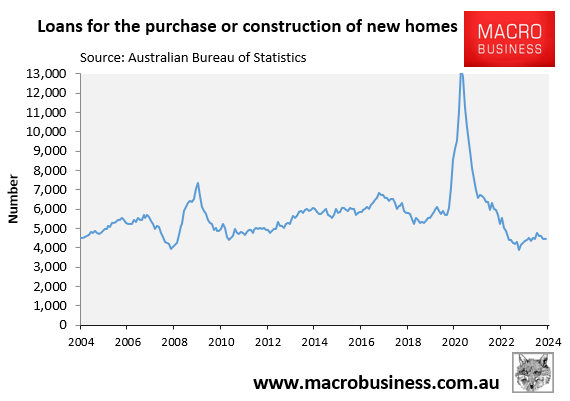

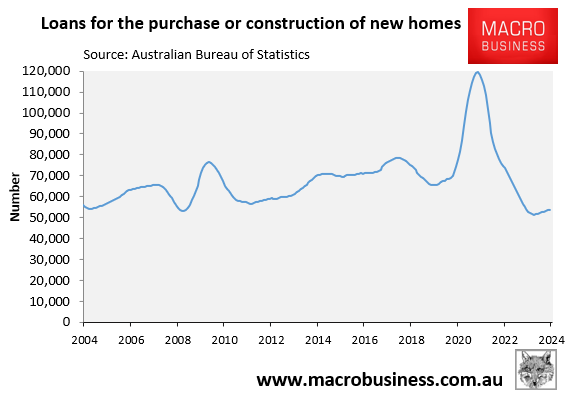

On Friday, the ABS released data on the number of loans taken out for purchasing or constructing newly built dwellings.

As you can see below, only 4435 of these loans were taken out in September 2024, close to all-time lows.

The following chart presents the same data on a rolling annual basis and shows that the number of new home finance commitments is tracking at around half their 2021 peak at near-record-low levels.

With the supply side of the housing market severely constrained, there is a near-zero probability of meeting the federal government’s housing targets. Even meeting the construction peak of the last decade will be a herculean task and is highly improbable.

This means that the only genuine solution to Australia’s housing shortage is to bring demand in line with supply by slashing net overseas migration.

In economics jargon, the demand curve must also shift left.