Australia’s auction market continues to lose momentum, pulling down Sydney and Melbourne’s house prices.

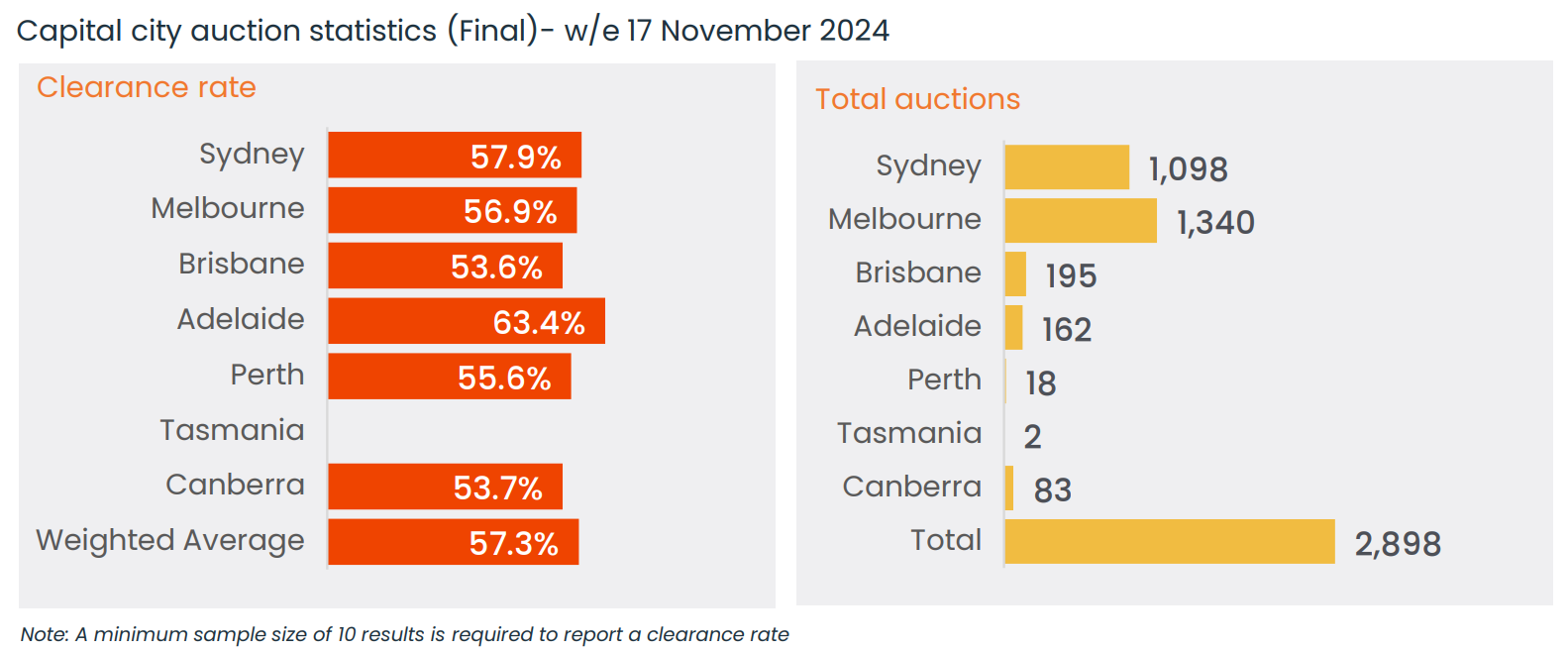

CoreLogic’s final auction results for last week reported a national clearance rate of only 57.3%, with all markets reporting weak results.

Source: CoreLogic

The national clearance rate has come in below 60% for five consecutive weeks. The result was also significantly below the 62.4% result recorded at the same time last year.

Melbourne’s clearance rate slipped to 56.9% last week, the city’s second-lowest rate of the year. It was also well below the 61.2% final clearance rate recorded at the same time last year.

Sydney’s final clearance rate was also weak, coming in at only 57.9% last week. This time last year, 63.9% of Sydney auctions were successful.

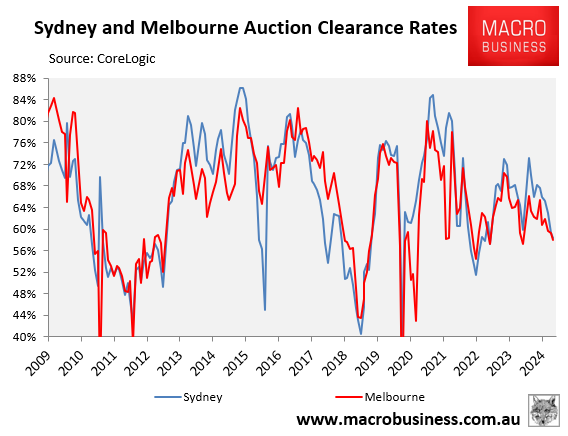

The following chart plots clearance rates on a monthly average basis across Sydney and Melbourne:

Both cities’ monthly average clearance rates have fallen to 58%, which is the lowest reading of the year.

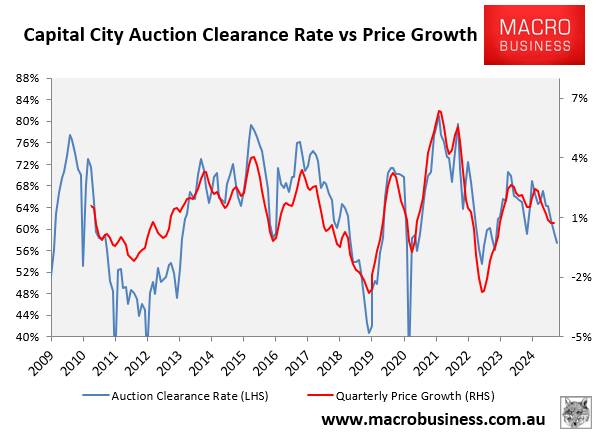

The correlation between auction clearance rates and prices is illustrated clearly in the following chart.

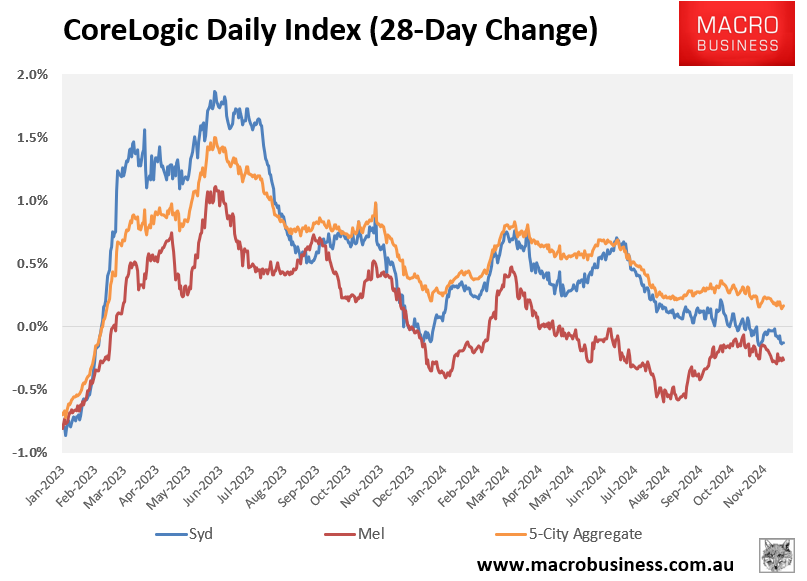

Not surprisingly, then, CoreLogic’s daily dwelling values index has recorded falling dwelling values across Sydney and Melbourne over the past 28 days.

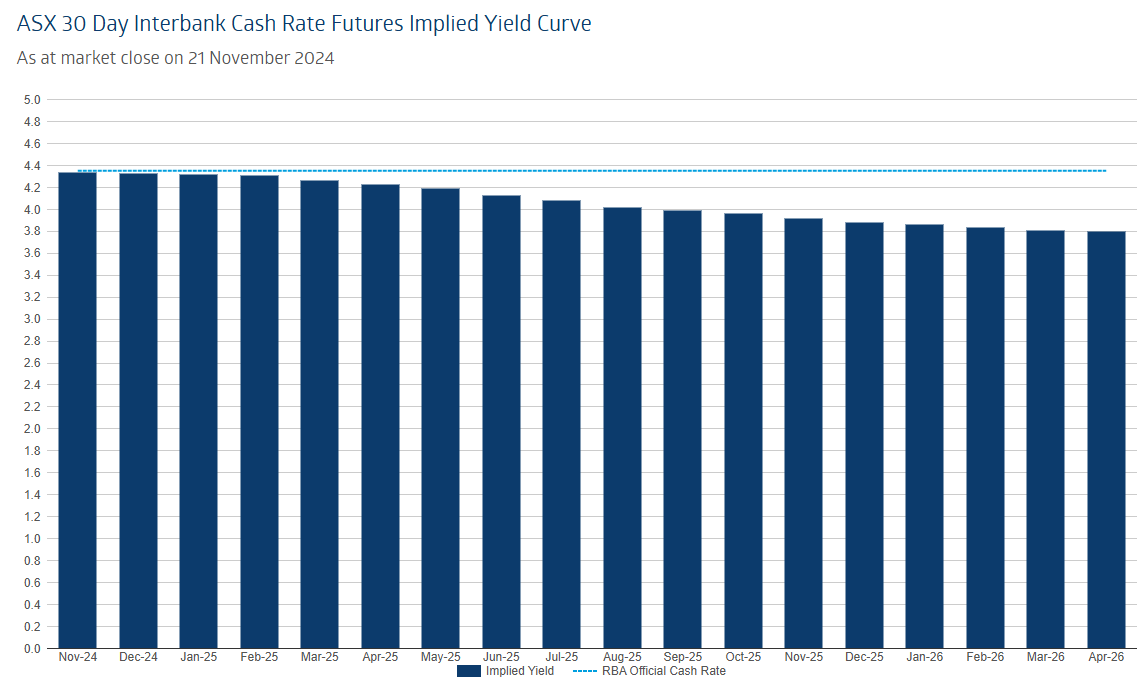

Both cities are likely to remain in a bear market until the RBA commences its next monetary easing cycle.

According to the latest market forecasts, interest rate relief will arrive mid-next year.

If true, expect further solid price falls for Sydney and Melbourne.