The AEMO and other energy regulators are worried that Australia will suffer from severe gas shortages in the coming winter and every winter after that.

They are behind the times. The East Coast gas cartel has delivered a permanent winter to Aussie energy prices.

Whenever there is a price shock anywhere, including during northern hemisphere winters, the export cartel immediately brings it back to Australia.

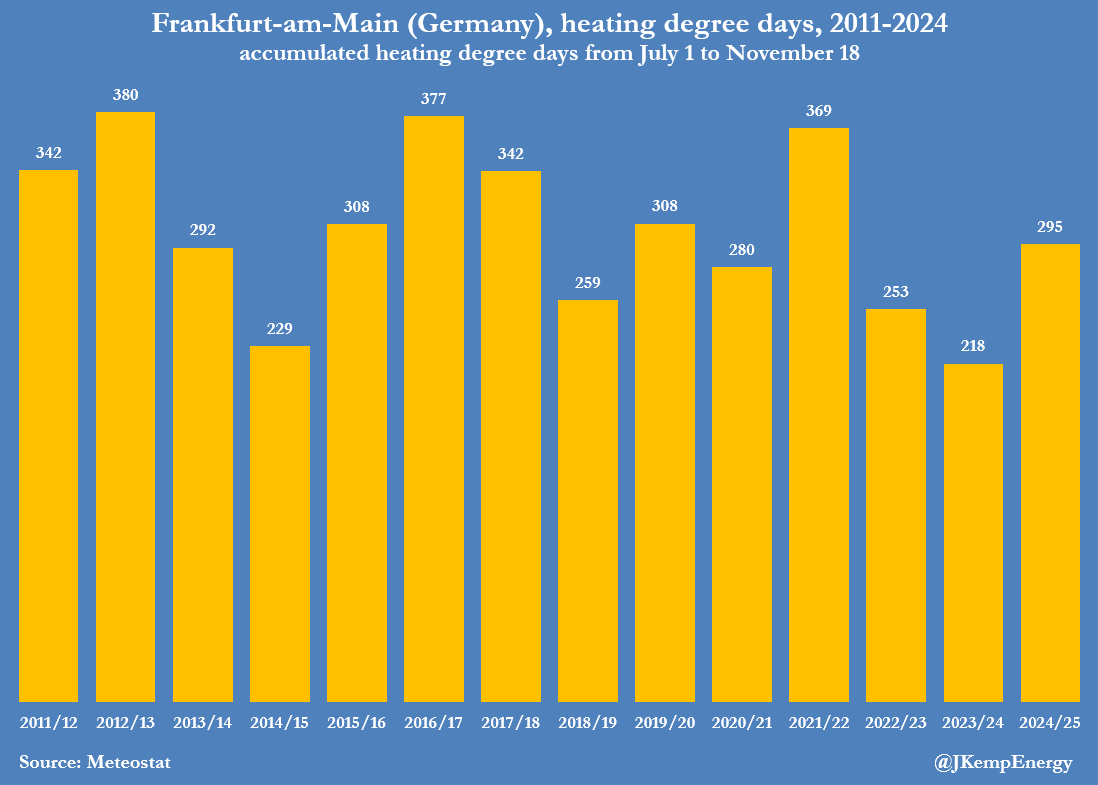

Today, Europe has started the winter with a chillier blast than the last two years.

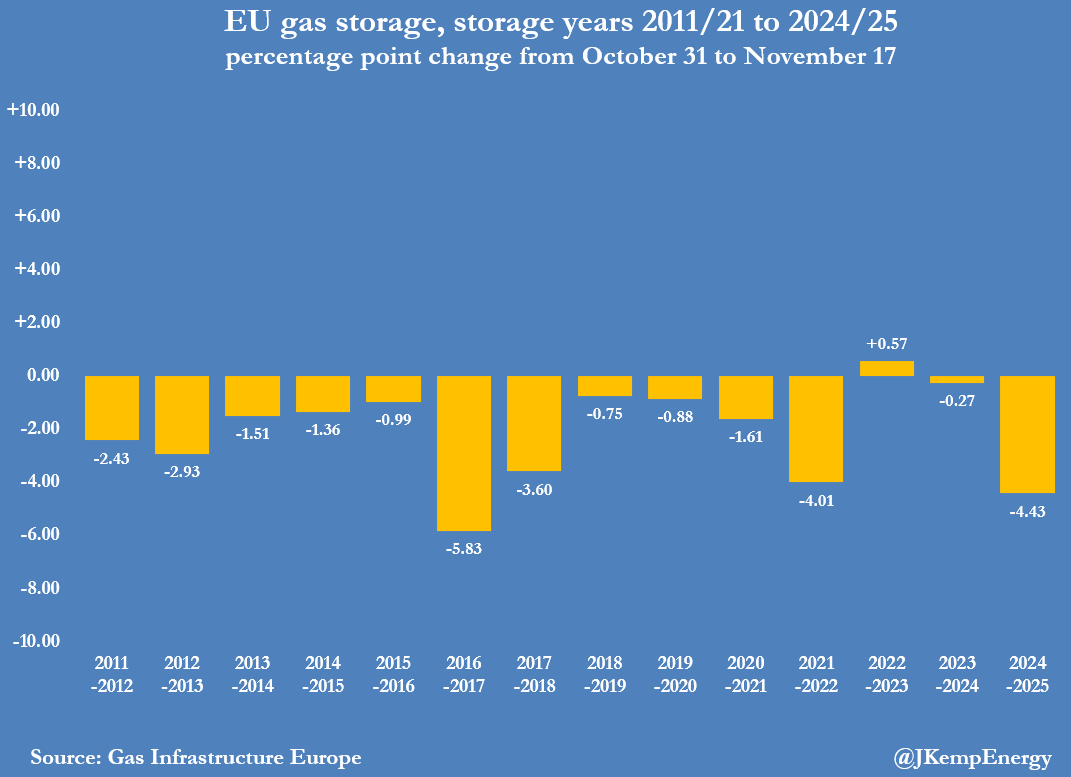

Storage has come off faster.

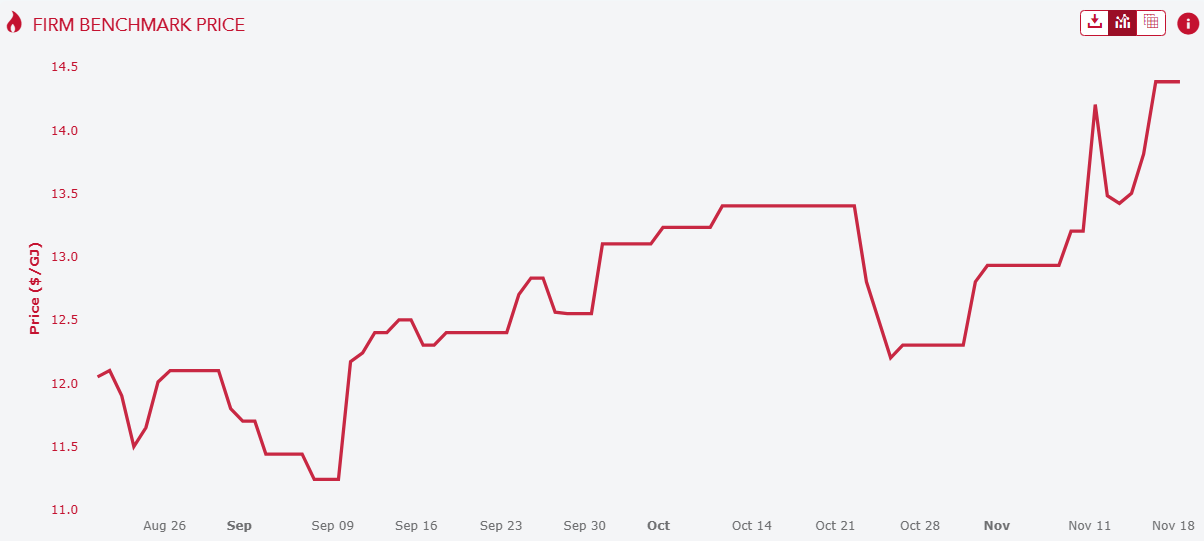

This has popped both European and Asian gas prices.

And here we are in our gas off-season, watching local prices go nuts as the East Coast gas export cartel brings the prices home.

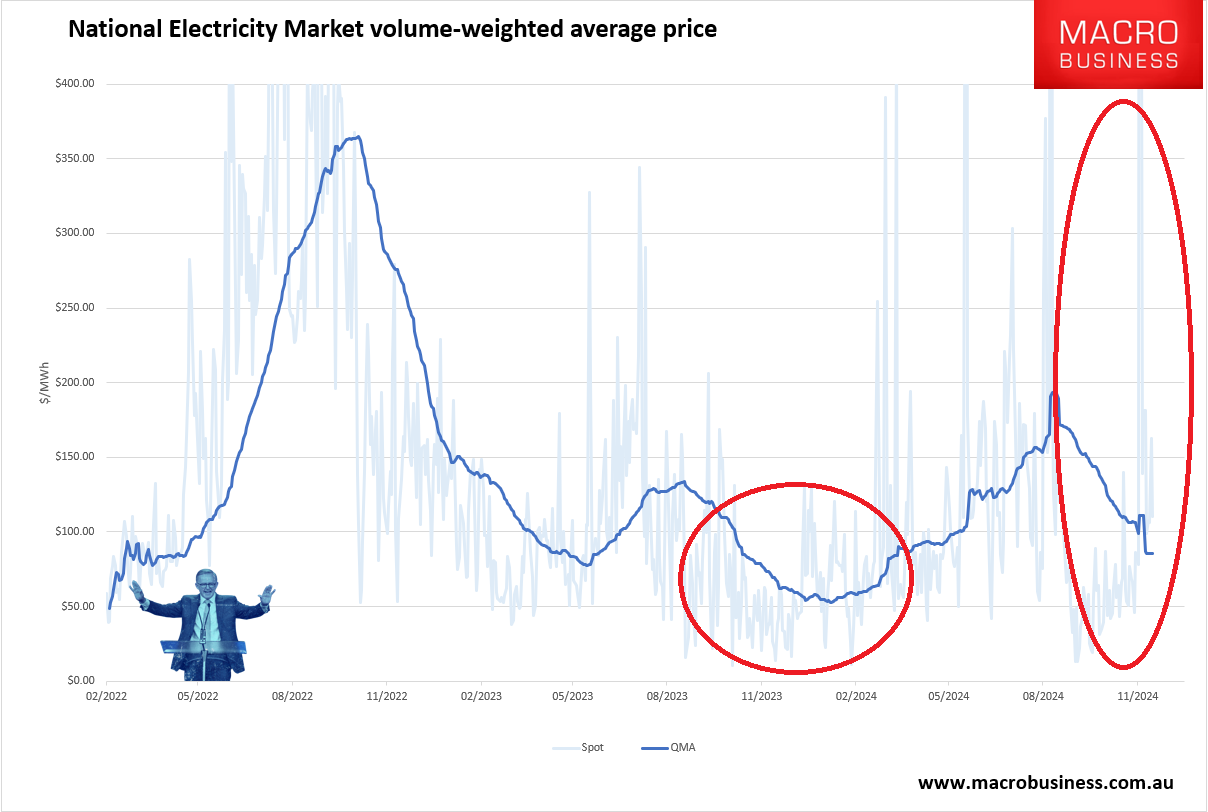

Dragging up power prices versus last year, which was much more typical. QMA prices are up roughly 20% year on year.

US gas prices are at $4Gj, which is where ours would be with effective domestic reservation. Like there, it would raining rate cuts and real incomes would be rising.

As we are seeing in the disjunction between monetary and fiscal policy, no economy can prosper (or even survive) while a giant energy winter settles over it 365 days per year.

Energy rebates will not only be renewed; they have to grow.