Australia’s governments hope to ‘solve’ the housing crisis by pushing residents into living in high-rise apartments.

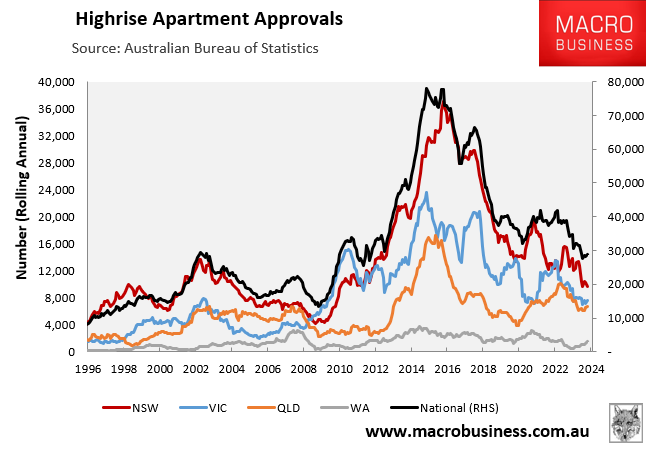

However, high-rise apartment approvals have collapsed, as illustrated in the following chart:

High-rise apartment approvals have decreased 63% nationally since their 2015 peak, with sharp declines in New South Wales (-74%), Victoria (-68%), and Queensland (-60%) being the main contributors.

Sydney developer Luke Berry, founder of Thirdi Group, warned that the ongoing supply crunch combined with rising demand would fuel sharp rises in apartment prices in the coming year.

“Very few apartment projects are going ahead at the moment because it’s very hard to make them stack up due to high costs, so there’s going to be bigger supply issues in the next couple of years”, he said.

“I think as soon as interest rates start to fall, maybe middle of next year, there’s going to be renewed interest in new apartments and there’s not going to be enough supply”.

Rich Harvey, chief executive of Sydney-based buyer’s agency Propertybuyer agreed, noting that apartments will be the only thing that younger buyers could afford when they have lower deposits to get into the market.

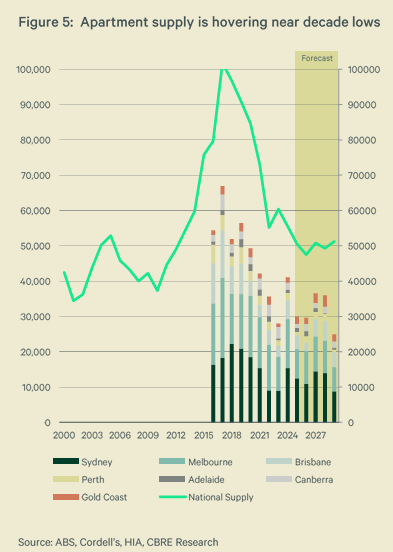

The latest forecasts from CBRE suggest that overall apartment supply nationally would average only 50,000 units annually between 2025 and 2029.

This level of construction would be around half the level of last decade’s peak and would be well below the rate of supply required to keep pace with projected population growth.

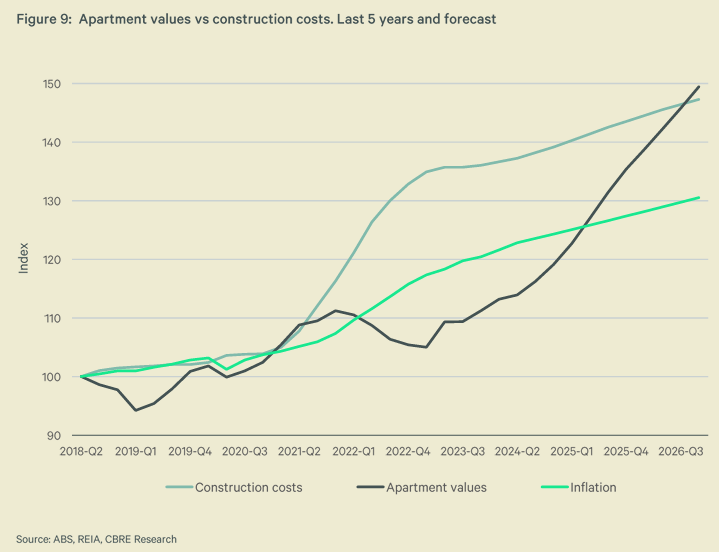

CBRE also projected that apartment prices need to increase significantly to make construction feasible for developers, given the rise in costs since the pandemic.

“That disparity [between prices and costs] is currently at 23%”, said Sameer Chopra from CBRE. “We expect this gap to close out and revert to a premium”.

“In our view, apartment values will need to accelerate significantly higher to entice developers”, he said.

Charter Keck Cramer also believes that apartment prices for new and established stock need to rise to make development financially feasible. However, such price rises risk choke out demand from prospective buyers.

“Because building costs have jumped by 30% to 40%, prices have to basically go up to be about 30% higher compared to pre-pandemic levels”, Charter Keck Cramer national executive director of research Richard Temlett said.

“The prices of established units need to recalibrate upwards by around 15% for new stock to be accepted by the market at current price points”.

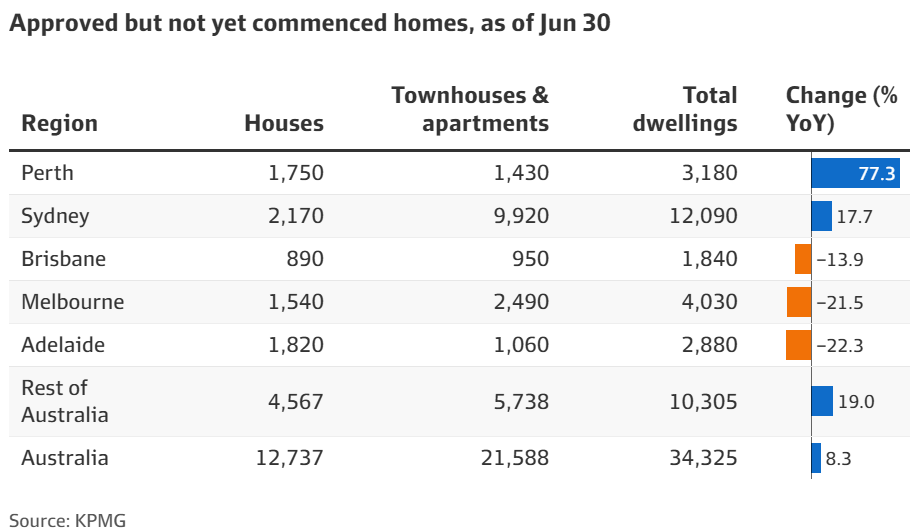

Recent analysis from KPMG estimates that more than 30,000 new homes have been approved but not started nationally, with most being apartments and townhouses.

“With all the construction price increases and where interest rates have landed, it’s hard for developers to make those more medium to high-density projects stack up”, explained KPMG urban economist Terry Rawnsley.

“Sometimes people also forget that interest rates also impact on the developer side as well – it means they can’t borrow as much to get the projects up and running”.

It is difficult to see the construction environment improving anytime soon given the following factors:

- Interest rates are likely to remain structurally higher for longer.

- Construction costs have increase by around 40% since the beginning of the pandemic.

- Thousands of home builders have collapsed.

- Builders are competing with government ‘big build’ infrastructure projects for labour and materials.

With apartment supply likely to remain stillborn for the foreseeable future, the federal government must restore balance to the market by significantly cutting population demand via lower immigration.

Otherwise, Australia’s housing crisis will become permanent.