DXY has torn a hole in the roof of its range. EUR is toast as PMIs sag.

AUD is EUR.

North Asia has not yet even begun to devalue.

You can’t keep a good gold bubble down. Oil hanging in.

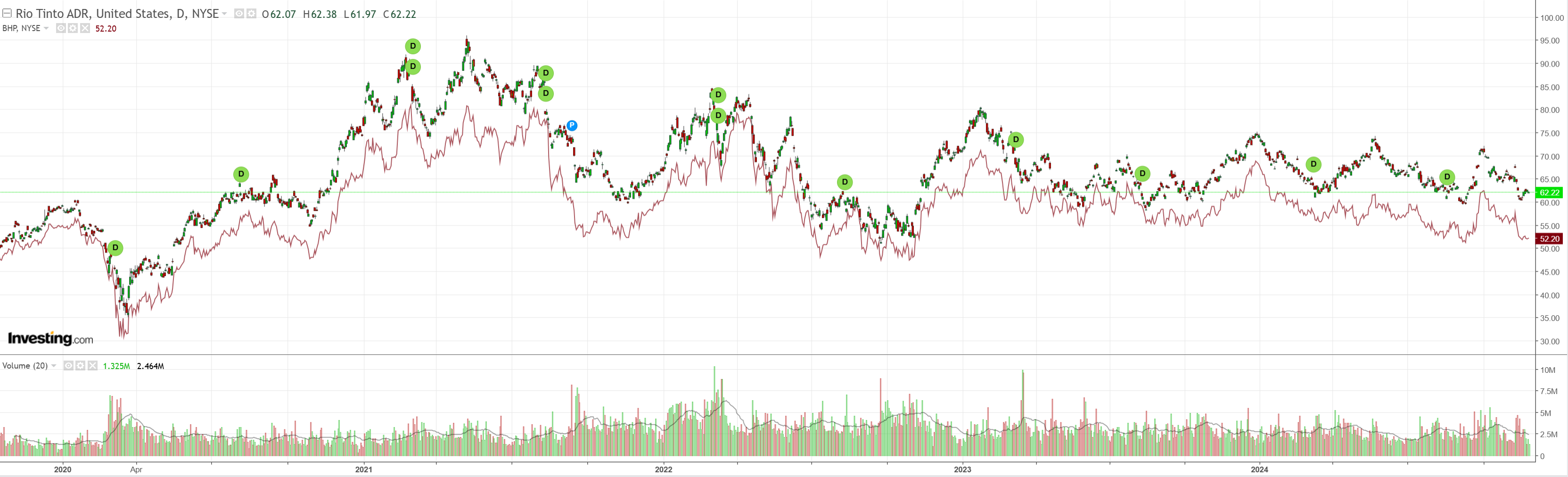

Dirt is breaking down.

Miners are on the treadmill to hell.

EM yawn.

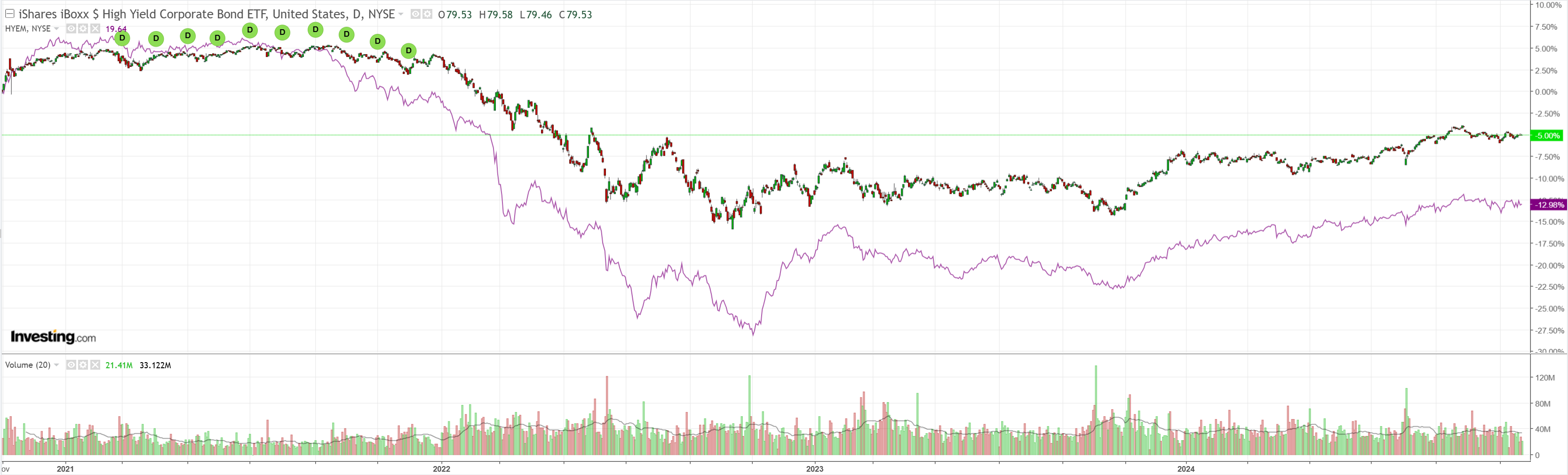

Junk is stalled.

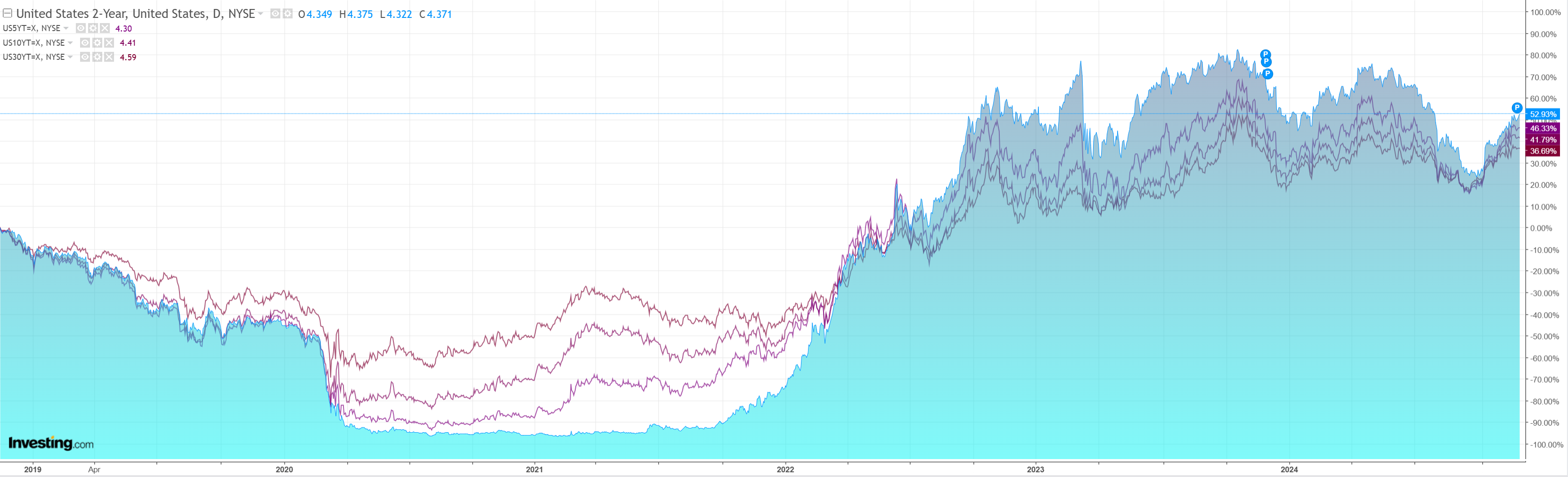

The US curve is bear flattening. This ain’t bullish!

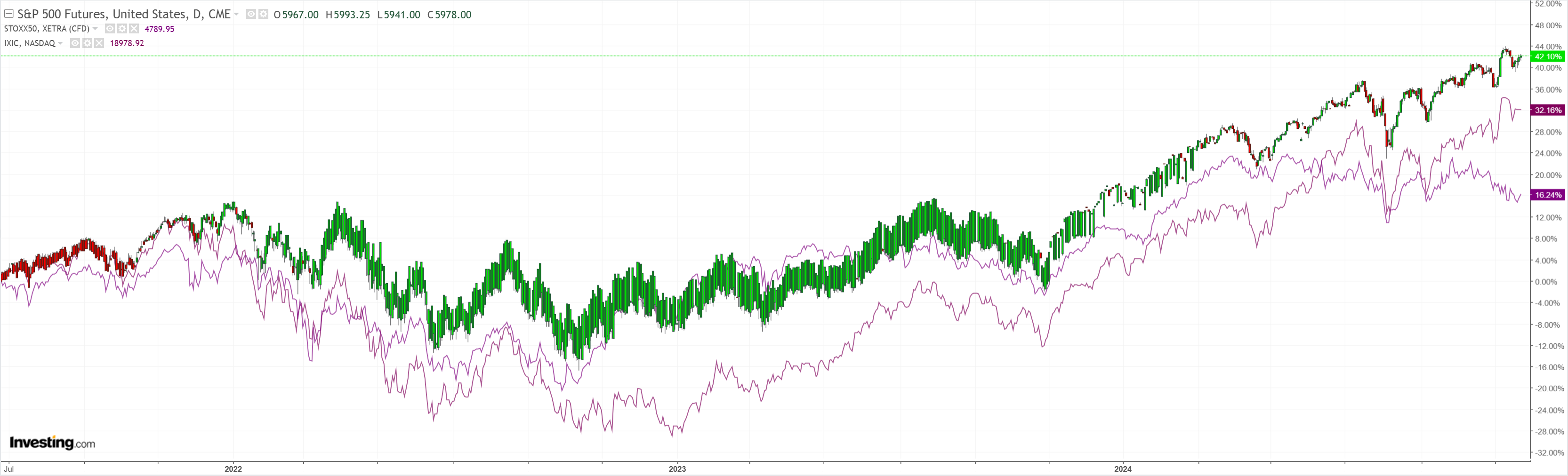

But stocks are.

Deutsche sums it up.

Markets are currently pricing in only a 30% probability of a maximalist Trump policy scenario.

This involves substantial fiscal expansion (1% by mid-2024), aggressive tariffs (50%+ on China and 10% universal tariffs by 2026), and sharp immigration reductions.

Dollar strength is underpricing potential risks, with EUR/USD at 1.00 reflecting closer to a 50% policy impact.

Analysts remain bullish on the dollar, seeing potential for further downside depending on future developments.

Every signal I see points to “maximalist” tax and tariff outcomes.

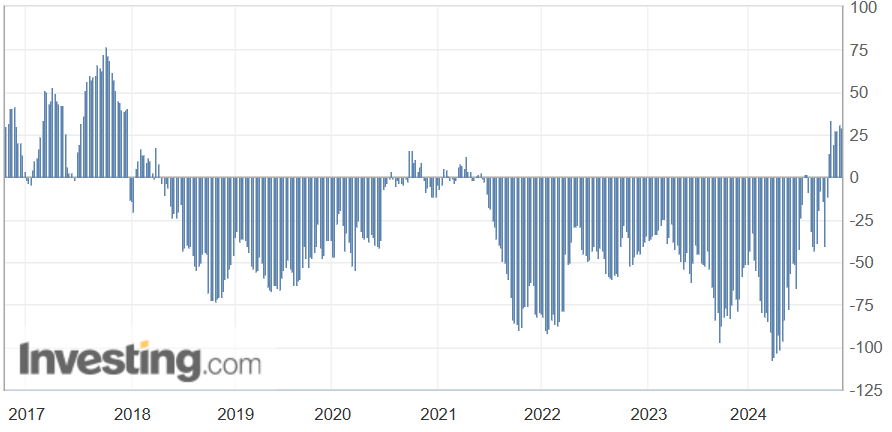

Yet China has not allowed CNY to react so far. Plus, speculators are still long AUD.

It’s all so bloody bearish AUD that I don’t know where to look. At the rate we are going, AUD will approach the 50s before the inauguration.

That is an exaggeration. CNY needs to start falling to really spook the battler.

But you will wait a long time before you see the greenback fly like this again.