DXY fell!

But nobody noticed. The long-term chart of AUD is a giant descending triangle to hell. This is the market judgement of your leaders.

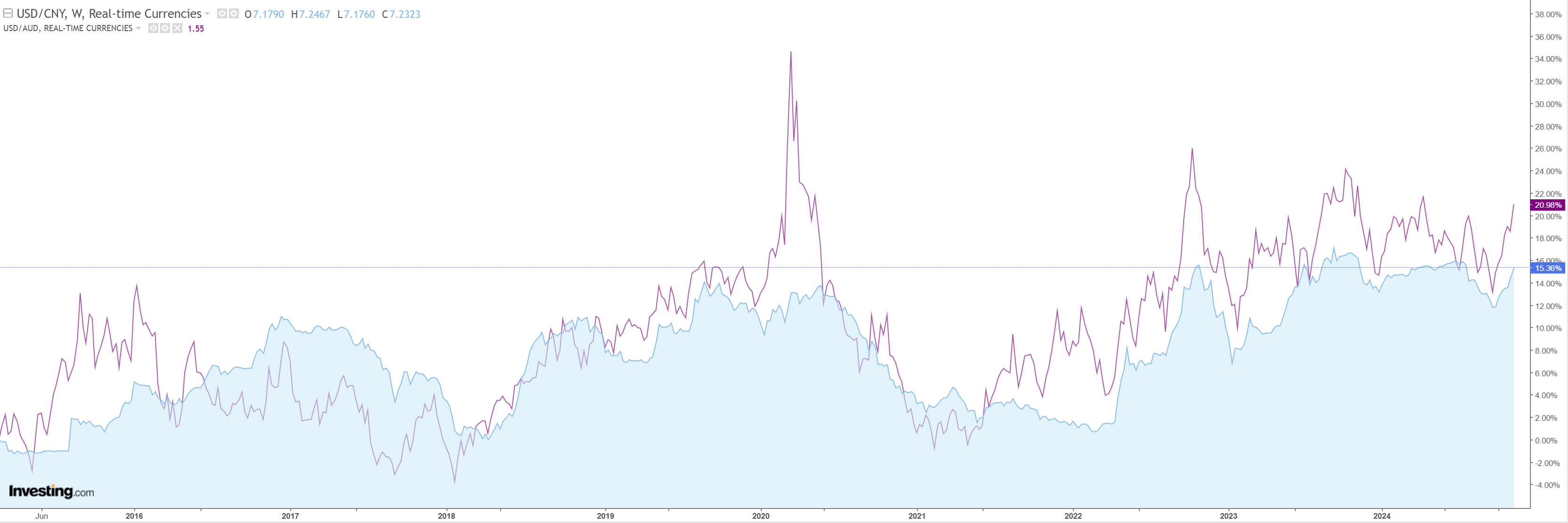

North Asia held up.

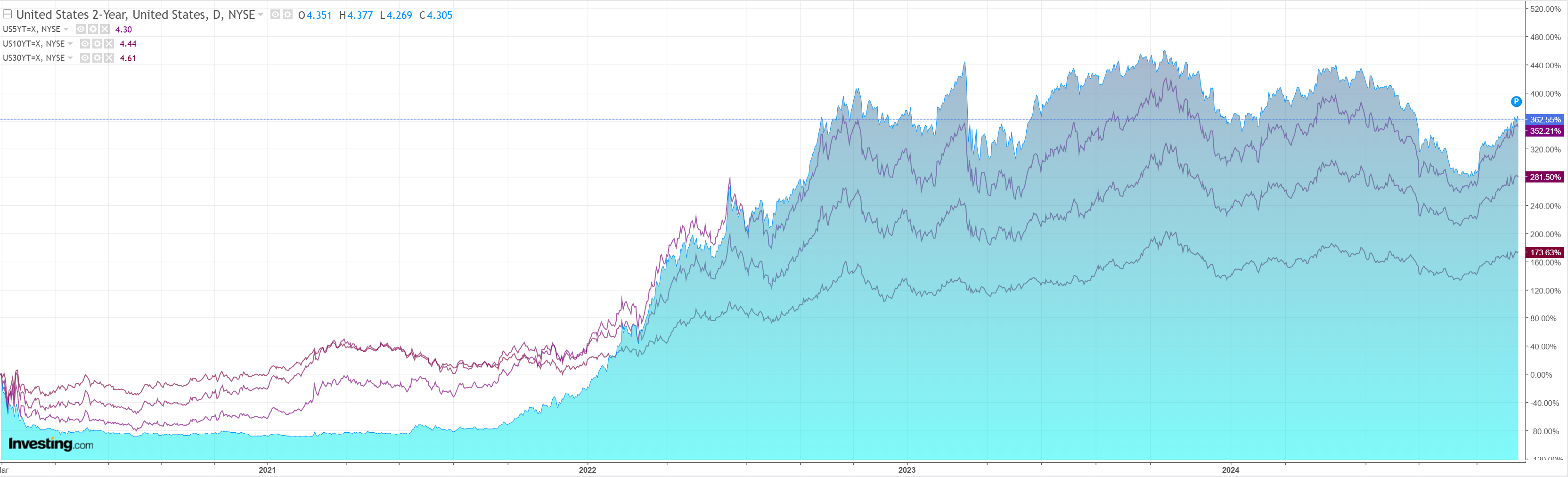

Gold and oil did not. Oil is everything here. If it crashes through the lows, it will contain the US long-end and restore the rally. If not, yields are going to kill it.

Dirt squirt.

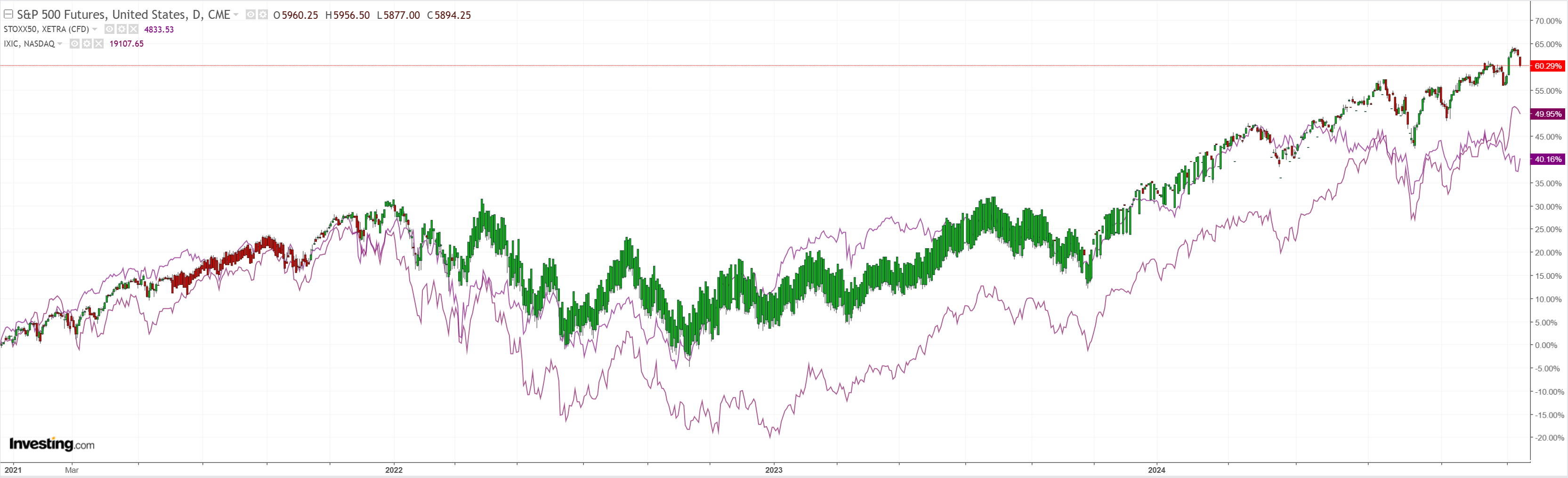

Xi rally put down.

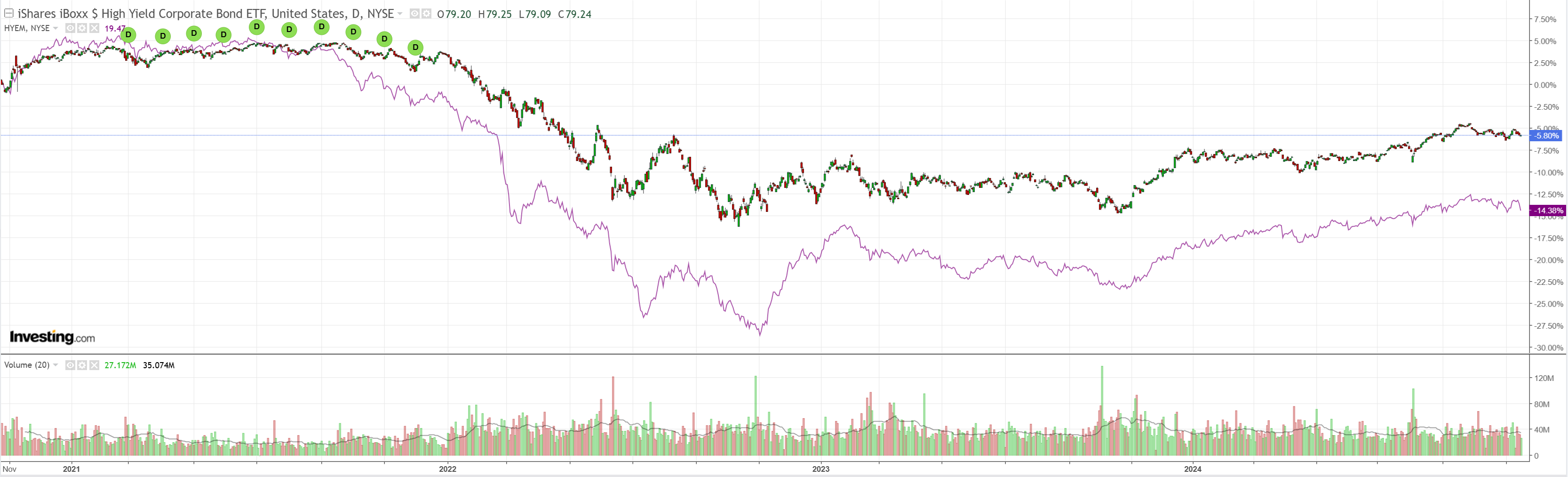

Junk puked.

Even though yields eased.

Stocks flamed out.

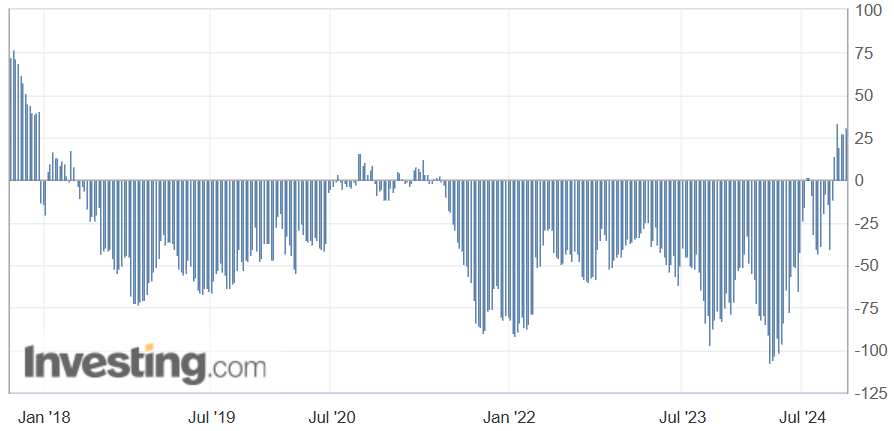

Astonishingly, AUD positioning continues to move longer even as the price collapses. I cannot tell you how bearish this is.

But BofA can!

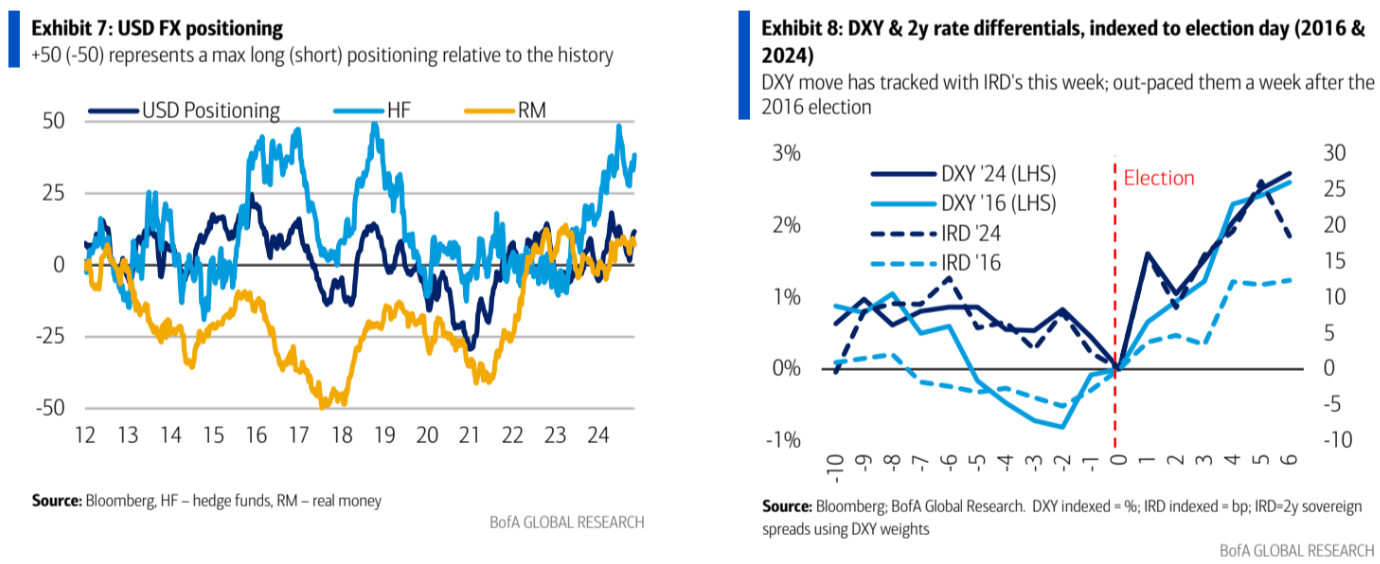

Our proprietary flows suggest overall investor positioning is close to neutral.

While hedge funds extended USD longs to crowded levels in October, positioning was reduced heading into the US election and remains below historical extremes for now.

Meanwhile, real money positioning is closer to neutral and they could be forced to buy USD if the rally extends.

We have argued there remains scope for “Trump trade” risk premium to increase in FX markets.

This is based on the DXY rally tracking rate differentials post-election (at least until the US CPI data) in contrast to outpacing the move in rates after the 2016 election.

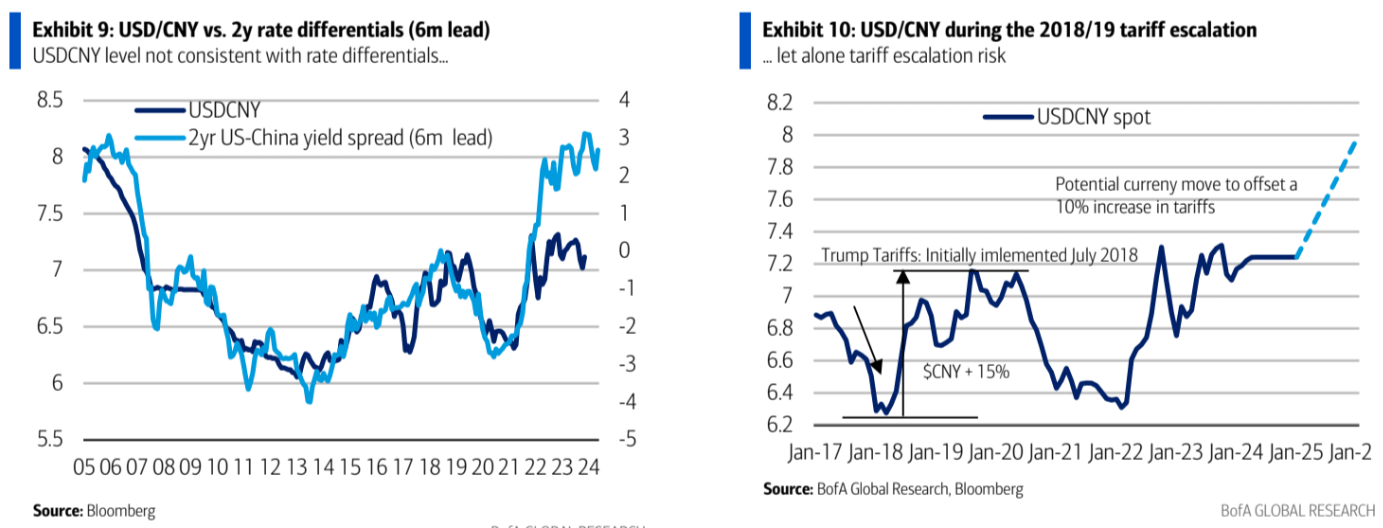

USDCNH levels not yet factoring tariff escalation risk USDCNH remains our preferred USD long despite the recent signal from PBoC fixings.

This is already a popular expression of the “Trump trade” but current levels are far from consistent with rate differentials, let alone tariff escalation risk.

With our recommended call spread maturing this week, we now recommend outright longs via USD/CNH 6M forward outright at 7.1950 (carry +85bps, stop at 7.10, initial target 7.45).

The risk to this trade would be an early US-China trade negotiation and resolution or sharp US slowdown, resulting in more aggressive Fed easing.

A move to 8 on CNY/USD will take AUD into the 0.50s.