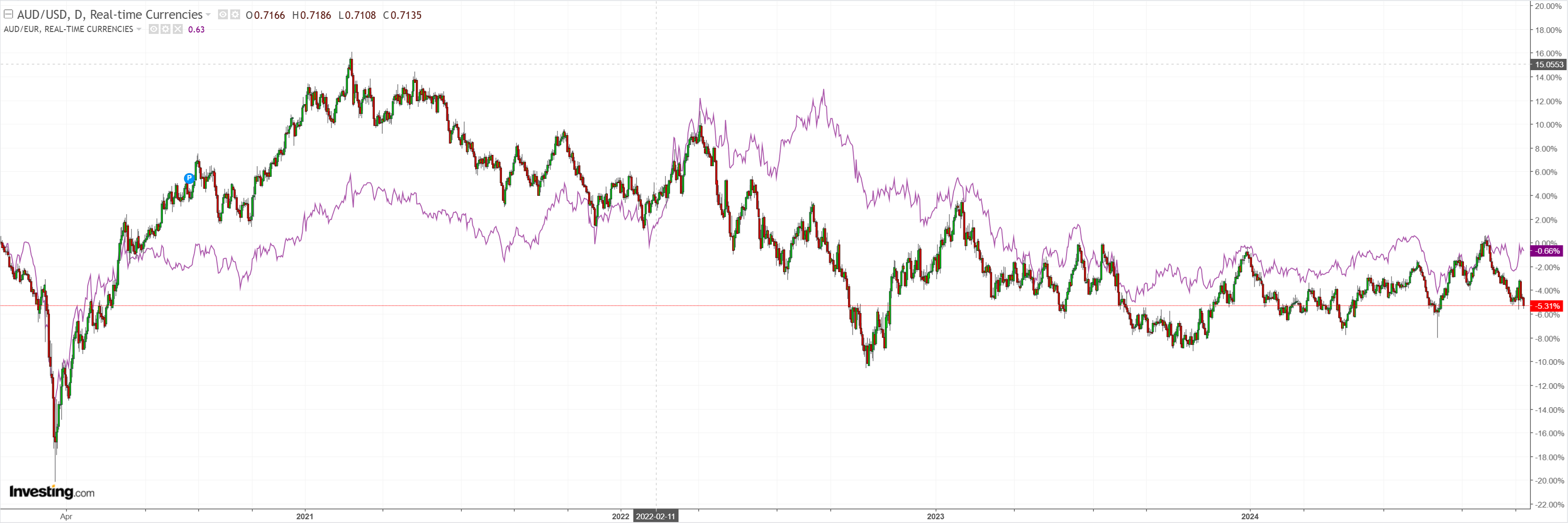

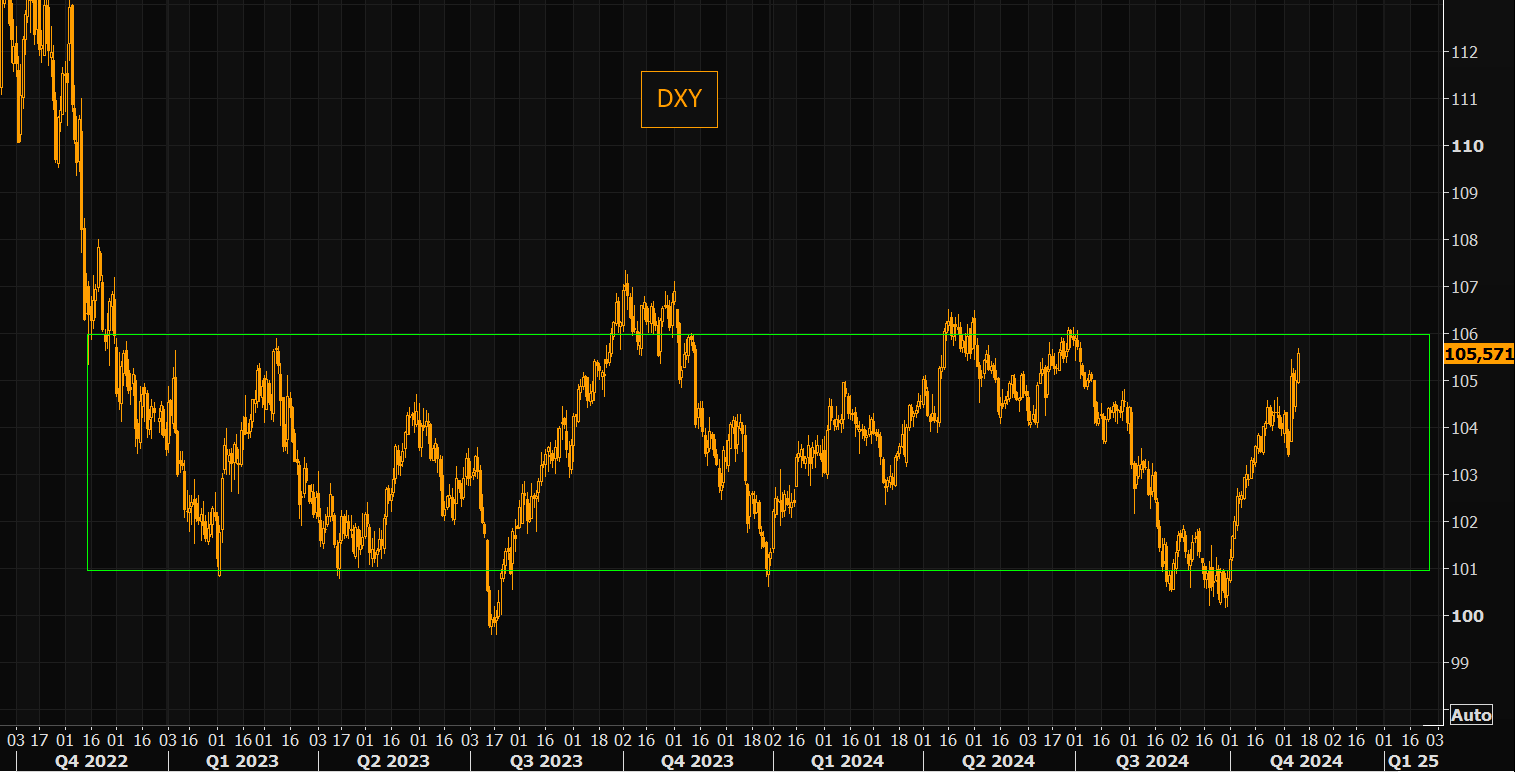

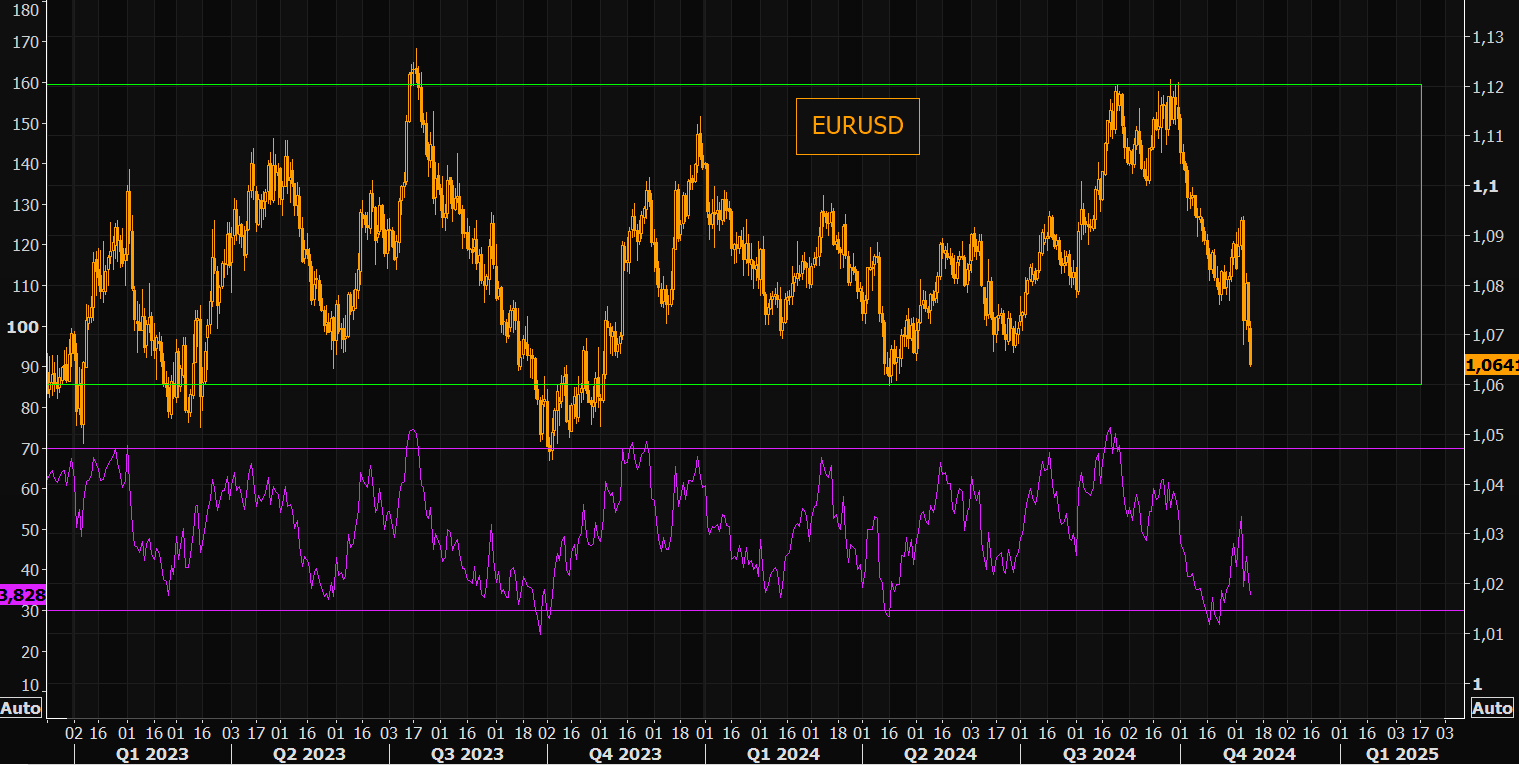

As expected, the DXY MAGA boom is a global wrecking ball.

AUD is on the verge of a new medium-term downtrend.

CNY is being let go. JPY won’t have it. Very AUD bearish.

Gold and oil haven’t had a proper flush yet. It’s coming if trends continue.

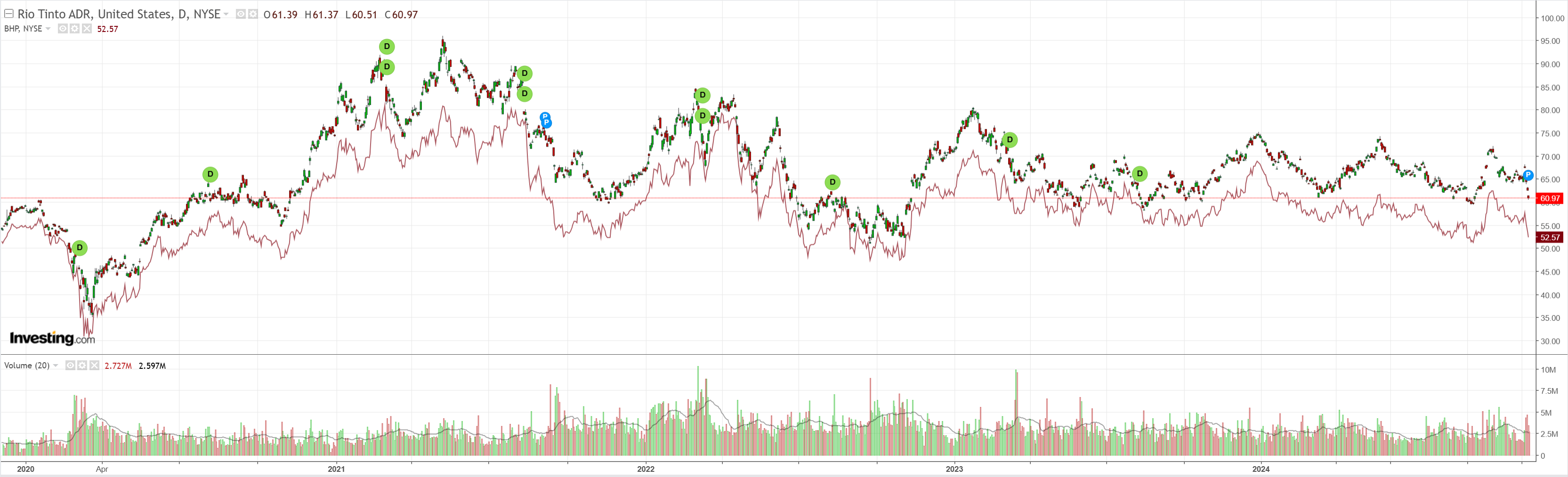

Dirt is threatening to get there first.

Miners have developed gapitis.

So much for the Xi rally.

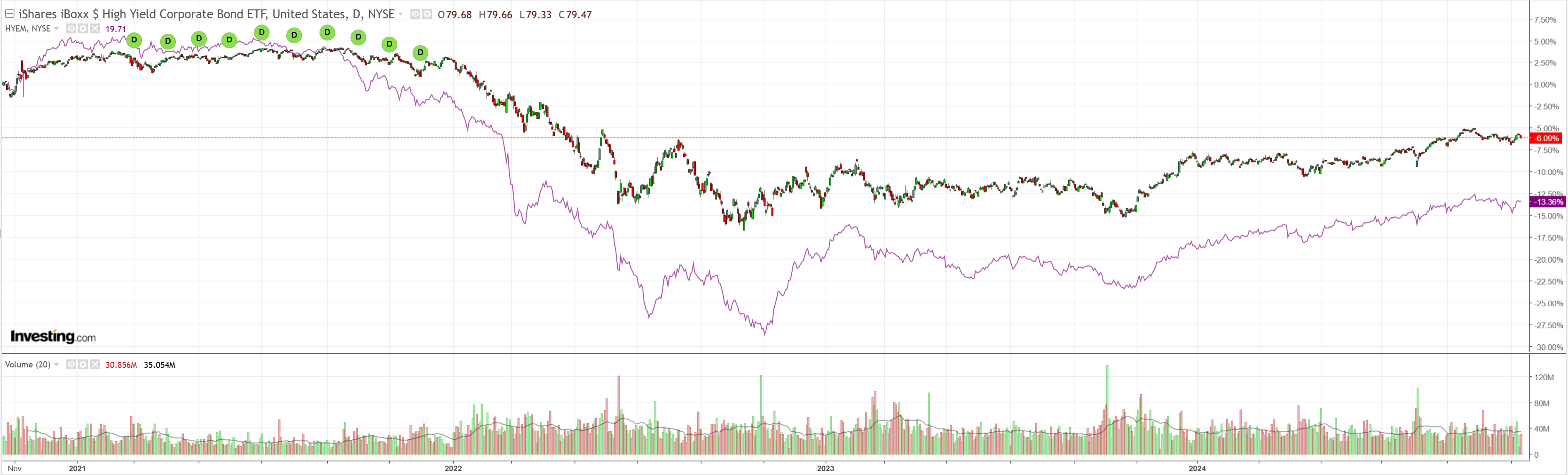

Junk is threatening a new downtrend.

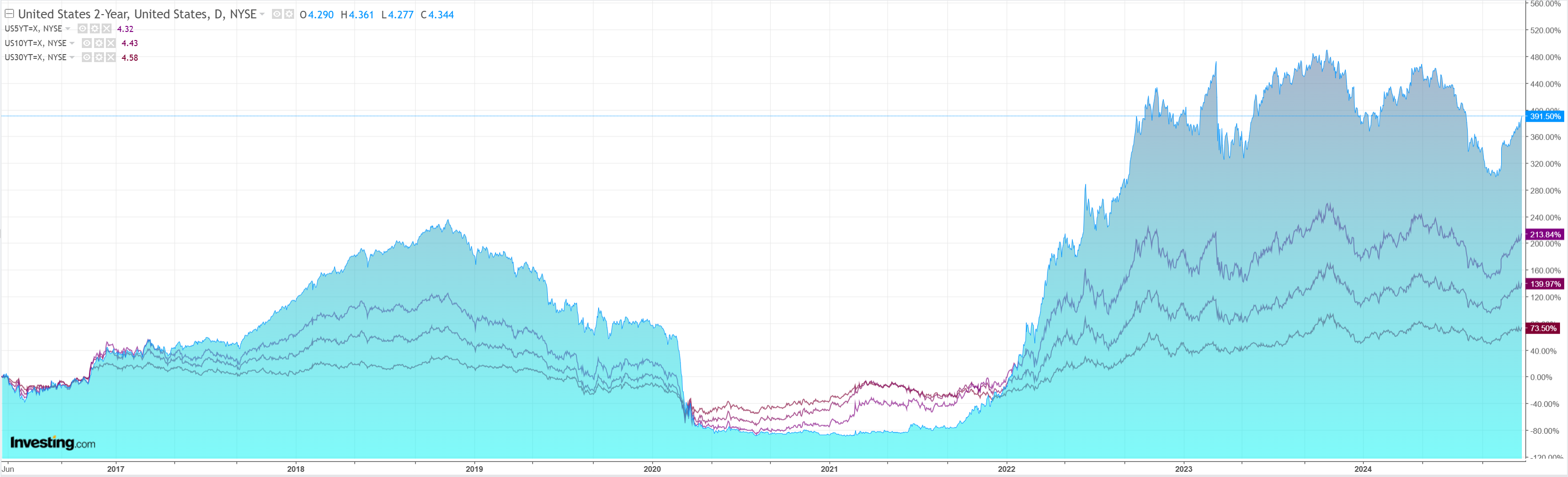

As yields back up.

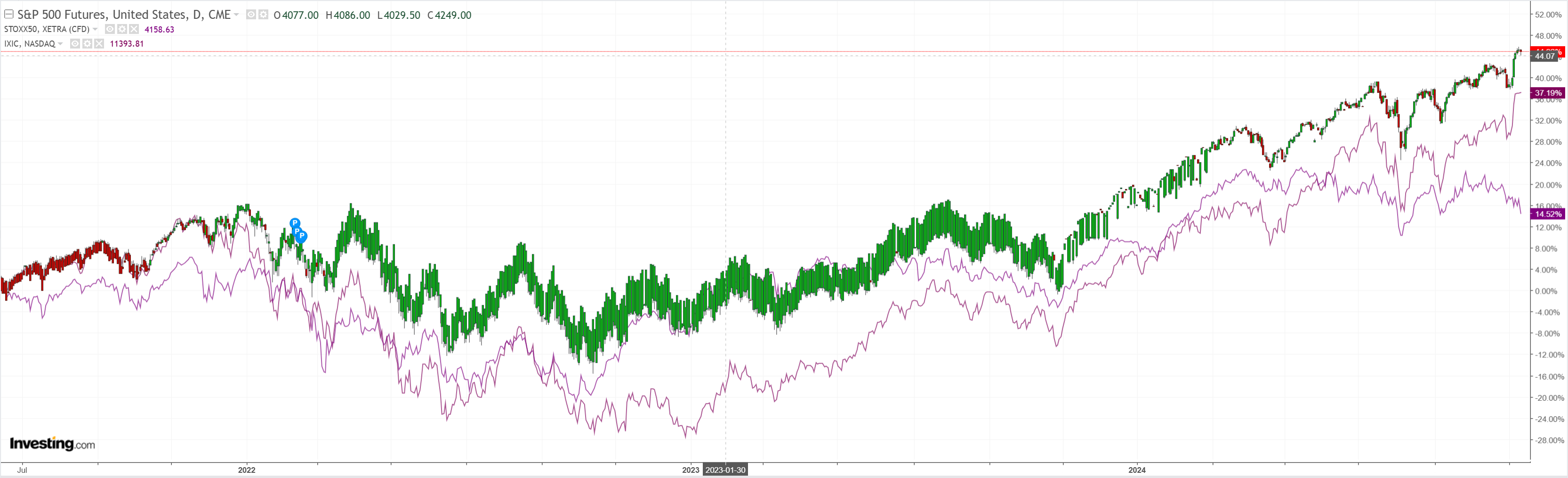

American assets are the only game in town.

The race is on between the US inflationary boom and the global deflationary bust.

The blowoff in US assets appears unstoppable but the bond backup is already applying the brakes.

Working the other way, commodities are being routed, setting up a disinflationary shock.

The swing factor will be oil.

The MAGA rally can continue so long as DXY breaks oil down and hoses off the long end of the bond market.

If not, bonds will derail this runaway MAGA train sooner rather than later.

That said, we are moving to the outer edge of long-term ranges and getting stretched on RSI.

So we may pull back for a bit anyway.

Even so, MAGA will continue to club AUD like a baby seal so long as China adds a falling CNY club to the bloodletting.