It’s machine-like trading around the US dollar at the moment. DXY up is dirt, mining, EM and junk negative. Down is the inverse. Today we are down.

AUD up.

North Asia doesn’t want a bar of it.

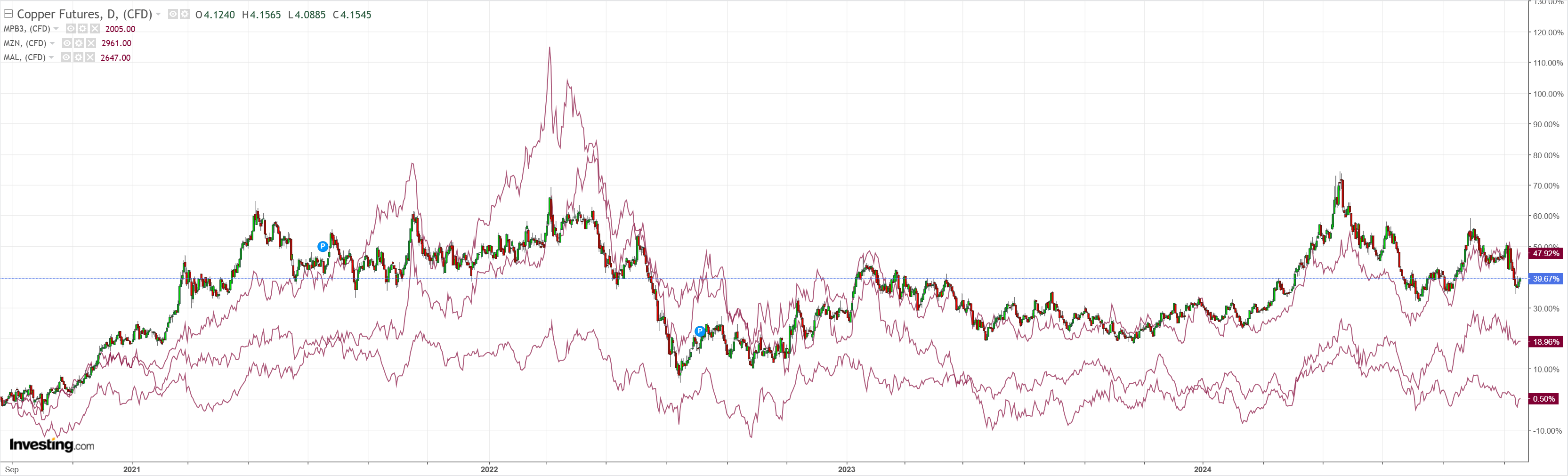

Dirt is flying.

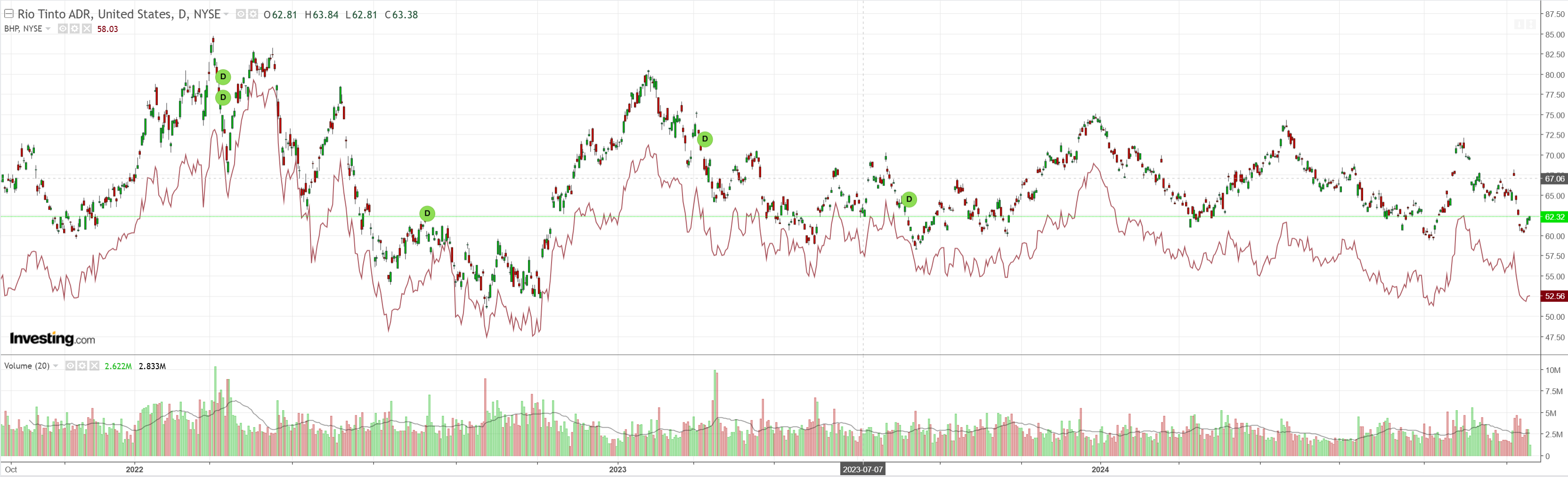

Miners more muted.

EM up.

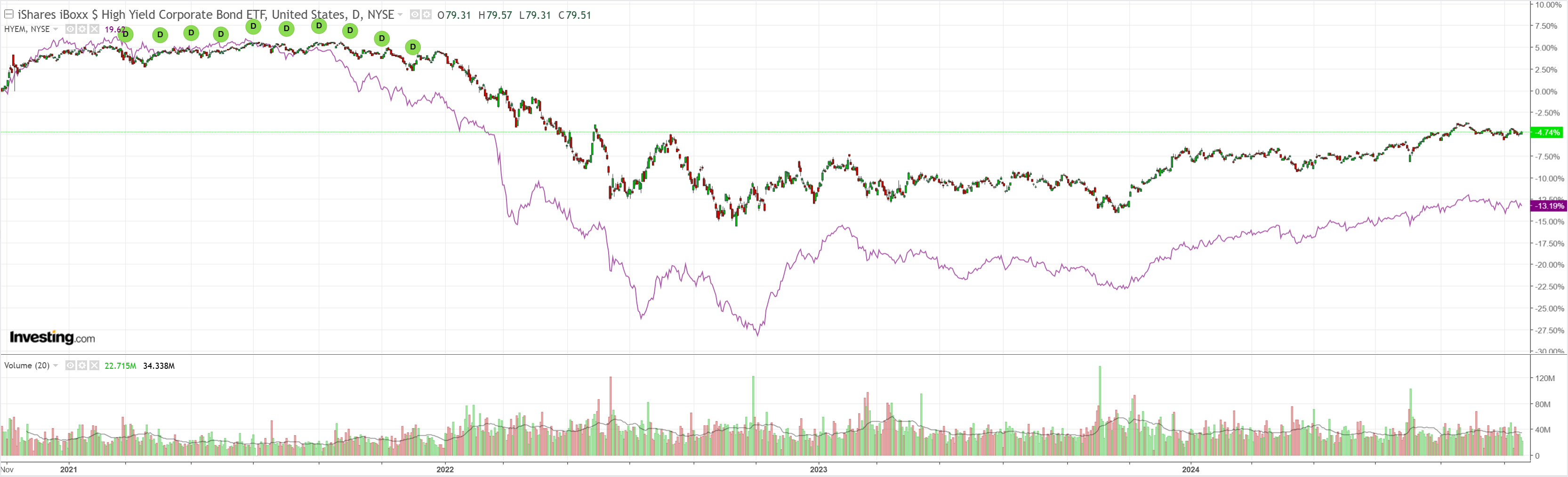

Junk is still melancholy.

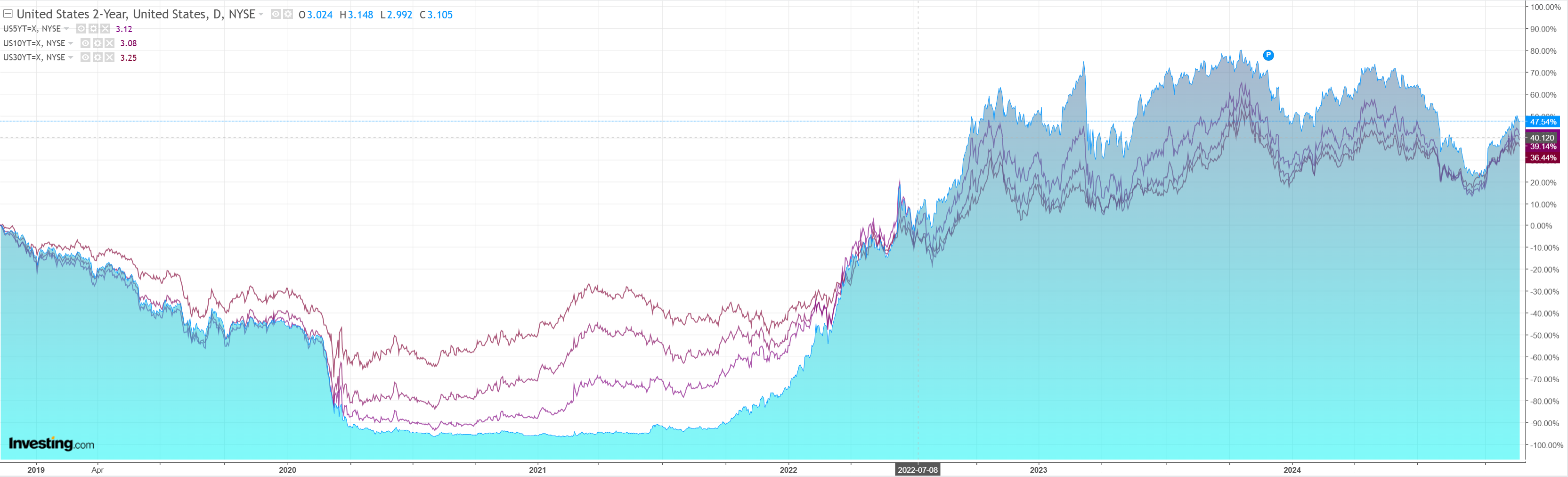

Even as bonds are bid.

With stocks.

Lite data allows the overheated Trump FX trade to take a breather.

Which brings us to the major newsworthy piece this week (apart from WWIII and NVDA earnings). Credit Suisse has more.

…the US Treasury Secretary race has be thrown wide open with potential candidates including former US Trade Representative Robert Lighthizer, hedge fund executive Scott Bessent, Trump transition team co-chair Howard Lutnick, former Fed Governor Kevin Warsh, asset manager CEO Marc Rowan and Senator Bill Hagerty.

The outcome of the Treasury Secretary race will be particularly important for the USD in terms of the winner’s stance on tariffs and international trade as well as the strong USD.

The US Treasury Secretary has historically defined the administration’sstance on the exchange rate.

Lighthizer’s views on trade are well known and he dislikes a strong USD.

Bessent has said Trump would stand by the USD’s reserve currency status and that the President-elect’s tariff stance is a negotiating position.

The other candidate’s views are not as well known.

Lighthizer might be a short-term DXY negative but it would send a very strong message on tariffs and trade so weakness wouldn’t last.

Weakness won’t last with any of them as the tariff agenda rolls out, most notably because everybody will devalue against tariffs.

Especially AUD’s daddy in North Asia.

More AUD downside once we chop some more wood.