DXY is a runaway freight train as EUR succumbs.

AUD is huddled in a corner hoping nobody will notice.

But they will as the Crap Complex is mown down. North Asia is already responding to looming tariffs.

Commods are being crucified as gold and oil do the limbo.

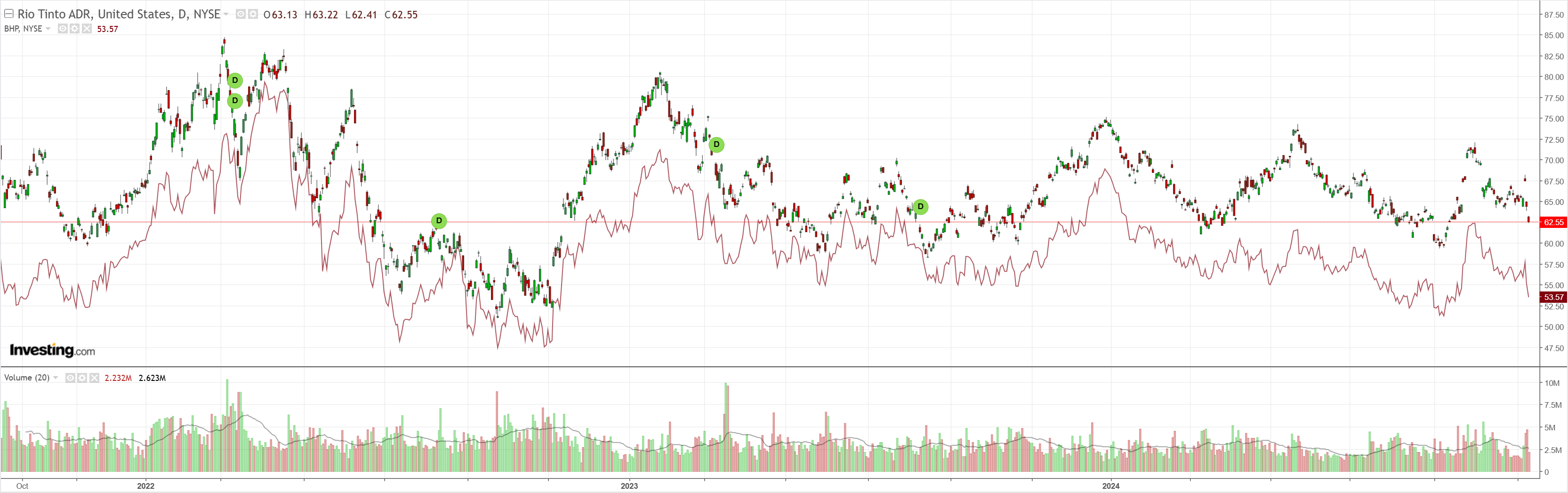

Dirt is breaking down.

Miners abandon hope.

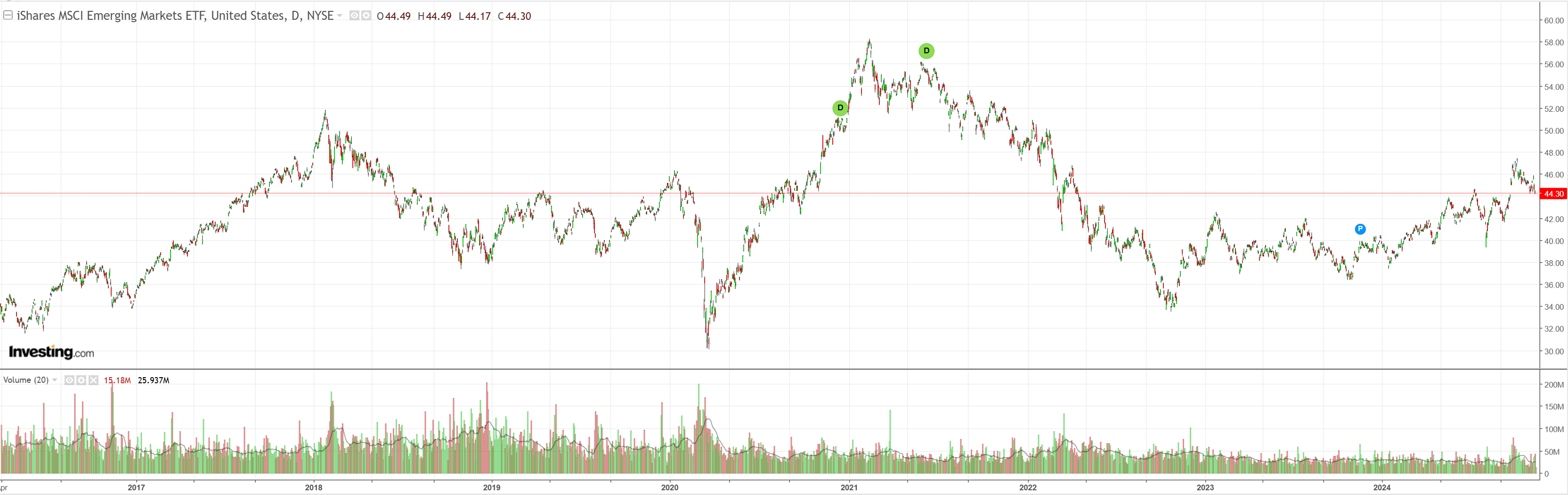

EM sucks.

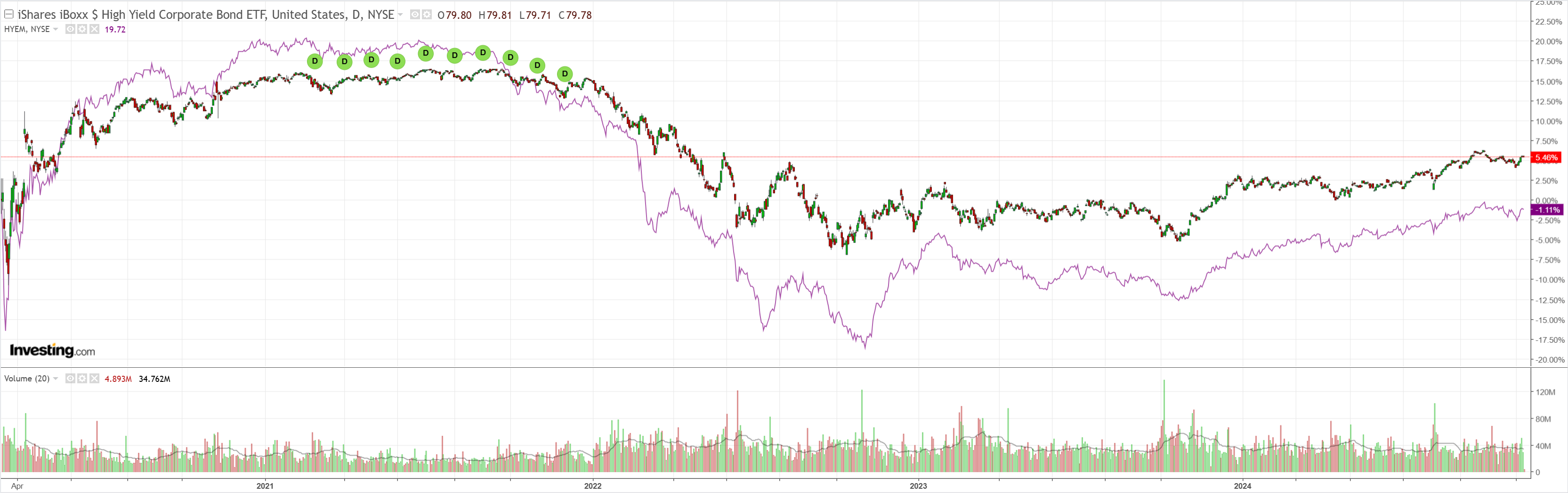

While junk does OK.

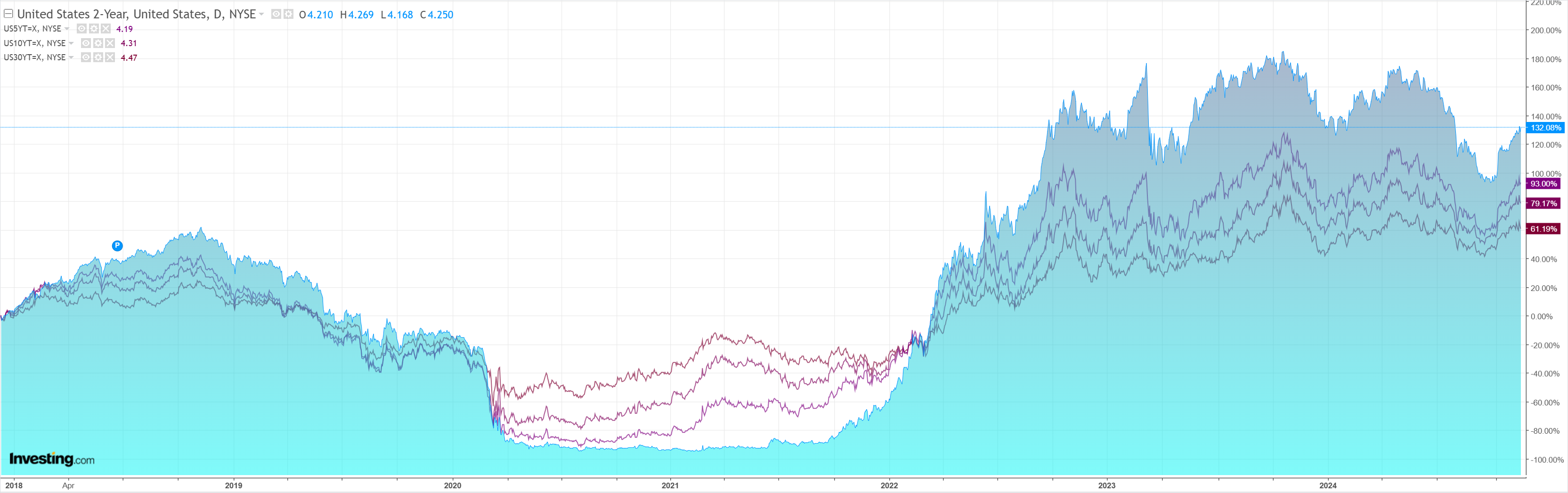

As the curve flattens.

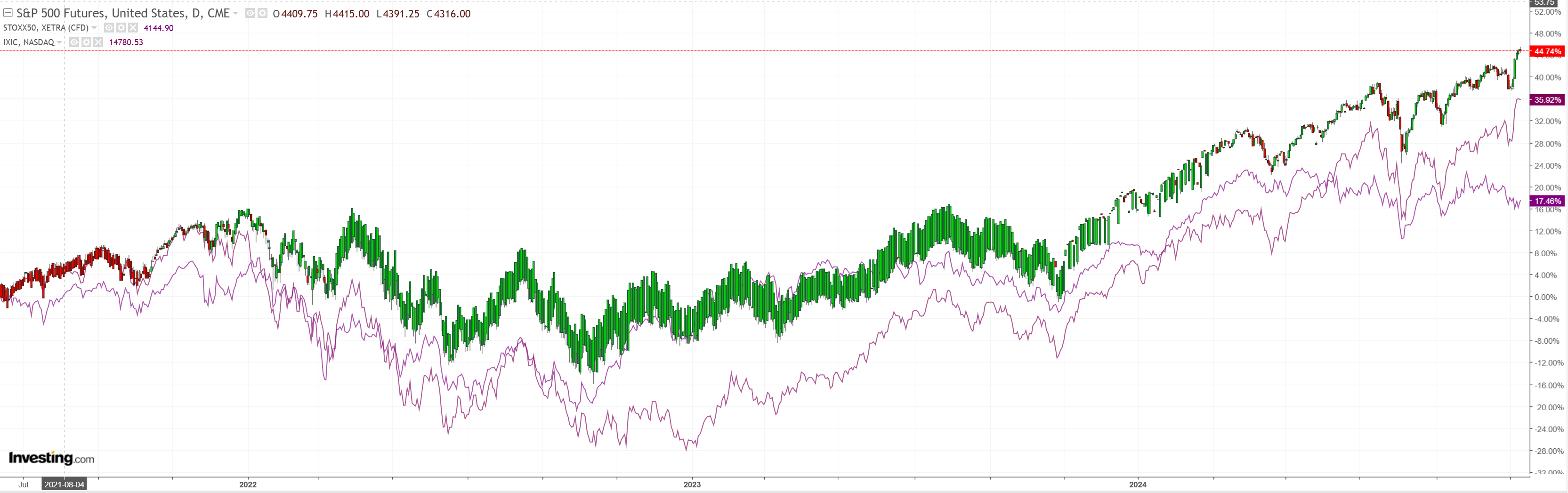

Stocks are running into resistance.

This is America First. World second. Australia last.

The window between now and the inauguration may do much of the forex tariff damage as the horrible position of Europe triggers EUR falls and China lets CNY go.

After that, there is the jawbone. Credit Agricole has more.

US President-elect, Donald Trump, is deliberating the return of Robert Lighthizeras US Trade Representative. Lighthizer’s was a trade envoy with the first Trump administration and is very protectionist having published the book “No Trade is Free: Changing course, taking on China and helping America’s workers”.

The return of Lighthizer would likely imply a ramping up of US trade protectionism, which along with any aggressive fiscal stimulus and immigration restrictions, risks pushing inflation higher, reducing Fed rate cuts and supporting the USD.

We note, however, that Lighthizer has as recently as April lamented the strength of the USD and how it reduces US companies’ competitiveness.

So there is the risk of Lighthizer and Trump engaging in verbal interventions to weaken the USD.

These interventions may be more effective than in Trump‘s first term given tariffs add downside risks to US growth and growth is already slowing.

Despite the risks to inflation, the Fed will also continue cutting rates, albeit by less.

Potentially hindering a weak USD strategy is the weakness of the currencies of the US’s main trading partners.

Trump said during the campaign he would support a strong dollar.

He will need to. The worldwide deflationary bust has already started and will feed back to the US as disinflation via oil, which will ease the pain of the tariff shock for households.

AUD looks ready to break.