DXY whoa!

AUD was hammered but bounced into Chinese stimmies:

North Asia is now a race to the bottom:

Oil and gold are stranded. The latter has a long history of up the escalaor and down the lift:

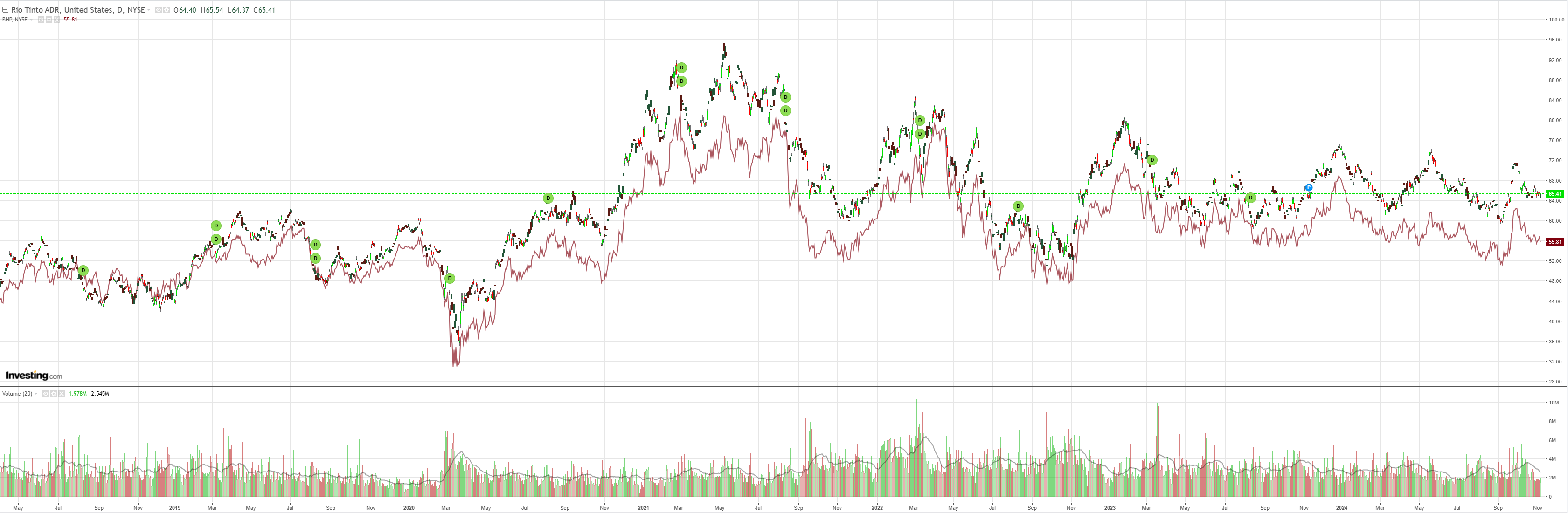

Dirt hosed:

Miners too:

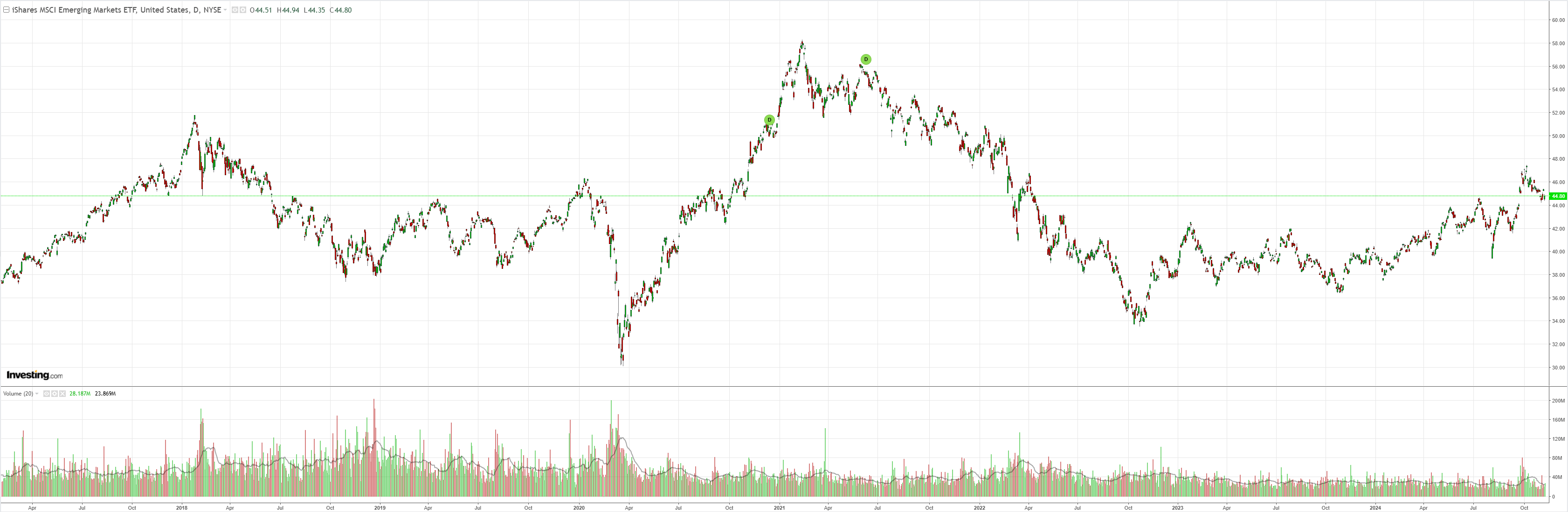

And EM:

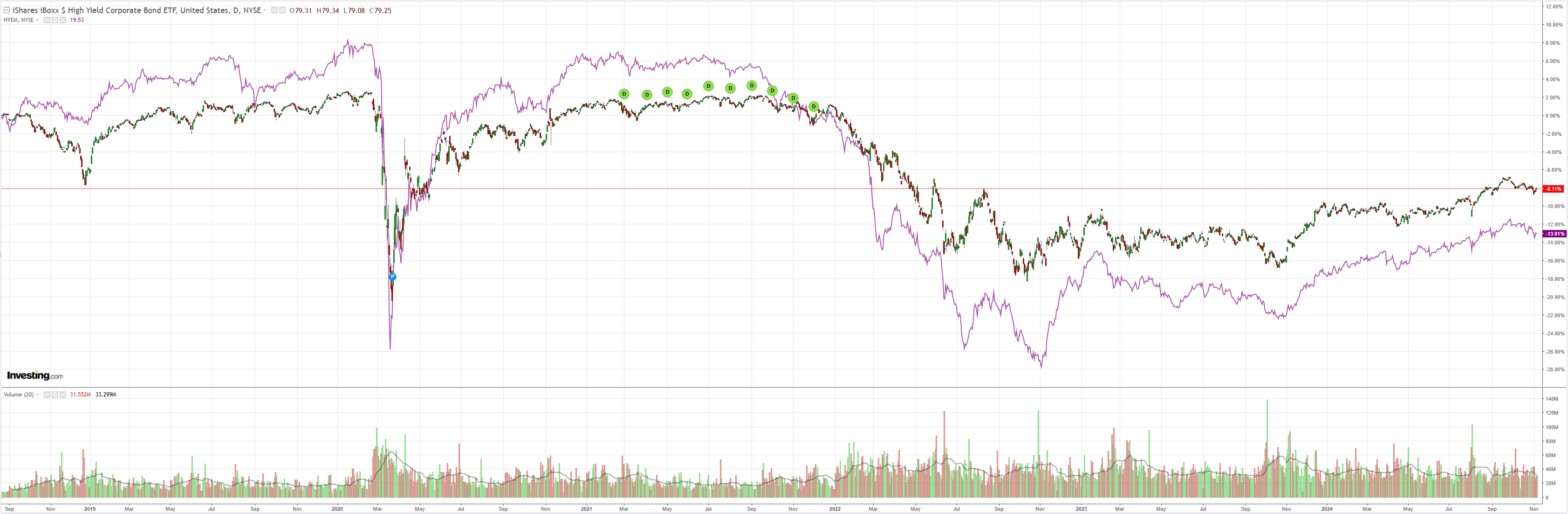

Junk is not out of the woods:

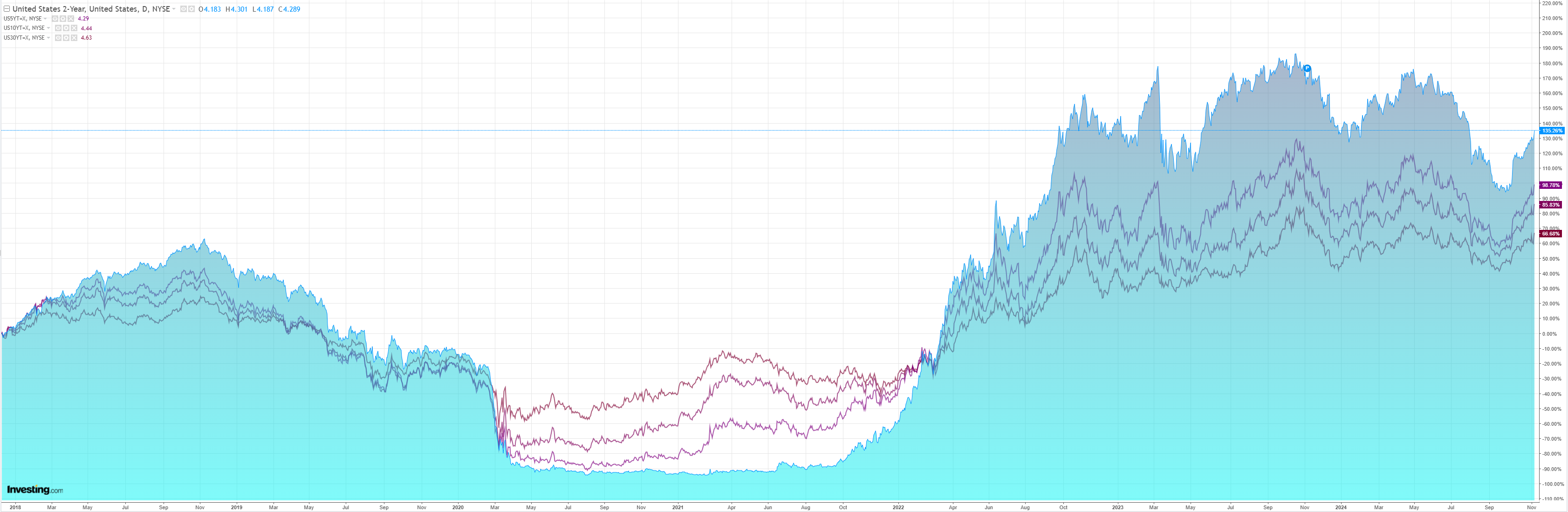

As yields price out the Fed:

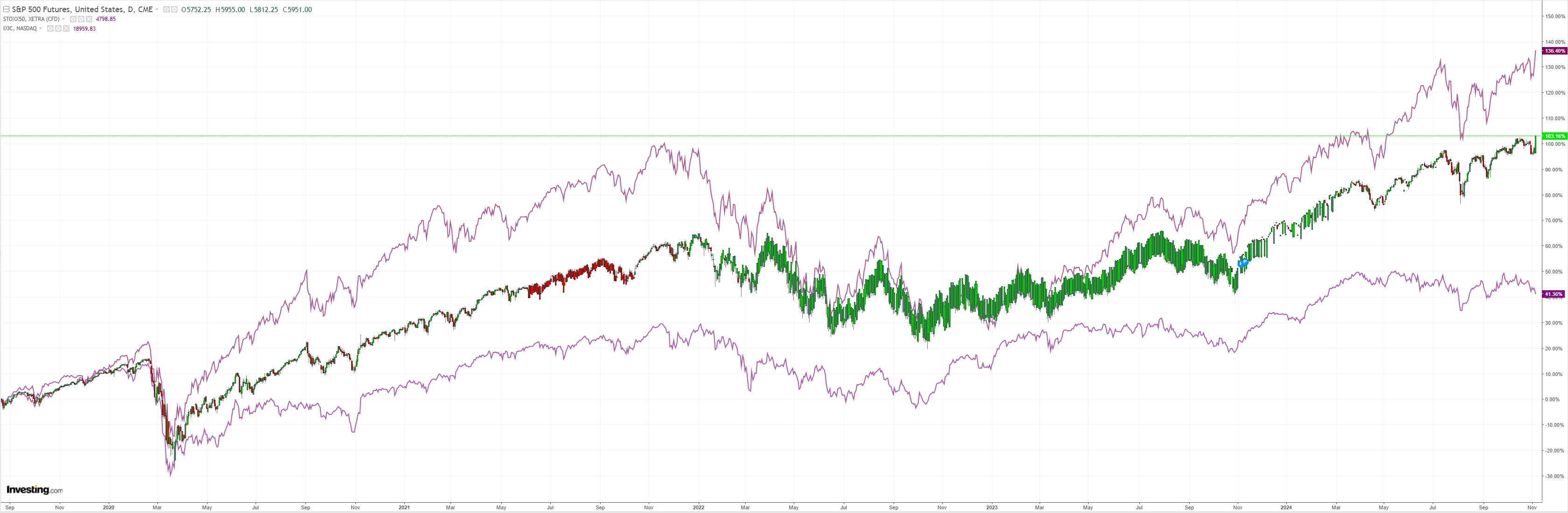

And stocks are ATH:

Trump’s tariffs and tax cuts agenda equals an inflationary American boom with a deflationary global bust.

This will not be good for the Australian dollar as China (and others) respond to tariffs with forex devaluation.

Europe, China and Japan are now in a competitive devaluation race to the bottom to preserve what is left of their trade market shares and mercantilist economies.

All will be forced to deliver more fiscal AND lower interest rates than before the Trump win.

This can only sink the AUD as commodity prices fall and the RBA joins the party.

Get ready for a jolt to the system.