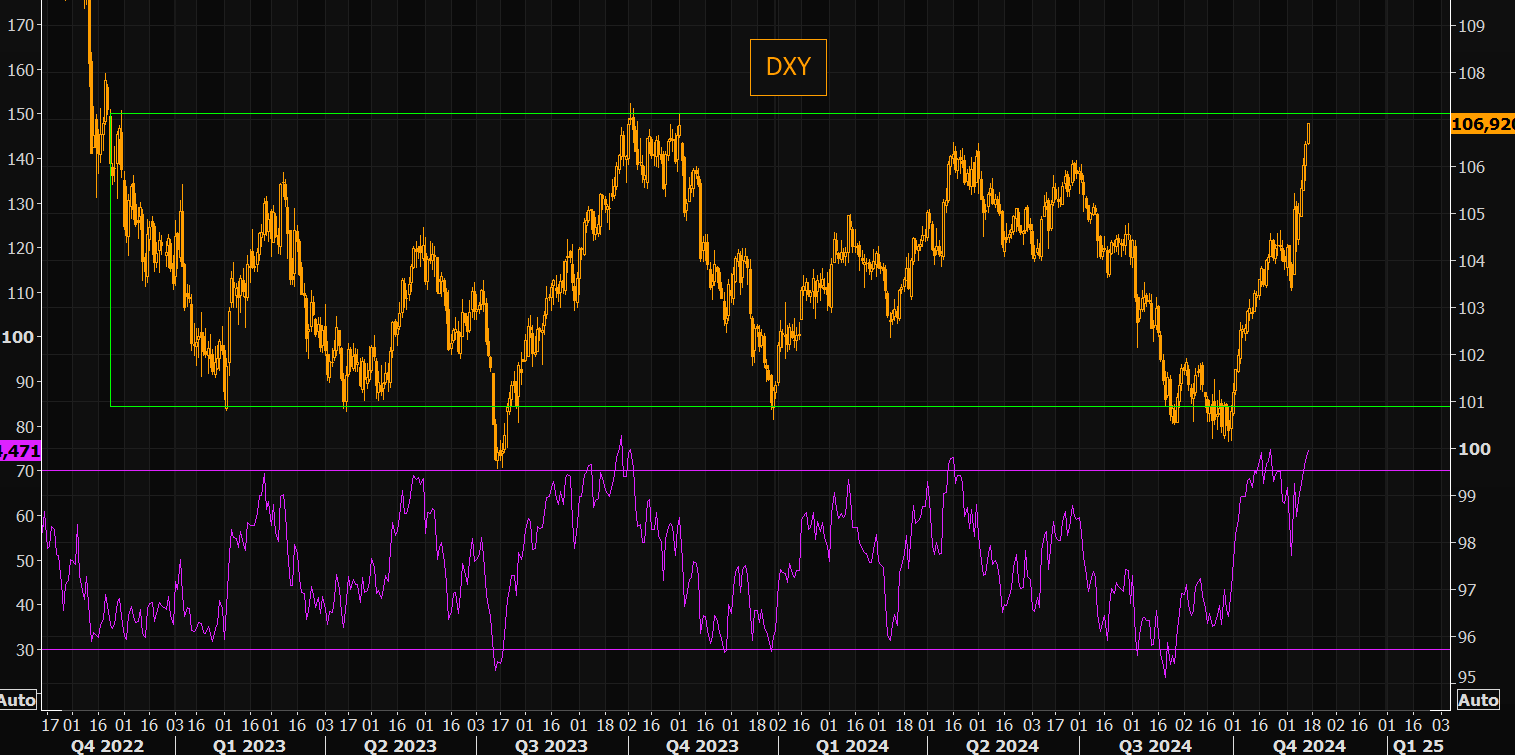

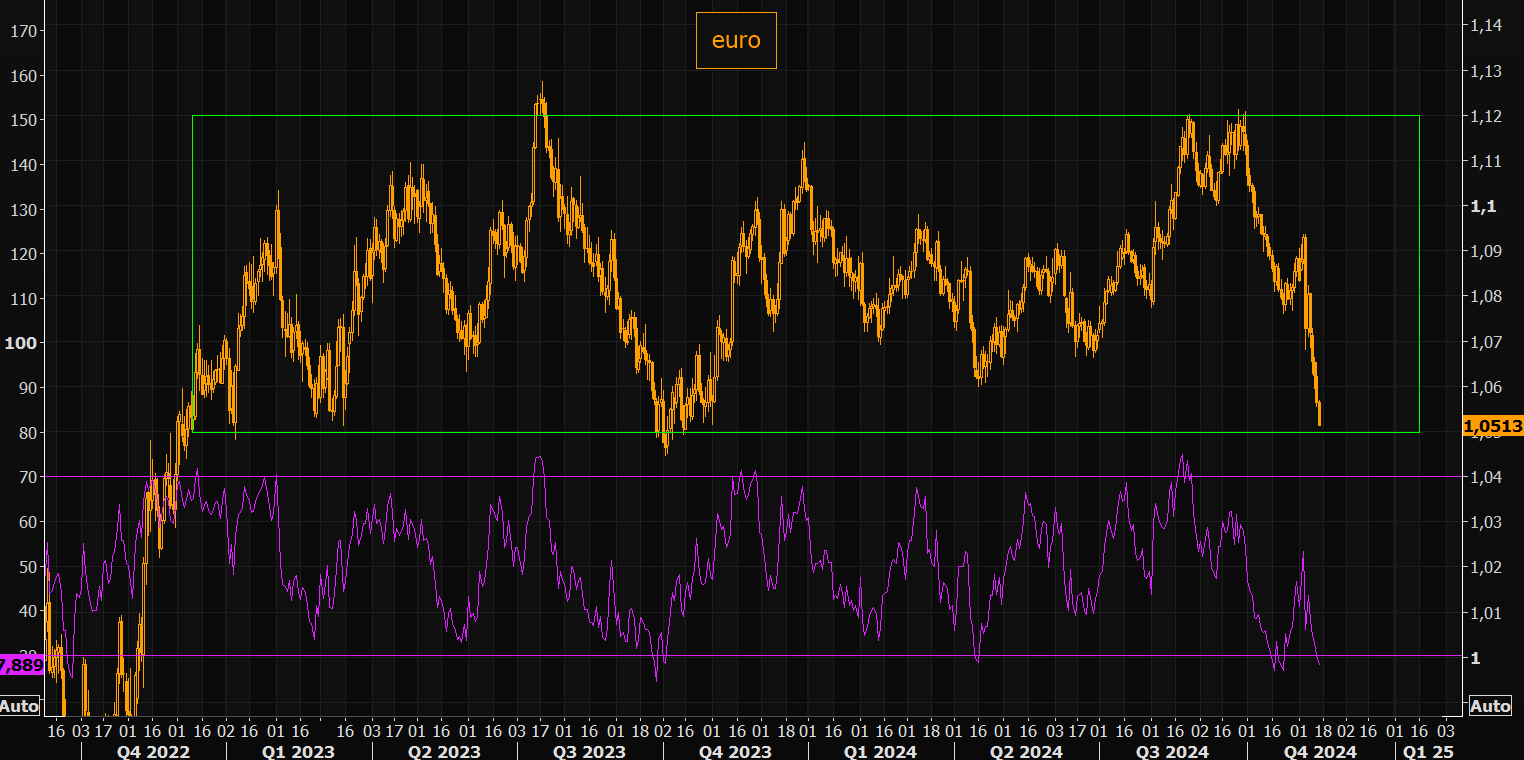

DXY and EUR both put in big candles overnight as the Trump trade got unruly.

AUD fell again. The uptrend is gone.

North Asia is a powder keg but the PBoC is now trying to slow CNY.

Gold is oversold. Oil remains vulnerable.

Copper also put in a candle.

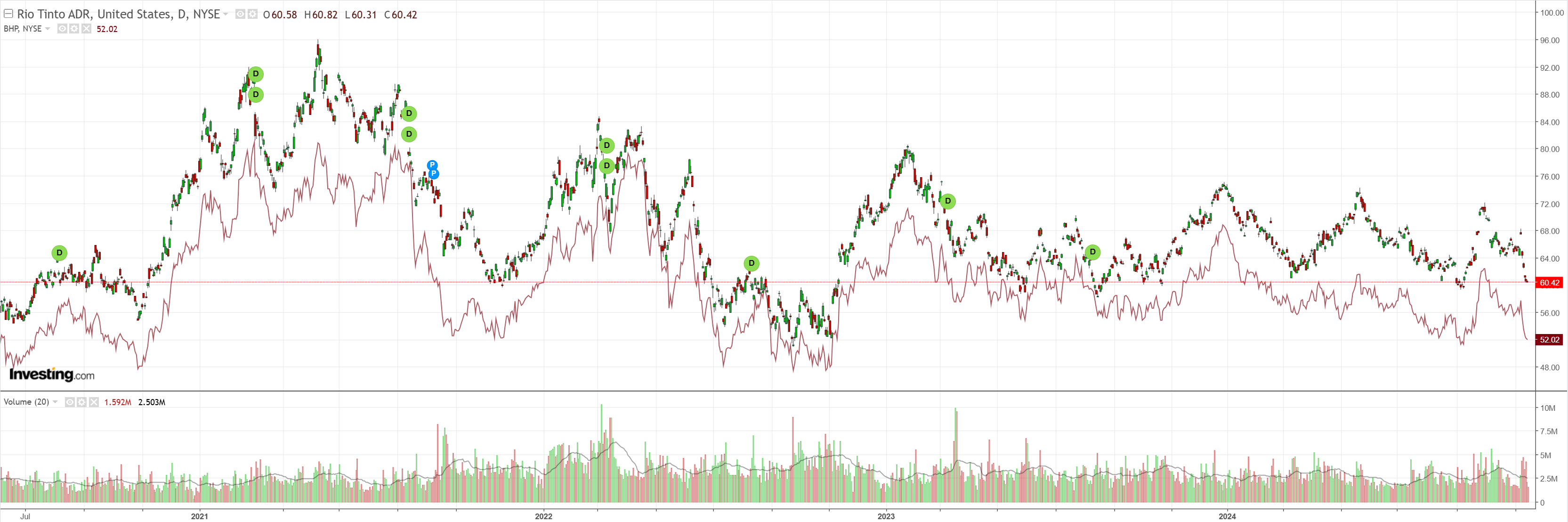

Miners are out.

EM is out.

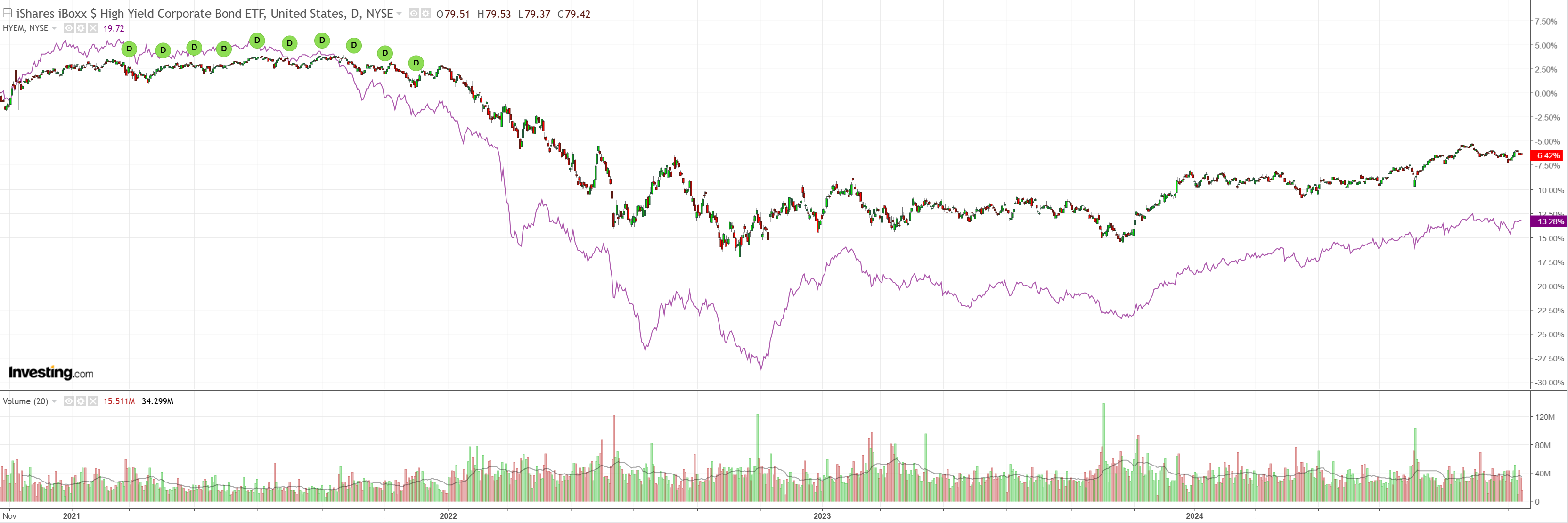

Junk calm.

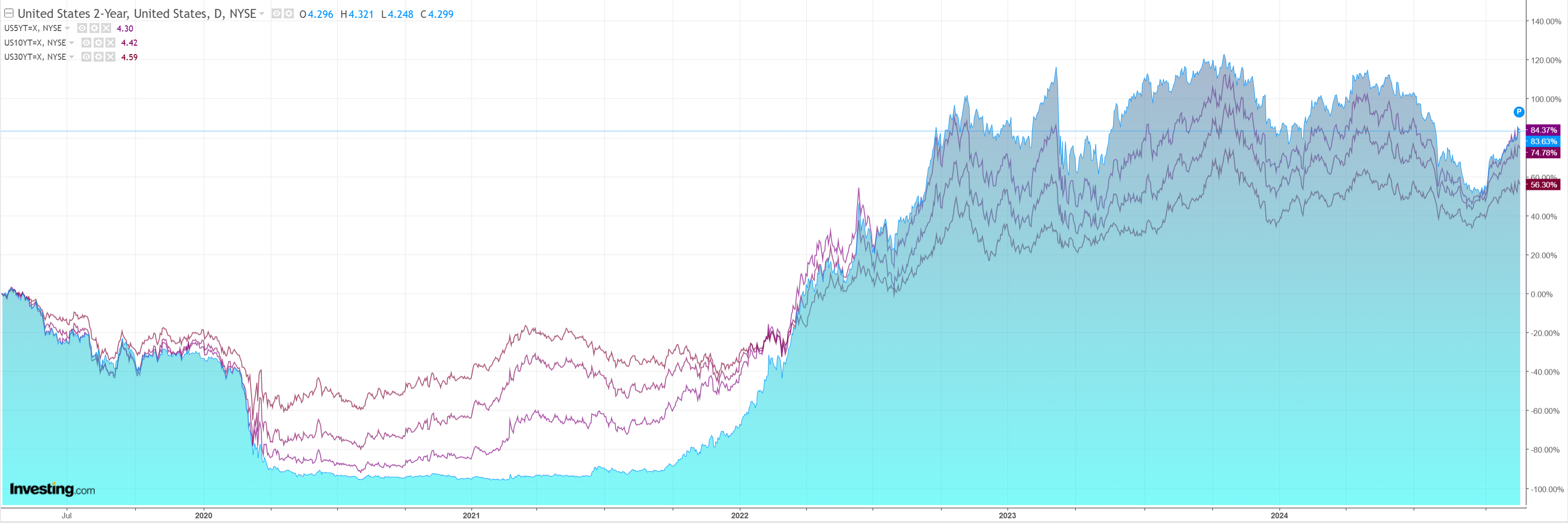

As yields eased.

With stocks.

Massive markets are overheated.

DXY is way overbought.

EUR is way oversold.

There is more in this trade when and if Trump delivers his tax and tariff policies, which he very likely will.

But nothing goes straight up or down and we are very stretched here.

AUD is not as oversold as some but if the big markets reverse so will it in the short term.

Update

Or not, in late breaking news, the Fed has spoiled the party. Chairsatan Powell.

Given progress toward our inflation goal and the cooling of labor market conditions, last week my Federal Open Market Committee colleagues and I took another step in reducing the degree of policy restraint by lowering our policy interest rate 1/4 percentage point.

We are confident that with an appropriate recalibration of our policy stance, strength in the economy and the labor market can be maintained, with inflation moving sustainably down to 2 percent. We see the risks to achieving our employment and inflation goals as being roughly in balance, and we are attentive to the risks to both sides. We know that reducing policy restraint too quickly could hinder progress on inflation. At the same time, reducing policy restraint too slowly could unduly weaken economic activity and employment.

We are moving policy over time to a more neutral setting. But the path for getting there is not preset. In considering additional adjustments to the target range for the federal funds rate, we will carefully assess incoming data, the evolving outlook, and the balance of risks. The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully. Ultimately, the path of the policy rate will depend on how the incoming data and the economic outlook evolve.

We remain resolute in our commitment to the dual mandate given to us by Congress: maximum employment and price stability. Our aim has been to return inflation to our objective without the kind of painful rise in unemployment that has often accompanied past efforts to bring down high inflation. That would be a highly desirable result for the communities, families, and businesses we serve. While the task is not complete, we have made a good deal of progress toward that outcome.

All candles erased!