DXY is suddenly struggling as election doubts surge:

Respite for AUD:

North Asia got the memo:

Is gold an equity now?

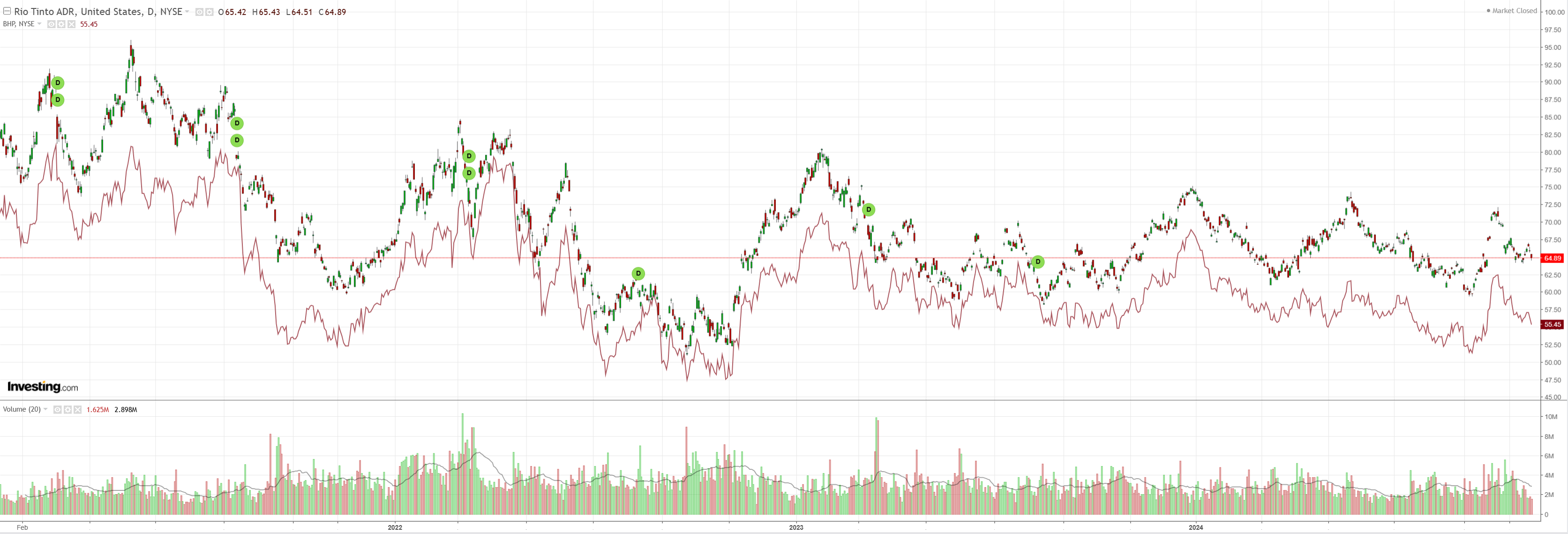

The Crap Complex buckled. Dirt down:

Miners down:

EM down:

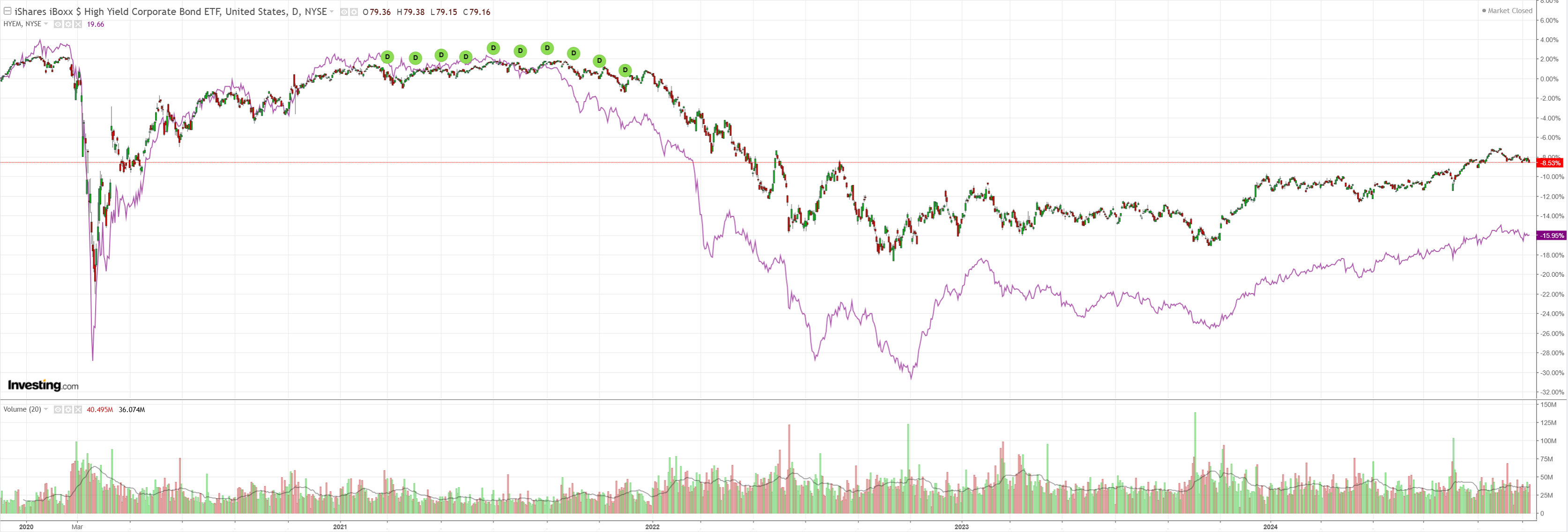

Junk down:

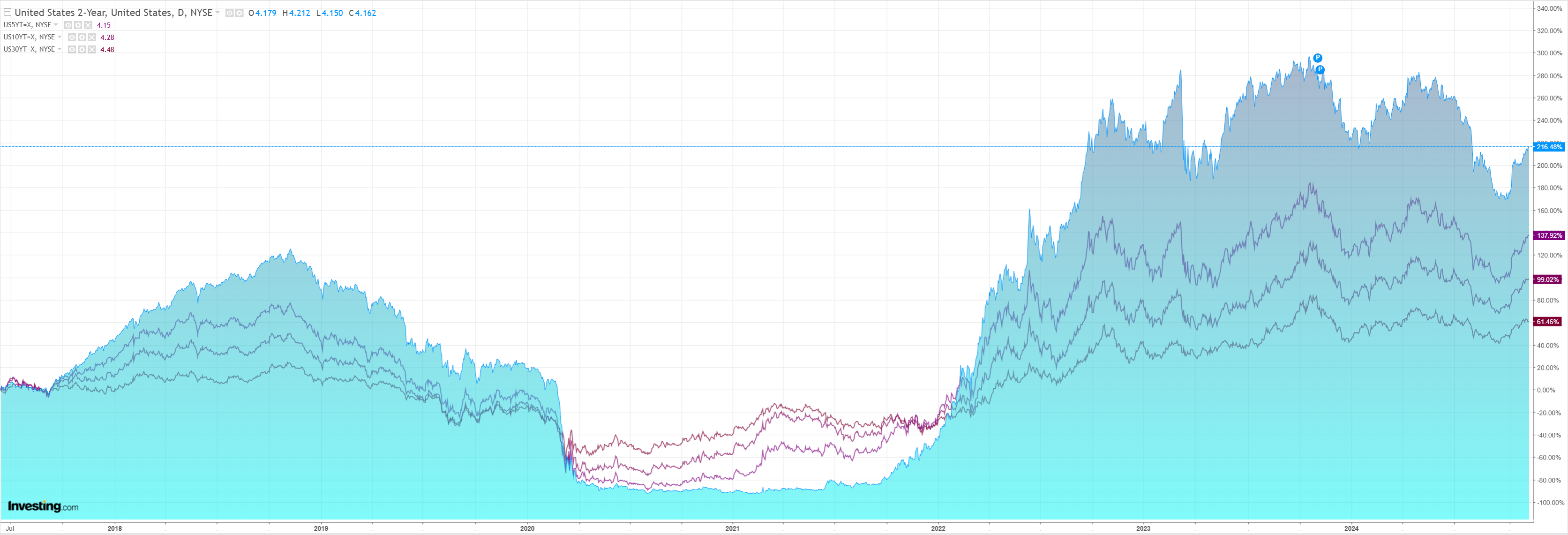

The yield curve is flattening out. Enough damage done in the sell off?

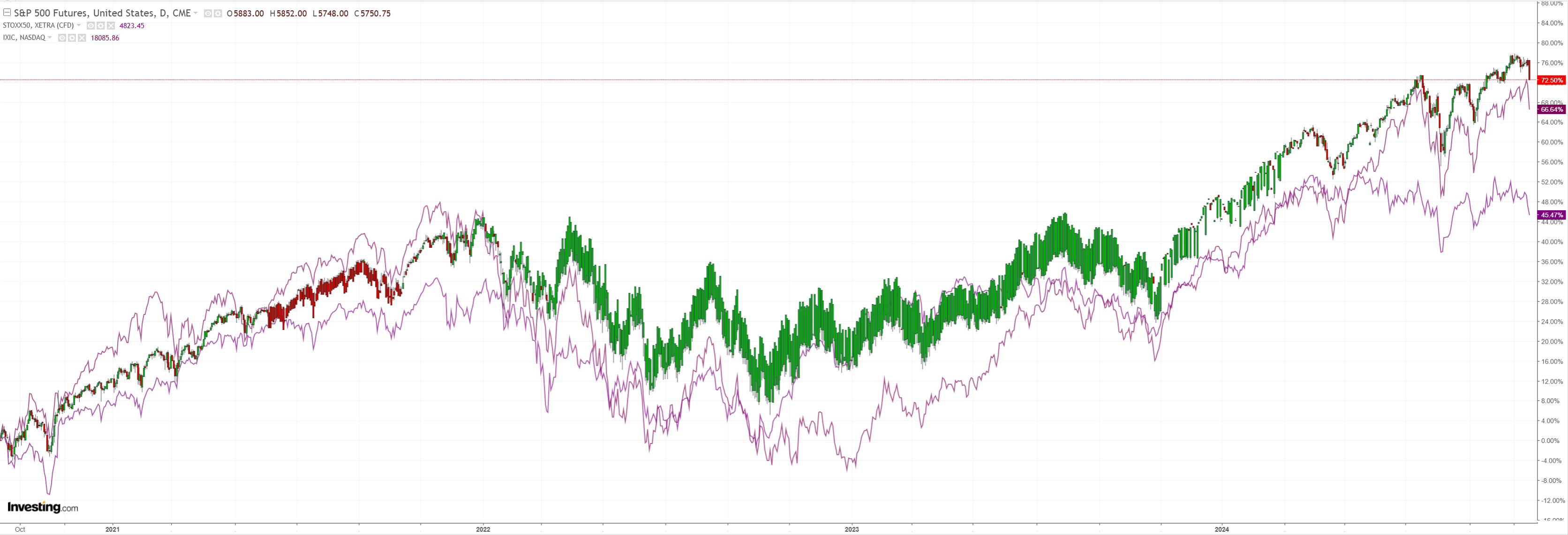

Stocks think so:

It’s not easy to distinguish the different factors.

Some of the volatility is definitely after markets went too far on Trump winning.

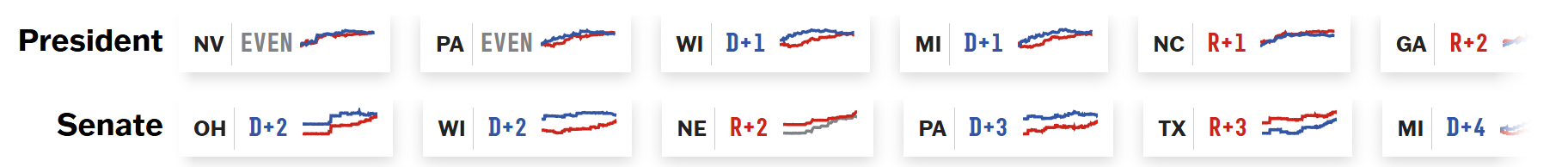

The latest polls hint at a firming “blue wall” in the Mid-West.

While PA anybody’s guess:

The favourite at this point may be election-count chaos as an overheated polity greets close-run races.

Which is hardly bullish.

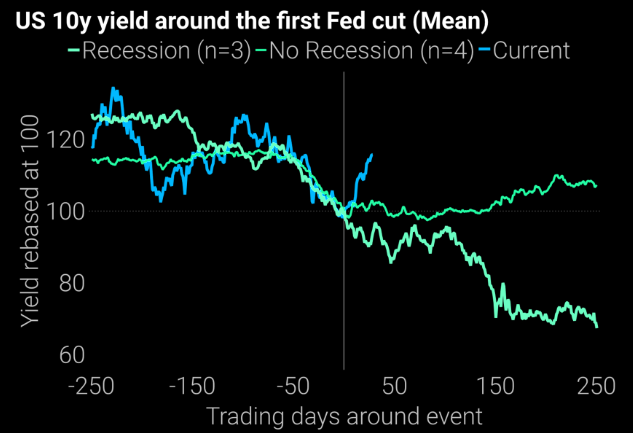

Then there is the bond back-up. This has run way too far given the outlook for more disinflationary growth:

This is more bullish as yields fall back.

Then there is China’s misfiring stimmies which will do plenty for liquidity and not much for growth.

This is more a sectorally specific force.

Anyway, the three pressures have finally proven too much for risk and it is selling off.

AUD warned of it in advance so is holding its own.

But, with long positioning, it is still at risk if the three forces go the wrong way.