DXY had the shortest rest in living memory and is off and running again, threatening to break out of its two-year range,

AUD is hanging on but this kind of pressure will break it.

CNY has barely begun to fall.

Gold has returned to its atypical bounce as DXY and real yields should send it lower.

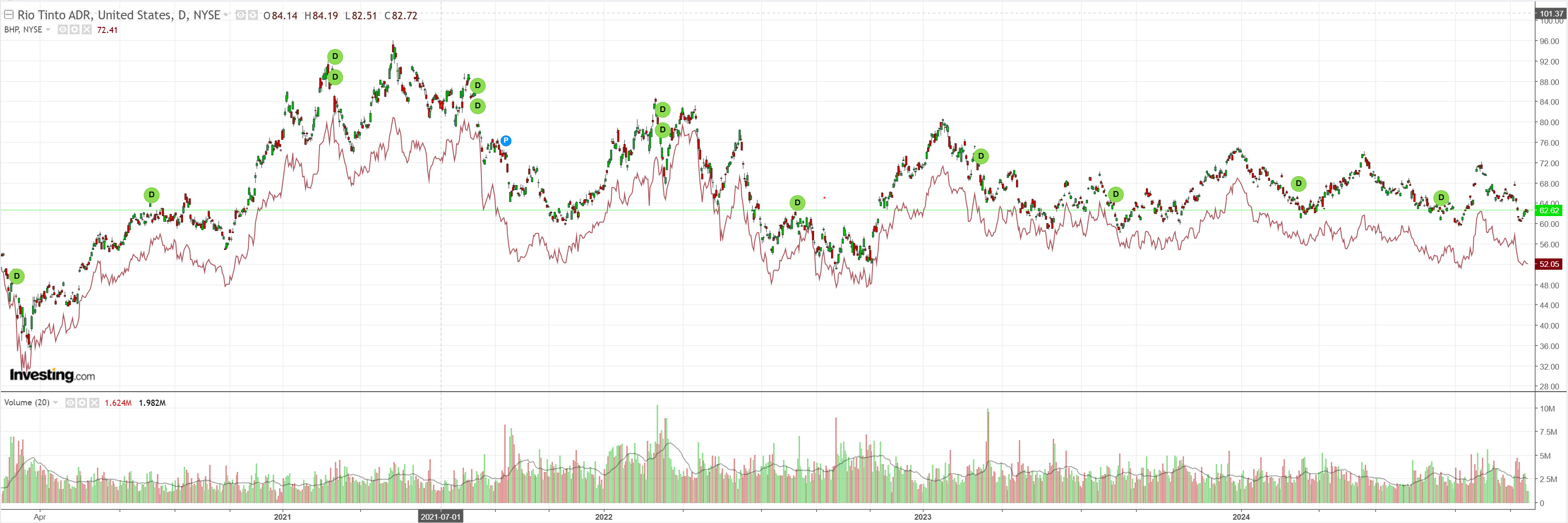

Dirt is not so lucky.

Miners are pancaked.

EM too.

Junk as well.

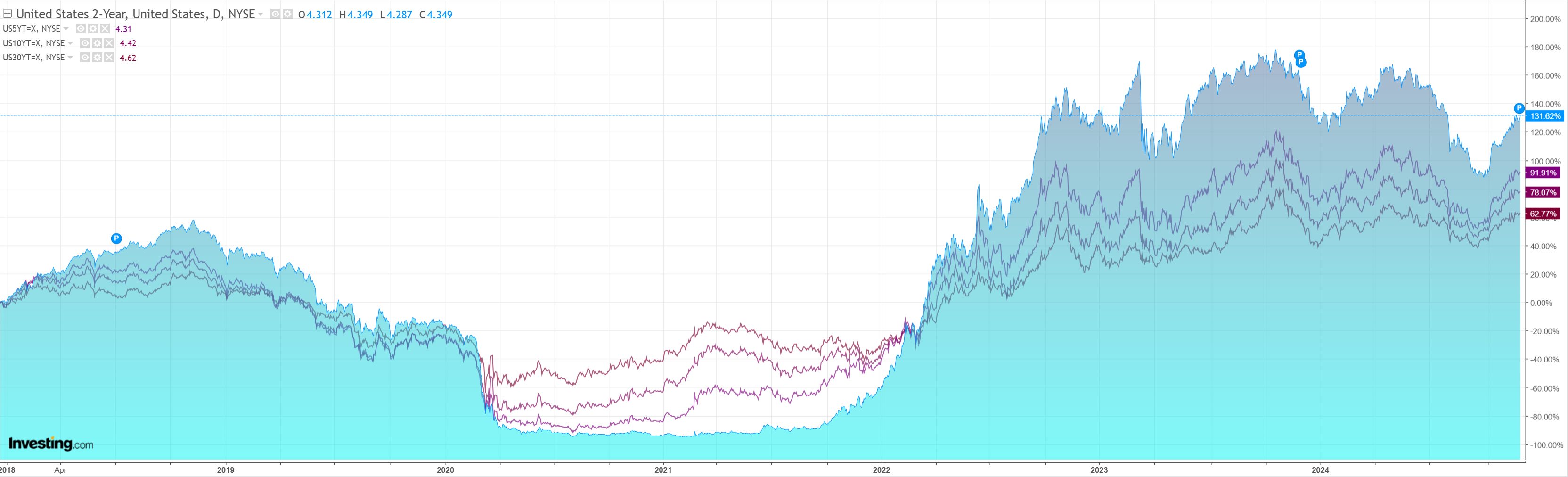

As yields rise anew.

Stocks only go up.

Another slow news day, other than WWIII developing in Ukraine, was enough to boost the Trump trades again.

Whether this is a pre-Trump peace escalation in the mould of the bombing of Hanoi only time will tell.

For now, analogue and digital gold are back on the chaos of missile launches even as DXY threatens a major breakout.

That yields were not bid is not a good sign for anything.

It appears risk will require a direct hit from an ICBM before it pays attention.

Nothing hear changes my view that AUD is going much lower over the first year of El Trumpo 2.0.