DXY is a SpaceX rocket.

AUD broke its uptrend. With markets long the battler, there is nothing to stop it falling.

As North Asia begins the competitive devaluation to defy Trump tariffs.

Gold could/should crash in this environment.

We’re gonna need more stimmies, Capt’!

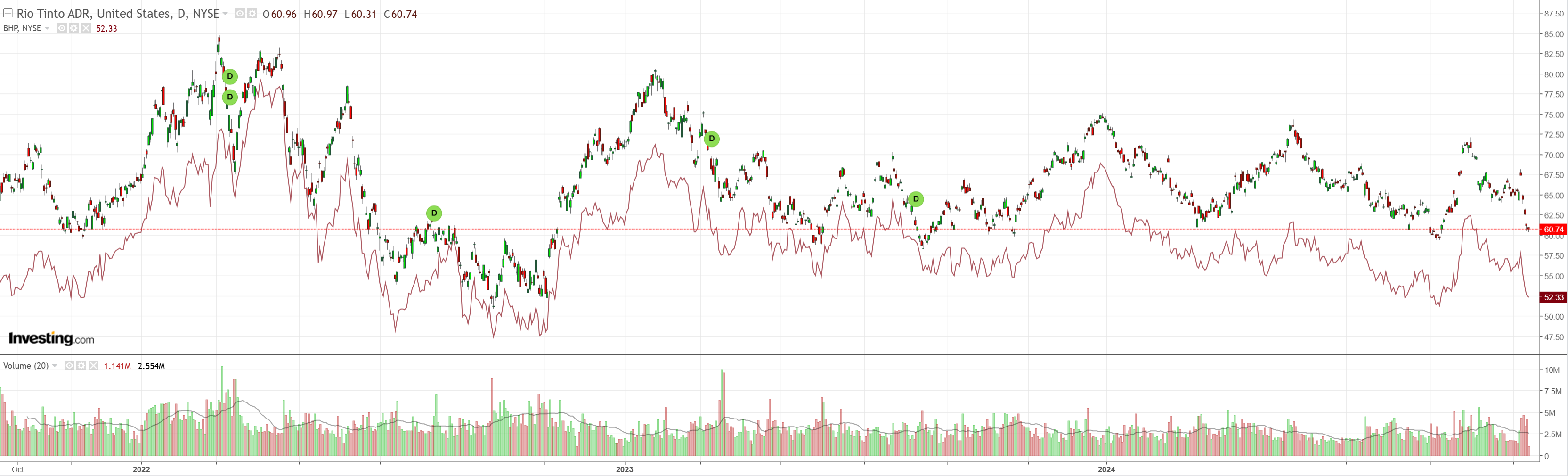

Miners flushed.

EM lol.

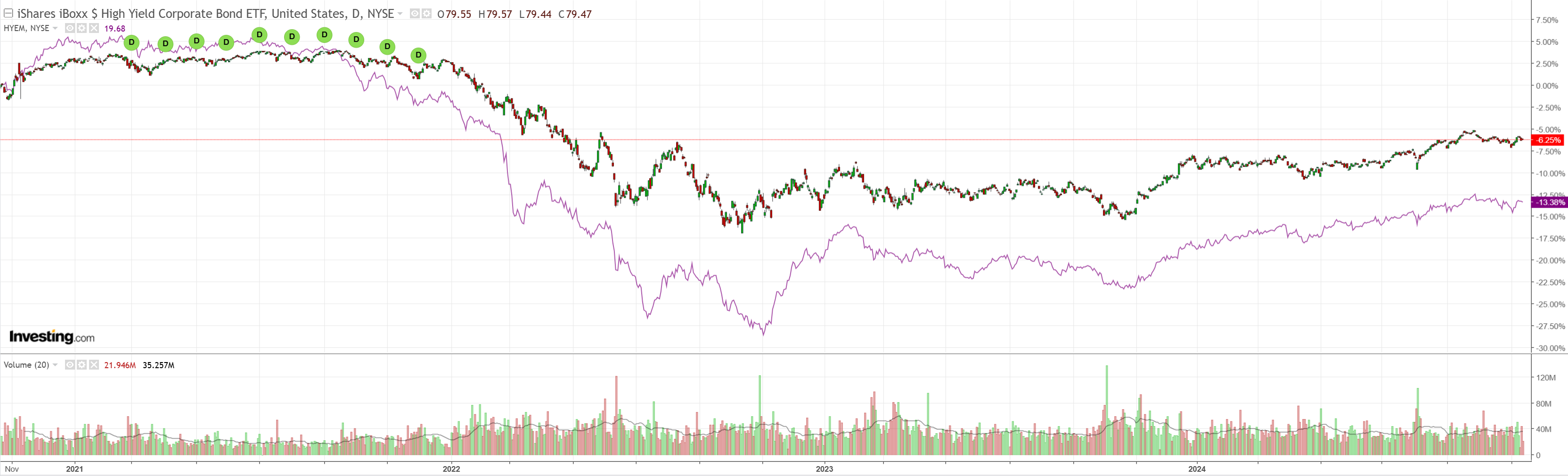

Junk is melancholy rather than scared.

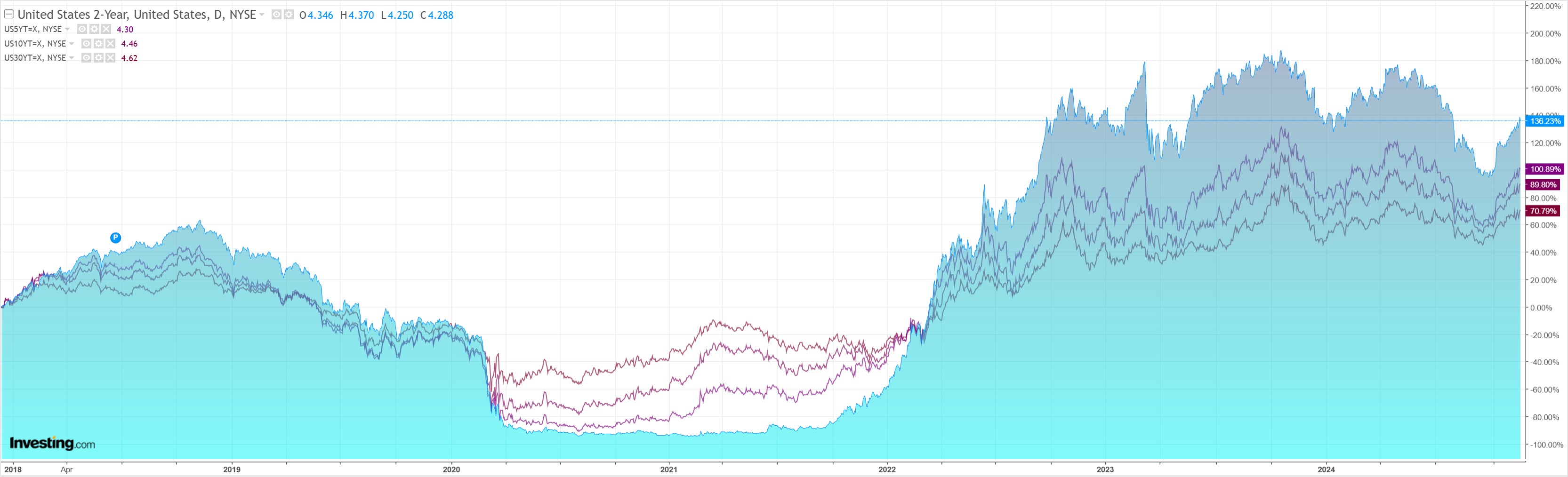

As yields flamed out.

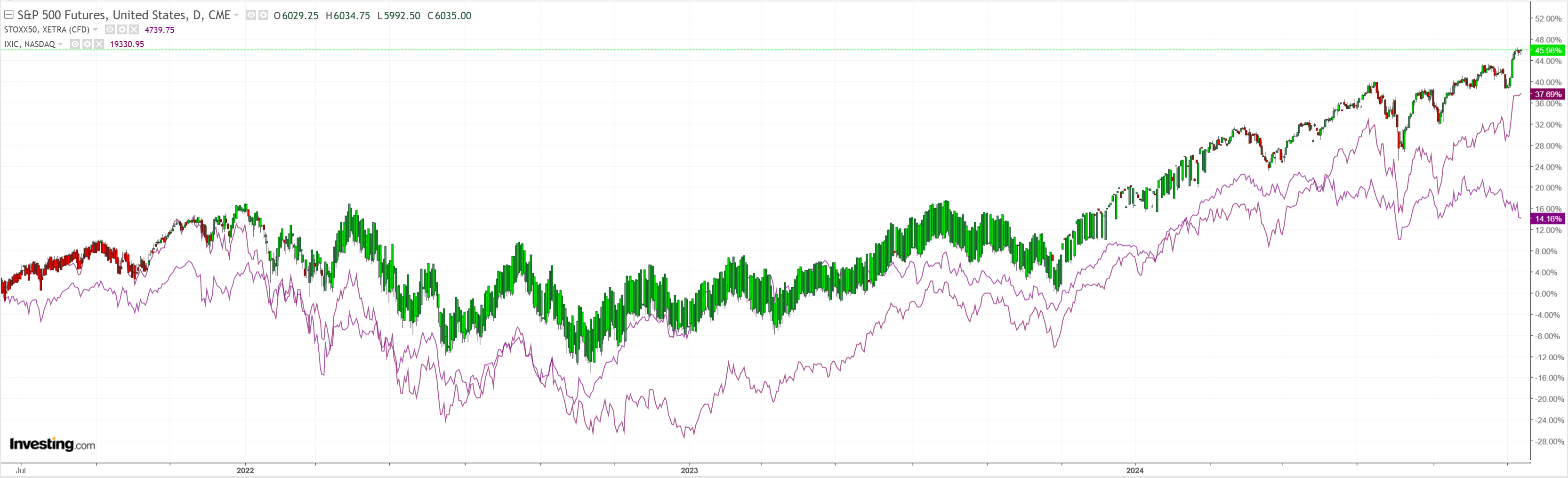

And stocks eked out gains.

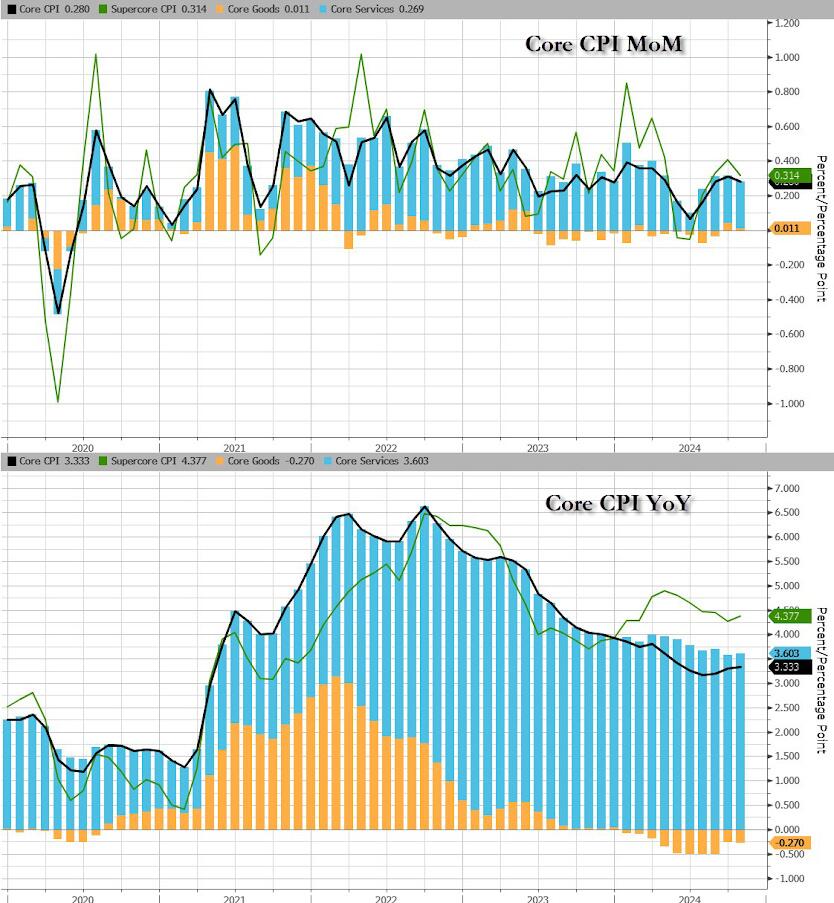

US inflation was OK with the headline at 2.6% and core at 3.3%, which looks an awful lot like Australia.

Also like Australia, there is plenty of embedded disinflation to come, most notably from rents, which remain sticky but have fallen in leading indicators.

Unlike in Australia, the US central bank is not a complete idiot and can forecast beyond the next meeting so it is cutting.

Another 25bps will come in December but then, perhaps, we’ll see a pause when tariffs arrive as the first order of Trump business.

There is nothing to stop AUD falling all the way to the inauguration when we might get some sell the fact for DXY.