DXY firmed Friday night:

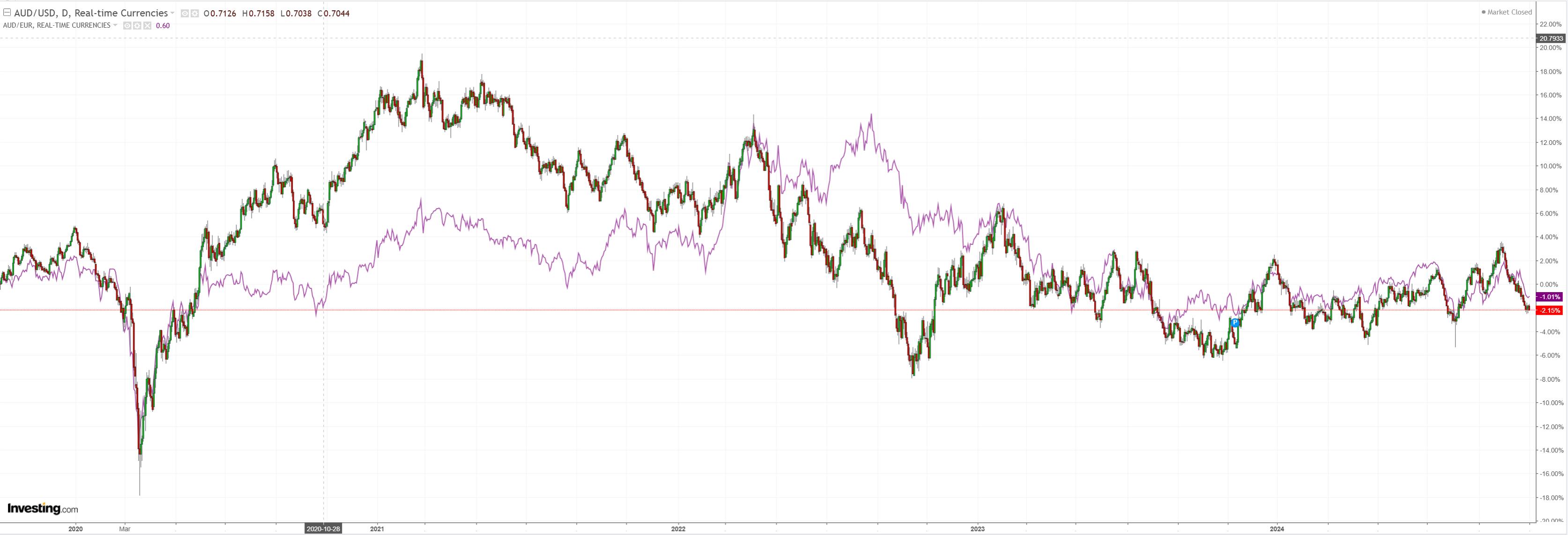

AUD back to the lows:

North Asia too:

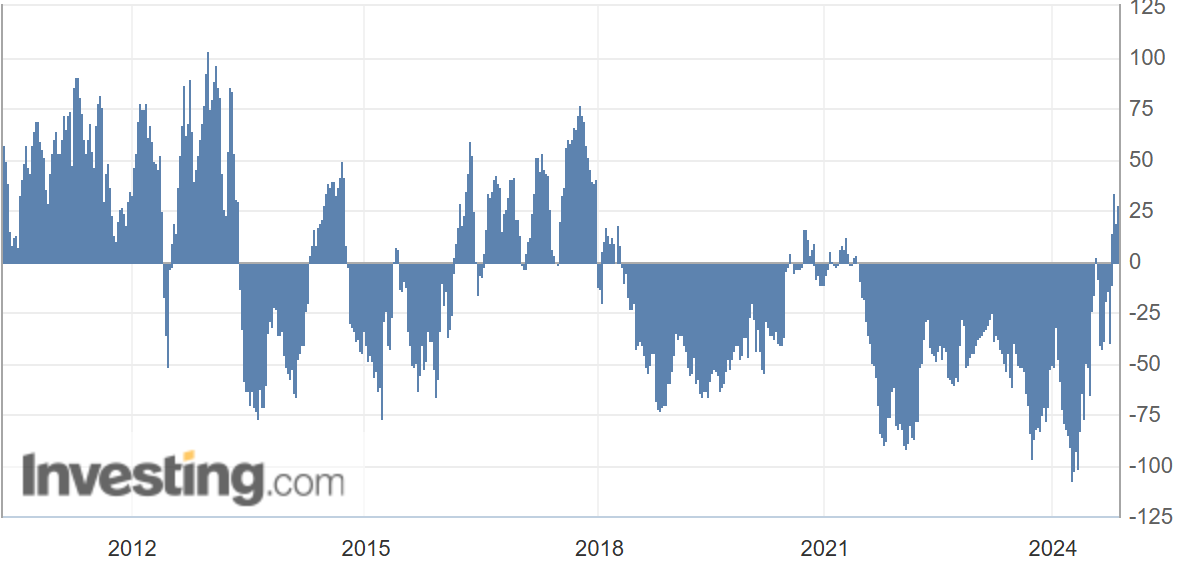

CFTC AUD is still long even as prices fall:

Advertisement

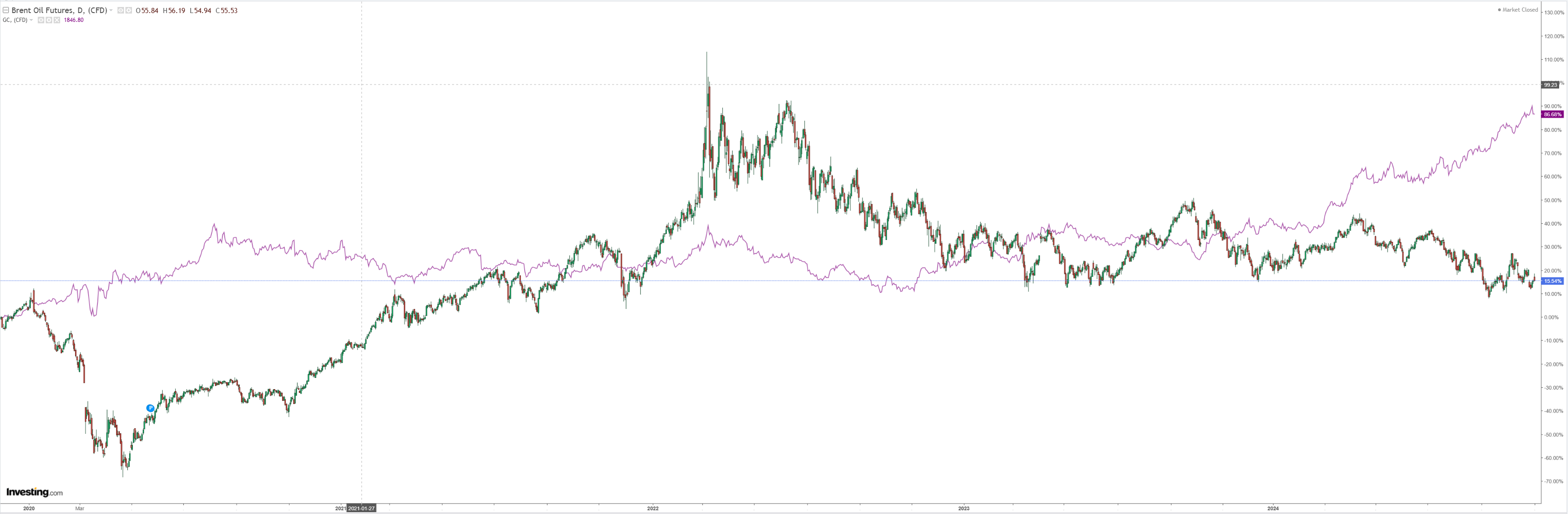

Oil is buggered. Gold is blowing off:

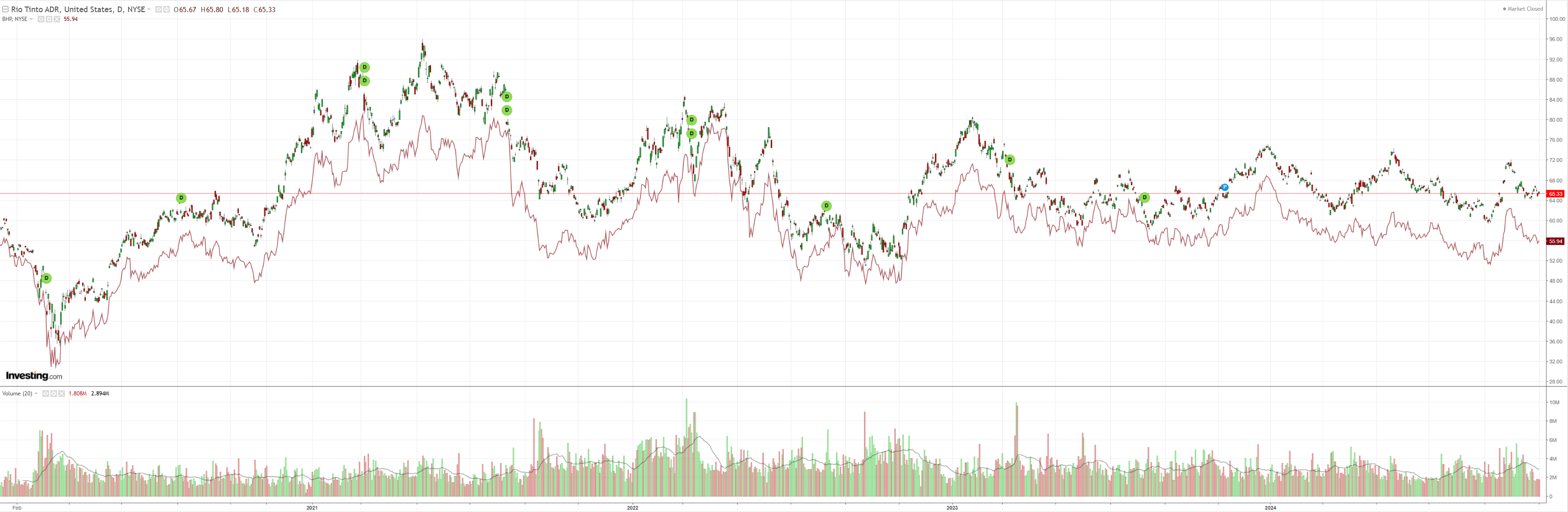

Dirt meh:

Miners meh:

Advertisement

EM meh:

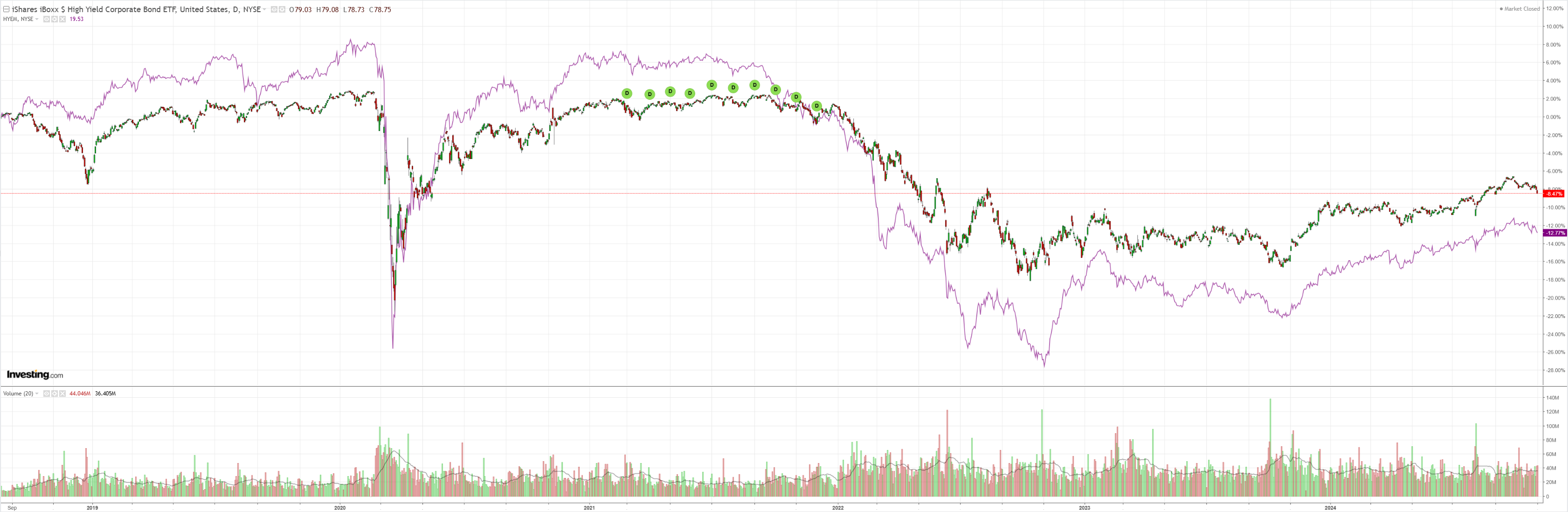

Junk is warning:

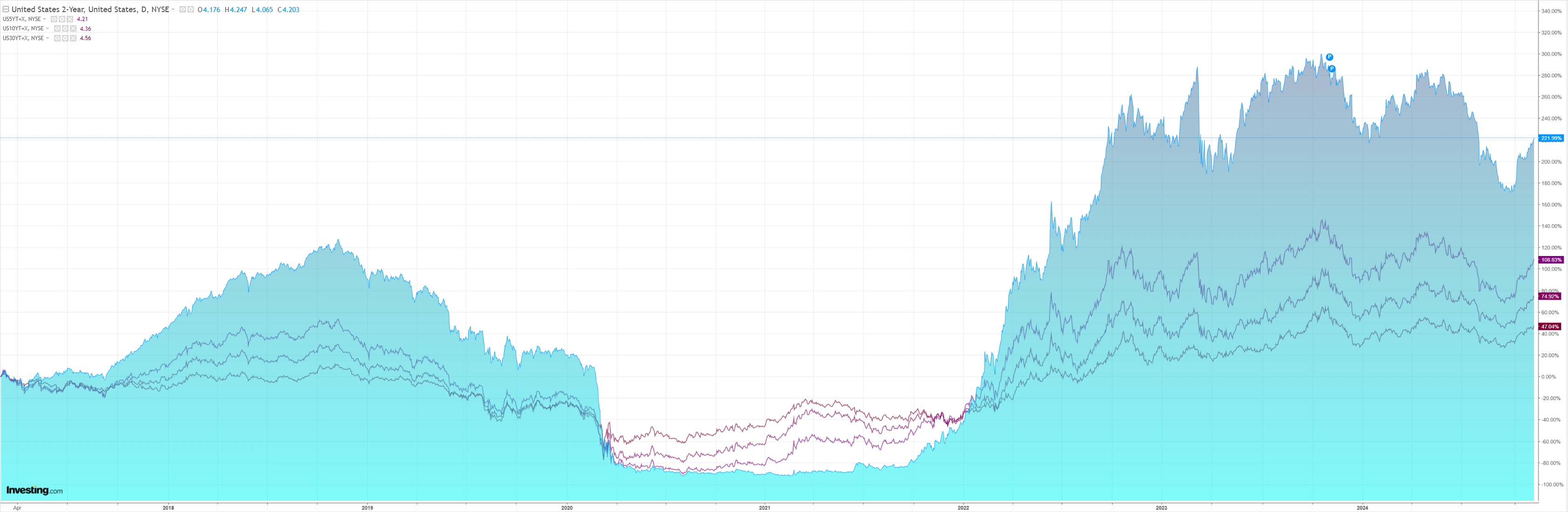

Yields are loonytunes:

Advertisement

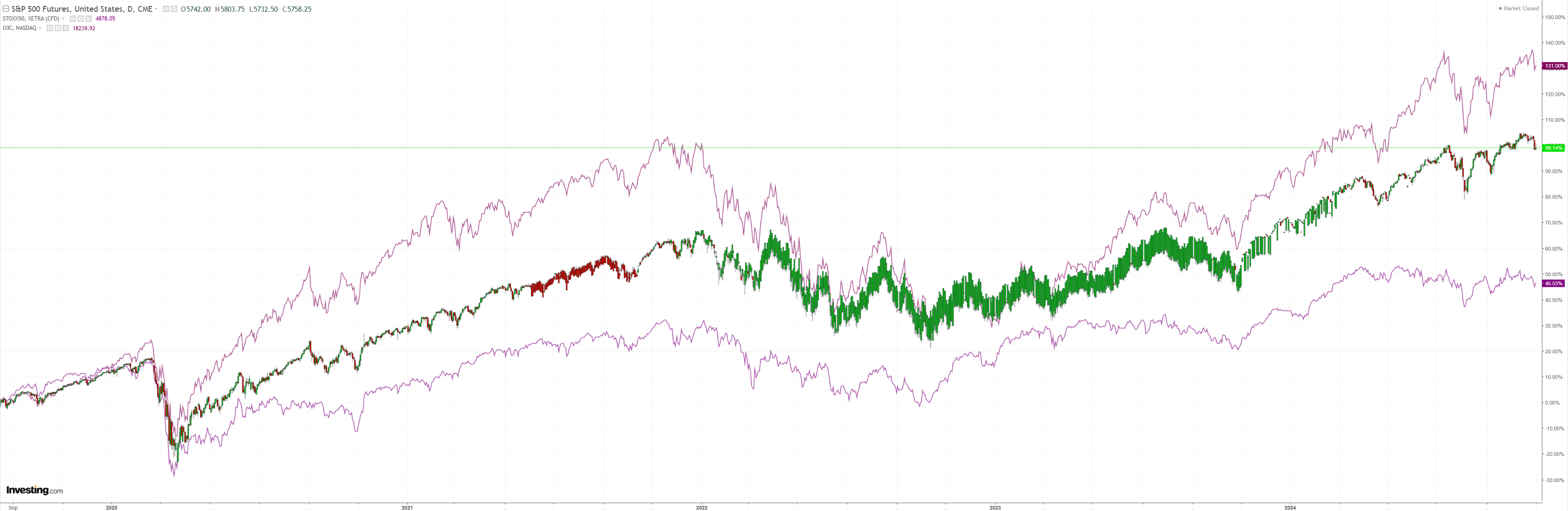

Stocks were bid anyway:

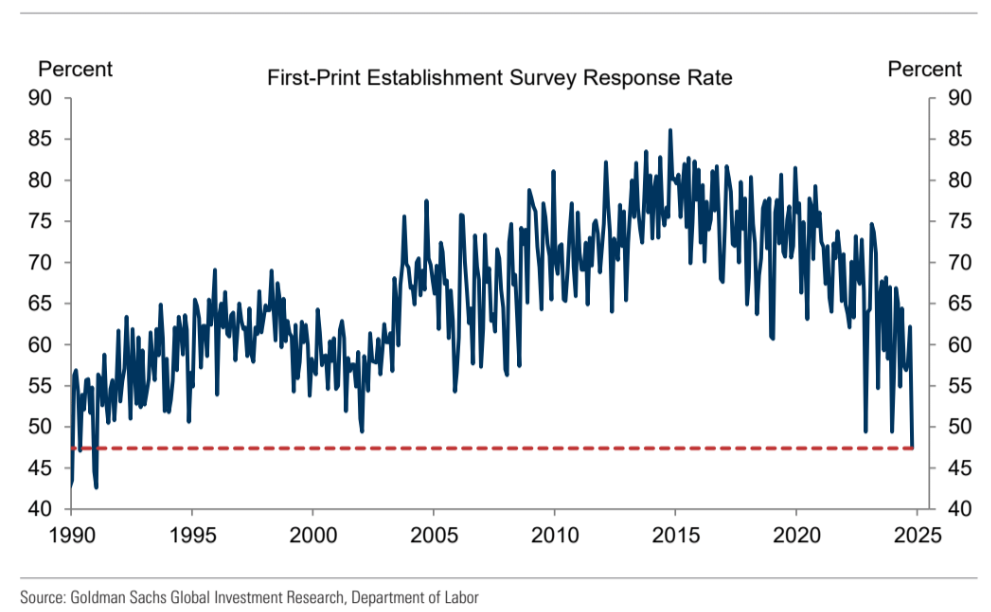

It was weather and strikes that affected the US jobs report so fade it:

Advertisement

If somebody can tell me where the next round of surging US inflation being priced into yields is coming from I am all ears:

- Wages? No.

- Commodities or oil? No.

- Currency? No.

- Fed? Long way to go there.

- Fiscal? Corporate tax cuts? No.

My view is the bond backup is another convulsion of CTAs, systematics and momo.

Advertisement

In other words, robots.

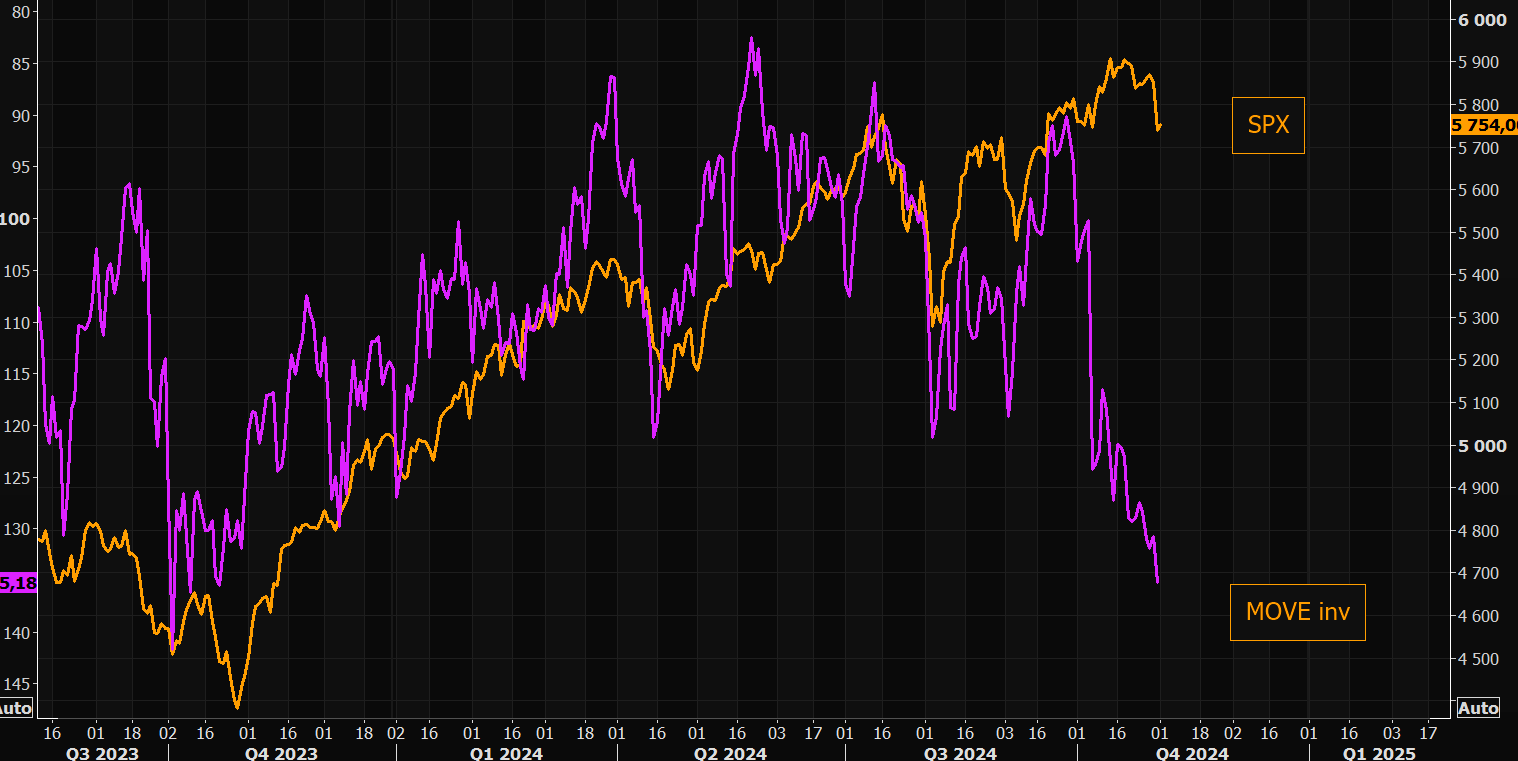

If we get a controversial US election, the rates gap is set to crush stocks which would probably puke the AUD:

And given Trump will challenge any close outcome, that is my base case for the week ahead.

Advertisement