Deutsche sums up my view of the US election:

“Global risk assets are taking their cue from US equities and generally doing well; in turn high-beta FX such as the commodity currencies are outperforming. We would be very cautious in extrapolating this price action and historical correlations going forward. The US election outcome in our view is historical in nature; it has the capacity to create a regime shift in markets whereby correlations break down due to highly idiosyncratic and divergent shocks between the US and the rest of the world. This is another way of saying it is entirely possible for one market to go up (US) and another to go down (rest of world) even if this has never happened before in history.”

“If the Trump policy platform goes ahead, there is still much more to go in the dollar and broader FIC market pricing, in our view.

A US inflationary boom and global deflationary bust is the base case as tariffs smash US demand for other’s exports and tax cuts keep US domestic demand booming.

This leads to an ever-expanding yield spread advantage underpinning the DXY.

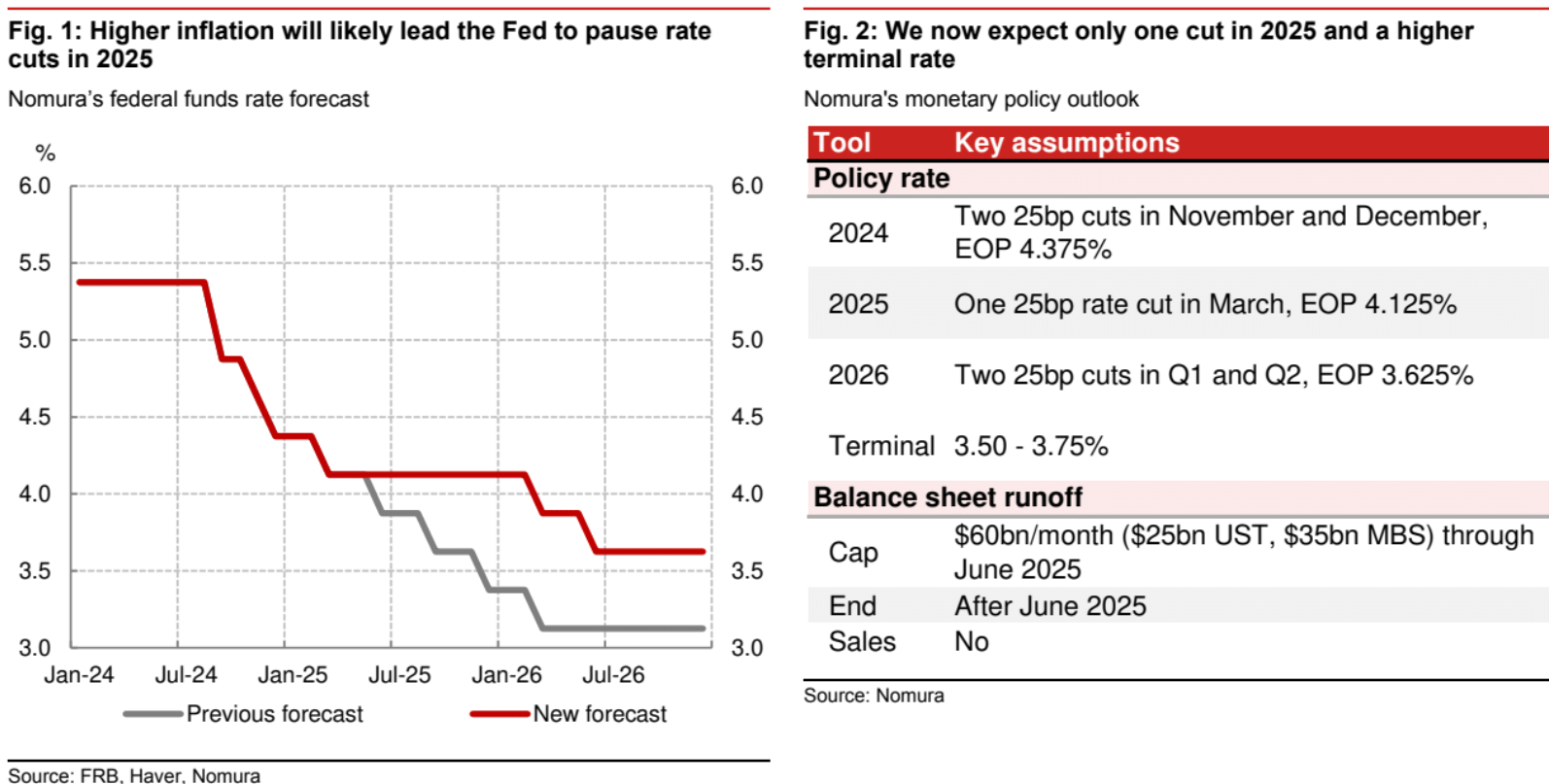

Banks are already pulling Fed easing. Nomura:

We now expect just one Fed cut in 2025, with policy on hold until therealized inflationshock from tariffshas passed (Figs. 1&2).

We expect some additional easing in 2026, but have raised our terminal rate forecast to 3.625% from 3.125%.

An eventual change in Fed leadership is likely by 2026, but it will be difficult for Trump to significantly impact monetary policy.

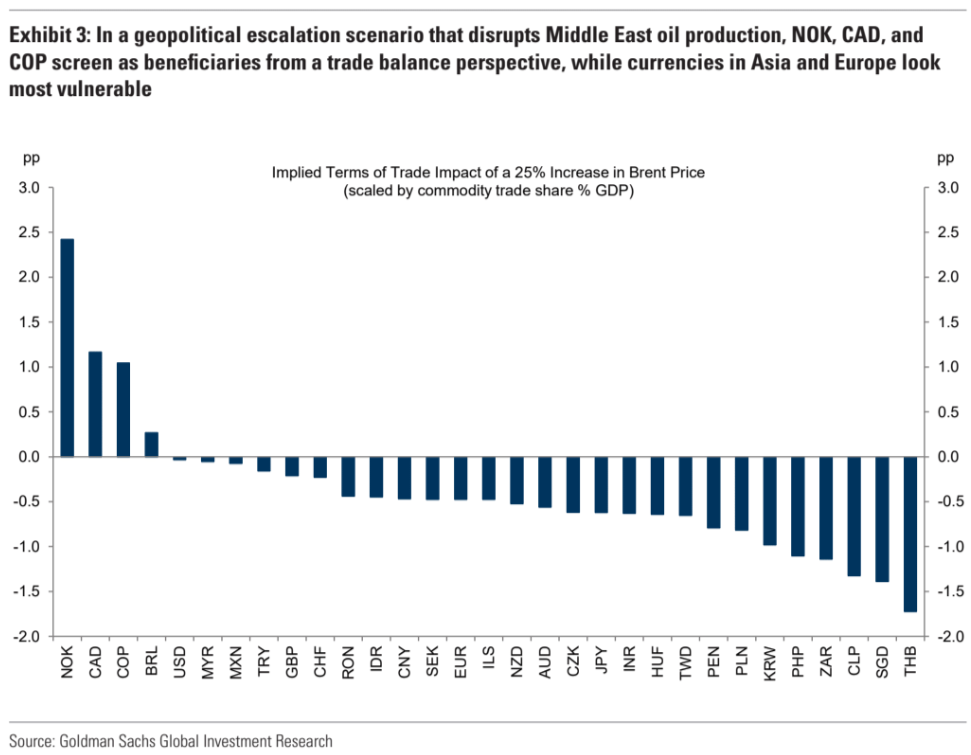

Another critical input into FX valuations is Terms of trade (Tot), especially for commodity exporters. That’s where we find Goldman assessing FX under Trump.

Following our economists’ latest upgrade to their China stimulus expectations, our commodity strategists’ 2025 average forecasts now imply roughly 5% of upside (versus current spot) in copper prices, 6% of upside in gold prices, and 7% of downsidein iron ore prices on a partial reversal of recent outperformance relative to fundamentals.

We apply these shocks to our ToT framework—or estimate the combined trade balance impact based on the weights in our ToT indices—to provide a rough gauge of the relative FX impact from our baseline China stimulus expectations.

This approach suggests that the biggest beneficiaries from a trade balance perspective should be CLP and PEN on the boost to copper prices and GBP on the upside in gold prices, while AUD should be most vulnerable to the partial reversal in iron ore prices and other Asia FX should be challenged by higher copper prices (Exhibit 2).

If China stimulus expectations increase in response to a Republican election victory, we would expect to see even greater outperformance of CLP, PEN, and GBP over time.

The currencies should benefit from the further boost to copper and gold prices, and are generally less exposed to a decline in China sentiment and a weaker CNY—even though additional stimulus should soften the growth hit from higher tariffs and be marginally supportive for regional sentiment.

Trump tariffs and tax cuts, AI boom, and weight-loss drugs boom, all push American growth and asset prices higher in the short term (before tariffs do harm in the medium term).

Meanwhile, commodities and global goods prices are smashed by weaker growth, lower demand, and dumping triggering deeper monetary easing everywhere else.

The AUD may be on the verge of making a run for the 0.50s (a 5-handle) through 2025…