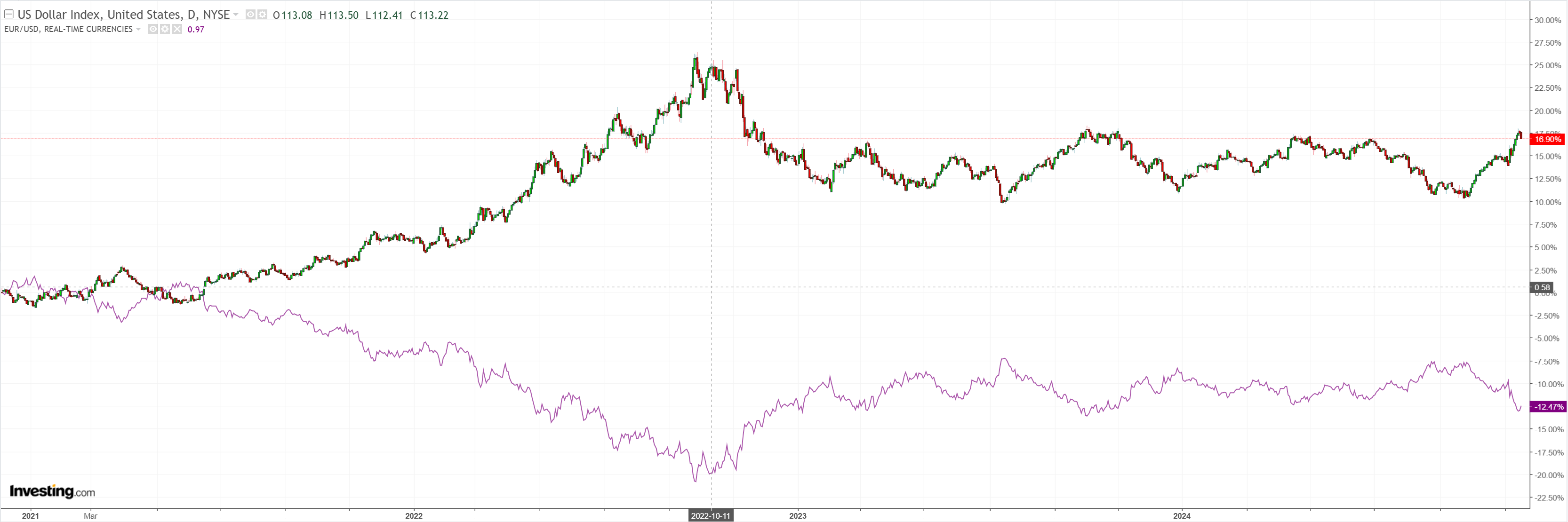

DXY finally took a breather.

Releasing the tourniquet choking off the Crap Complex. AUD up.

North Asia not so much.

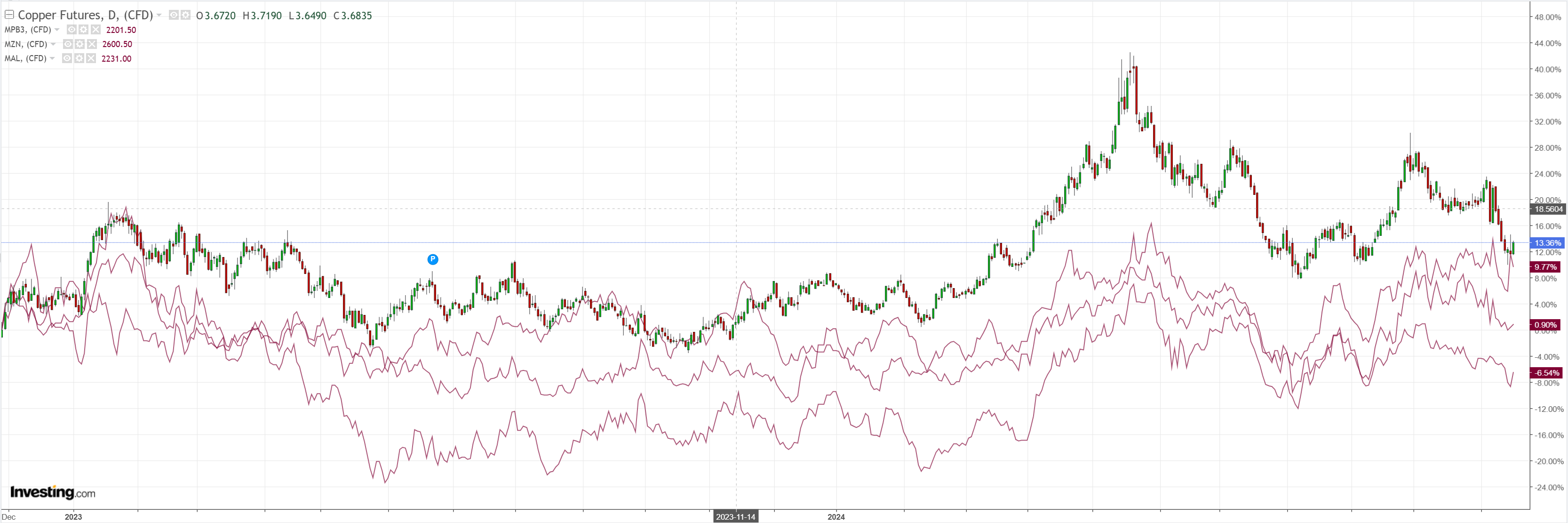

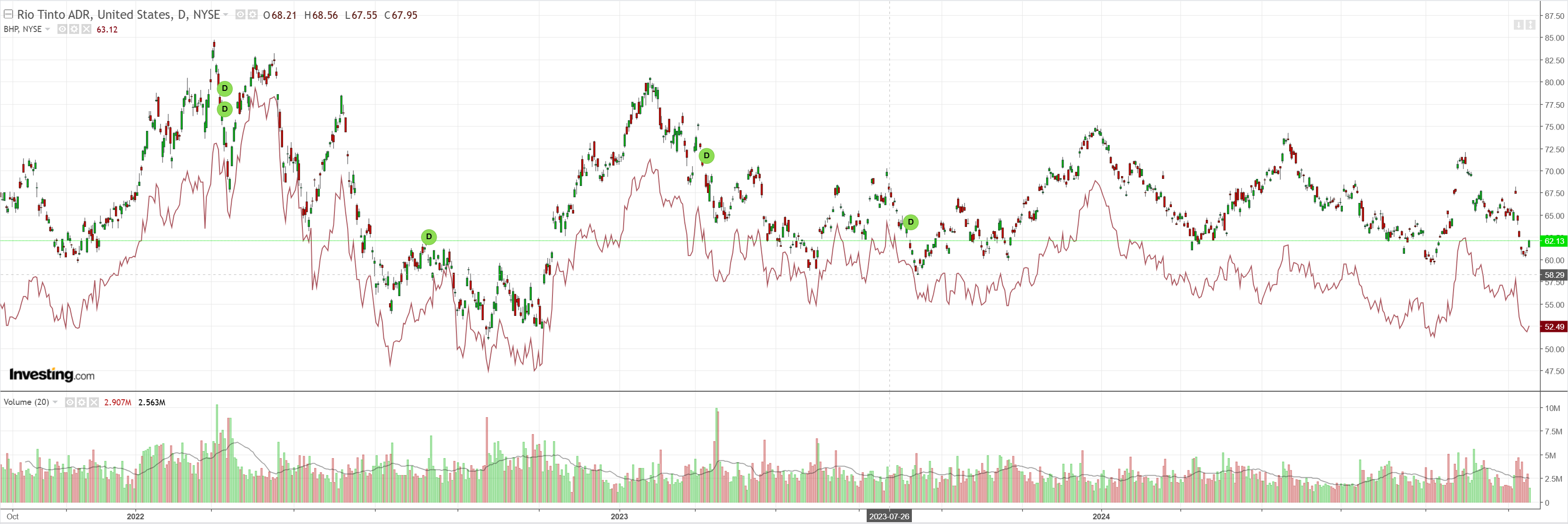

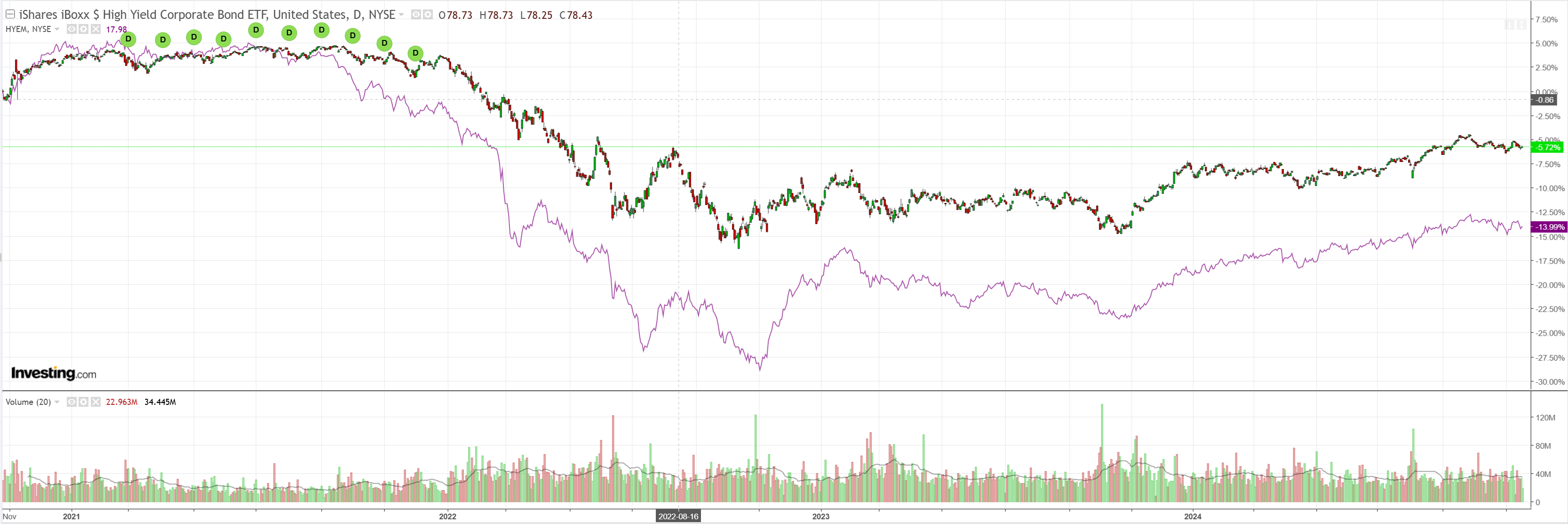

Gold, oil, dirt, miners, EM and junk up.

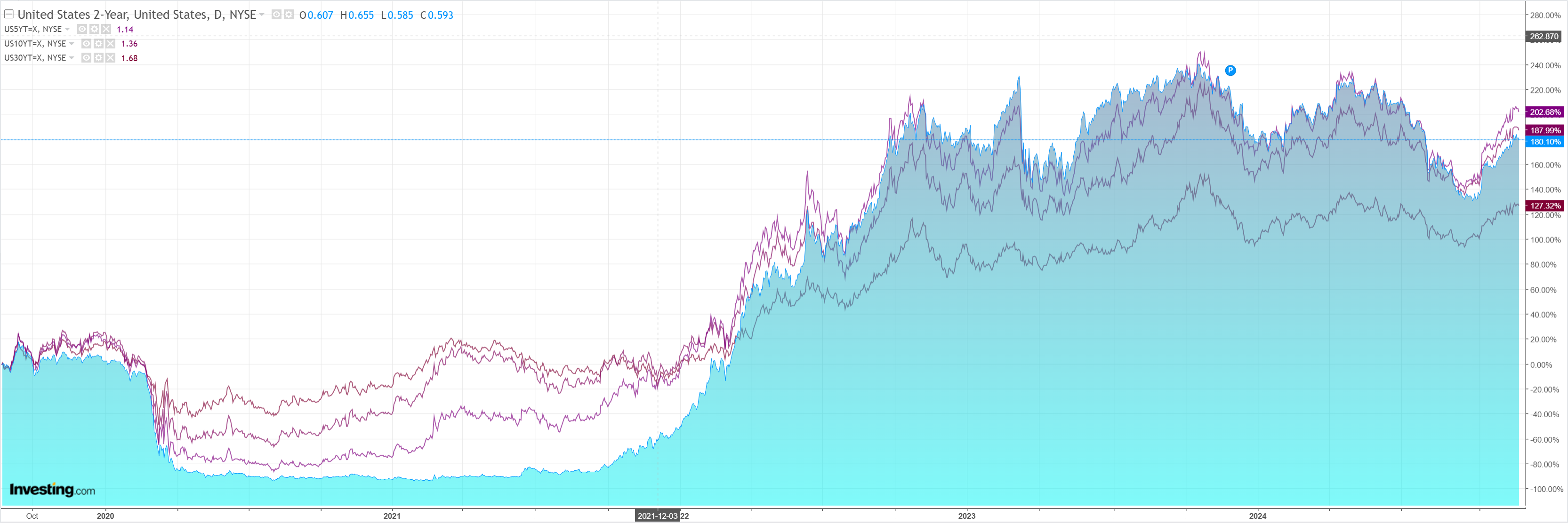

As Treasuries caught a bid.

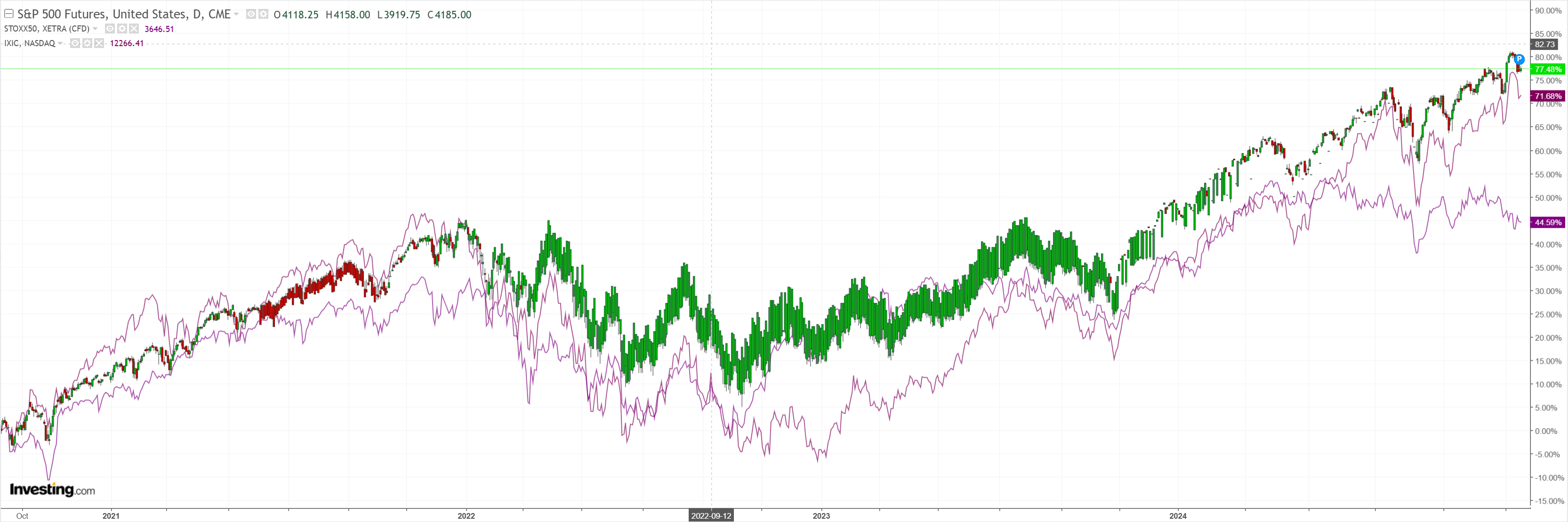

Stocks firmed.

Nothing much to explain it. Just exhaustion. Credit Agricole has more.

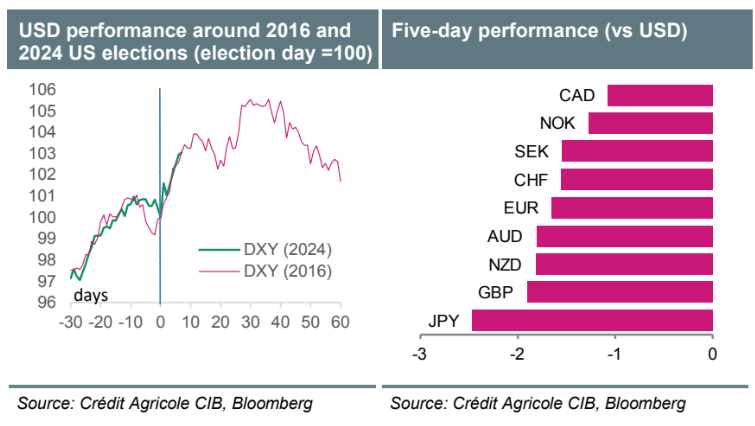

The post-US election USD moves across the board remain the main driver of the G10 FX price action in the near term.

That being said, there are some signs that the USD rally is starting to lose momentum.

Consistent with that, the USD rally in FX spot has not yet led to greater interests for further upside in the option space.

We further note that the latest USD path is very similar to that after Trump’s election win in 2016.

To the extent that the 2016 price action becomes a more dominant FX market template from here, we can conclude that many Trump-related positives are already in the price of the USD.

We also note that the USD is looking overvalued vs the EUR, AUD and CAD relative to short-term fundamentals, according to our FAST FX model.

I see more USD rally ahead as currency devaluation is launched into Trump’s tariff war.

But nothing goes straight up.