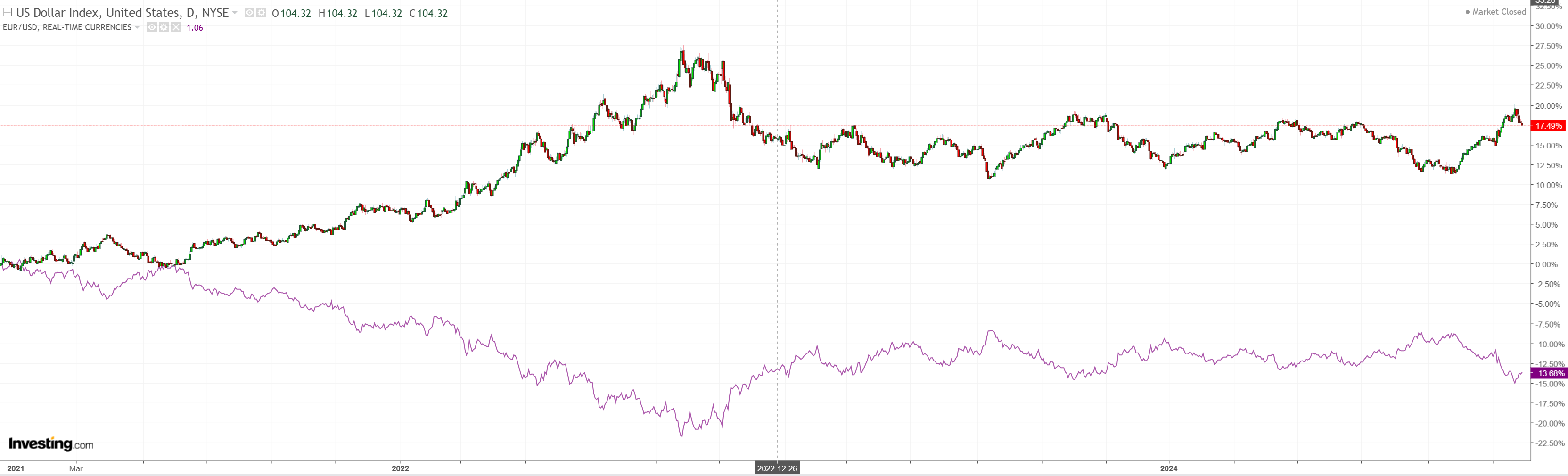

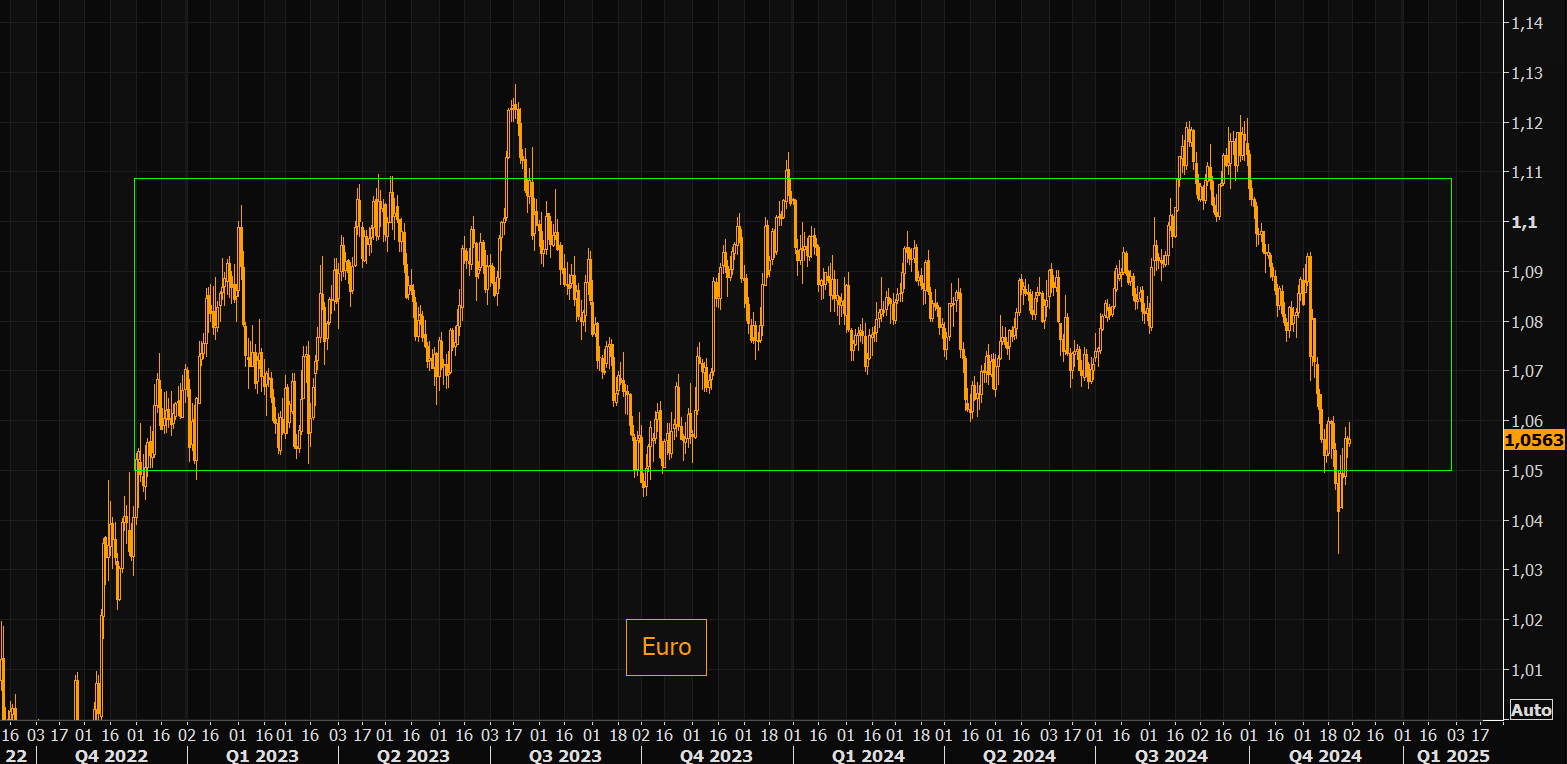

DXY has finally flamed out and is consolidating at the top of its range. EUR the reverse.

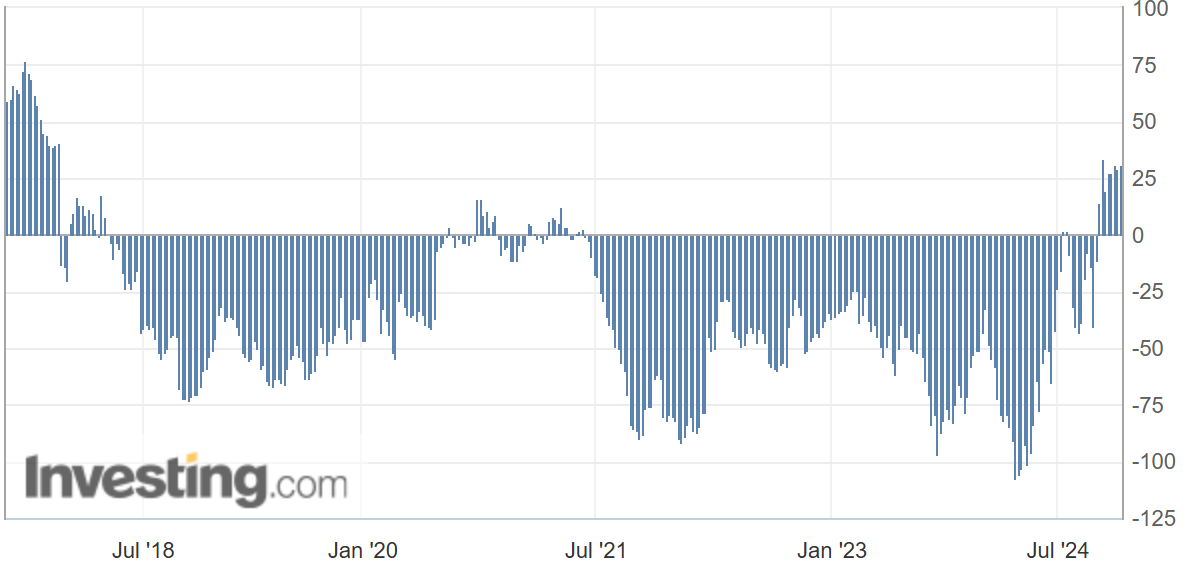

AUD is not bouncing hard.

The market is prematurely long.

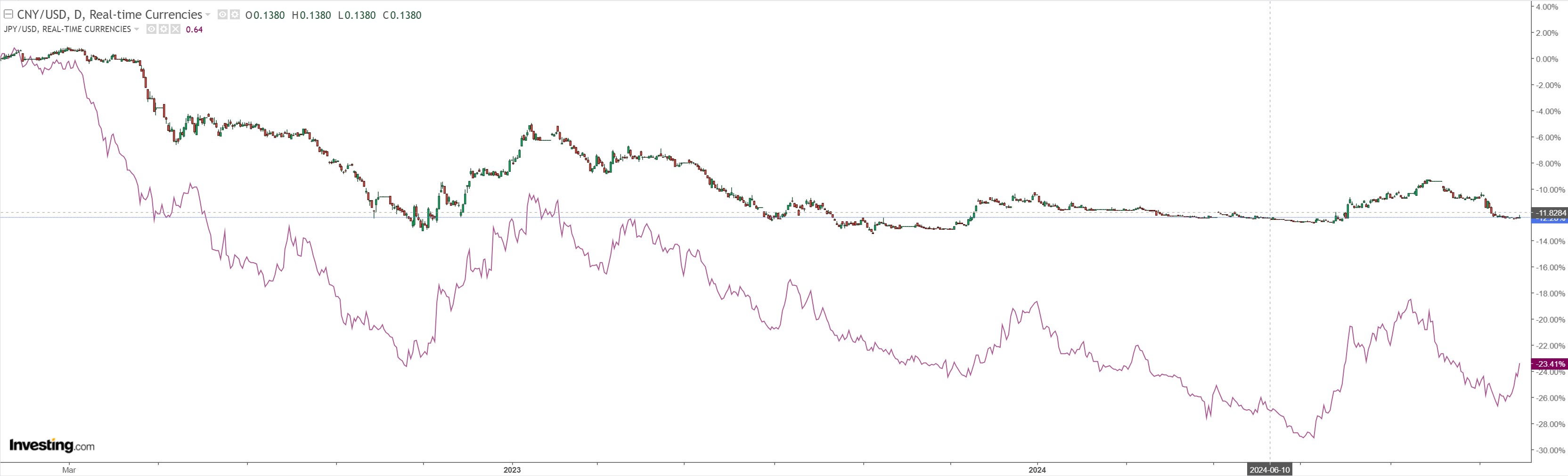

JPY is bouncing on rate hopes but the CNY smash lies ahead.

Oil is hanging on for grim death. I expect to lose the struggle eventually. Gold ain’t gotten much from a softer DXY.

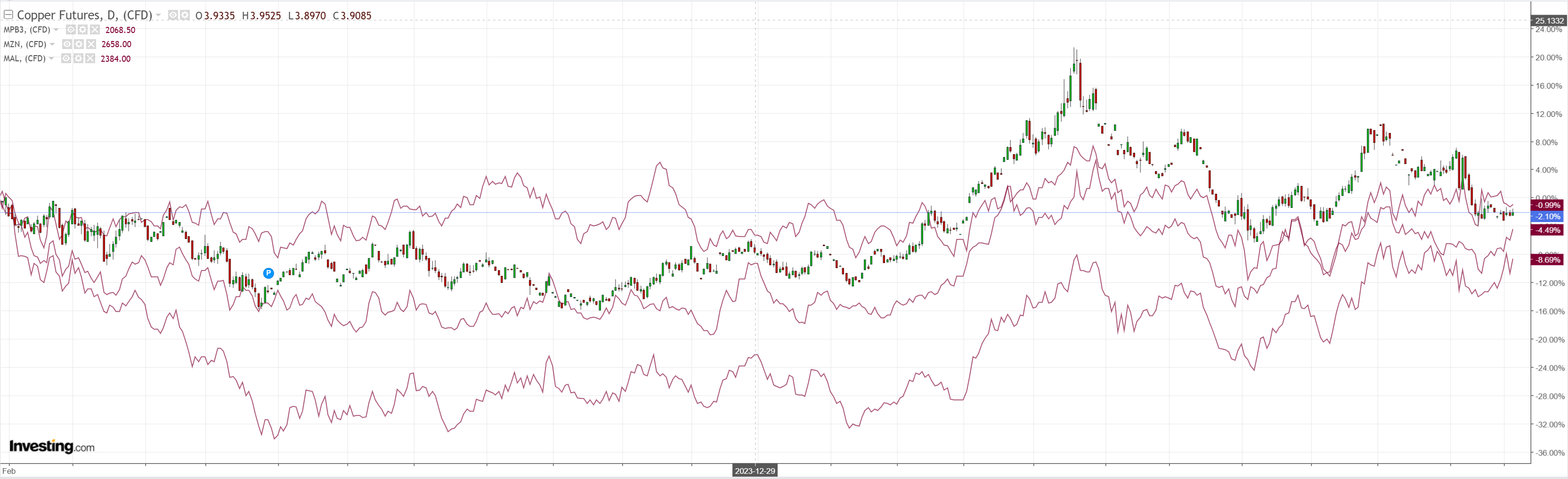

Nor copper.

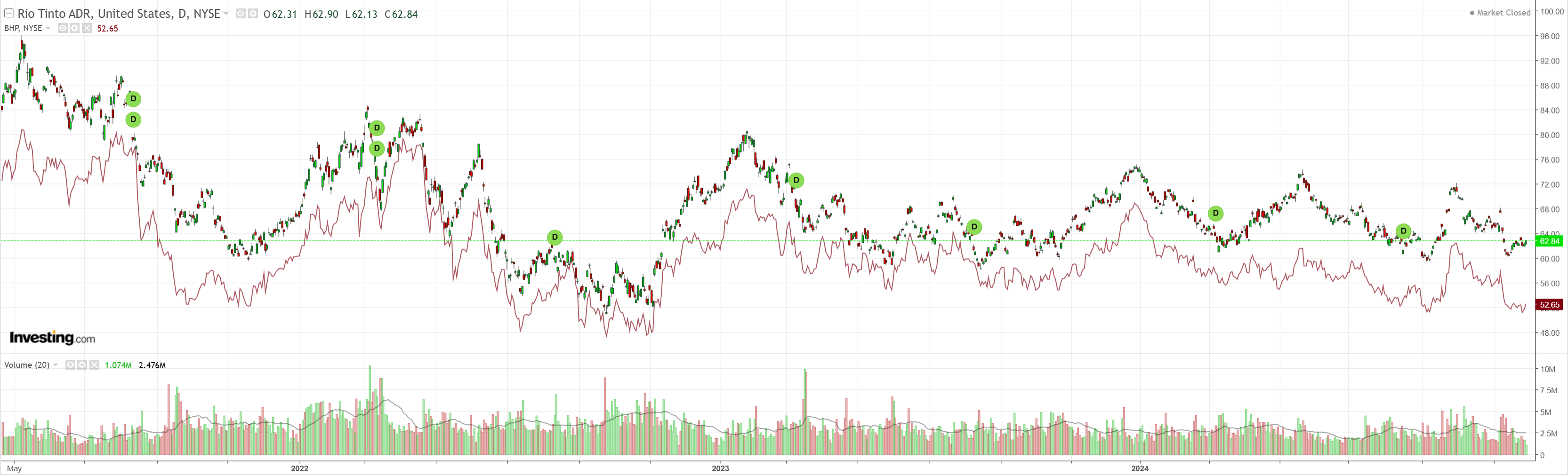

Nor miners.

Nor EM.

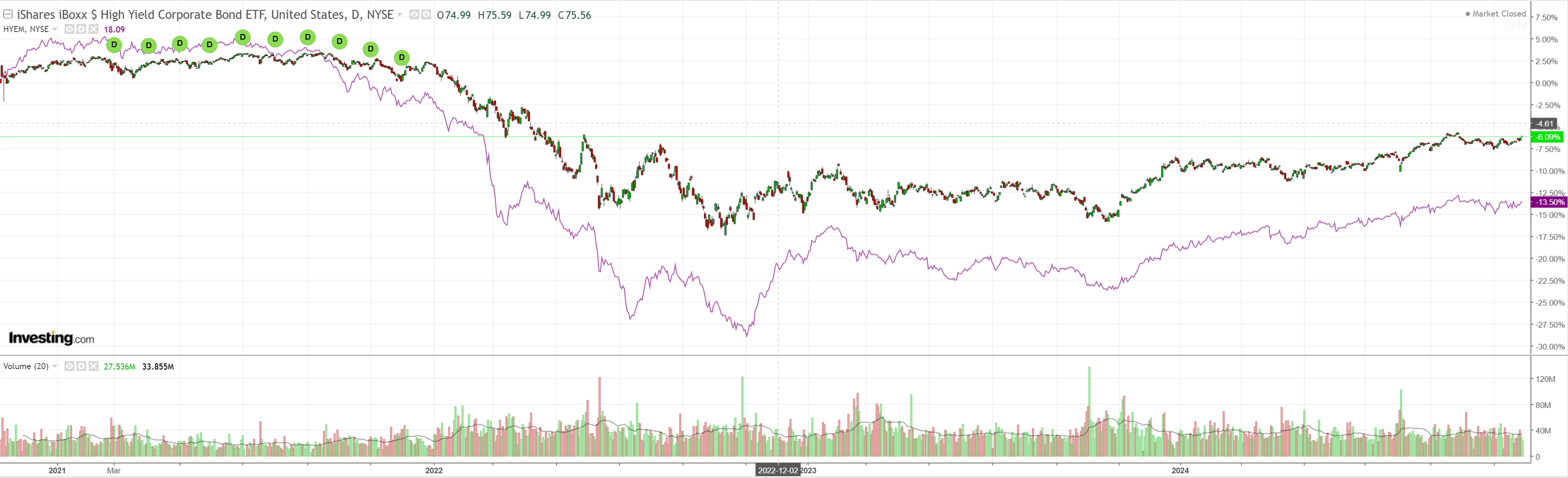

Junk is lifting again.

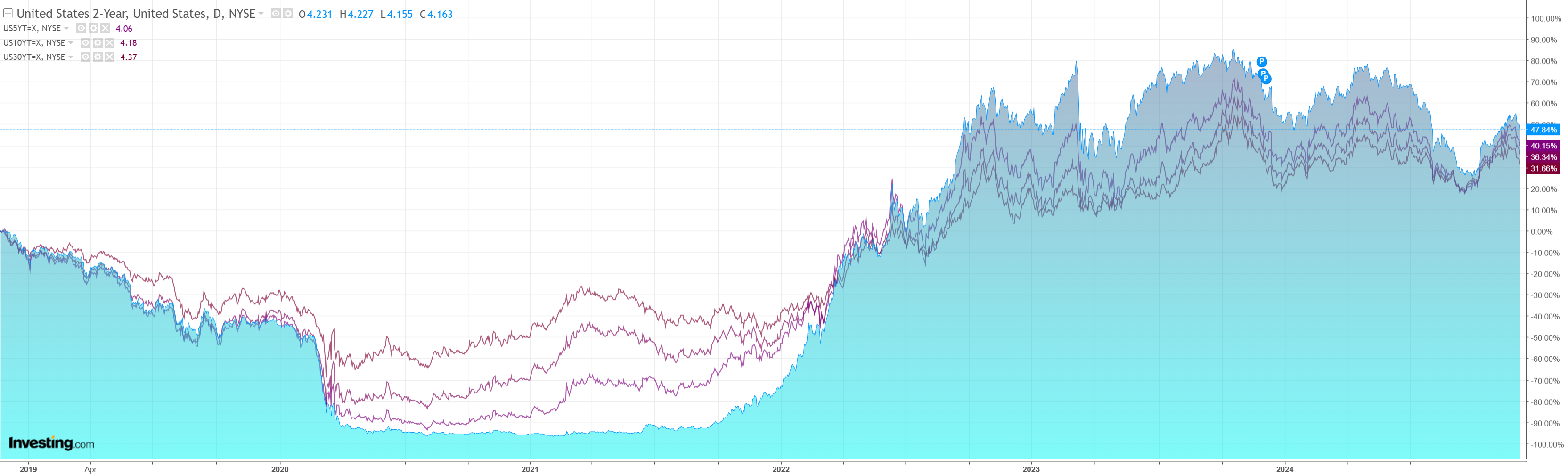

As the bond bid renews.

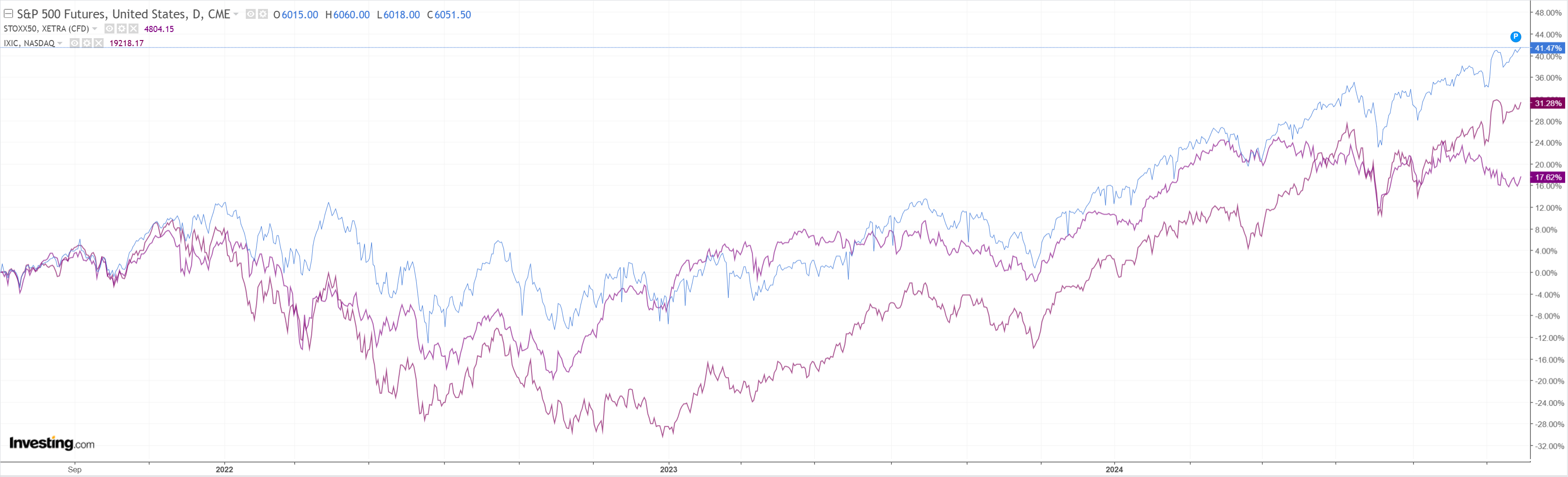

Driving stocks to another ATH.

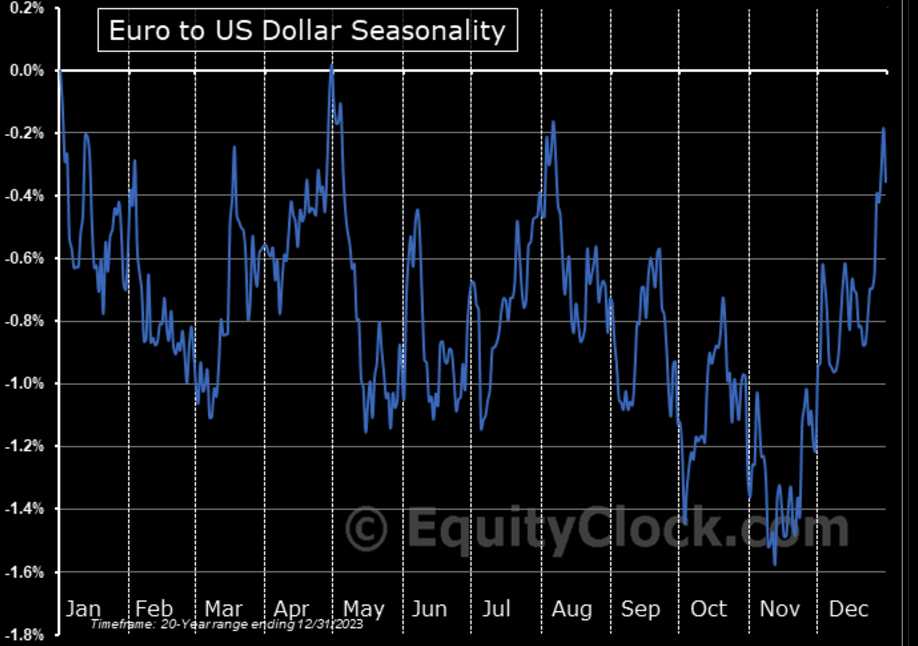

DXY is chopping wood while EUR is taking a breather. Both got overcooked.

I see this as the pause that refreshes for DXY.

As tariffs approach, there’s another leg in the rally, especially when China lets CNY go.

I’d probably be looking to buy AUD into that as global financial conditions ease violently versus tightening violently in the US.