DXY is a bull at a gate.

AUD is back at the line of control.

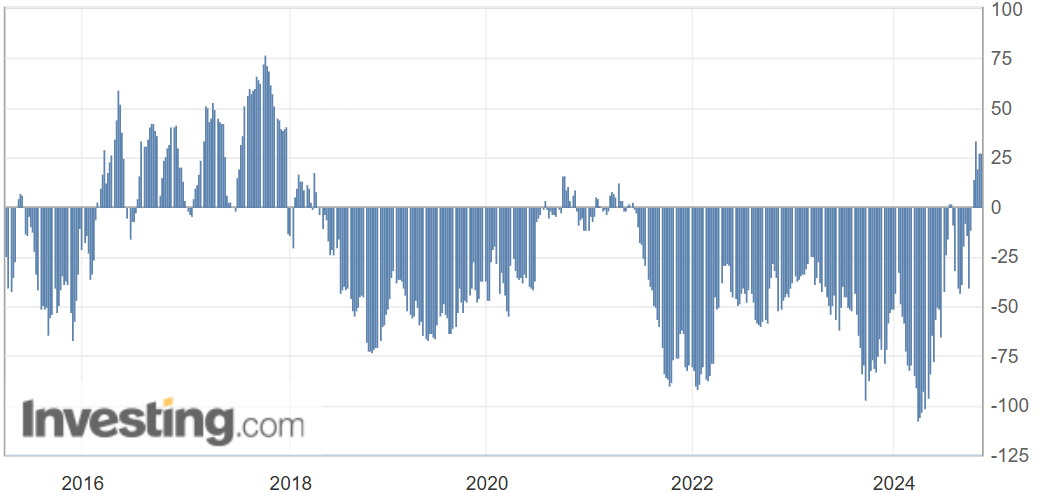

CFTC AUD positioning remains bizarrely bullish as the currency is murdered. This is very bearish.

CNY and AUD are the world’s worst bet.

Stay wary of gold and oil.

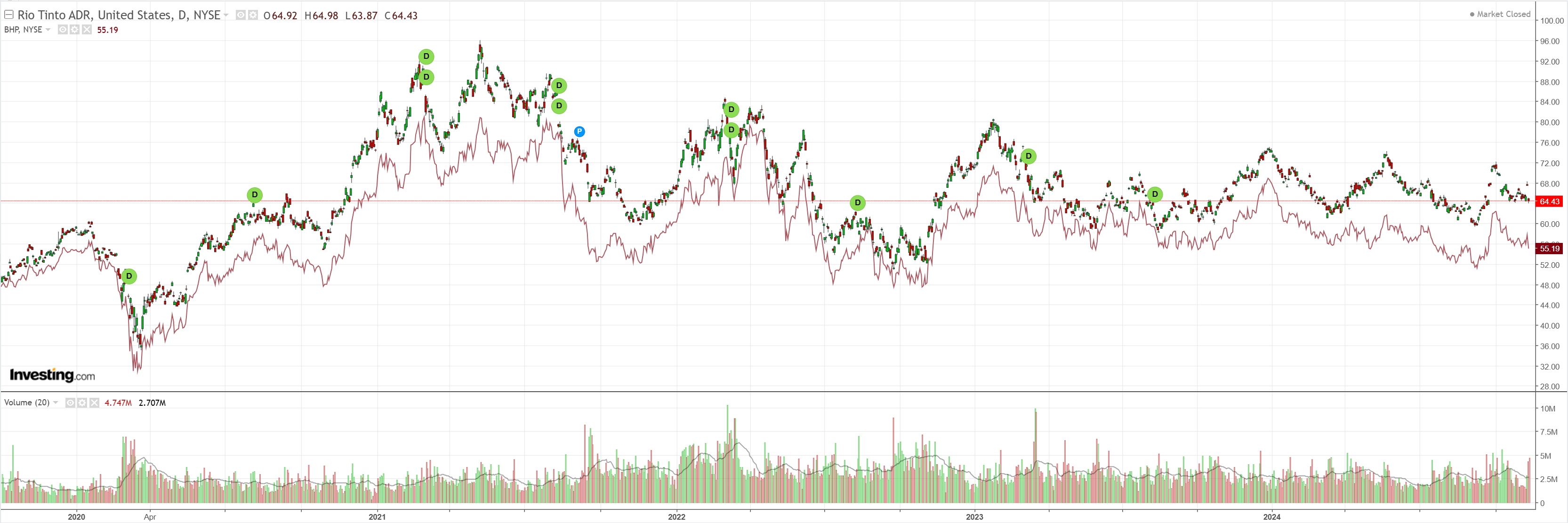

And dirt.

Big miners were hosed.

EM too.

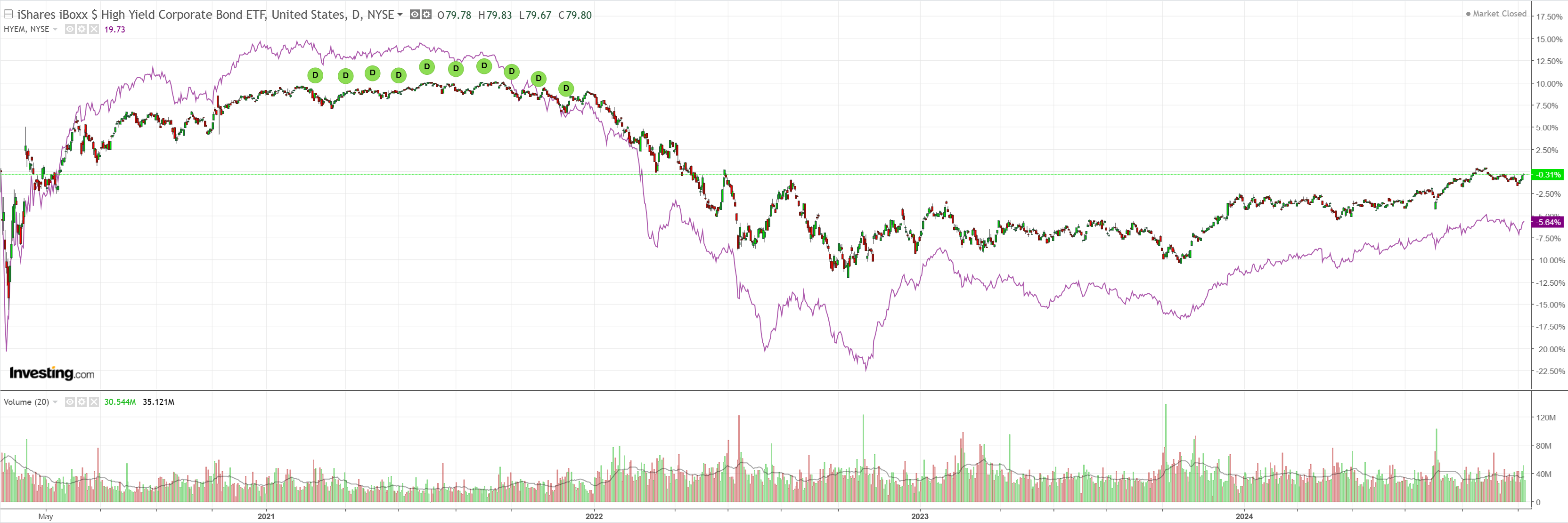

Junk is back.

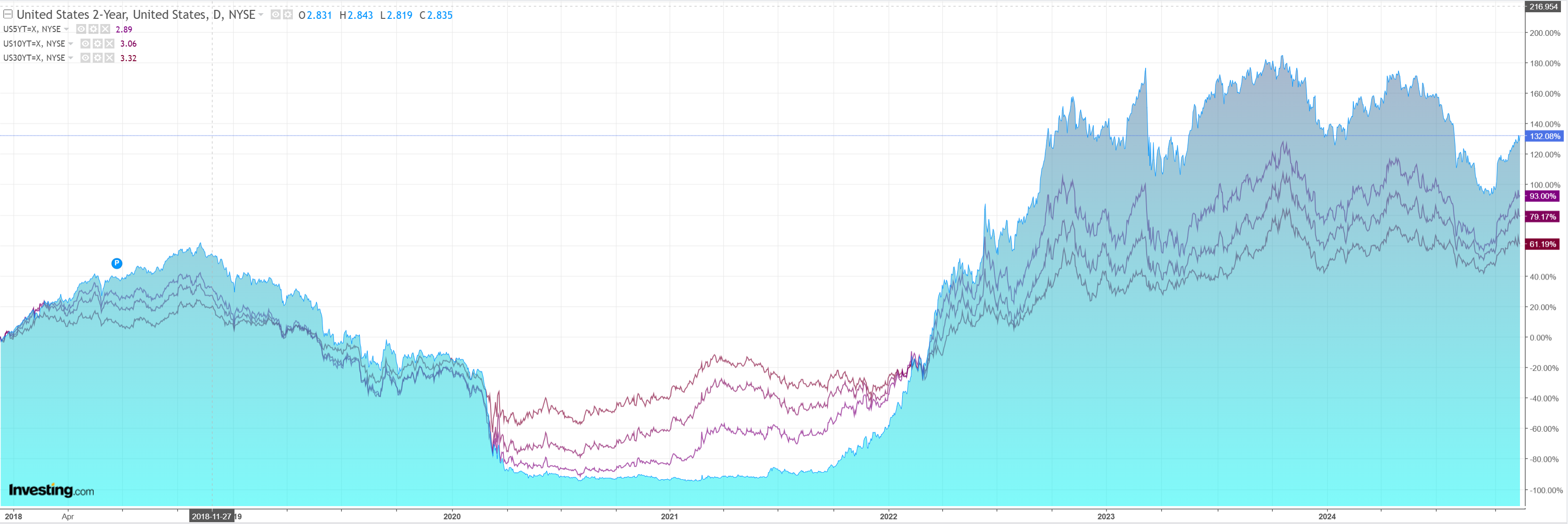

The US curve flattened.

American stocks are the only game in town.

Macro is usually a complex web of forces pushing against one another.

Only occasionally do you get an alignment of forces all going in one direction.

Right now, that is a convergence of negatives for the AUD.

The election of Donald Trump and his tariff and tax cut agenda will deliver a US inflationary boom.

The terrible state of the Chinese and European economies and the pending smashing of their external sectors will deliver a worldwide deflationary bust.

This means higher than otherwise US interest rates and lower than otherwise Chinese and European interest rates.

It means higher than otherwise US assets and lower than otherwise Chinese and European assets.

It means lower than otherwise commodity prices.

Australia follows European and Chinese economic trends, not the US.

The Australian dollar follows EUR and CNY, not DXY.

The other thing about macro is that nothing lasts forever.

As global growth and rates fall more than the US, plus non-US fiscal support also arrives, the picture will reverse.

But, for now, the AUD is the world’s worst bet.