DXY is finally taking a breather.

AUD got relief but not overly so.

JPY went nuts. Yeh, nah. CNY is the powderkeg.

Oil down, gold up.

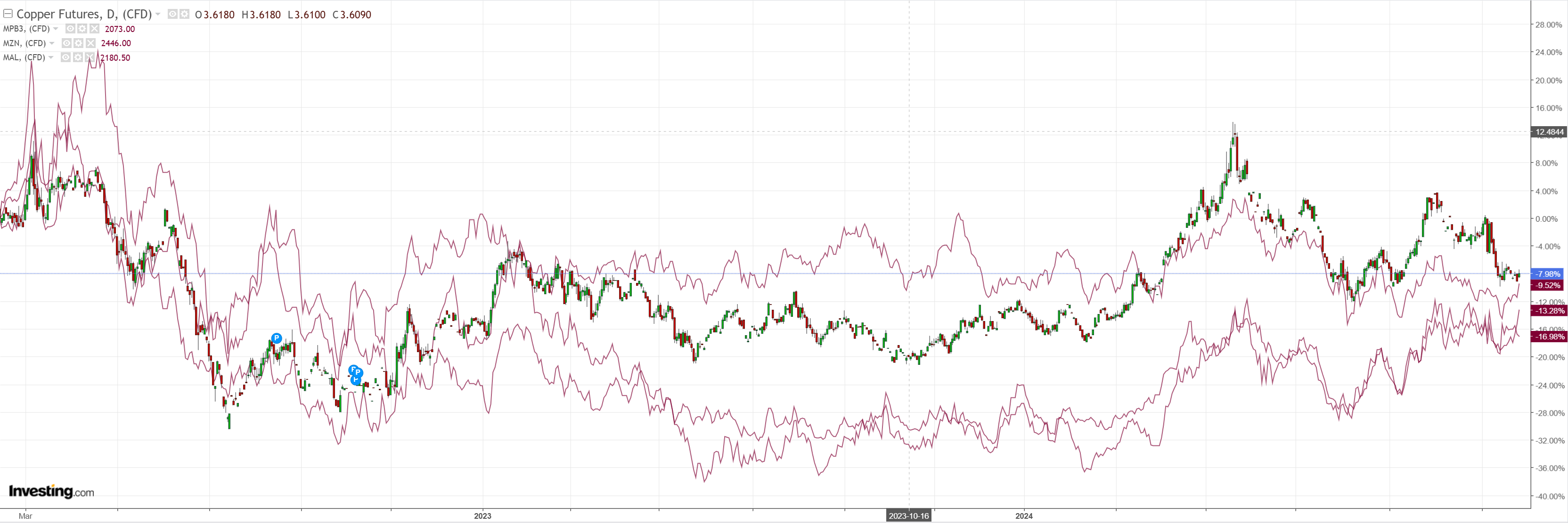

Dirt enjoyed the relief.

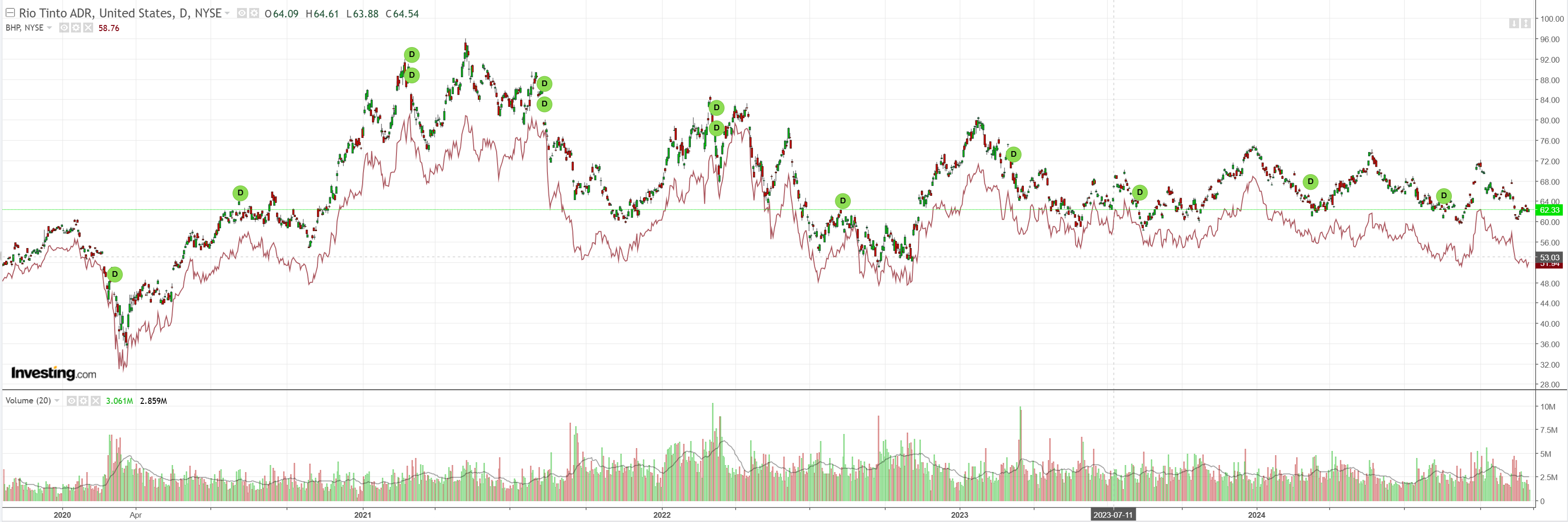

Miners too.

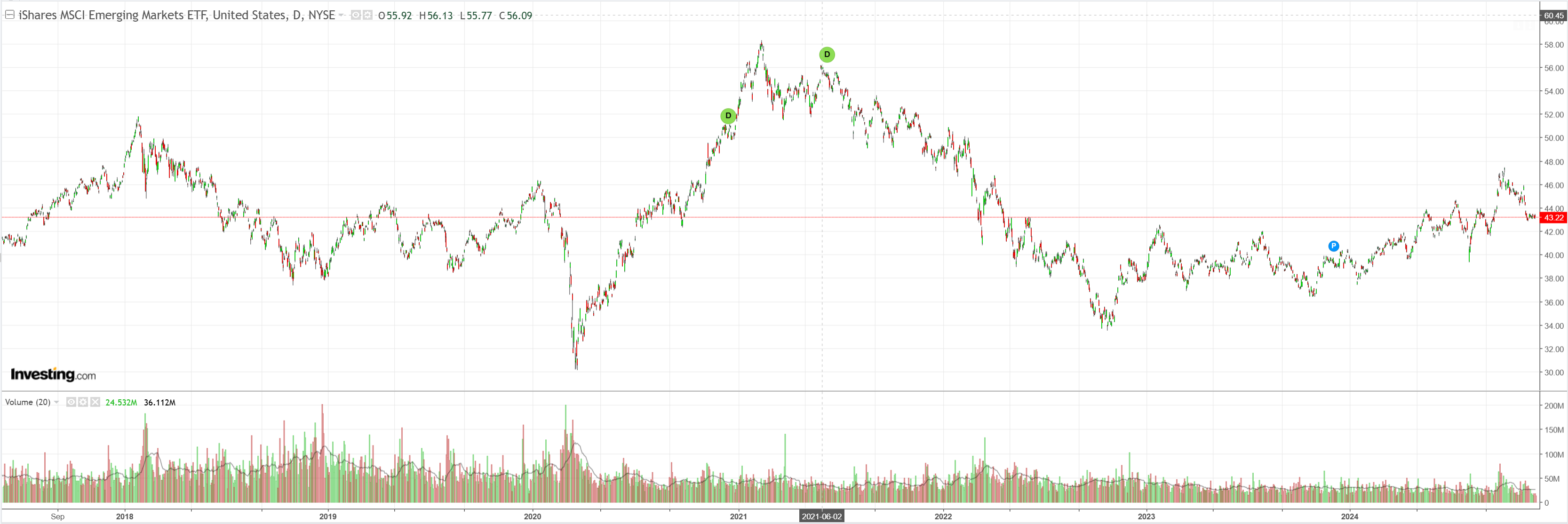

EM yawn.

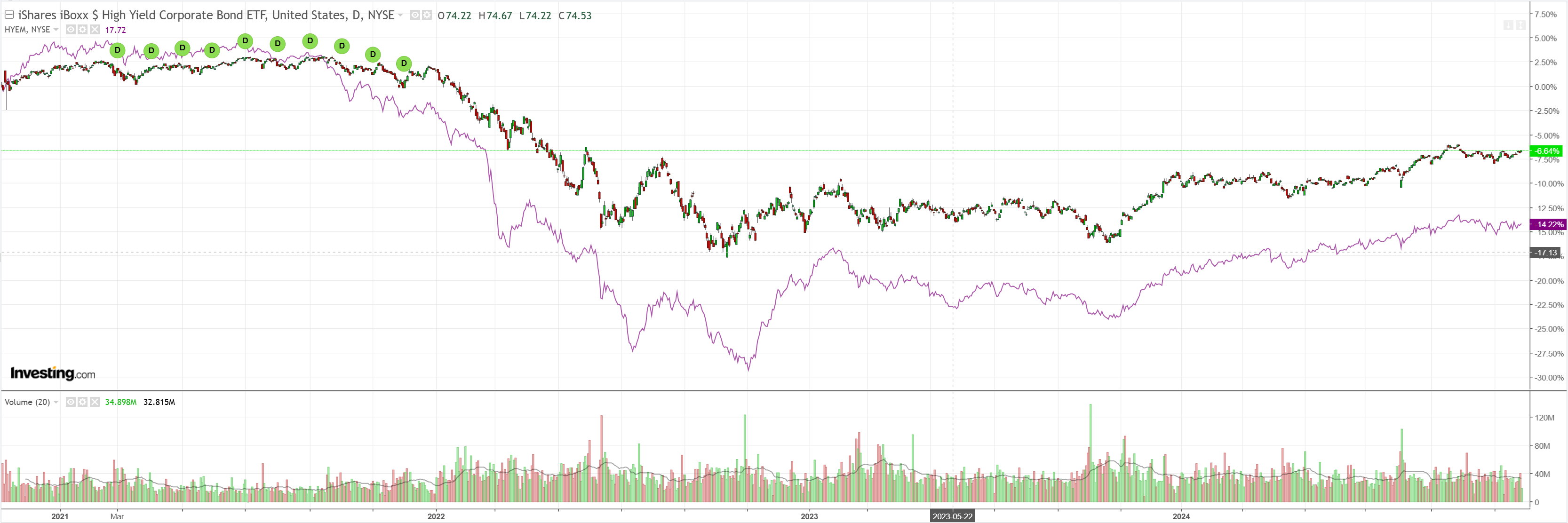

Junk is lifting.

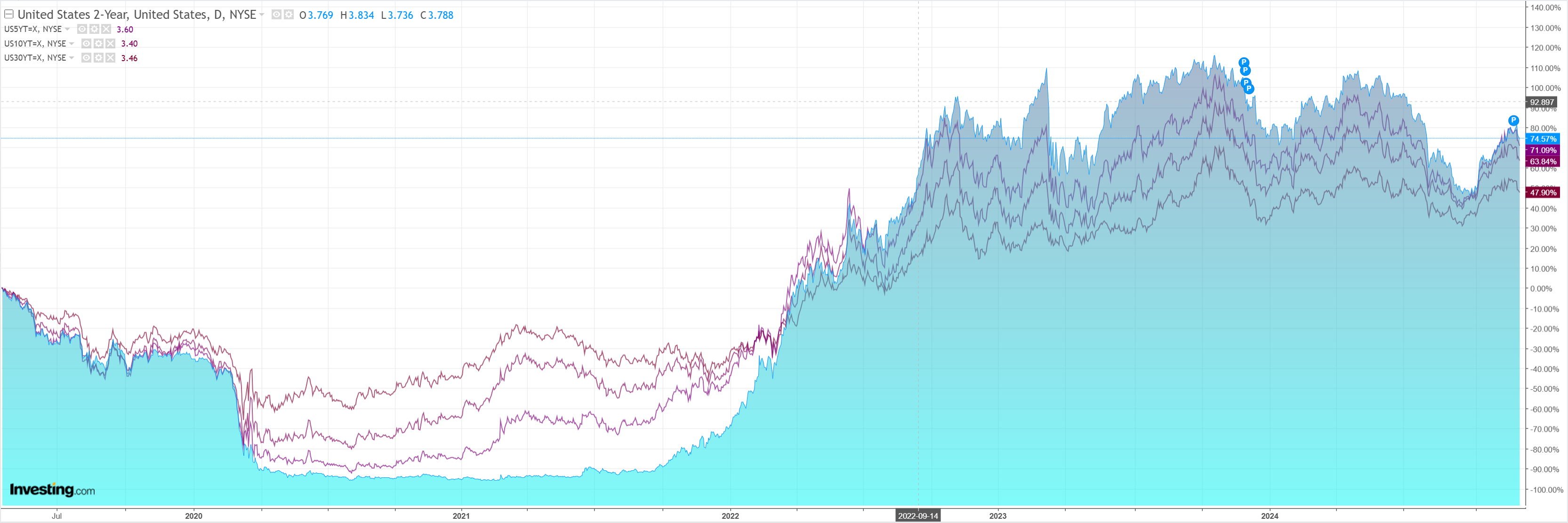

As yields fall.

Stocks edged down.

It just looks like exhaustion in DXY. It’s way overbought by systematics and humans alike.

I am cautious about reading much into it beyond that. Tariffs are the key to DXY strength, and the Trump team still looks committed.

The big one ahead is CNY.

China could allow its yuan to depreciate by as much as 10-15% in response to any trade wars unleashed by President-elect Donald Trump, according to JPMorgan Chase & Co.

In a note entitled “Bracing for a storm,” JPMorgan economists led by Jahangir Aziz say emerging economies will take a knock from Trump’s pledges for higher trade tariffs but “expect trade policy toward China to shift the earliest and materially.”

“Needless to say, China would be the worst affected,” Aziz wrote.

Assuming a 60% tariff and 10-15% response devaluation would likely take AUD into the 50s.