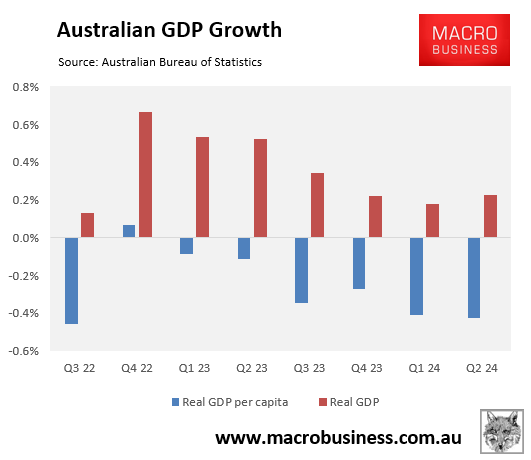

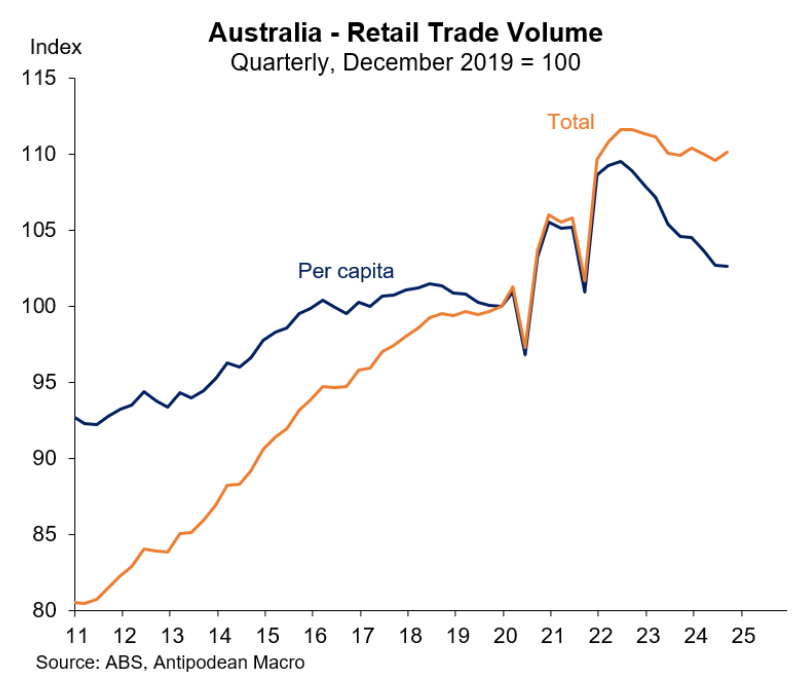

The Australian economy is stuck in the longest per capita recession on record following six straight quarterly declines.

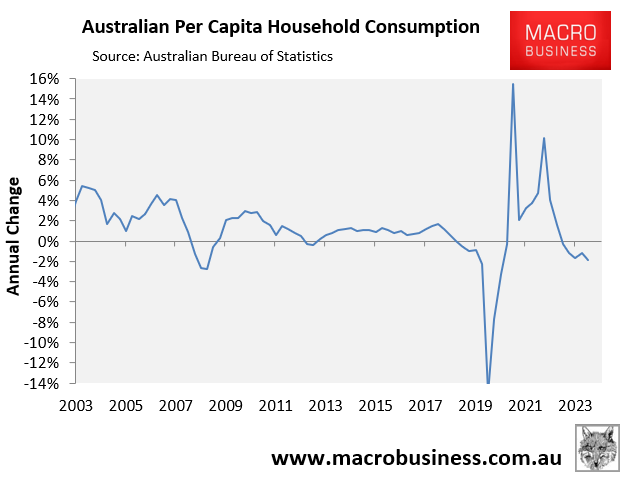

The household sector, which has seen a sharp decline in per capita consumption, has driven the decline in per capita GDP.

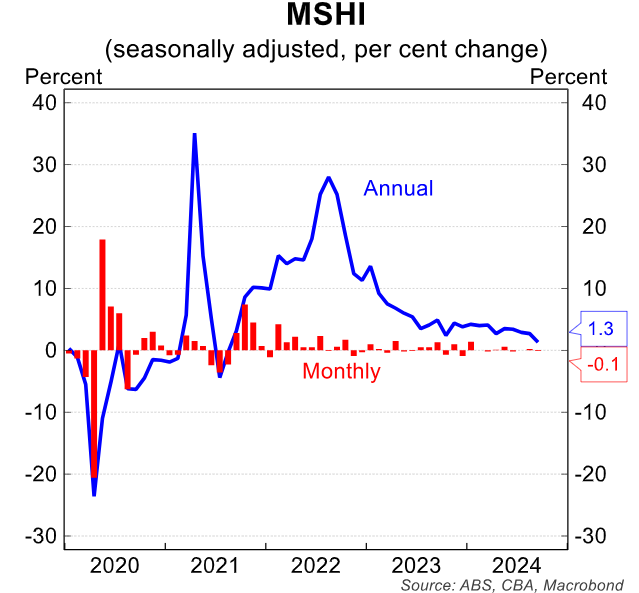

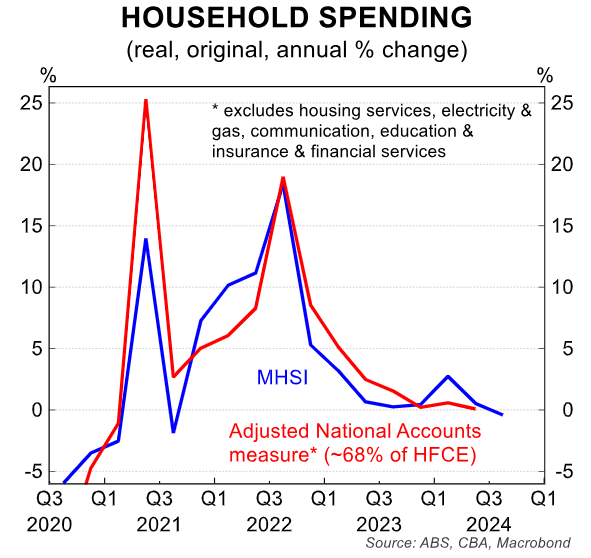

On Friday, the Australian Bureau of Statistics (ABS) released its monthly household spending indicator (MHSI), which fell by 0.1% in September to be up only 1.3% year-on-year:

This remains below the level of inflation (2.8%) and given strong population growth (~2.3% annual), real per-capita spending has fallen sharply.

This suggests that the Stage 3 tax cuts have failed to stimulate consumer spending.

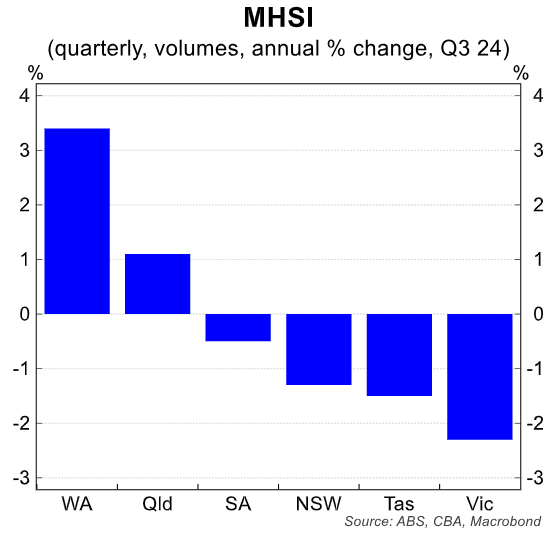

As illustrated in the next chart from CBA, the MHSI rose in Western Australia and Queensland over the year to September but fell across the other states.

The quarterly MSHI was down 0.4% from a year ago in quarterly volume terms and suggests another very weak result when the Q3 national accounts are released in early December.

As expected, discretionary spending continues to ease more quickly than non-discretionary spending. Again, this data suggests that the Stage 3 tax cuts had minimal impact on discretionary discretionary spending in the September quarter.

While the MHSI does not capture all of household consumption since it excludes some essential items that are seeing stronger growth, it does still suggest that Australian households remain stuck in recession.

This was also confirmed by last week’s soft retail sales data, which posted another decline in real per capita terms in the September quarter.

In short, the recession continues for Australian households.