CoreLogic’s latest house price and auction results reveal that Australia’s housing market has stalled.

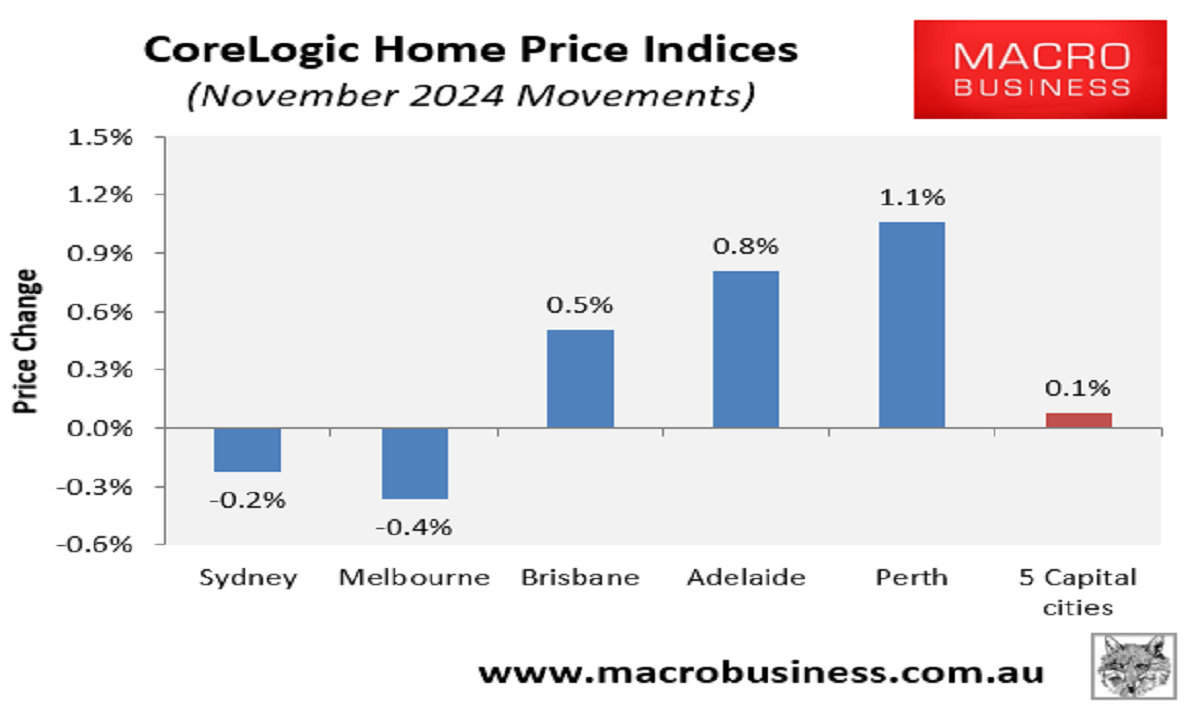

CoreLogic’s daily dwelling values index, which tracks prices across the five major Australian capital city markets, grew by only 0.1% in November.

As illustrated above, home values fell in Sydney and Melbourne in November, offsetting price rises across the other major capital cities.

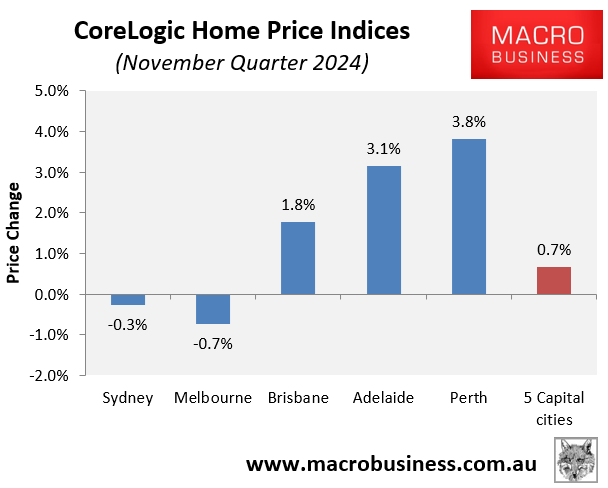

The story was similar over the November quarter, with Sydney and Melbourne weighing down the national market.

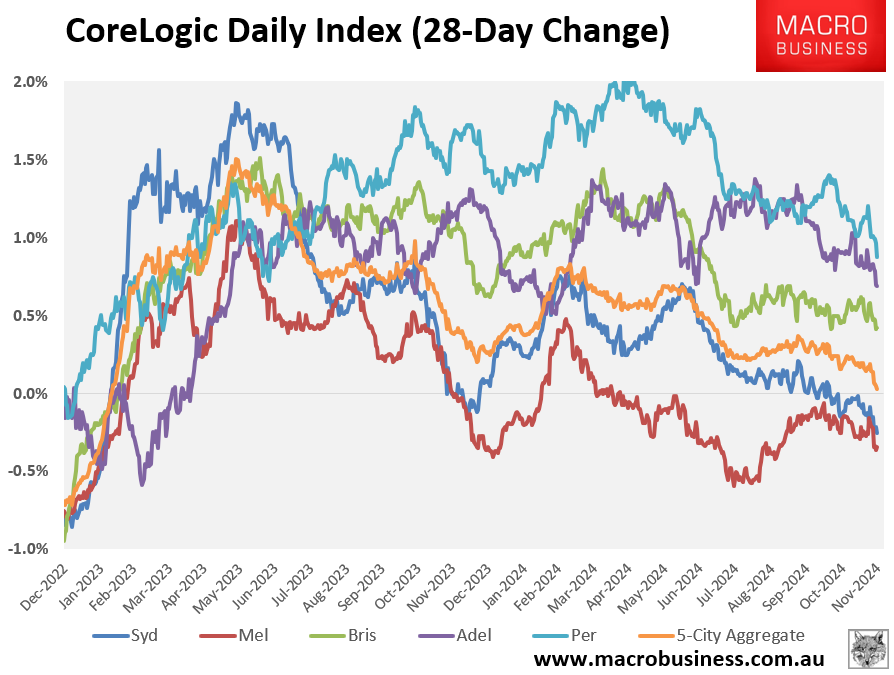

As illustrated in the following chart, which plots the rolling 28-day change, price momentum has slowed across all major markets.

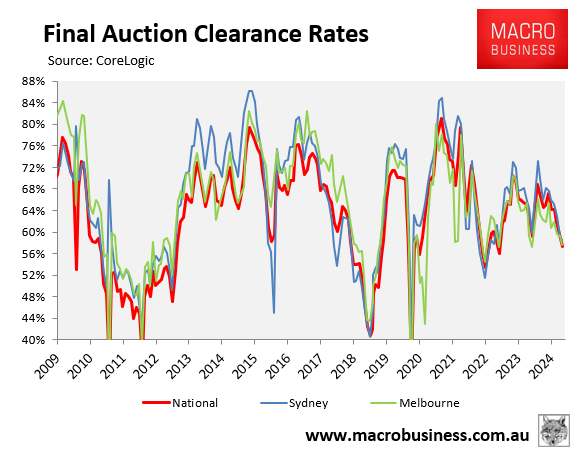

This is also reflected in the nation’s auction market, where clearance rates have collapsed.

Sydney’s monthly average clearance rate (58%) is the lowest since December 2022; Melbourne’s (58%) is the weakest since December 2023; and the national average clearance rate (57%) is the lowest since August 2022.

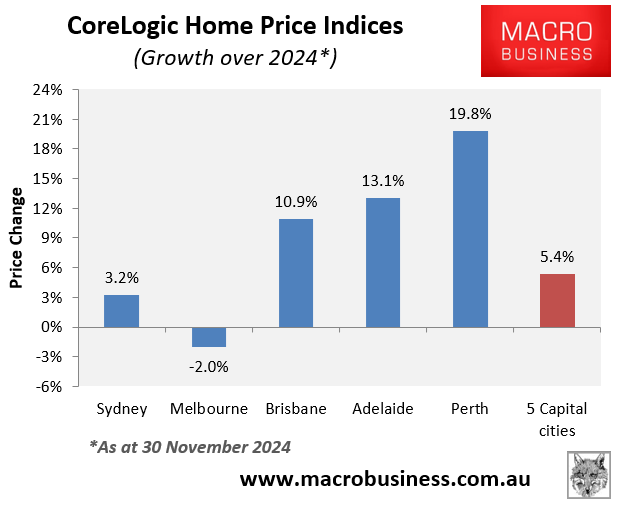

The following chart plots the change in values over 2024 across the major markets.

As shown above, Australia’s housing market is two-speed, with low or negative growth across Sydney and Melbourne and strong growth across the other major markets.

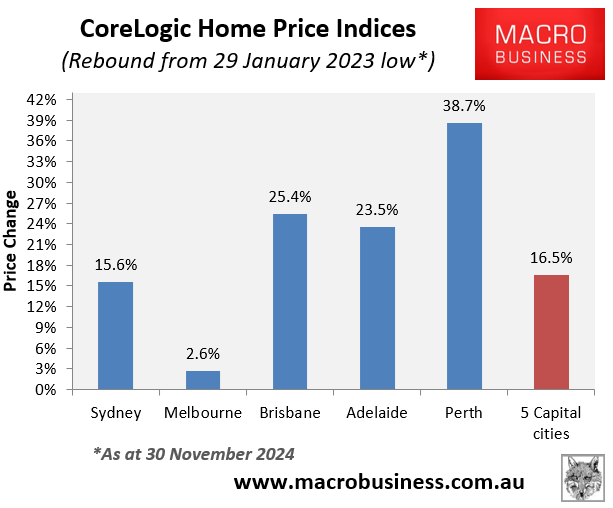

The next chart plots value changes since values bottomed in January 2023, which illustrates a multi-speed market.

Perth has experienced phenomenal growth of 38.7% over the cycle, followed by strong growth in Brisbane (25.4%) and Adelaide (23.5%).

Sydney has experienced solid growth (15.6%), whereas Melbourne dwelling values have lagged well behind (2.6%).

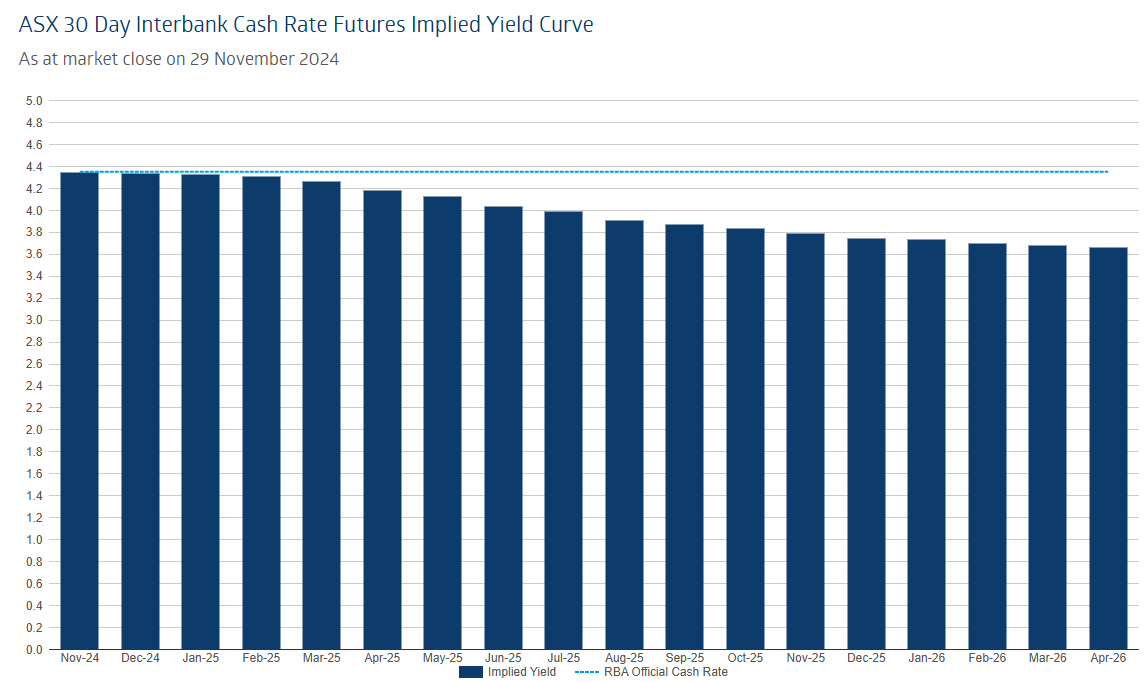

Price momentum is expected to continue to slow until the Reserve Bank of Australia commences its next monetary easing cycle next year.

As illustrated below, financial markets have pencilled in the first interest rate cut for Q2 2025.