Australian Treasury gaslights on housing affordability

Treasury Secretary Steven Kennedy told a Senate estimates hearing that his department is modelling the impact of changes to the capital gains tax and negative gearing regimes.

Kennedy said that Treasury undertakes such modelling “from time to time”, but emphasised that the federal government had not asked it to do so and is not considering any changes to these tax breaks.

He also contended that reducing capital gains tax (CGT) deductions for investors would do more to put downward pressure on house prices than negative gearing reforms.

However, Kennedy emphasised that neither reform would address the key issue of increasing the nation’s housing supply.

“Those sorts of things are more likely to impact on the way the prices of those assets change over time and the way they’re distributed, less so on the interaction between supply and demand, which in the much longer term is going to be driven by household formation and a range of other things”, he said.

“We tend to look at it [i.e., negative gearing and CGT] more from the point of view of tax reform, to be frank, rather than potential changes to the tax system over time, rather than from the point of view of housing.

“I’ve said to you in the past, I think the dominant impact on the housing market at the moment is simply not building enough dwelling units”, he said.

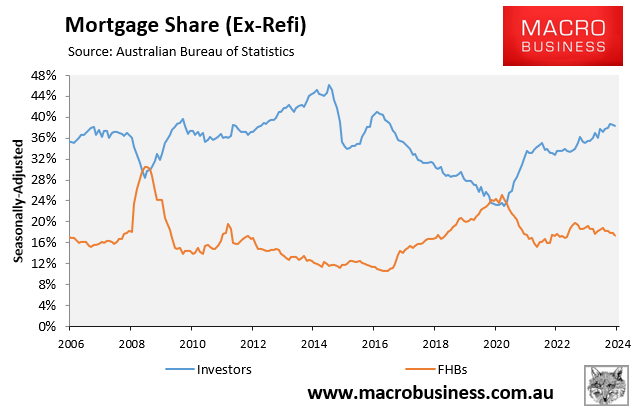

Reducing demand from investors by limiting tax concessions would place moderate downward pressure on home prices. It would also increase the share of first-home buyers and, therefore, the nation’s homeownership rate.

Kennedy’s claim that Australia’s housing crisis is fundamentally an issue of supply because we are “not building enough dwelling units” is pure gaslighting.

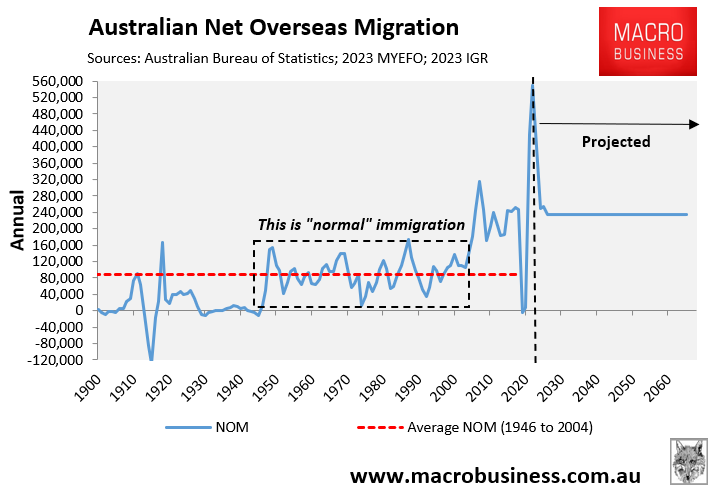

The primary reason why Australia has a shortage of housing is because the federal government, encouraged by the Australian Treasury, has chosen to run a mass immigration policy.

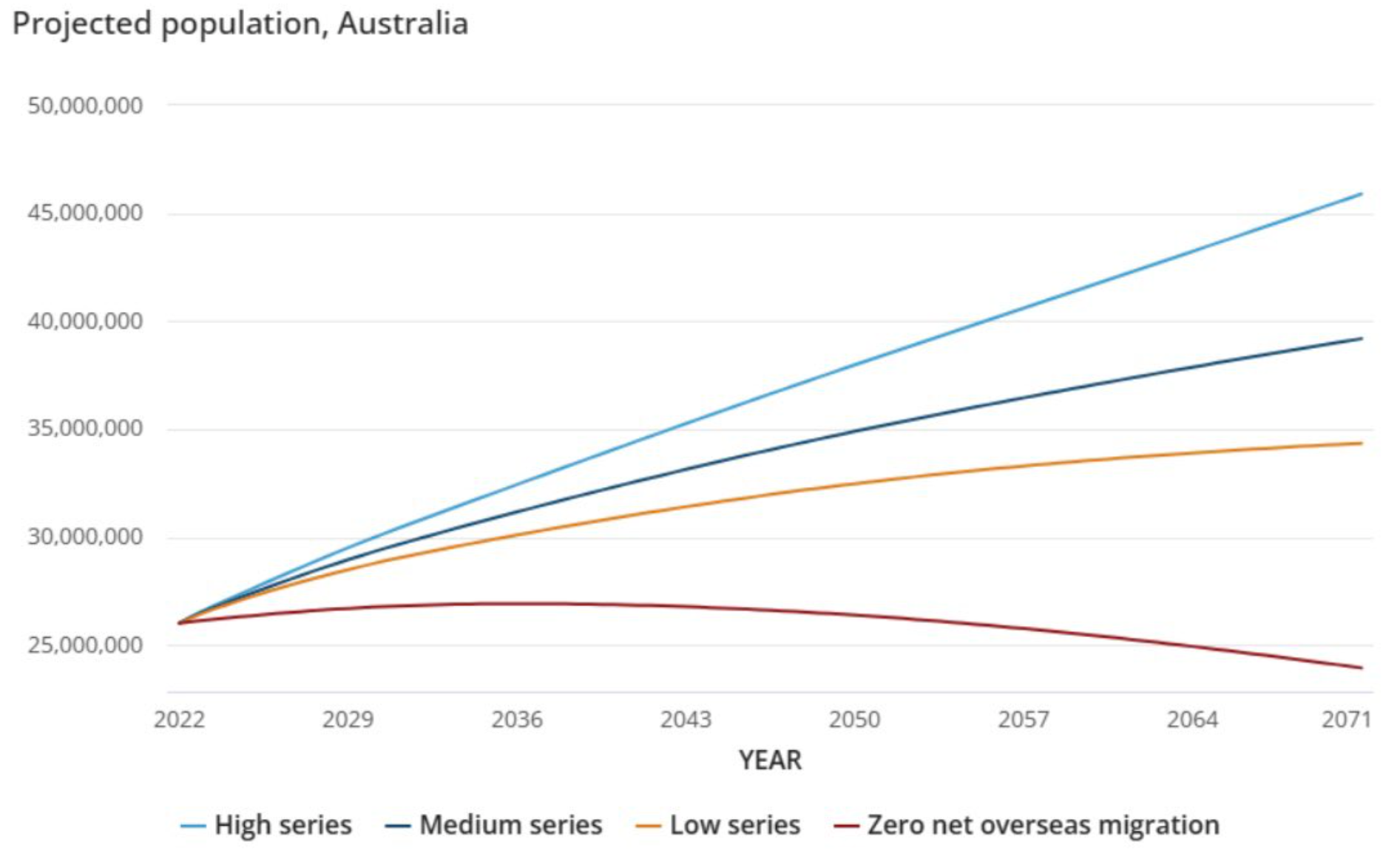

The reality is that Australia’s population would not grow without net overseas migration.

Source: Australian Bureau of Statistics

Therefore, virtually all of Australia’s new household formation comes via net overseas migration. In turn, any shortage of housing is driven primarily by excessive levels of immigration.

Sadly, the Australian Treasury is one of Australia’s key supporters of high immigration because it augments aggregate GDP growth and federal government tax receipts (via increased personal and company taxes).

The costs of high immigration are borne by state and local governments, as well as the broader community.

As a result, Treasury Secretary Steven Kennedy will never be honest and admit that Australia’s housing crisis is really a problem of excessive levels of demand via immigration.

Australia is chronically oversupplied with imported renters.