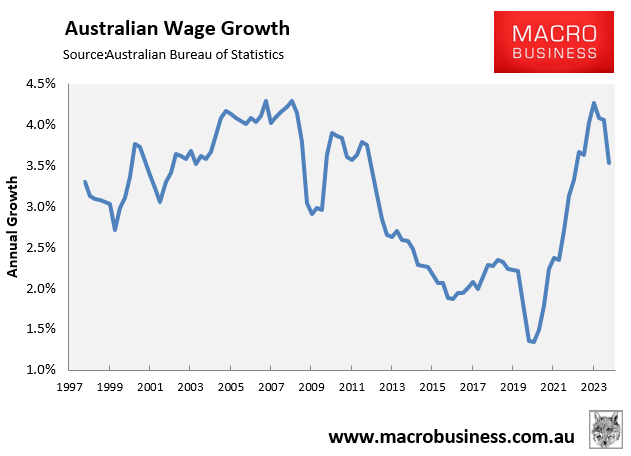

Wednesday’s wage price index data from the Australian Bureau of Statistics (ABS) was weaker than expected, growing by 0.8% in Q3 and 3.5% year-on-year.

The result was slightly lower than economists’ expectations of 0.9% growth in Q3 and 3.6% growth year-on-year.

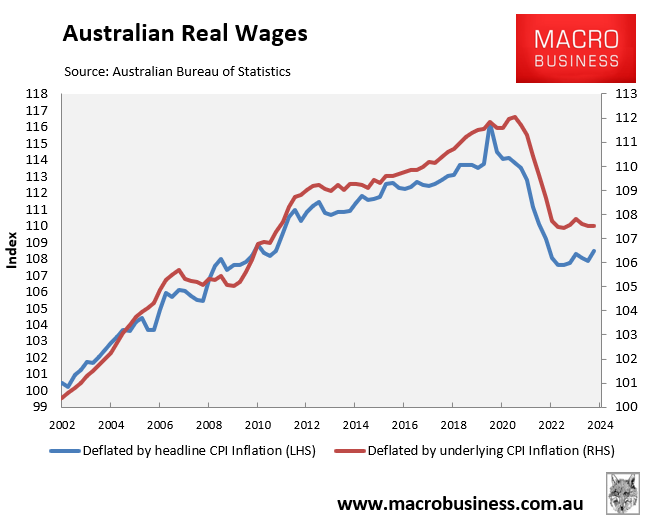

The following chart plots the growth in Australian wages in real inflation-adjusted terms against headline CPI inflation and underlying (trimmed mean) inflation.

Australian real wages were tracking 6.7% below their June 2020 peak when deflated by headline CPI inflation.

Australian real wages were tracking 4.0% below their June 2021 peak when deflated by underlying inflation.

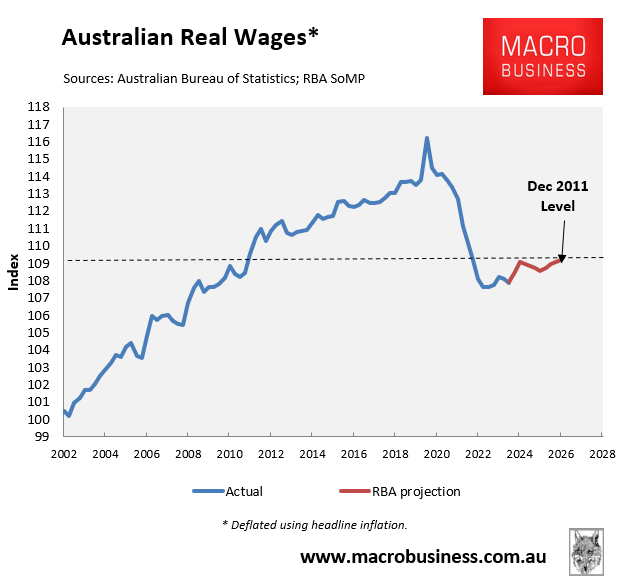

The latest Statement of Monetary Policy (SoMP) from the Reserve Bank of Australia (RBA), released last week, included forecasts of wage growth and inflation.

The RBA SoMP projected that Australian real wages will only recover 1.2% by December 2026. This would leave wages 6.1% below their June 2020 peak, adjusted for headline CPI inflation.

However, it is worth noting that Q3 wage growth was significantly below the RBA’s forecast, as illustrated below by Alex Joiner at IFM Investors.

Source: Alex Joiner (IFM Investors)

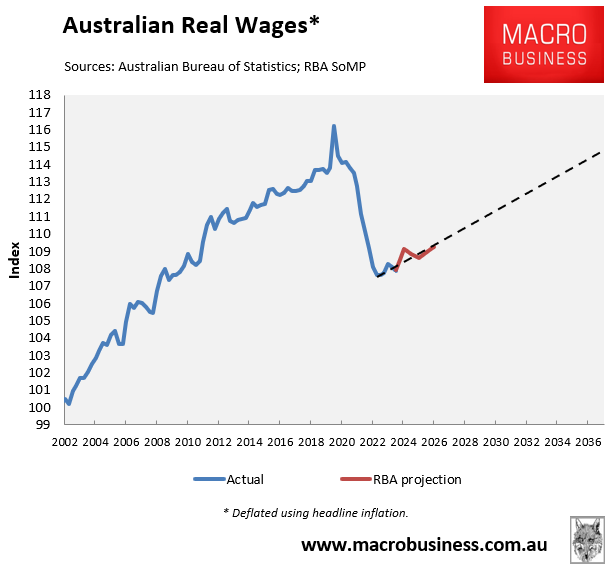

Regardless, if the RBA SoMP’s implied rate of recovery persisted, Australian real wages would not recover to their previous peak until the middle of the 2030s.

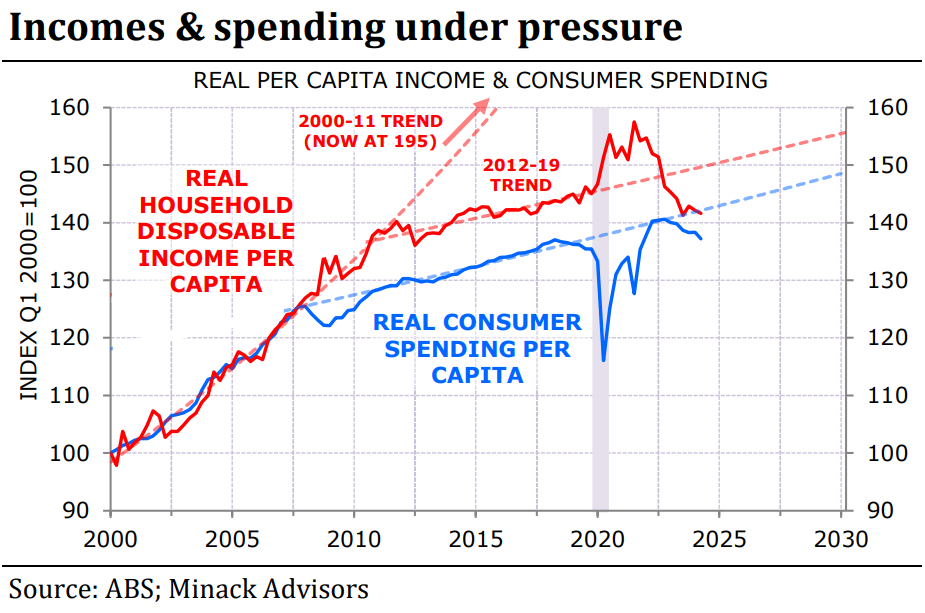

Obviously, a lot can happen between now and then. However, unless Australia’s productivity growth miraculously picks up, the nation faces subpar economic and income growth into next decade.

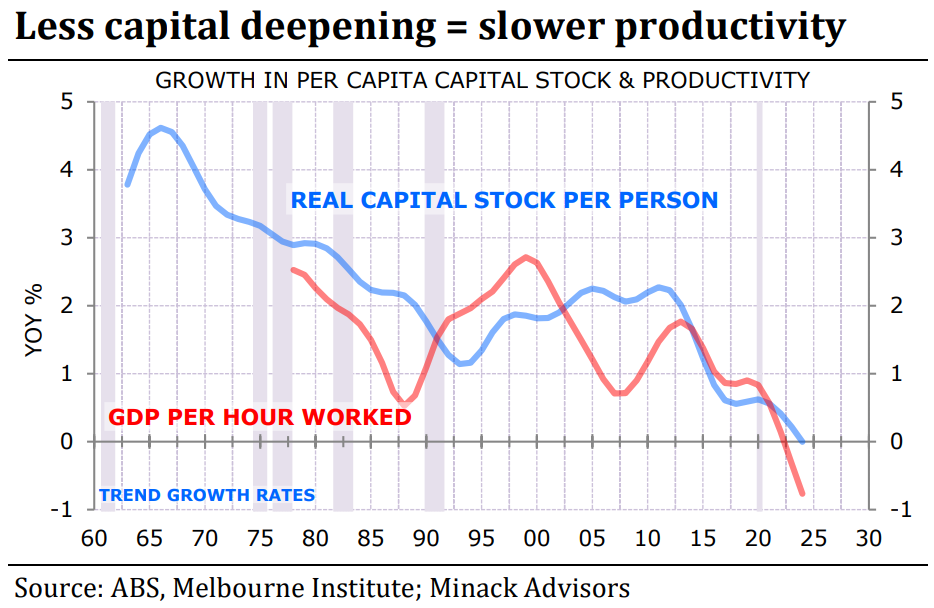

As explained by leading economist Gerard Minack in last week’s seminal report on the Australian economy, “Low investment and fast population growth is crushing productivity growth, leading to structurally weak income growth”.

“Poor productivity growth in Australia is a structural headwind for GDP growth”.

Australians should brace for a ‘lost decade’ of poor income growth and stagnating living standards.