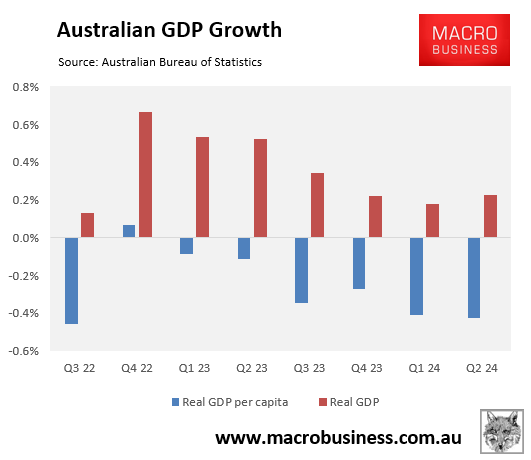

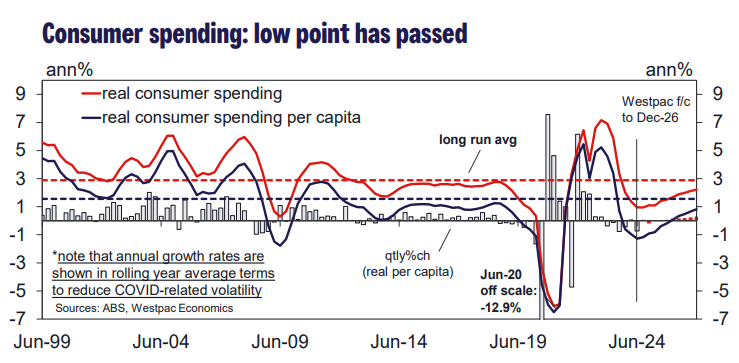

It has been well documented that Australians are experiencing the longest recession on record following six consecutive quarterly declines in per capita gross domestic product.

The household sector has driven this decline in per capita GDP.

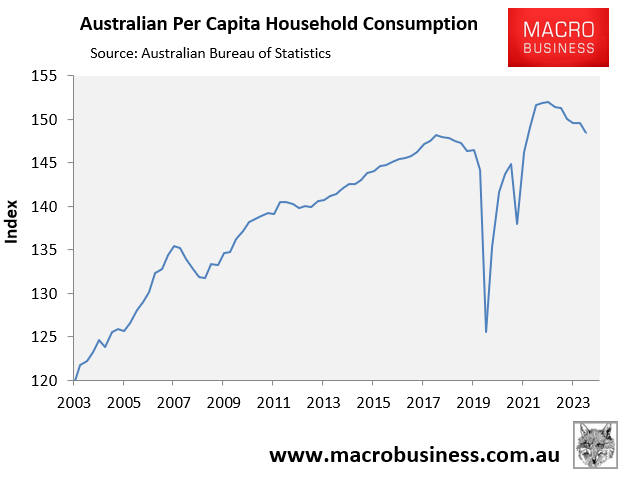

As of Q2 2024, real per capita household consumption had fallen by 2.4% from its peak.

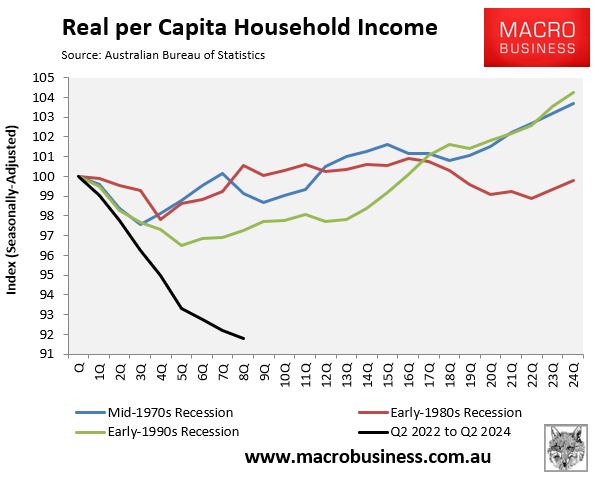

Even worse, real per capita household disposable income has fallen by around 8% from its peak, according to the national accounts, representing the largest decline on record.

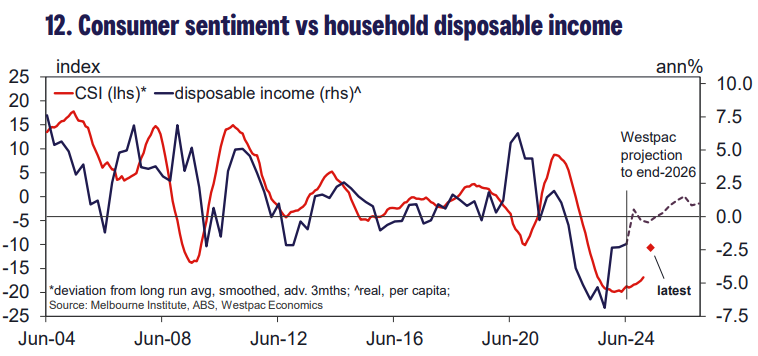

Westpac has released its Red Book for October, which forecasts a long grind out of recession.

Westpac notes the brutal decline in real per capita disposable income, which it estimates at “an eye-watering 10%”.

“The combined effect of rising income tax payments, higher interest and the surge in inflation has produced a 4.8% drop in aggregate terms since Sep 2021 and an eye-watering 10% plunge in per capita terms”, Westpac says.

“That is about double the size of the decline seen during the recession in the early-1990s (when the average mortgage interest rate was 15% and the unemployment rate spiked 4ppts on its way to an eventual peak of over 11%)”.

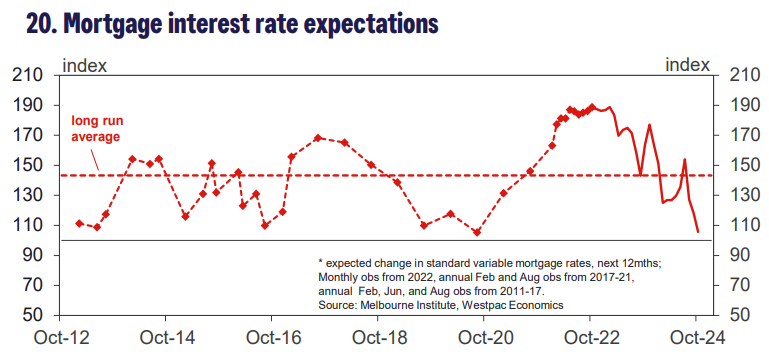

Westpac notes that “the consumer mood has become considerably less bleak, buoyed on the one hand by the additional cash in hand as tax cuts and other support measures flow through, and on the other by turning expectations for interest rates”.

“The most striking sentiment shift over the last three months has again been around consumer expectations for interest rates. The Westpac-Melbourne Institute Mortgage Rate Expectations Index fell by a third between July and October”.

However, Westpac warns that “the medium-term recovery process looks likely to be a slow one”.

“The RBA’s easing cycle is expected to be gradual and modest. Household disposable incomes will be slow to recover the ground lost over the last 2½ years, with less support available from saving reserves accumulated during COVID and an additional headwind coming from slowing population growth”.

Therefore, “despite some more promising signs, the consumer recovery still has a long way to go”.