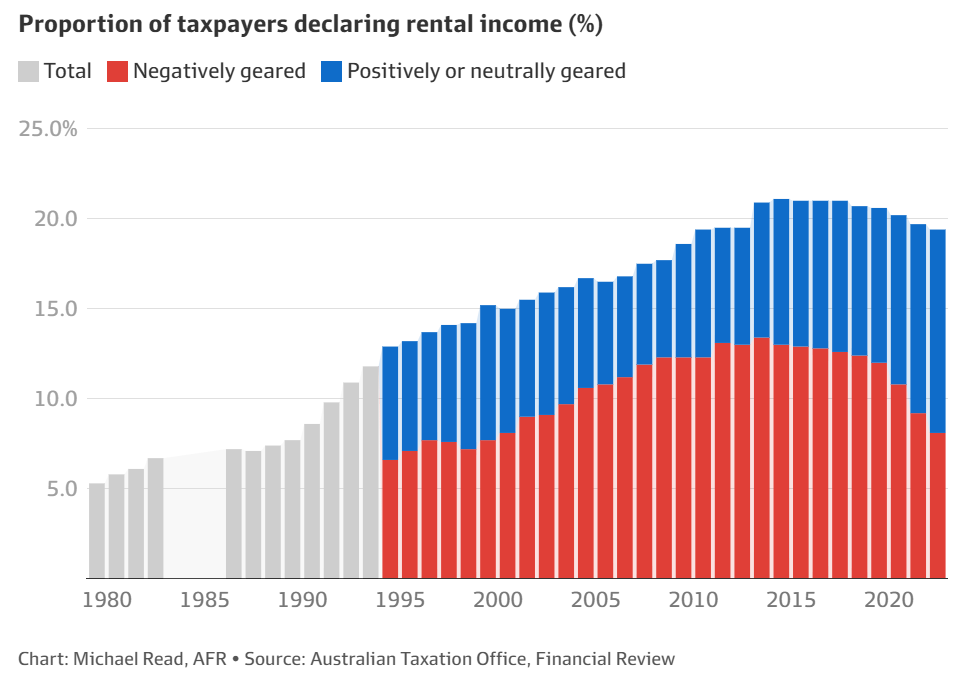

An investigation from the Australian Financial Review’s Michael Read showed that the proportion of taxpayers declaring rental income has fallen over the last decade:

As shown above, the share of investors more than quadrupled from 5% of taxpayers in 1980 to a peak of 21% by 2014. It has since fallen to around 19%.

The absolute number of property investors has also declined, albeit less sharply.

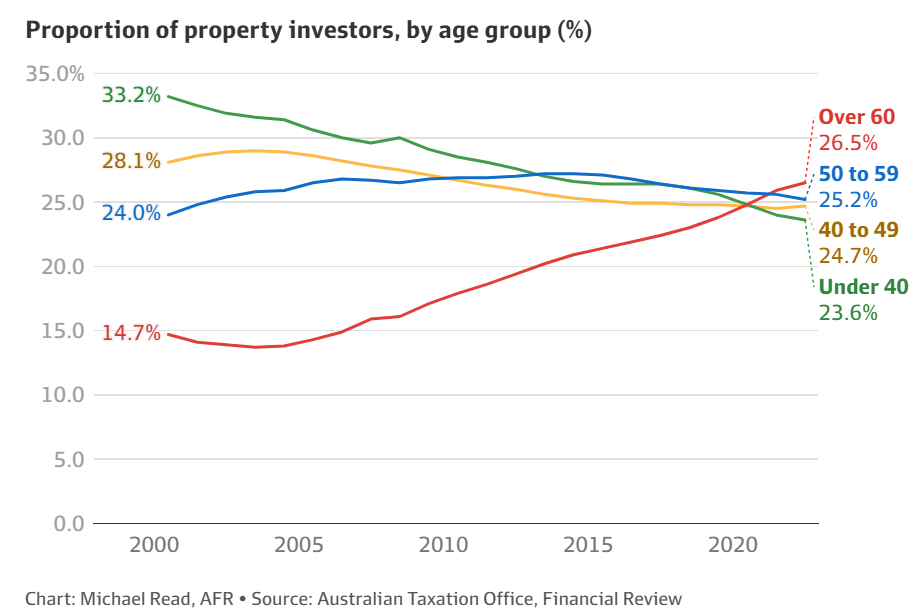

Michael Read also showed that the baby boomer generation has been the driving force behind property investment.

By contrast, Australians aged under-40 are the least invested age group, deterred by poor affordability, which has prevented them from entering the market as either owner-occupiers or investors.

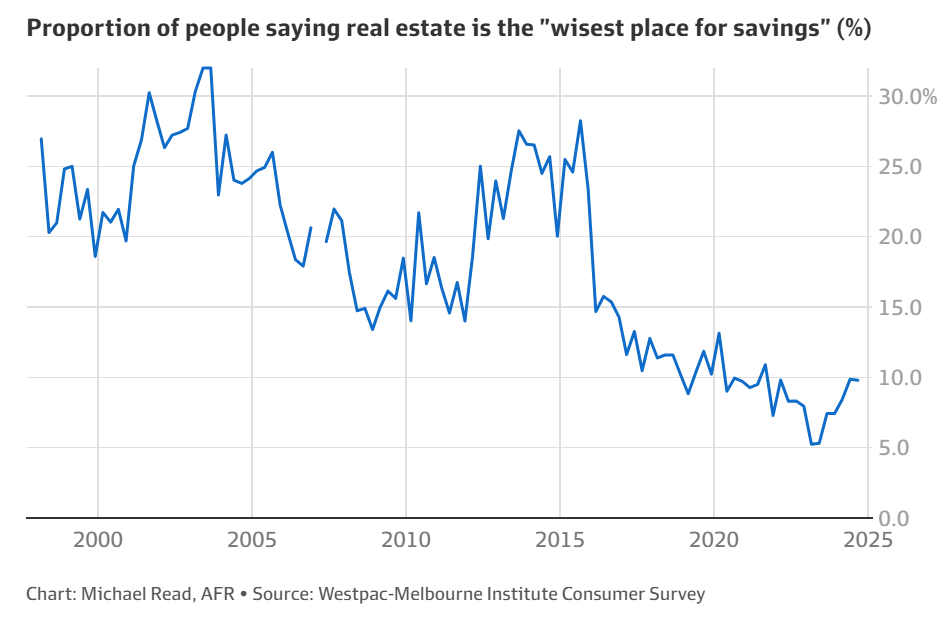

Westpac also shows that the share of Australians choosing real estate as the wisest place for savings has fallen to around 10%, down from the long-term average of 24%.

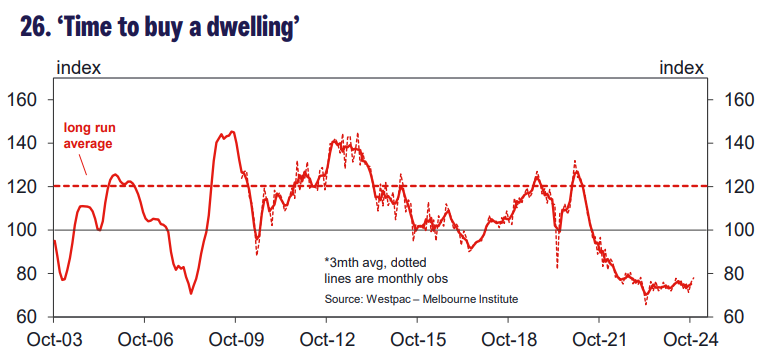

Meanwhile, Westpac’s ‘Time to buy a dwelling’ index has collapsed to historical lows. The index’s reading of 78 in October was well below the long-run average of 120.

Westpac explained the result as follows:

“The ‘time to buy a dwelling’ index is closely linked to affordability. Previous research shows it is closely linked to measures based on the proportion of average income required to raise a deposit and make mortgage payments on a purchase of a median-priced dwelling”.

“As such, it captures the effect of not just interest rate changes – actual or expected – but also changes in prices and incomes”.

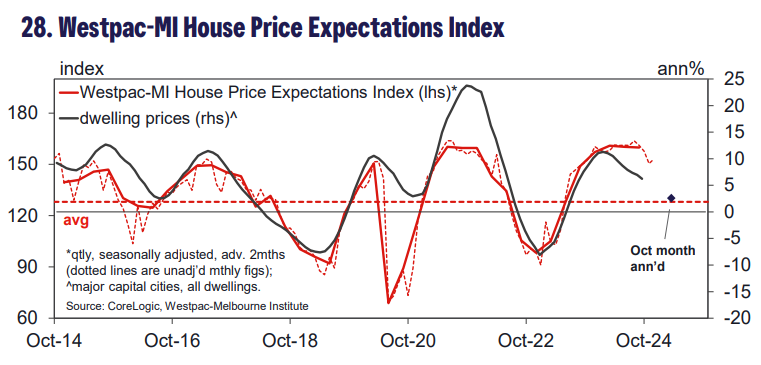

However, while the ‘time to buy a dwelling index’ remained at historical lows, expectations for house price appreciation remain fairly bullish, indicating future appreciation in home values.

Specifically, 64% of consumers expect dwelling prices to rise over the next 12 months, 21% expect no change, and 10% expect prices to decline.

The above contradiction is indicative of the housing ‘hunger games’ gripping the nation.

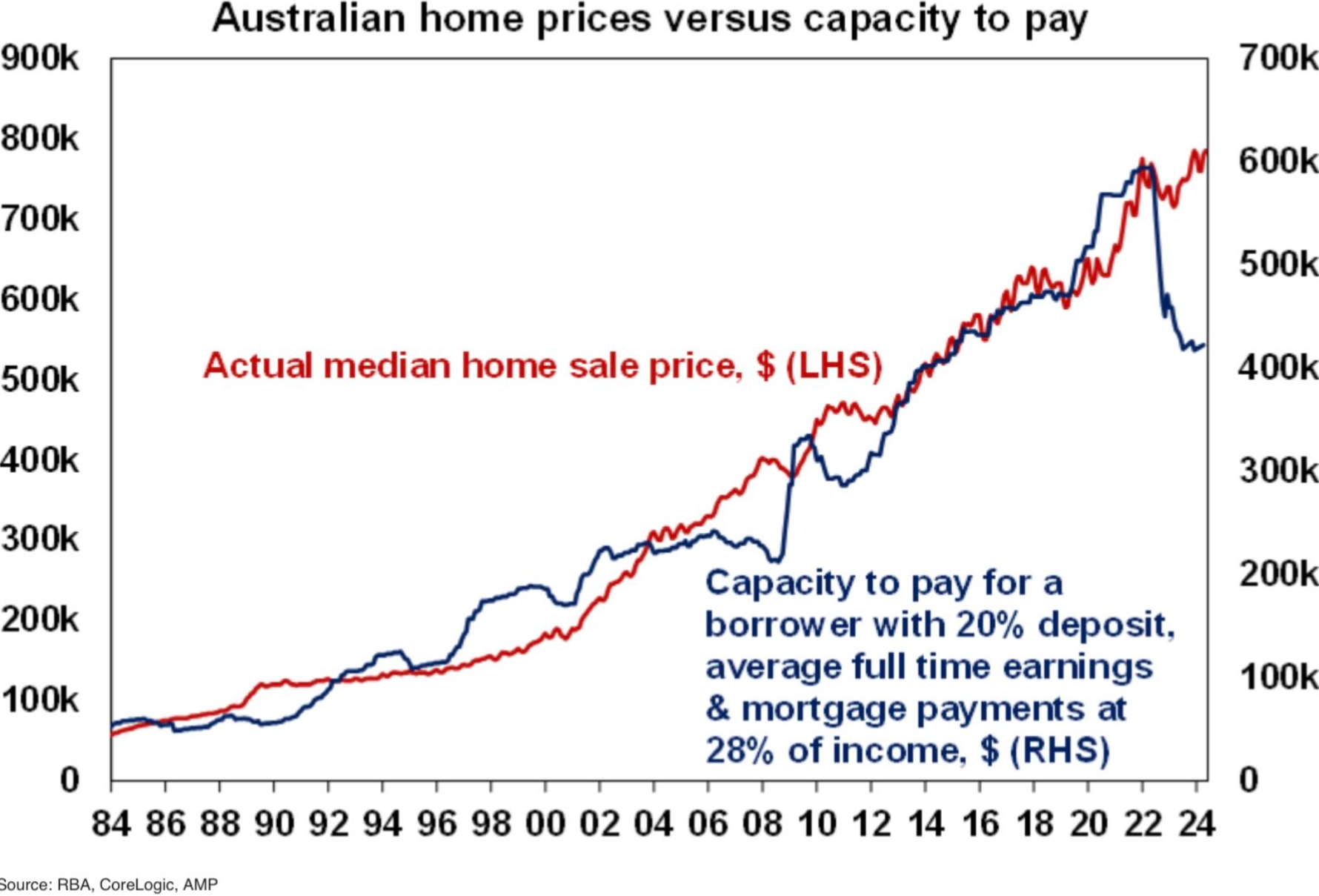

Rising prices, along with the highest mortgage rates in more than a decade, have lowered housing affordability and ability to pay.

Nonetheless, Australians continue to pile into the property market, driving prices and average mortgage balances to historic highs.

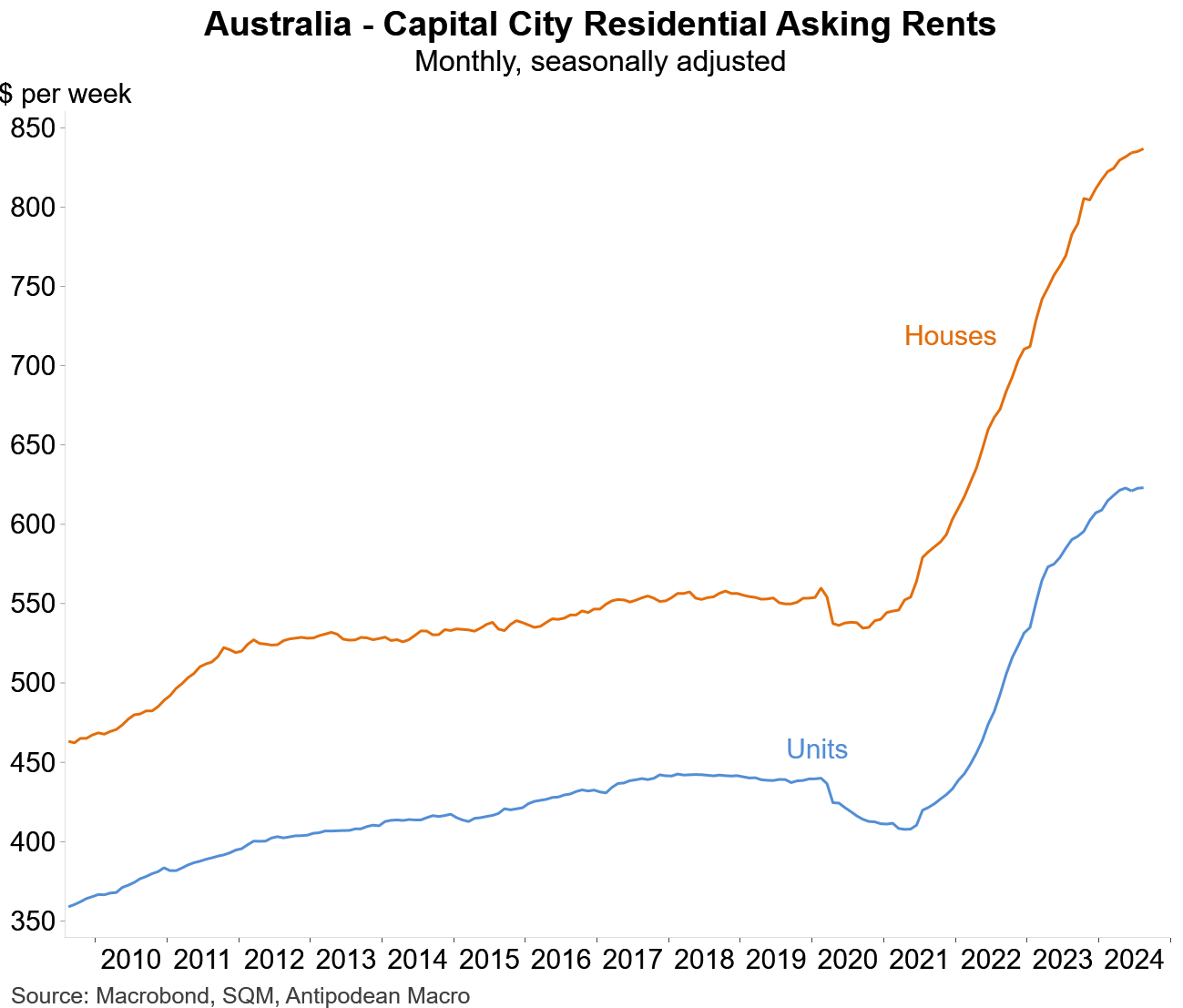

Australians have been compelled to enter the market due to high rental inflation and the concern that prices will continue to rise, locking them out indefinitely.

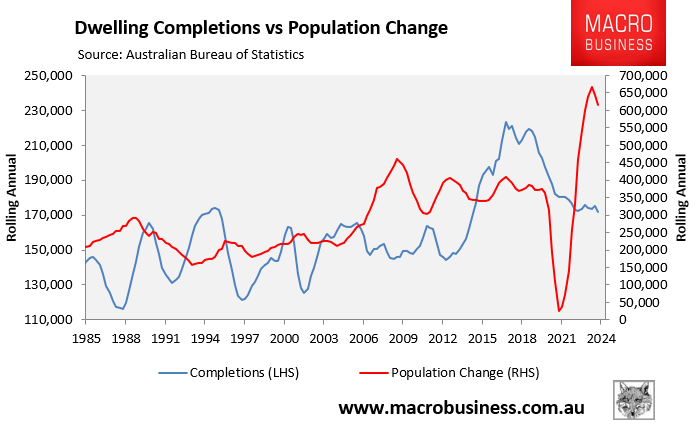

Underpinning this “fear of missing out” (FOMO) is the chronic undersupply afflicting the market, whereby population demand via net overseas migration is overwhelming bottlenecked supply.

The federal government’s excessive immigration has facilitated the housing Hunger Games, resulting in unprecedented FOMO and ‘panic buying’.