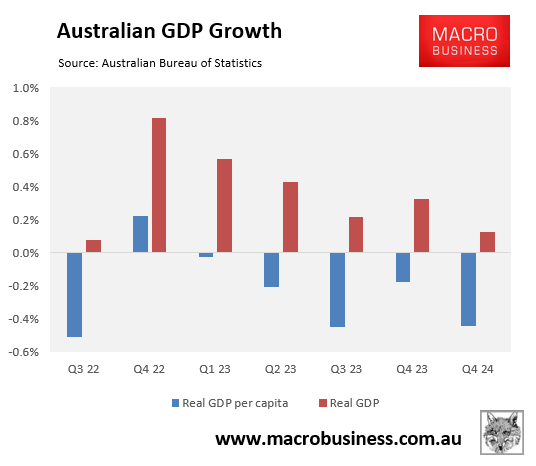

Australians are locked in the most prolonged recession on record following six consecutive quarterly declines in real GDP per capita.

Australia’s prolonged per capita recession has arisen despite unprecedented government spending.

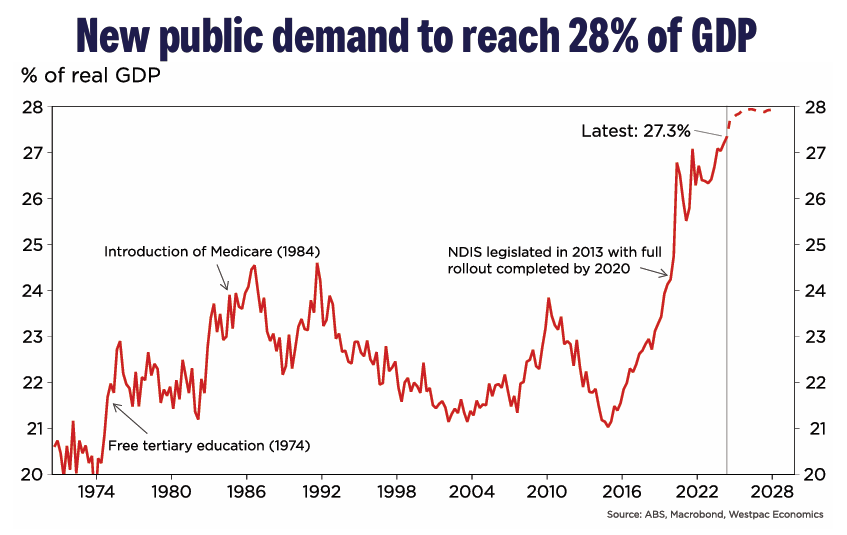

Public demand hit a record-high 27.3% share of GDP in Q2 after growing by 1.5% over the quarter. Government spending is also projected to increase further as a share of the economy.

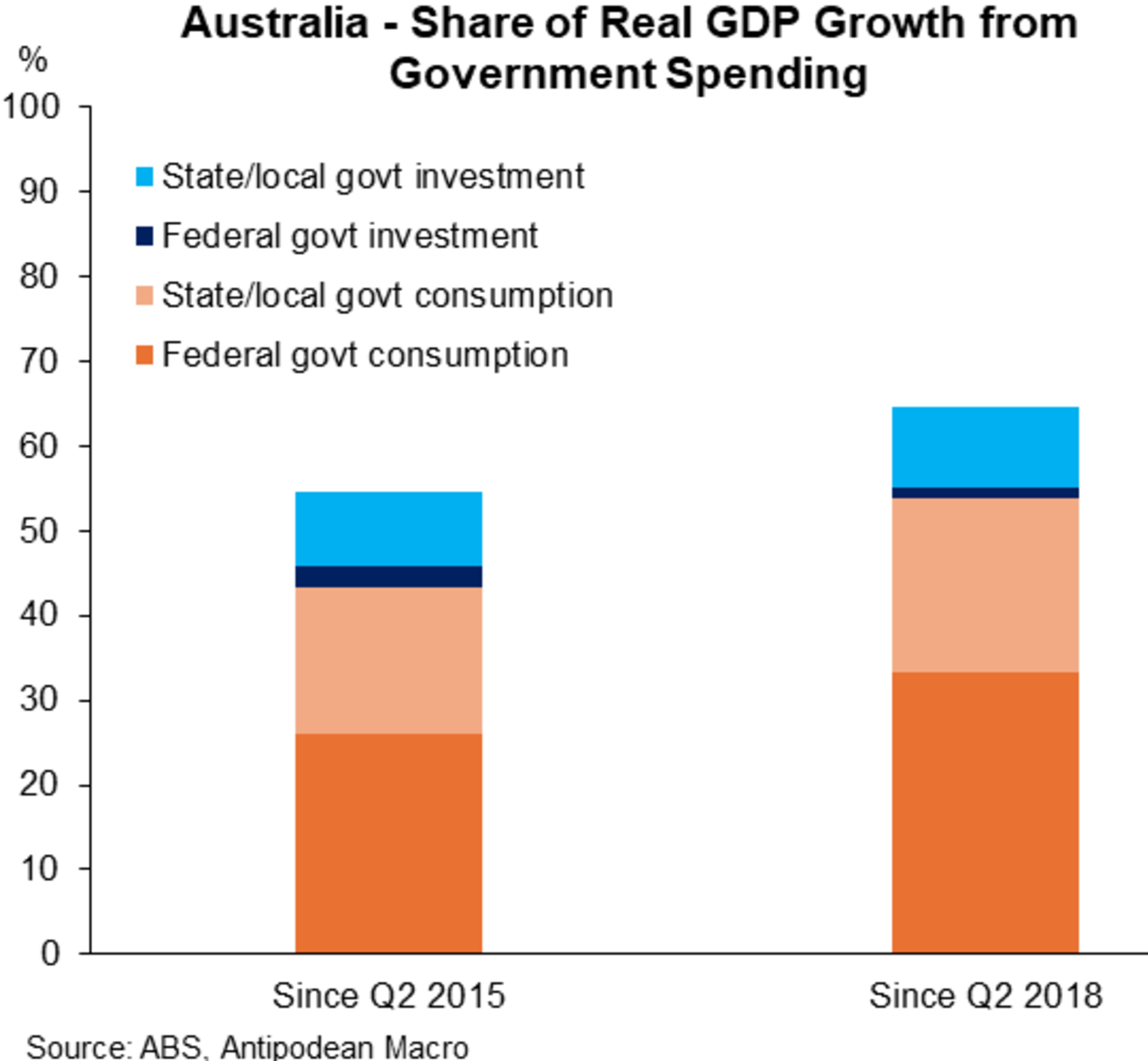

Justin Fabo from Antipodean Macro published the following extraordinary chart showing that government spending has accounted for more than half of real GDP growth since mid-2015 and nearly two-thirds since mid-2018.

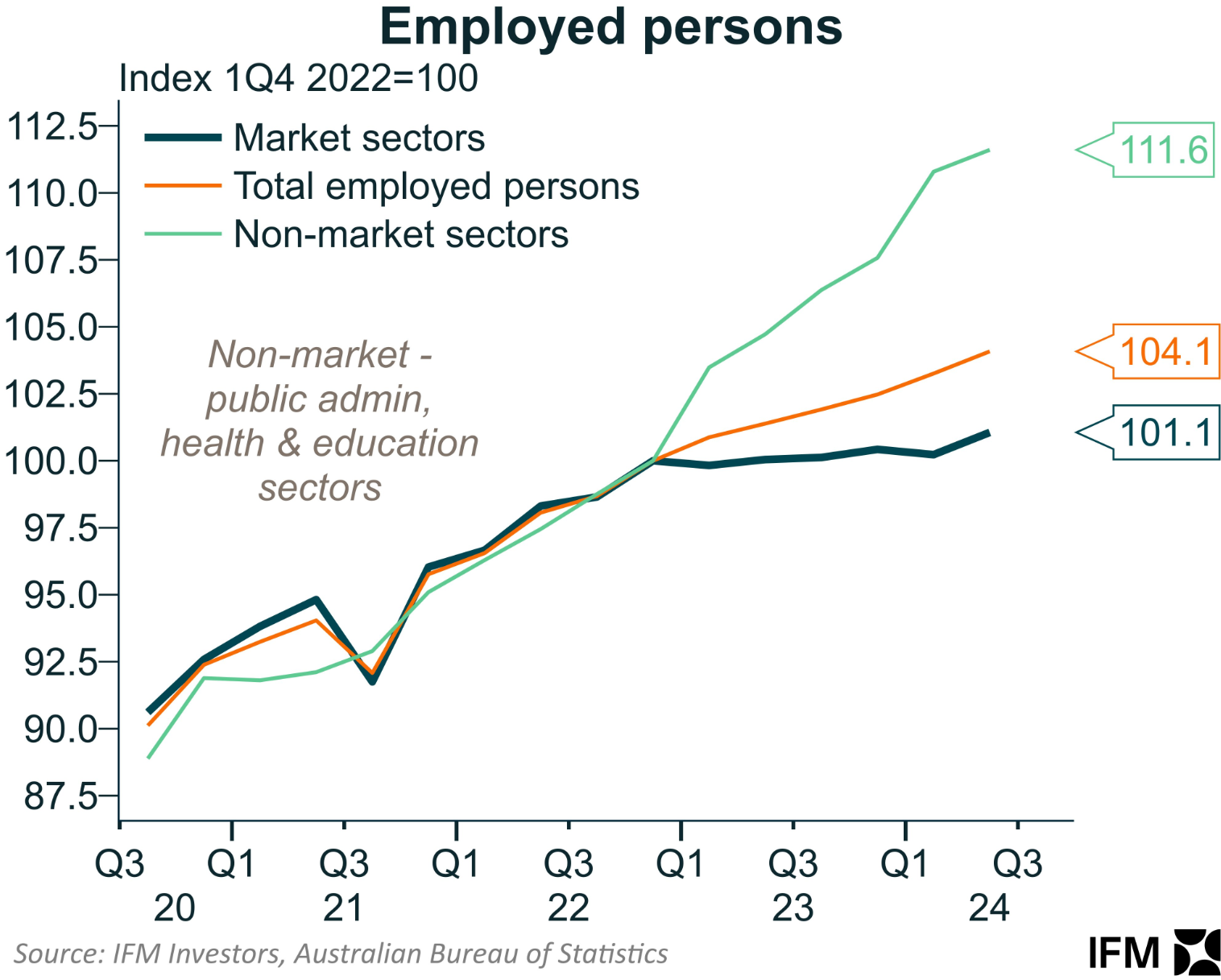

It is a similar story in the labour market, where the non-market (government-aligned) sector has driven almost all of the nation’s job growth since Q4 2022:

As illustrated above by Alex Joiner at IFM Investors, overall employment grew by 4.1% between Q4 2022 and Q3 2024.

The non-market (government-aligned) sector ballooned by 11.6%, compared to only 1.1% job growth across the market sector.

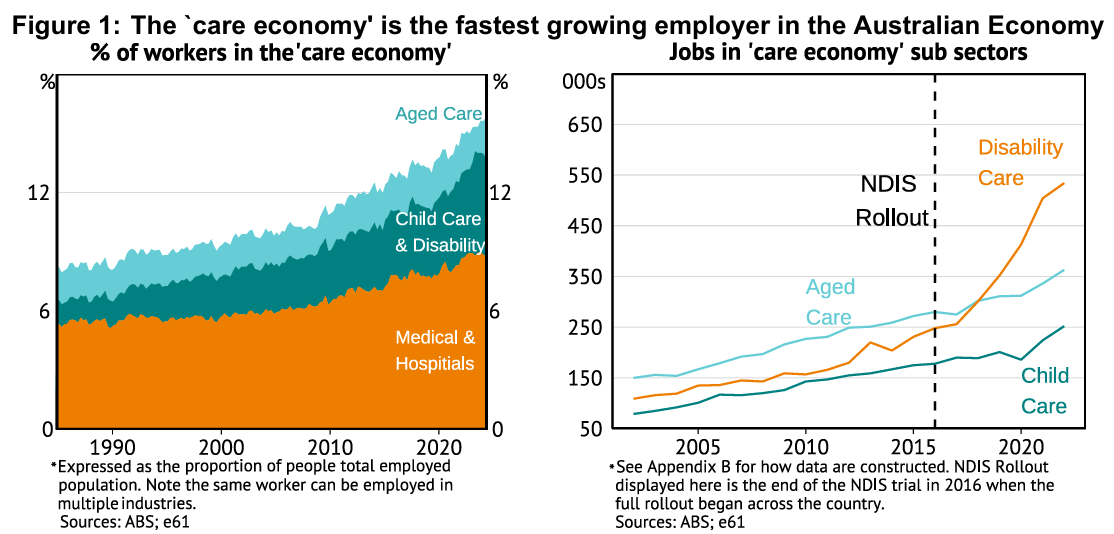

Most of this job growth has arisen from NDIS caring jobs, as illustrated below.

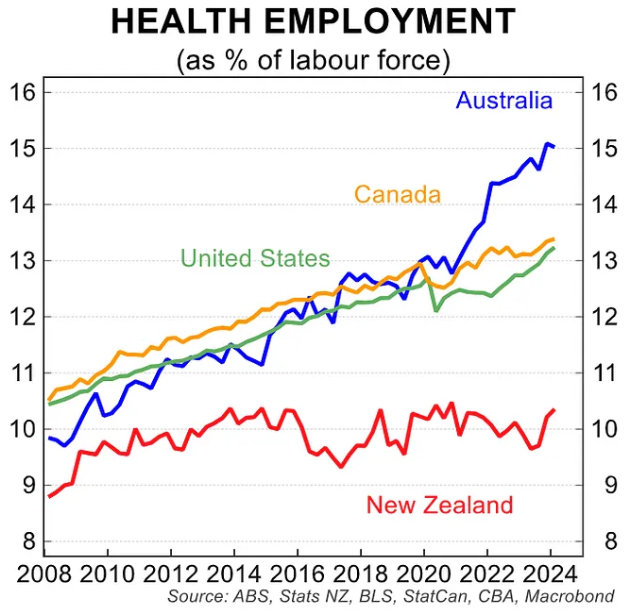

The growth in Australia’s healthcare and social assistance sector has also been unpararelled compared against other advanced nations.

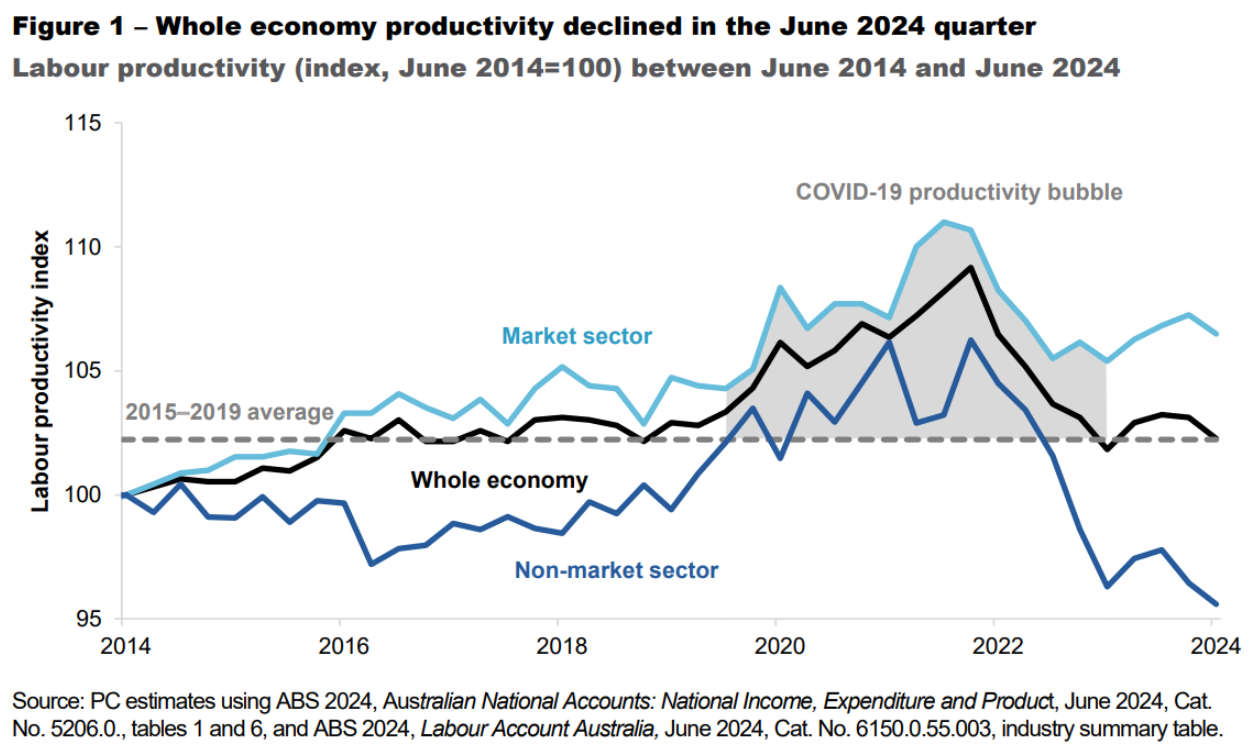

The Q2 national accounts revealed that Australia’s labour productivity (GDP per hour worked) fell to 2016 levels, driven by the non-market sector. This corresponded with the doubling of caring jobs over the same period.

Given that the NDIS is projected to roughly double in size in nominal terms over the coming decade, caring jobs will inevitably expand as a share of the economy.

Australia has transformed into a ‘tax and spend’ economy, with the private sector taking a subordinate role.