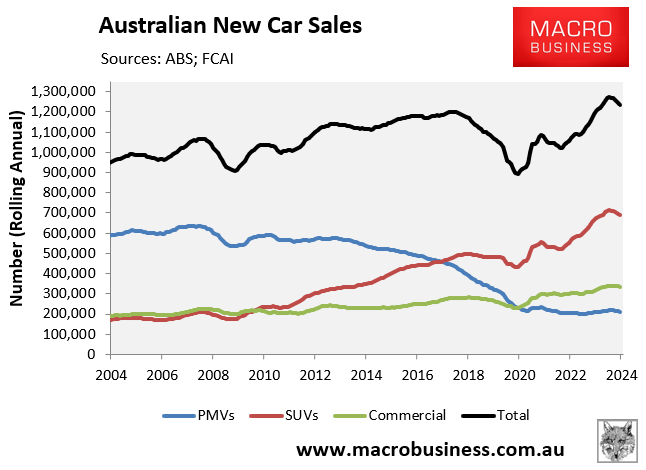

The latest new car sales data from the Federal Chamber of Automotive Industries (FCAI) showed that sales nationally are trending lower, down 7.9% year-on-year in October.

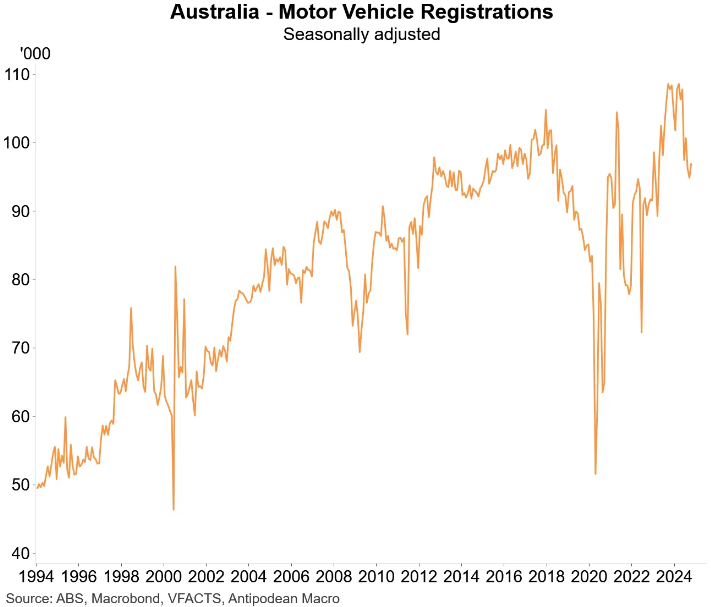

This decline in new car sales has been matched by the fall in motor vehicle registrations this year.

FCAI chief executive Tony Webber noted that the industry is “concerned about the continuing performance of the private buyers segment which was down 14.2% this month following a reduction of 17.2% in September”.

“This does indicate that economic pressures are a concern for families across the country”, he said.

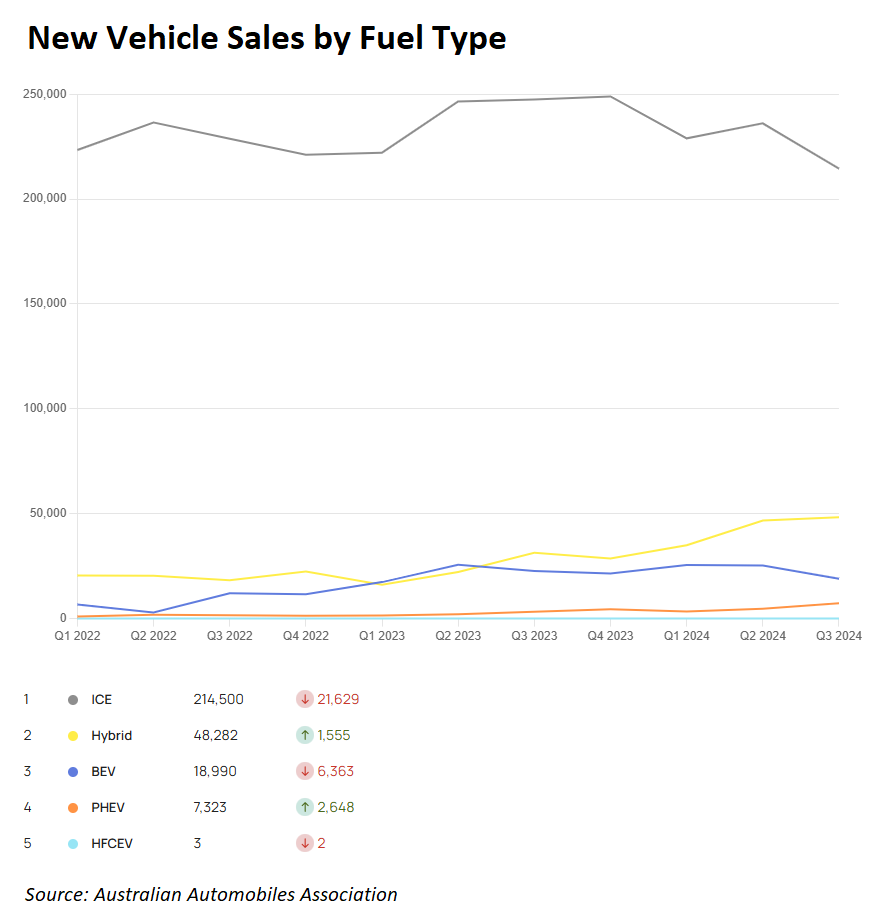

Webber also noted that battery electric vehicle sales have stalled “despite an increasing number of new brands entering the market and substantial tax benefits available to some purchasers through the FBT concession”.

“Many of these new EV sales are in the highly competitive medium passenger segment which already records almost 50% of sales being electric, but the segment accounting for just over 4% of total sales”.

However, sales of hybrid vehicles remain strong “in the SUV and Light Commercial segments which have previously been dominated by petrol and diesel models”.

“This is significant given the overwhelming popularity of SUVs and Light Commercial vehicles in Australia”, Webber said.

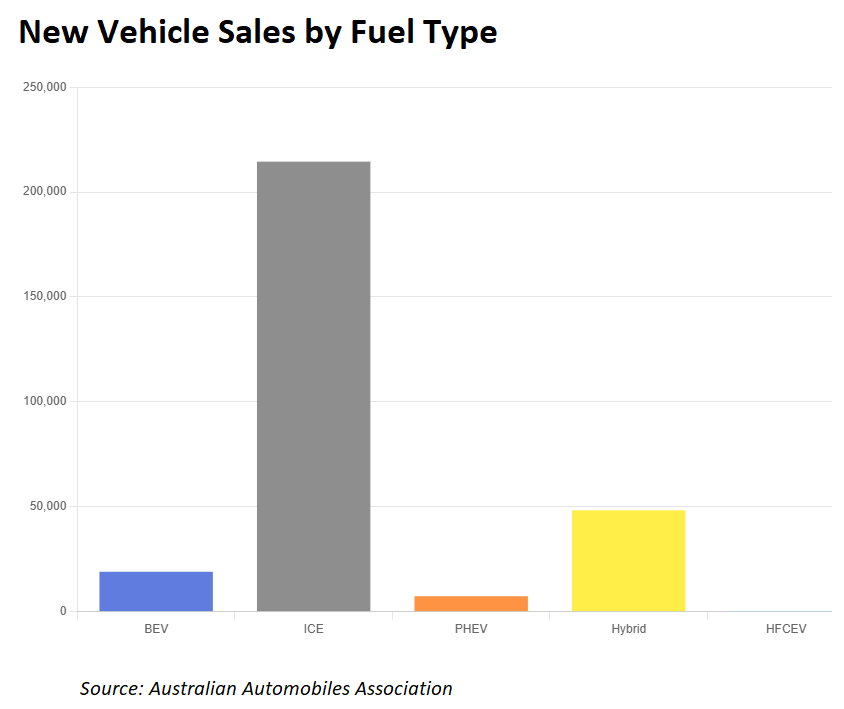

FCAI’s Electric Vehicles Index paints a sorry picture for battery EV fanboys. As illustrated in the following chart, battery EV sales are declining, whereas hybrids are experiencing strong growth and ICE vehicles are still dominating sales.

The following chart shows how battery EV sales remain a rounding error in the overall passenger vehicle market.

EV fanboy website PV Magazine has run damage control, claiming that buyers are being put off battery EVs by “misinformation”:

Before this downturn, electric vehicle (EV) sales had been rising steadily, supported by increased choices and government incentives.

In early 2024, year-to-date sales continued to grow compared to the same period in 2023. Then, in April, electric vehicle sales fell for the first time in more than two years.

Australia isn’t simply mirroring a broader global trend…

A range of factors or combinations of them could help explain the trend in Australia. These include governments axing incentives, concerns about safety and depreciation, and misinformation.

Indeed, the main driver behind battery EV sales was not market-based consumer preferences but federal, state, and territory government financial incentives.

National incentives include a higher luxury car tax threshold, as well as exemptions from fringe benefits tax and customs duty.

However, numerous states and territories have reduced their rebate program and tax exemptions for 2023 and 2024.

New South Wales and South Australia’s $3,000 rebates expired on January 1 of this year. At the same time, the New South Wales government discontinued a stamp duty rebate for new and second hand zero-emission vehicles worth up to $78,000. Both incentives had been offered since 2021.

Victoria’s $3,000 rebate, which began in 2021, expired in mid-2023.

In the ACT, the incentive of two years’ free registration expired on June 30, 2024.

Queensland’s $6,000 electric vehicle rebate expired in September 2024.

Battery EVs are also exempted from paying road user charges via fuel excise, which is effectively a subsidy.

In true rent-seeker fashion, the lobby group for EVs, the Electric Vehicle Council, has demanded more subsidies to stimulate flagging consumer demand.

“The premature withdrawal of incentives for electric vehicles in several states, coupled with lingering concerns about EVs, is stifling rapid uptake”, Electric Vehicle Council legal, policy and advocacy head Aman Gaur said.

“Governments must continue implementing targeted programs that make it easier and more affordable for Australian households and businesses to transition to electric vehicles”.

“At the same time, the industry must continue to address misconceptions about EVs to attract the next wave of adopters”, Gaur said.

Recall that the Australian Energy Market Operator (AEMO) slashed its projections for battery EV take-up over the coming decade, from seven million units to four million.

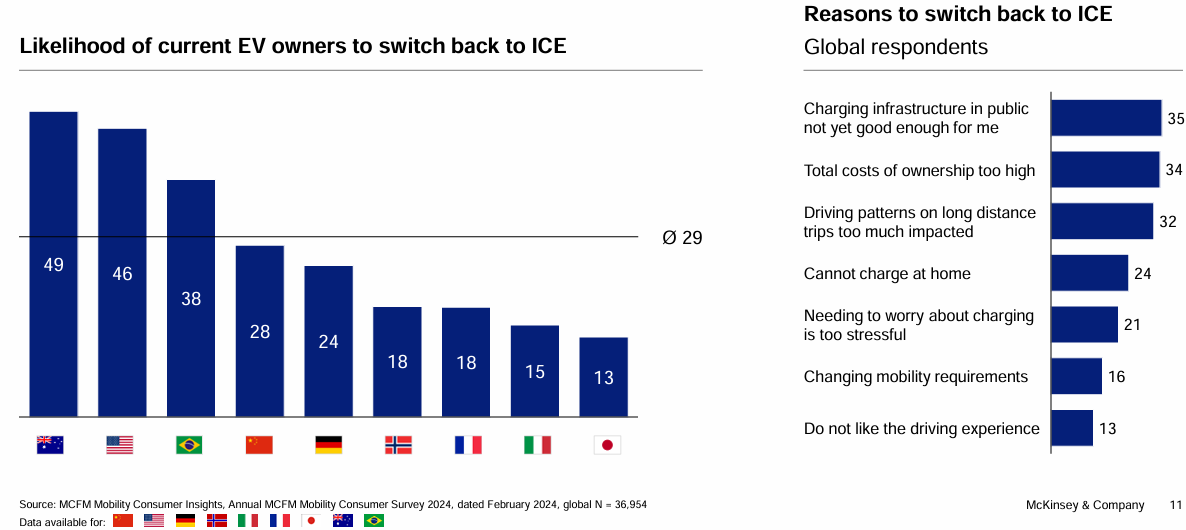

A recent McKinsey Mobility Consumer survey revealed that almost half of Australian EV owners (49%) are “very likely” to return to petrol and diesel ICE vehicles.

The major concerns cited by respondents included the poor state of public charging infrastructure (35%) and high ownership costs (34%).

Concerns around ownership costs were highlighted last month in a survey of 12 insurers carried out by comparison site Compare the Market. It found that electric vehicles are almost 50% more expensive to insure than their ICE counterparts.

“EVs are generally more expensive to insure because the battery pack creates more complexity for repairers, many EV-specific parts need to be imported from overseas, and there are fewer qualified smash repairers for electric cars”, Compare the Market’s economic director, David Koch said.

Meanwhile, several major global automotive manufacturers have pulled back on EV production amid soft consumer demand and stalling global sales.

The reality is that battery EVs are not ready for mass adoption. They remain too expensive, lack fast and convenient charging options, offer poor range (especially on highways where regenerative braking is not utilised), are expensive to insure and repair, and suffer from extreme price depreciation.

By contrast, standard hybrids overcome most of these drawbacks, which is why their sales have risen so strongly.

Toyota has made reliable and competitively priced hybrids since the late-1990s, when they launched the Prius. These hybrid vehicles achieve fantastic fuel economy and range and have strong resale value, unlike battery EVs, whose depreciation resembles disposable junk.