KPMG’s head of turnaround and restructuring, Gayle Dickerson, has warned that home builders were being squeezed by soaring costs and a lack of available labour.

“It means that there are less builders to meet any demand for new housing stock”, she said.

“This is exacerbated by builders flocking to government infrastructure projects, where there is more security of payment, and cost overruns can usually be renegotiated”.

“Many project approvals have not gotten off the ground as the costs to build remains high, impacting project feasibility”.

KPMG also warned that major construction companies are at risk of becoming “zombie companies”, meaning that they show signs of financial distress while managing not to collapse.

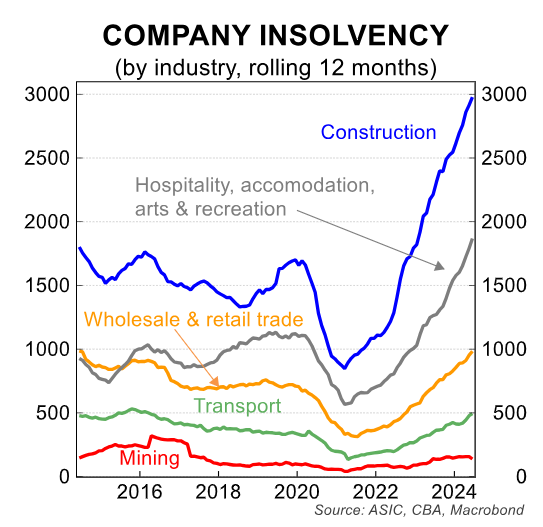

The warning follows a record 3,000 construction firms entering insolvency last financial year.

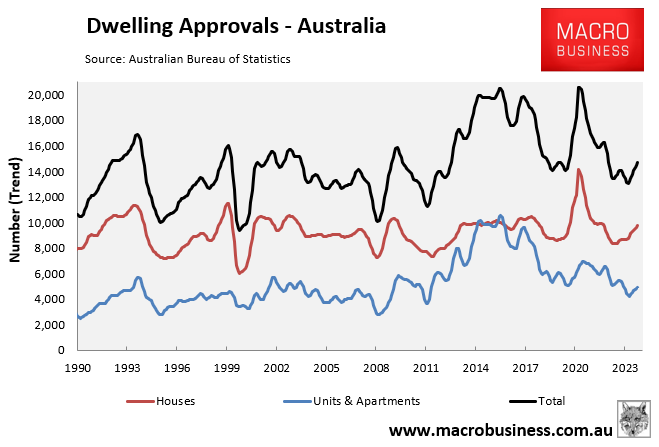

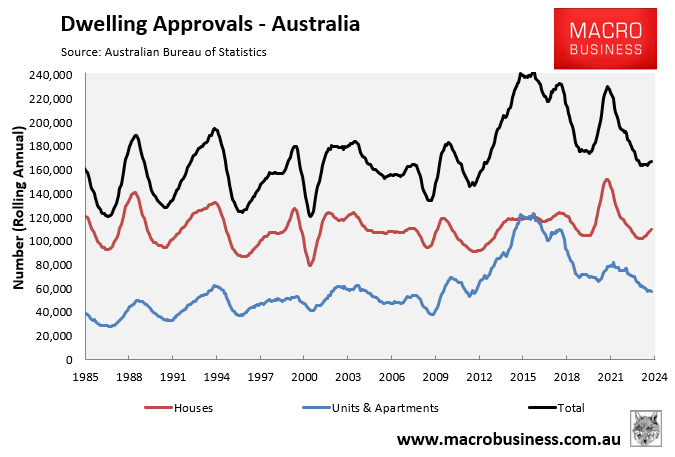

Reflecting the above, the Australian Bureau of Statistics (ABS) on Thursday released dwelling approvals data for September, which showed that housing construction will remain stillborn for the foreseeable future.

In September, only 14,660 homes were approved for construction in trend terms, which is 27% below the Albanese government’s target of building 20,000 homes per month.

Over the year to September, only 167,300 homes were approved for construction, 72,700 (39%) below the Albanese government’s housing target of 240,000 homes a year.

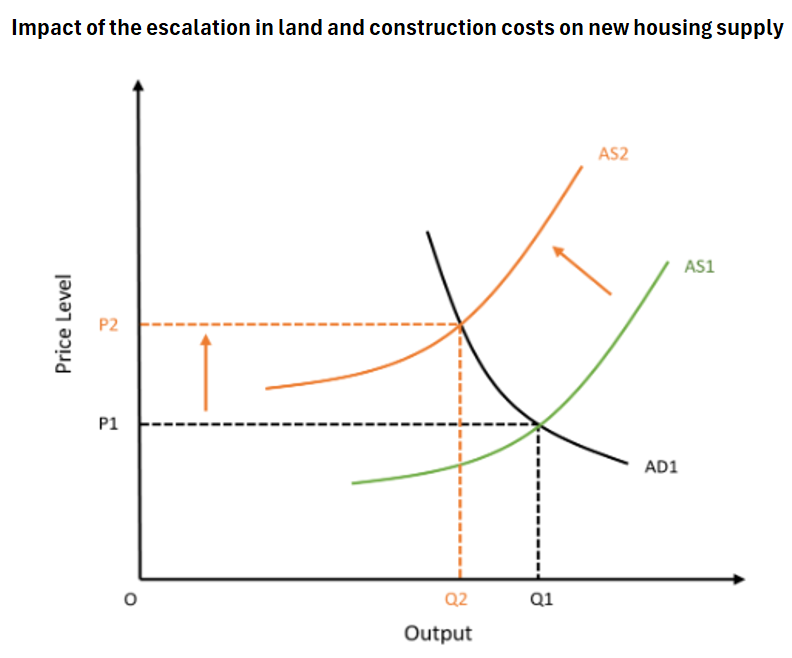

The barriers facing Australian homebuilders are high and include:

- Elevated interest rates.

- A circa 40% increase in construction costs.

- Competition with government infrastructure projects for Labour.

- High construction company insolvencies.

In economic terms, these factors have caused a shift in the aggregate supply curve to the left, reducing the nation’s capacity for producing homes at every price tier.

As a result, the only genuine solution to easing the nation’s housing crisis is to reduce demand by cutting immigration to a level below the nation’s capacity to build housing and infrastructure.