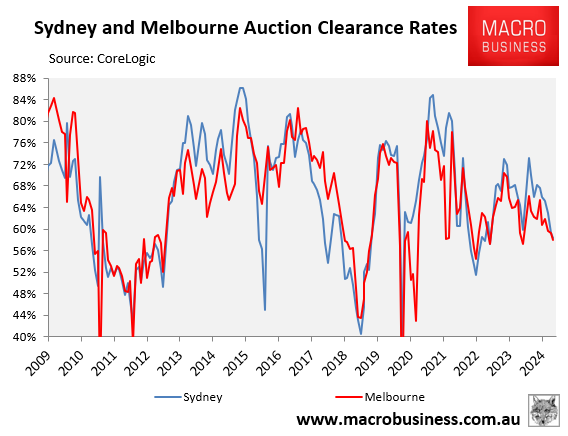

I noted on Saturday how final auction clearance rates across Australia’s two largest markets, Sydney and Melbourne, had fallen to their lowest level of the year, pushing dwelling values lower.

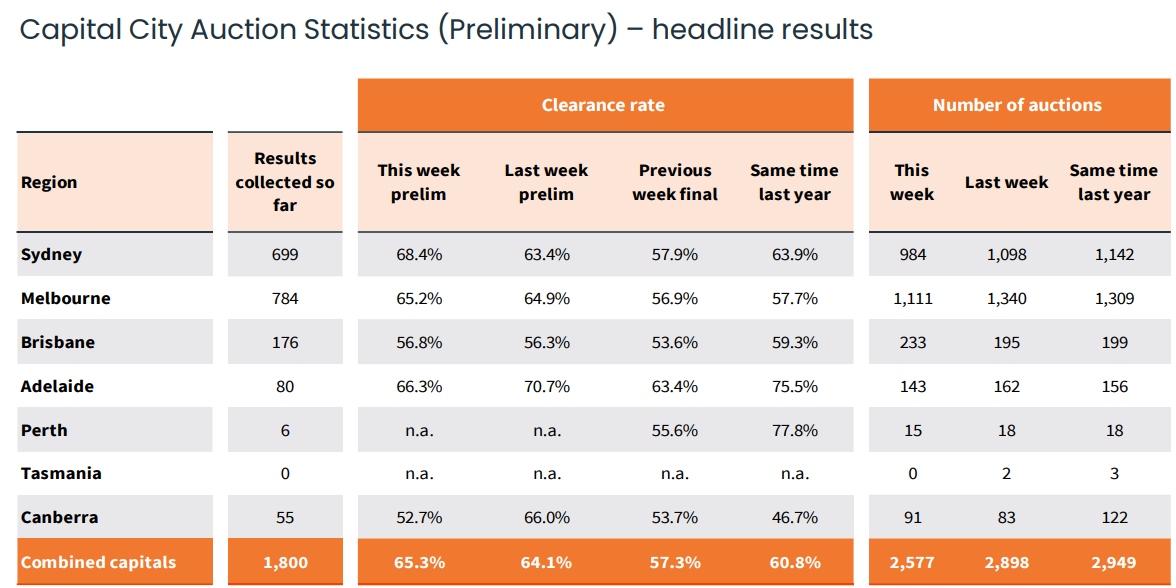

CoreLogic has released its preliminary auction results for the weekend, which remained soft.

Source: CoreLogic

The national preliminary auction clearance rate was 65.3%, up slightly from the previous week (64.1%, which was revised down to 57.3% on final figures). However, it is the eleventh week in a row that the preliminary clearance rate has been less than 70%, which is lower than the spring season average of 66.7%.

Melbourne reported a preliminary clearance rate of 65.2%, up from 64.9% last week (later reduced to 56.9%). The average preliminary clearance rate for the spring season to date has been 66.2%.

The preliminary clearance rate for Sydney was 68.4%, up five percentage points over the previous week’s 63.4% early clearance rate, which was revised down to 57.9%.

In his weekend market wrap, prominent Sydney auctioneer Tom Panos said that the market “is going from Bad to Worse” amid an oversupply of homes for sale.

“Today’s clearance rate would probably be my lowest clearance rate of this year”, Panos said. “Three out of 12 is not good”.

“It should be no surprise. I have been saying for quite some time that we were going to face an oversupply issue. And that meant prices were going to get impacted”.

“Right around Australia, apart from some submarkets such as Perth and bits of Brisbane, we have seen a market that is now officially a ‘buyer’s market'”.

“The amount of vendors planning to put their property on the market in late January or early February. Most of them will put it on after Australia Day”.

“I think there will be a glut of property on the market in February. We might actually see a decrease because of excess stock in February”, Panos said.

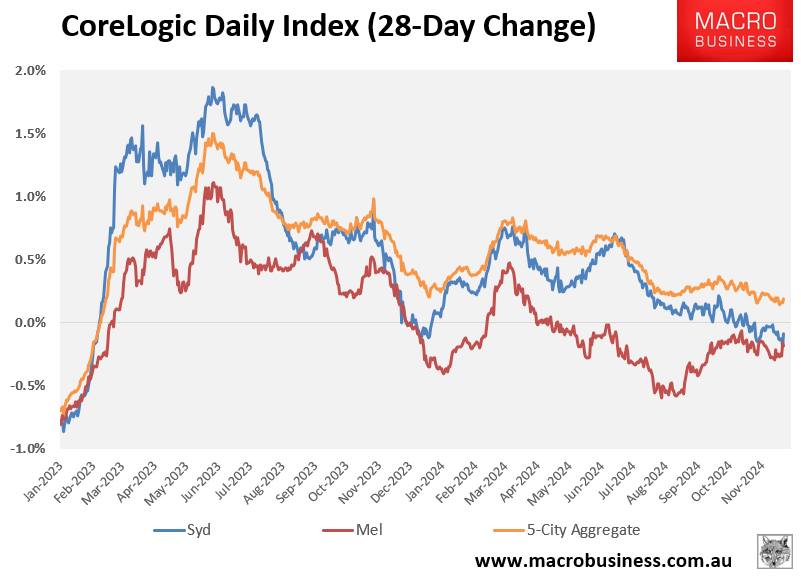

Based on CoreLogic’s daily index, dwelling values are declining in Sydney and Melbourne.

The situation is unlikely to turn around until the Reserve Bank of Australia commences a rate-cutting cycle.