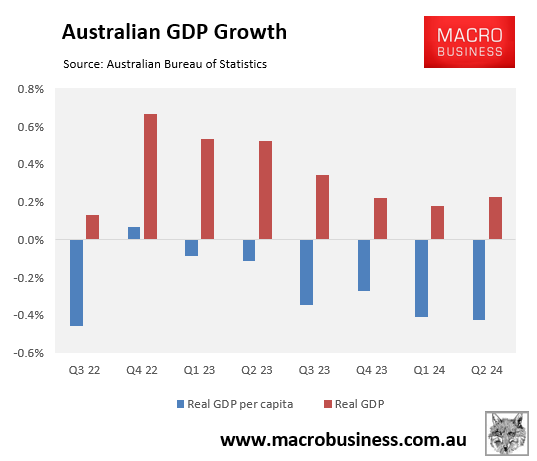

Australians are stuck in the most prolonged per capita recession on record, with per capita GDP falling six consecutive quarters and seven times in the previous eight quarters.

The International Monetary Fund’s (IMF) latest World Economic Outlook report projected that the Australian economy will grow by only 1.2% in 2024, down from its April forecast of 1.5%.

The IMF anticipates a modest recovery in real GDP growth to 2.1% by 2025.

The IMF’s projection is slightly more optimistic than the OECD’s most recent economic outlook, which reduced Australia’s GDP growth forecast for 2024 to 1.1%, down from 1.5% in the previous edition published in May.

The OECD forecast that Australia’s GDP will grow by only 1.8% in 2025.

Deloitte is even more pessimistic, forecasting growth of 1.1% this year and 1.6% in 2025.

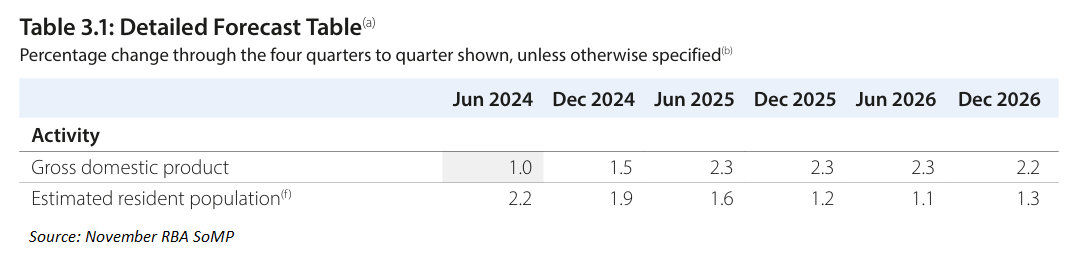

The Reserve Bank of Australia’s (RBA) November Statement of Monetary Policy (SoMP) downgraded Australia’s GDP forecasts to 1.5% for the year ended 2024 and 2.3% for 2024-25. This compares to projected population growth of 1.9% for the year ended 2024 and 1.9% for 2024-25:

Therefore, under all four forecasts, Australia’s per capita recession will continue until sometime next year.

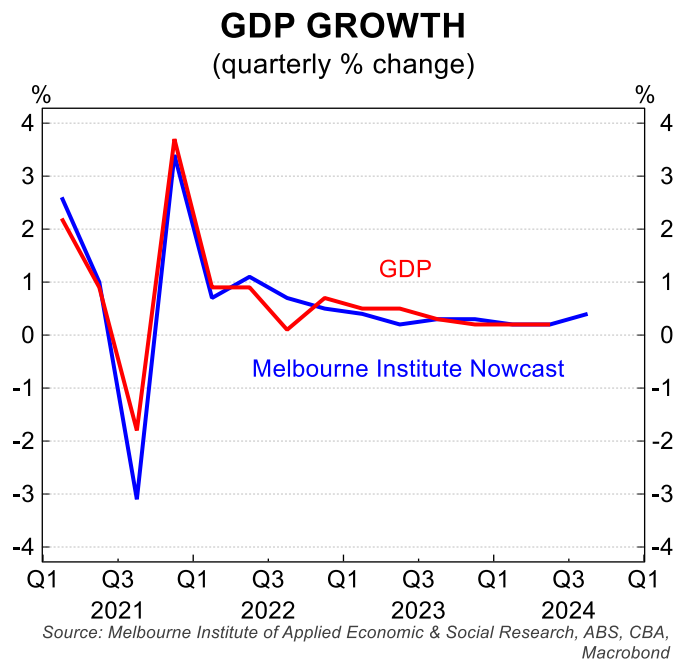

The following chart from CBA shows the Melbourne Institute’s latest GDP nowcast, which points to Q3 Australian GDP growth of 0.4% for the quarter:

Given that Australia’s population grew by 0.6%, as implied by figures from the retail trade release, this suggests that Australia’s per capita GDP will have declined for a seventh consecutive quarter.

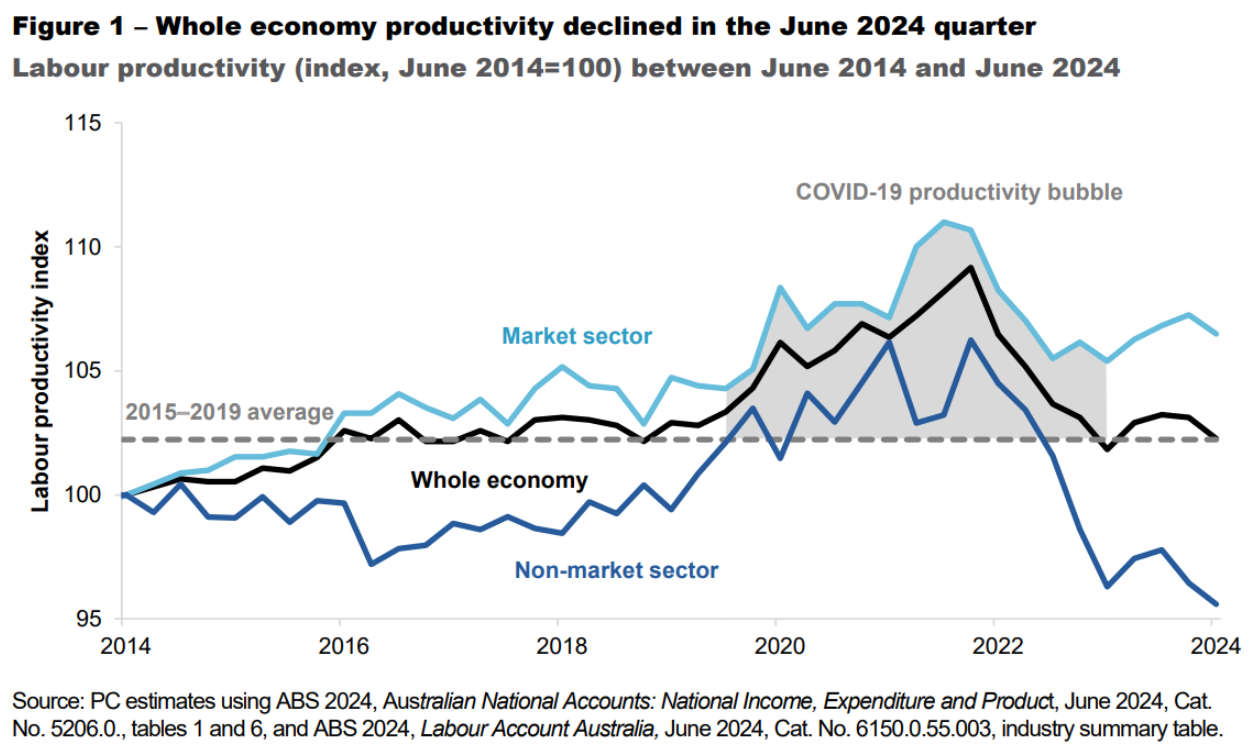

The RBA SoMP’s projections also suggest that the rebound out of the recession in 2025 and 2026 will be soft. This reflects in part Australia’s dismal productivity growth.

As shown above, the weakness in productivity growth has been driven by the composition of job growth, which has been concentrated in the non-market sector (e.g., the NDIS).