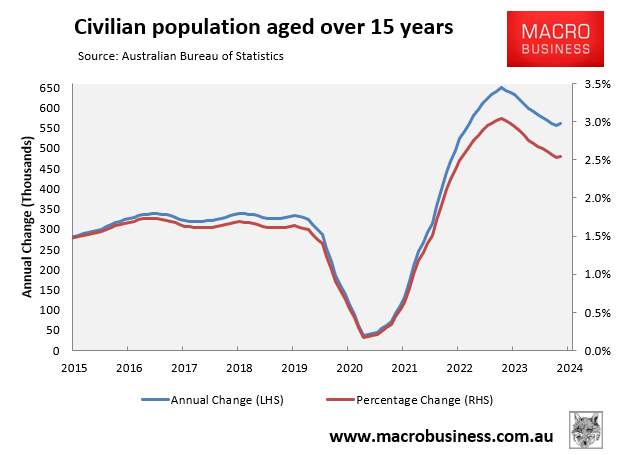

The latest population estimates from the monthly ABS Labour Force survey show that the number of Australians aged 15-plus ballooned by 561,000 (2.5%) in the year to October.

Australia’s civilian population has also increased by 1.2 million (5.6%) over the most recent two years.

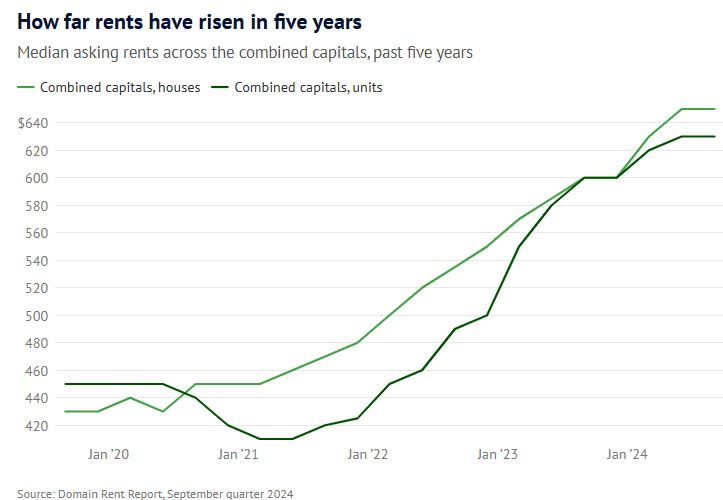

The surge in Australia’s 15-plus population has created an unprecedented rental crisis, as evident by historically low clearance rates and soaring rents.

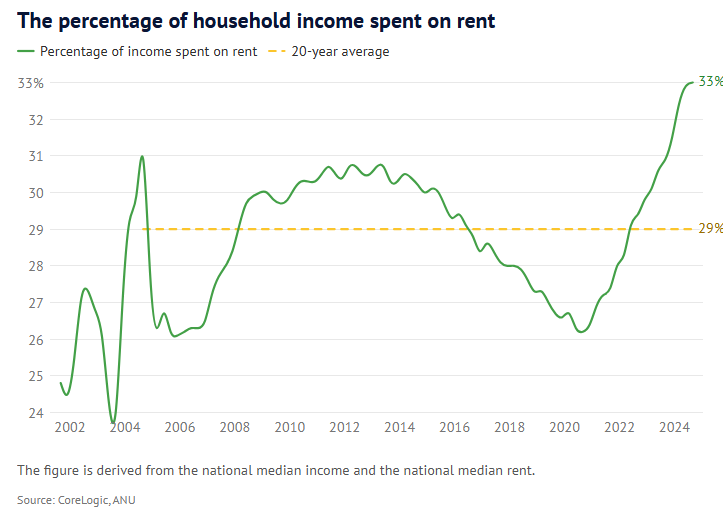

As a result, affordability has fallen to a record low, with the typical tenant paying 33% of their income on rents.

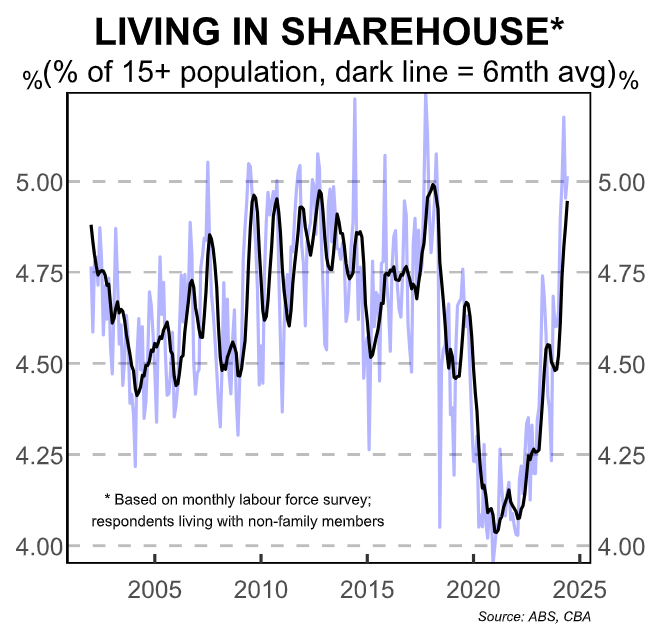

Tenants have responded to the rampant rental inflation by economising on costs and moving into shared housing. There has also been an increase in those living with other related individuals (e.g. siblings, cousins, grandparents).

Indeed, the latest National Share Accommodation Survey (NSAS) from Flatmates.com.au revealed that 43% of respondents claimed that affordability constraints have pushed them into share accommodation.

“While share house living has long been associated with younger demographics who might be unable to crack into the housing market, we have seen a significant increase in Australians over 55 entering share house living arrangements in recent years”, Flatmates.com.au Product Manager, Claudia Conley, said.

“Half of respondents over 55 did so through financial necessity, however there was also a 30% rise in respondents opting for shared living for the companionship that it offers”.

Landlords are also turning to share housing to help manage cost of living pressures.

“With the rising cost of living, renting out a spare room is fast becoming an attractive option for many Australians seeking a second income stream”, Conley said.

“According to the NSAS, nearly threequarters of spare room listers are driven by growing rent pressures and financial stress, turning unused space into a much-needed additional income”.

“Landlords are increasingly open to share house arrangements, with over half of surveyed landlords listing their properties for shared housing within the past two years. These extra rooms have helped to provide critical relief through more difficult rental market conditions”, she said.

The RBA also noted in its August Statement of Monetary Policy that the average household size had increased further over recent months “possibly in response to affordability constraints”.

The increase in shared housing has helped moderate rental price pressures. However, it is a short-term band-aid.

The rental crisis will continue so long as the nation’s adult population continues to grow at a faster pace than housing and infrastructure can be built.