The Australian Bureau of Statistics (ABS) published its final monthly housing finance release on Friday, which will move to a quarterly series, with the next one due in February 2025.

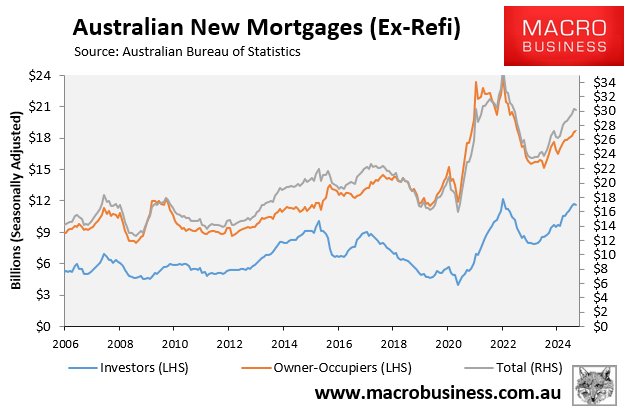

In September, the total value of housing lending fell by 0.3%, the first monthly fall since March 2024.

The value of owner-occupier loans rose by 0.1% in September and was up by 13.1% year on year. Lending to investors fell by 1.0% over the month but was up 29.5% through the year.

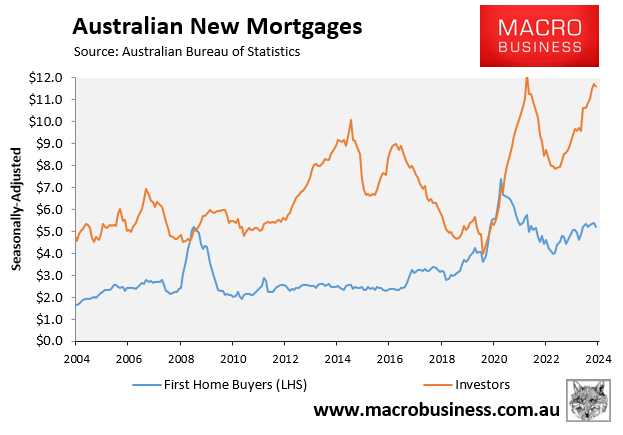

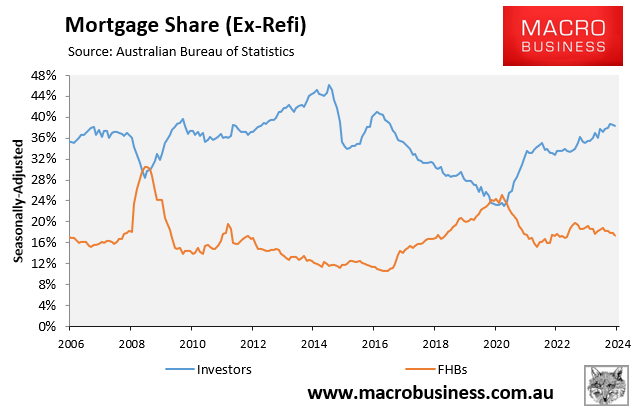

Lending to first-home buyers was weak, down by 3.3% over the month and up only 8.8% annually.

As illustrated in the following chart, first-home buyers continue to be crowded out by investors.

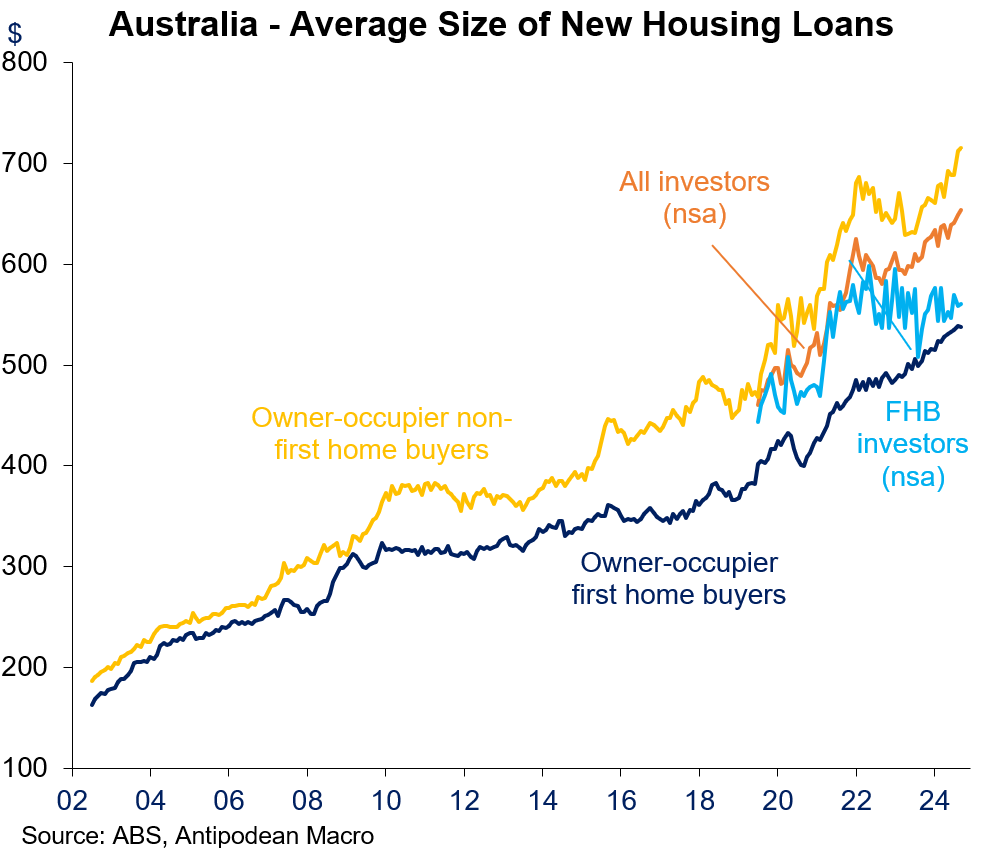

The most exciting finding from this release was that the average mortgage size rose to a fresh record high, as illustrated below by Justin Fabo at Antipodean Macro.

The average mortgage size for upgrading owner-occupiers hit an all-time high of $711,575 in September 2024. The average investor mortgage also hit a record high of $654,056.

The average first-home buyer mortgage was significantly smaller at $538,210 in September but also hit a record high.

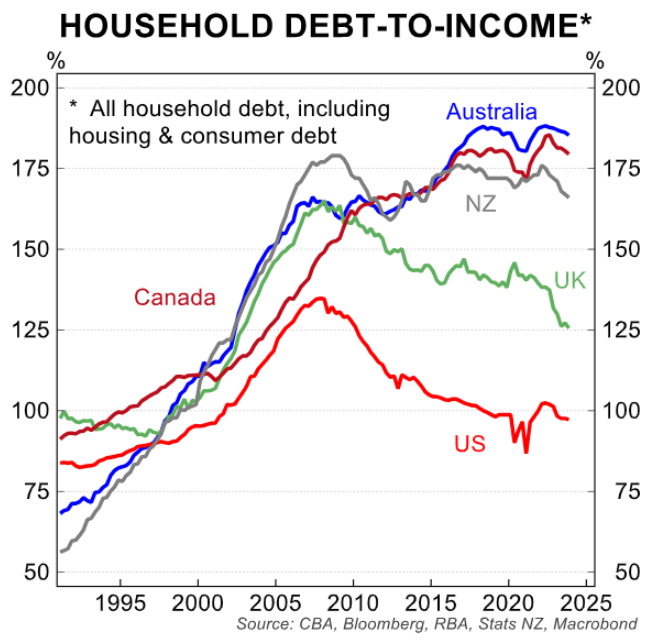

Australian households carry the highest debt load relative to income in the Anglosphere, as illustrated below.

This data from the ABS suggests that Australians’ appetite for debt shows few signs of slowing down, despite the highest mortgage rates in over a decade.