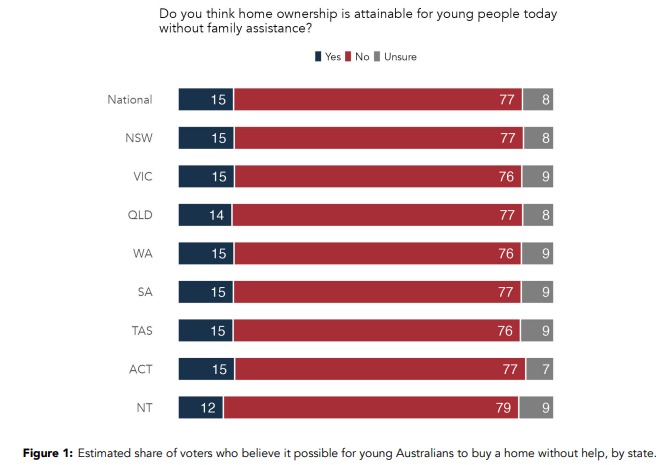

Earlier this month, Accent Research released a survey showing that only 15% of respondents believed that younger Australians could purchase a home without financial assistance.

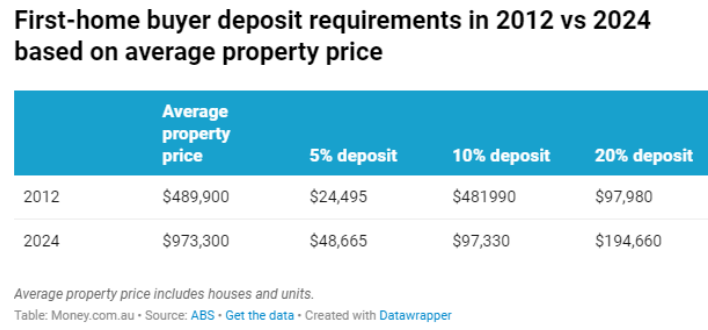

The results followed an analysis from Money.com.au showing that homebuyers need to save a deposit of nearly $200,000 to purchase an average-priced home with lenders’ mortgage insurance.

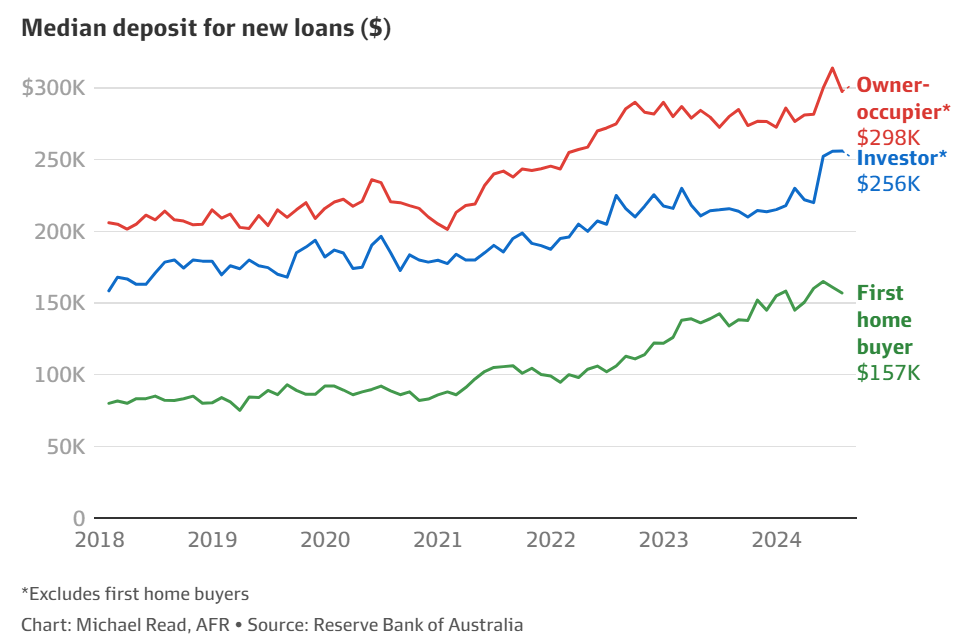

A separate analysis from the Reserve Bank of Australia (RBA), published on Monday, showed that the median deposit for first-home buyers has soared to $157,000 from $89,000 in 2019:

RBA assistant governor Christopher Kent also noted that “the first home buyer share of new loans has been a bit above average of late”, suggesting “the so-called bank of mum and dad may have increasingly helped many first home buyers”.

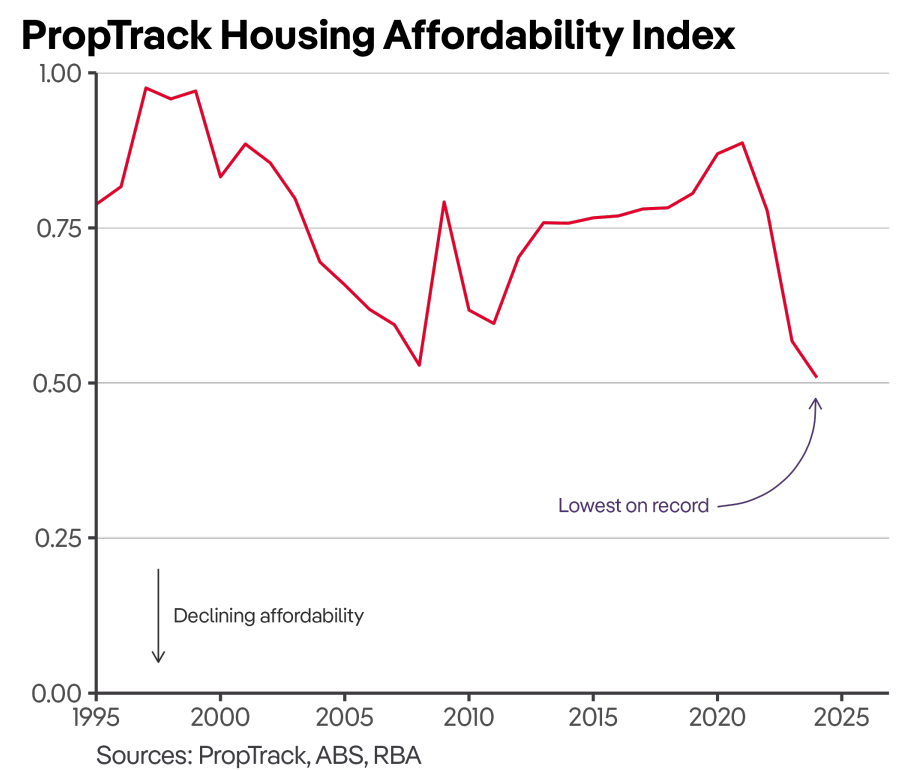

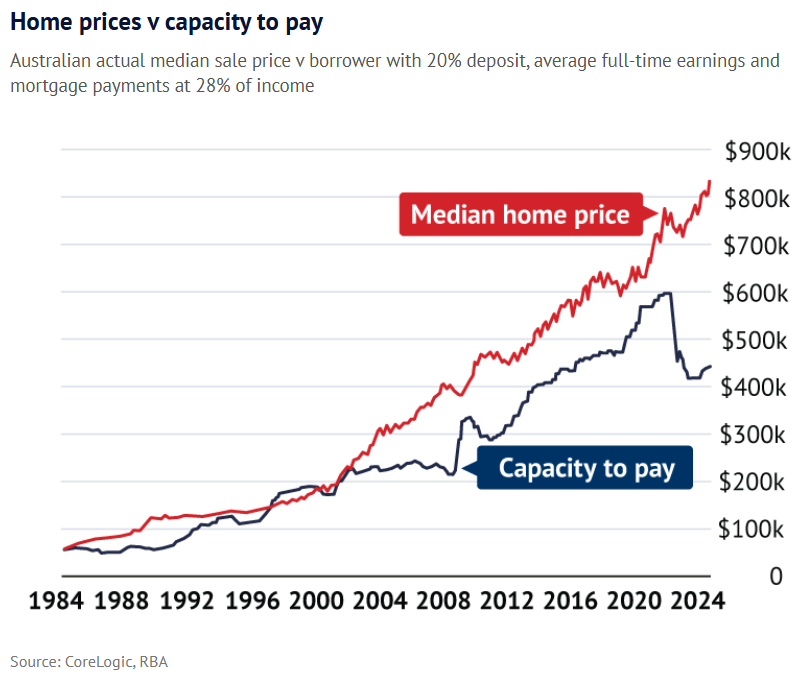

With housing affordability at a record low, according to PropTrack, and the gap between home prices and borrowing capacity at an all-time high, first-home buyers are as reliant as ever on family financial assistance.

In fact, if you don’t have wealthy parents to tap for assistance and you live in a major Australian city, the chance of owning a home is slim.

Intergenerational wealth transfer has replaced the Australian dream of home ownership.