Bloomberg has smashed the recalcitrant RBA:

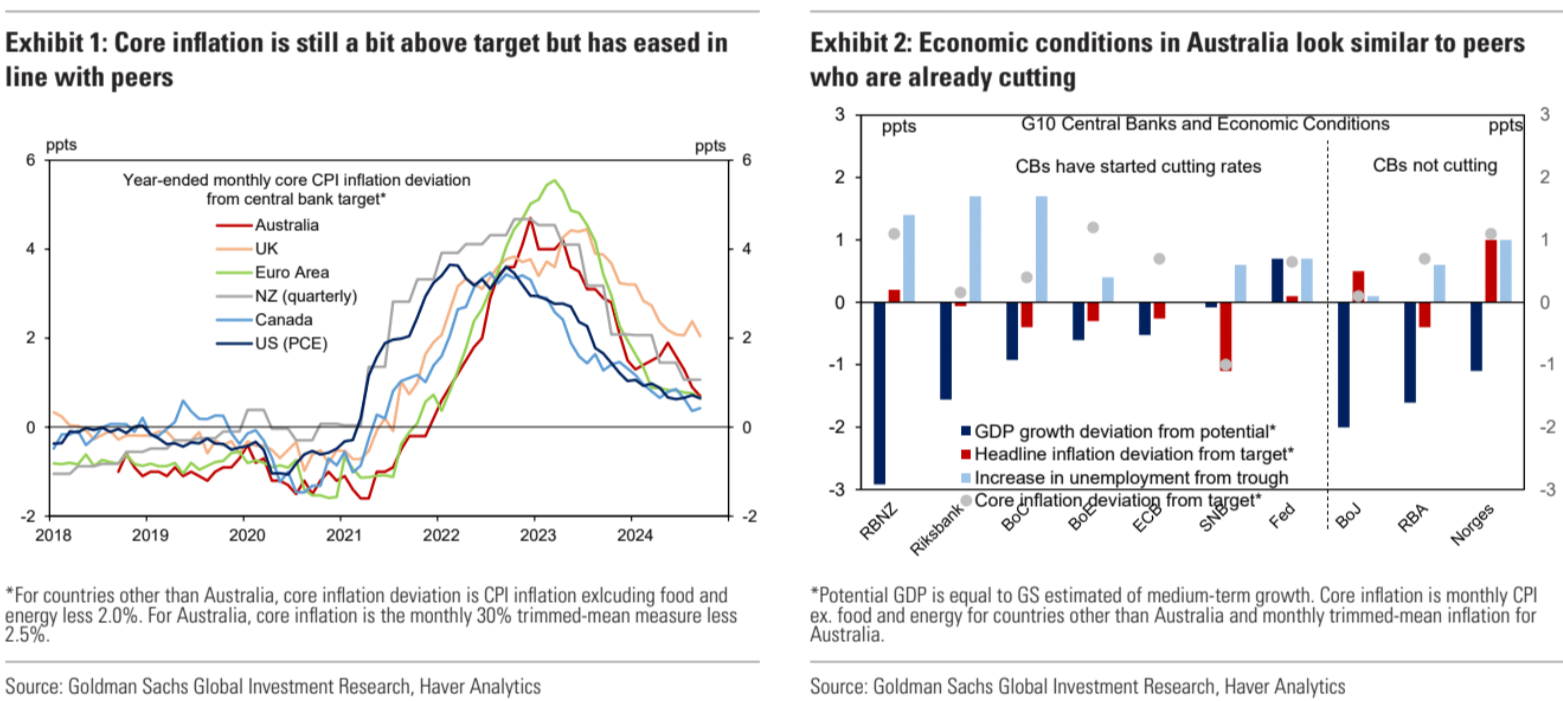

Australia truly is an island. When it comes to monetary policy, the country is at risk of becoming a serious — and embarrassing — outlier. The global cycle of interest-rate cuts is well advanced and inflation looks beaten.

Yet you wouldn’t know it from the words and actions of the country’s central bank. Its rhetoric is defensive and could use some freshening. The Reserve Bank’s mantra that it’s “not ruling anything in or out” made sense when the pace of price increases was still uncomfortably quick. The line, which also enabled Governor Michele Bullock to put daylight between herself and her predecessor, has now outlived its usefulness.

Federal Reserve Chair Jerome Powell gave a nice explanation of how to square cuts if inflation is still above target.

Powell was asked how close does inflation need to get to 2% before the central bank would be confident in easing.

Powell responded that waiting until 2% was achieved “would be prescription (for a policy) of going way past the target… you would stop raising long before you got to 2% inflation and you’d start cutting before.” Nobody wants to see inflation surge again, but also few desire revisiting the decade before the pandemic when price gains became too sluggish.

Not so hard, is it? Especially since Aussie inflation is crashing and will continue to do so into 2026 as rents, food, goods, energy, and administered prices all fall away.

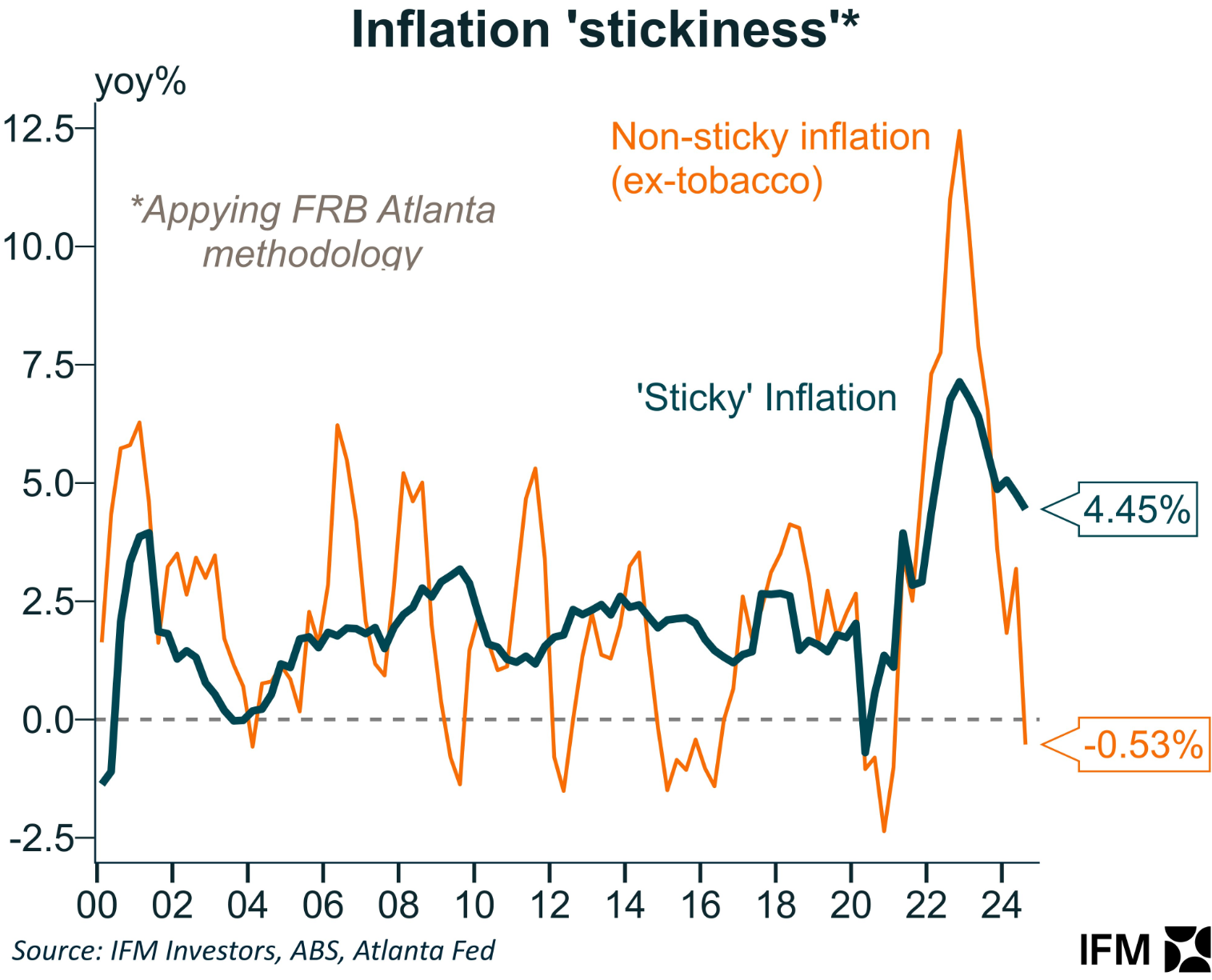

Wages will also pull back further as the immigration perma-shock has its way. Sticky services inflation is age-driven and will follow everything else.

It’s not surprising that the RBA has succeeded.

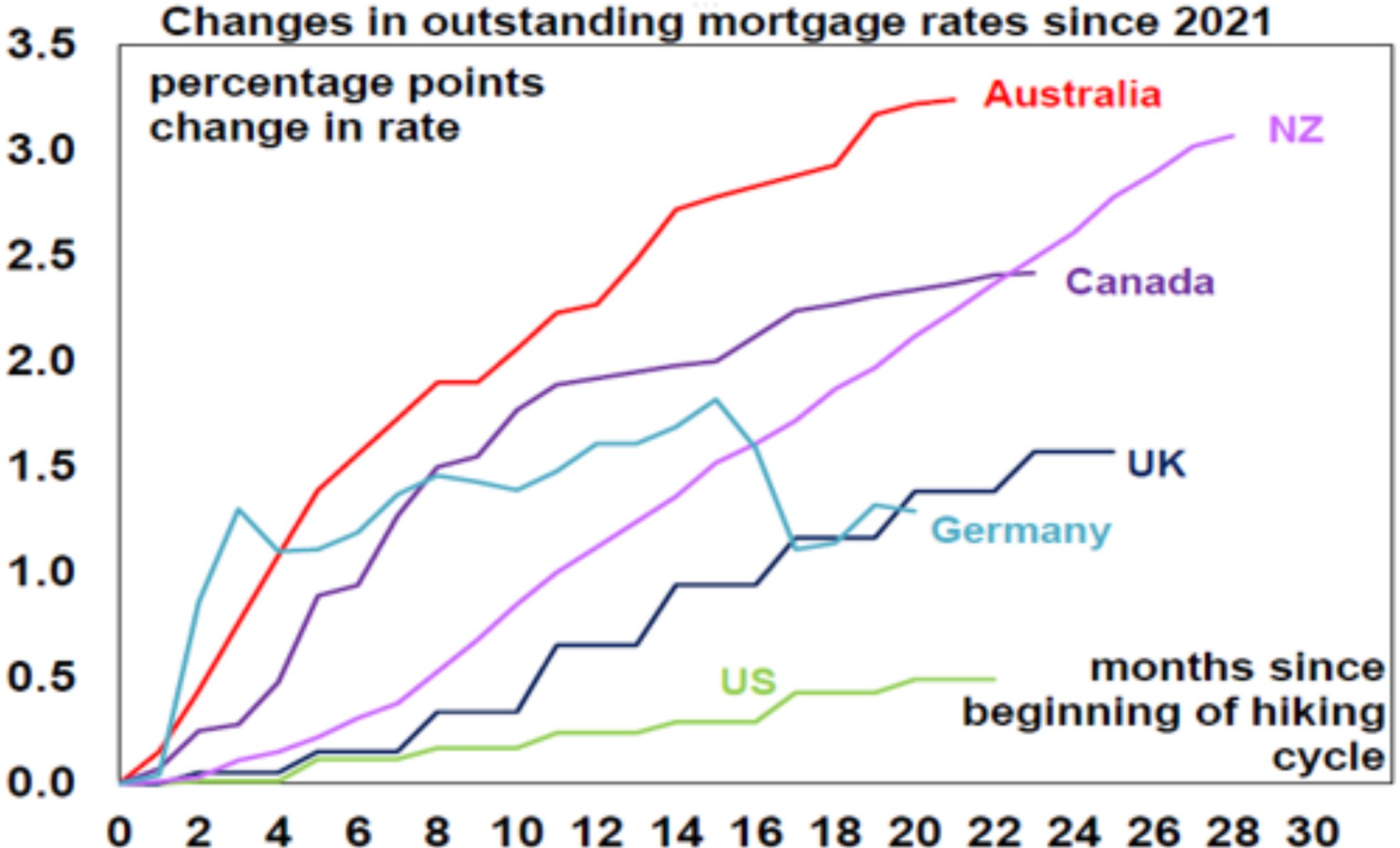

In real terms, the RBA tightened the most of any developed market central bank as it chased Albo’s disastrous economic mismanagement.

The result is that the central bank smashed the economy to pieces and inflation is back in line with the other developed markets.

I had a conversation with a senior economist recently who has tried to reverse engineer how households have survived this shock without bankruptcy carnage and the numbers simply do not add up. They must have turned to black-market prostitution.

The RBA needs to take a yes for an answer. Its world-beating tightening has succeeded in bringing Australia back into line. Andrew Boak at Goldman:

Michele Bullhawk was only appointed after her predecessor, Phil Lowe, was sacked for being far too hawkish for the better part of a decade before COVID.

It seems you can change the staff at the RBA but not the dominant species of bullhawk.