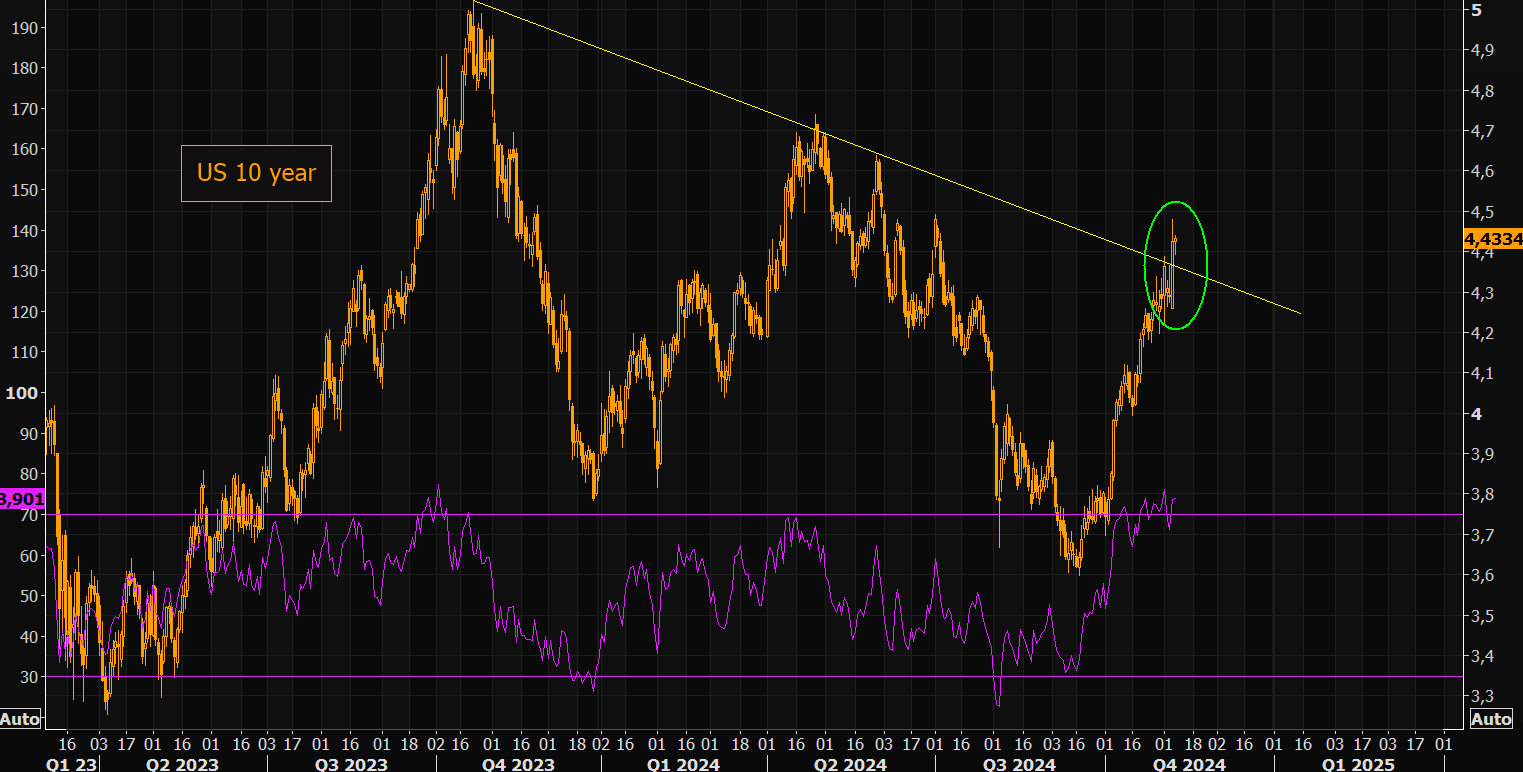

US bonds have been getting a flogging. This is overdone is overdone in my book.

The Fed cut again last night and is on track for more. It will pause once Trump’s tariffs hit, but then resume in 2026.

The 10-year has priced enough:

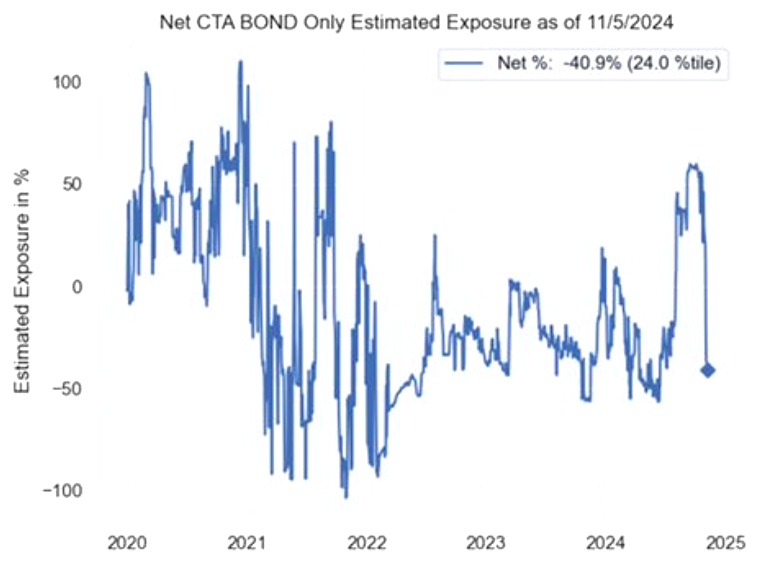

The backup has been driven by robots which are almost done selling.

Advertisement

In Australia, all rate cuts are now priced out, which is pretty stupid given we are about to begin an easing cycle.

Advertisement

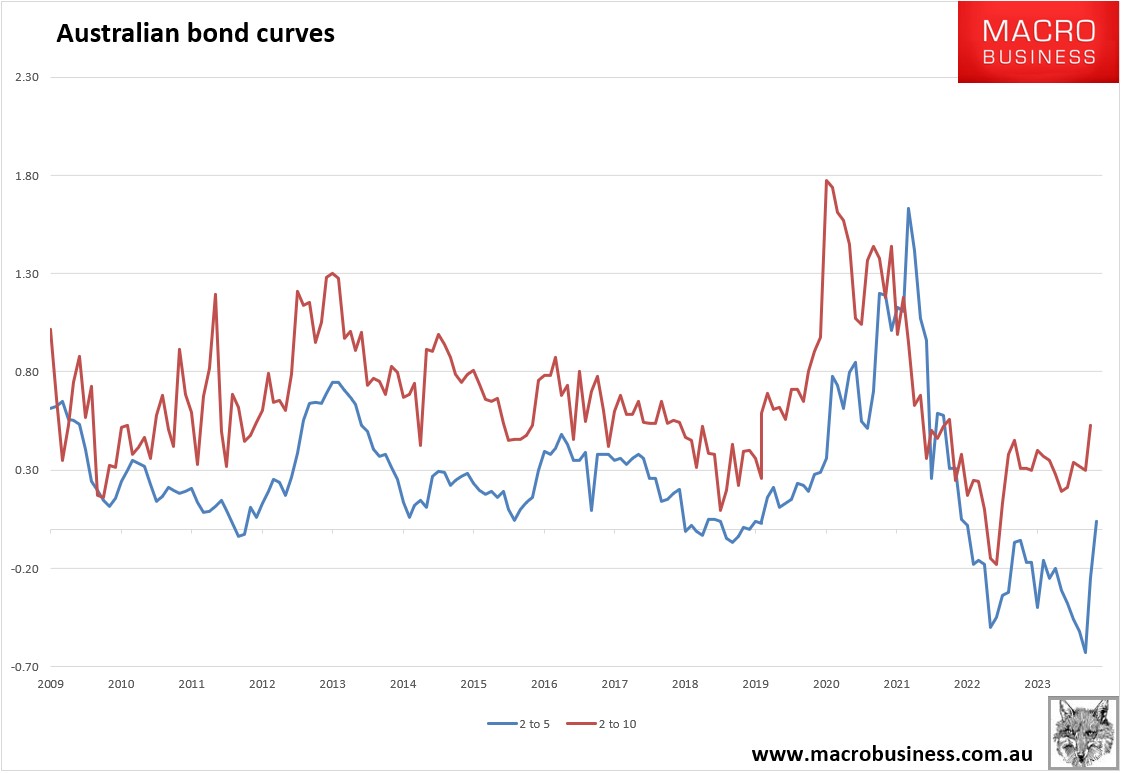

The imminent RBA easing (and US election) has begun to steepen the curve. However, the belly of the curve has not broken out of its per capita recession range.

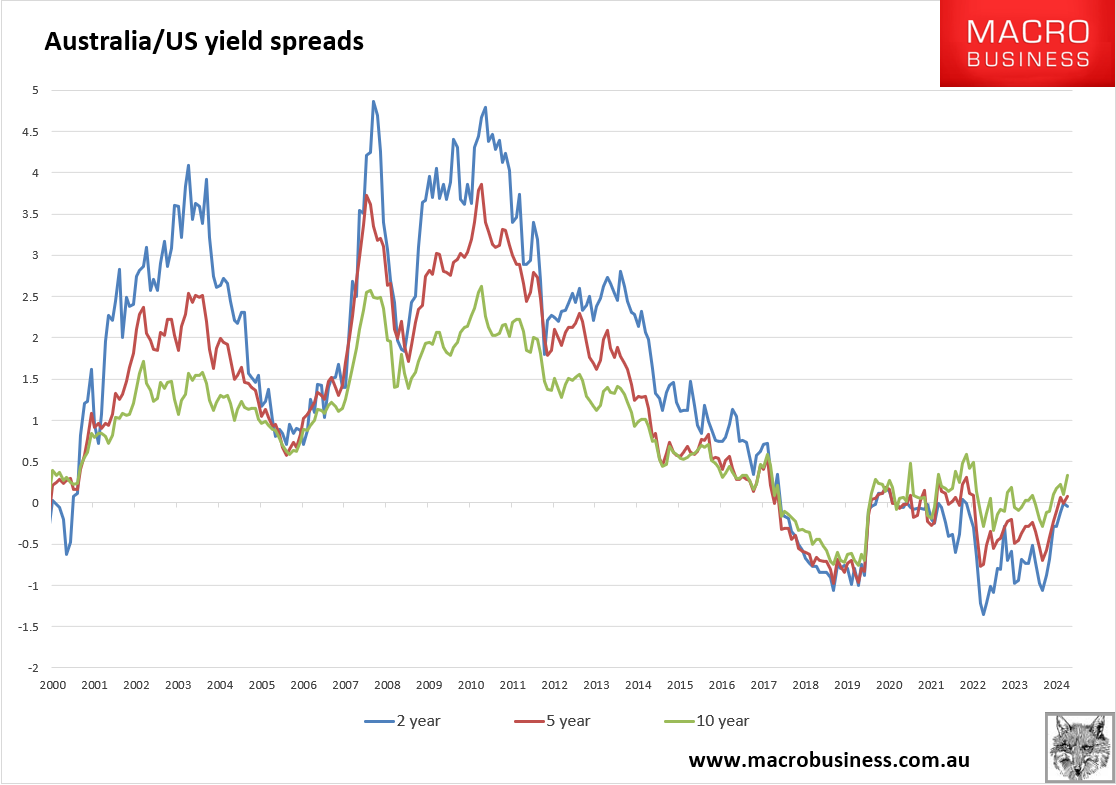

The Chinese stimulus has rescued yield spreads for now. This won’t last in 2025, in my view, pressuring AUD.

Advertisement

Bonds are mispricing the RBA pivot.