We have repeatedly warned that Victoria’s state debt burden is problematic.

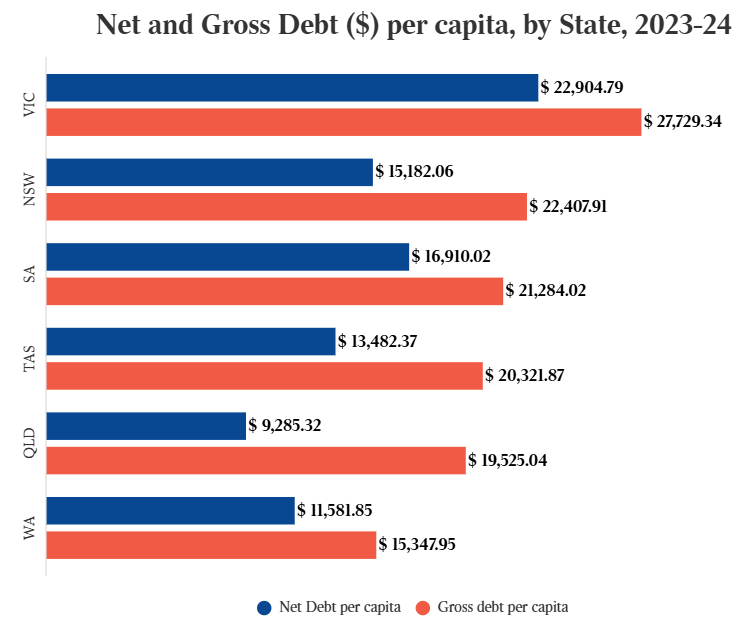

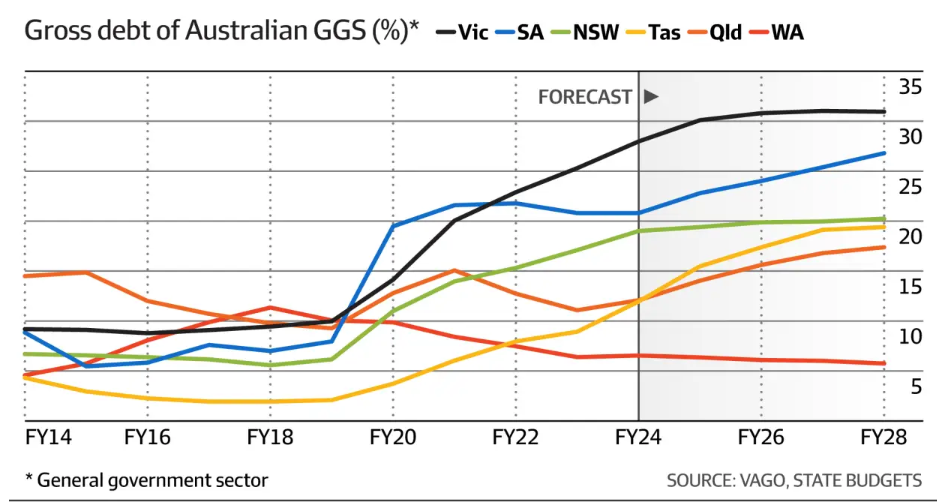

Victoria has the nation’s largest per capita debt and the lowest credit rating.

The world’s two leading credit rating agencies, S&P and Moody’s, have warned that the state faces future rating downgrades if it does not address its financial position.

Downgrades appear unavoidable, given that the Labor state government signed the first major tunnelling contracts for the $216 billion Suburban Rail Loop against experts’ recommendations.

The increase in Victoria’s debt is particularly problematic given the economy’s lagging growth, which makes debt repayment more challenging.

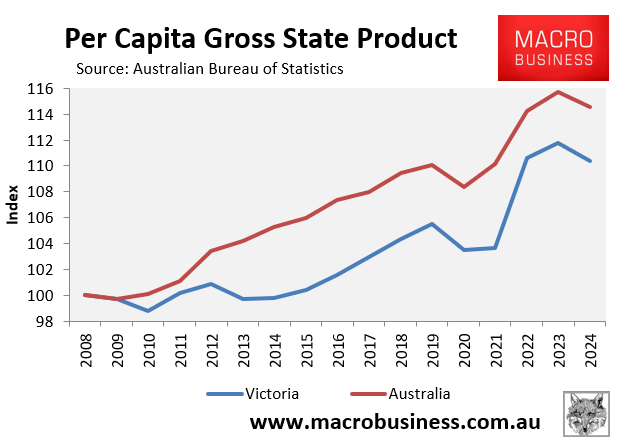

As noted last week, Victoria’s per capita GDP growth has badly lagged the nation since the Global Financial Crisis (GFC) hit in 2008.

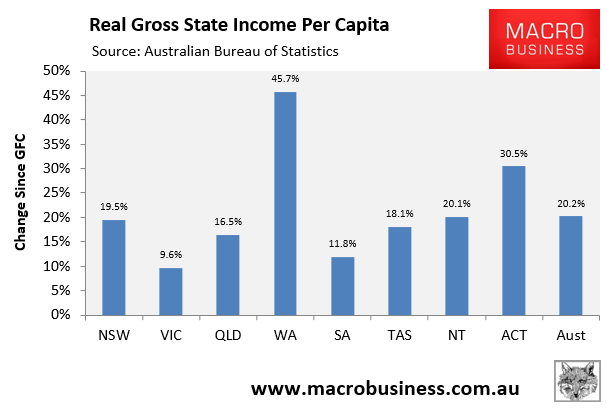

Victoria has also experienced the weakest per capita state income growth since the GFC.

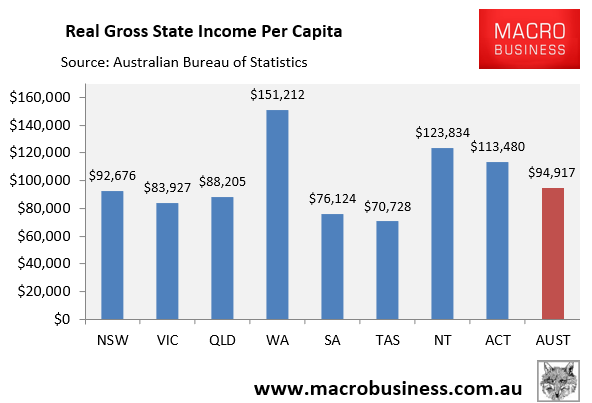

Victoria’s per capita state income is also the third lowest in the nation, behind South Australia and Tasmania.

Over the weekend, independent economist Saul Eslake published a report explaining how Victoria’s economy has suffered over the past decade of Labor rule.

“[Victoria] now ranks alongside South Australia and Tasmania as “cellar-dwellers” in terms of relative economic performance; it is the most indebted state or territory as a proportion of its economy; and it has been almost 33 years since a Victorian was last living in The Lodge”, Eslake wrote in The AFR.

“The parlous state of Victoria’s finances mean voters are bound to face a combination of cuts in government spending and increases in taxation”.

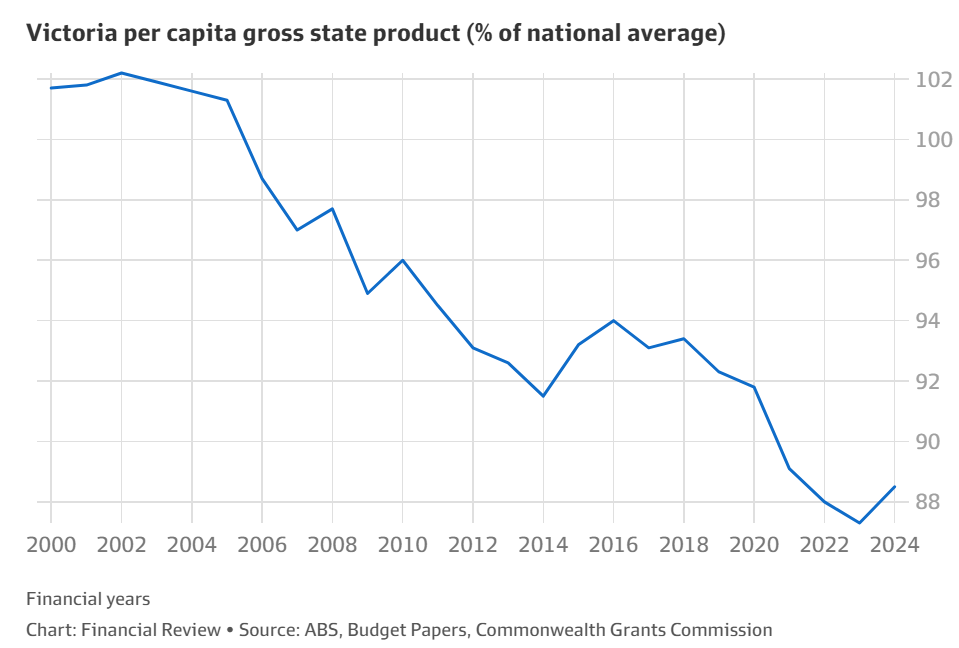

The following charts from Eslake encapsulate Victoria’s decline. “Victoria’s per capita gross product has declined from 1.7% above the national average in 1999-2000 to 11.5% below the national average in 2023-24, ahead of only South Australia and Tasmania”.

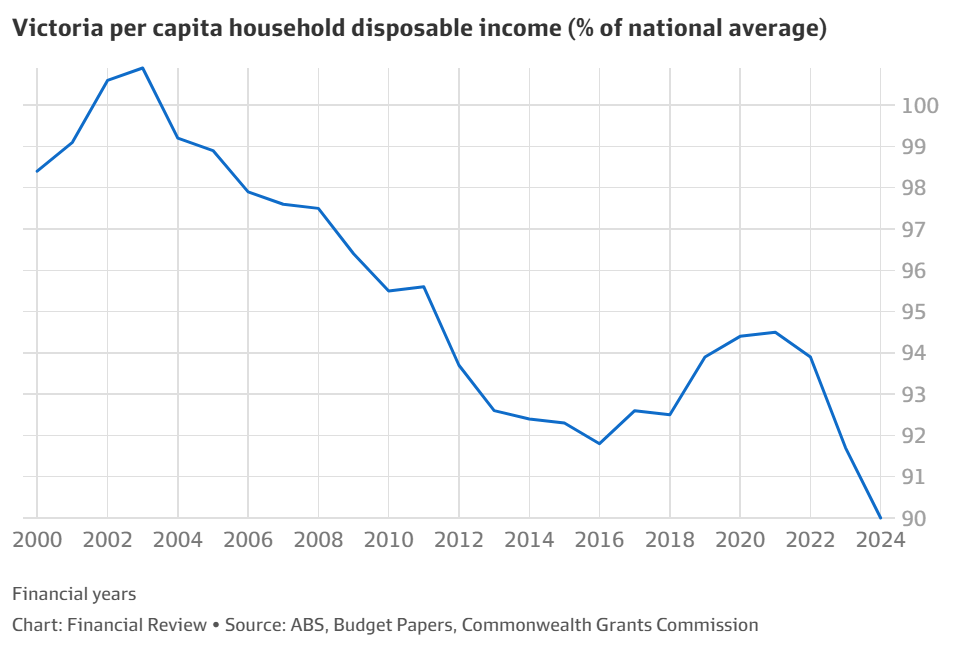

Worse, Victorians’ material well-being, as measured by real household disposable income, has plummeted from being just above the national average at the turn of the century to 10% below the national average. It is now the second lowest in the nation behind Tasmania and just ahead of South Australia.

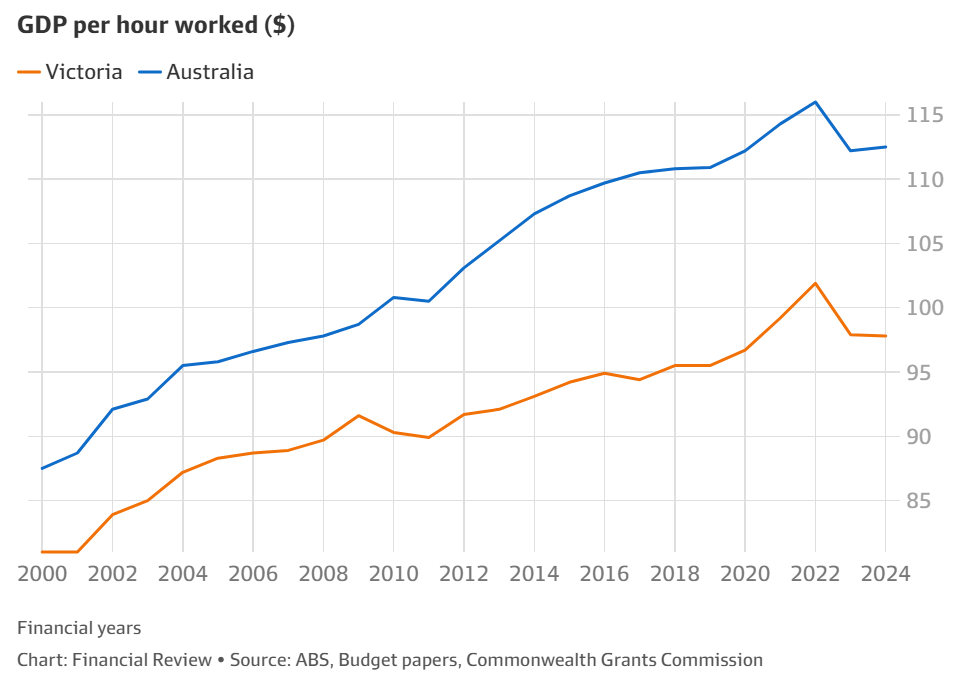

Eslake attributes Victoria’s poor economic performance to its “cellar-dwelling productivity performance. Since the turn of the century, labour productivity in Victoria has risen at an average annual rate of 0.8% per annum, the slowest of any state or territory, and well below the national average of 1.1% per annum”.

“Victoria’s labour productivity has fallen by 5.6 percentage points relative to the national average since 1999-2000”, notes Eslake.

Eslake attributes part of Victoria’s productivity decline to an overabundance of low-productivity people-servicing jobs:

“The share of employment in intrinsically labour-intensive, and hence low-productivity, industries (retail trade, accommodation and food services, administration and support services, education and training, healthcare and social assistance, art and recreation services, and other services) has risen by relatively more in Victoria (4.9 percentage points) over the past 24 years than in Australia as a whole (4.1 percentage points)”.

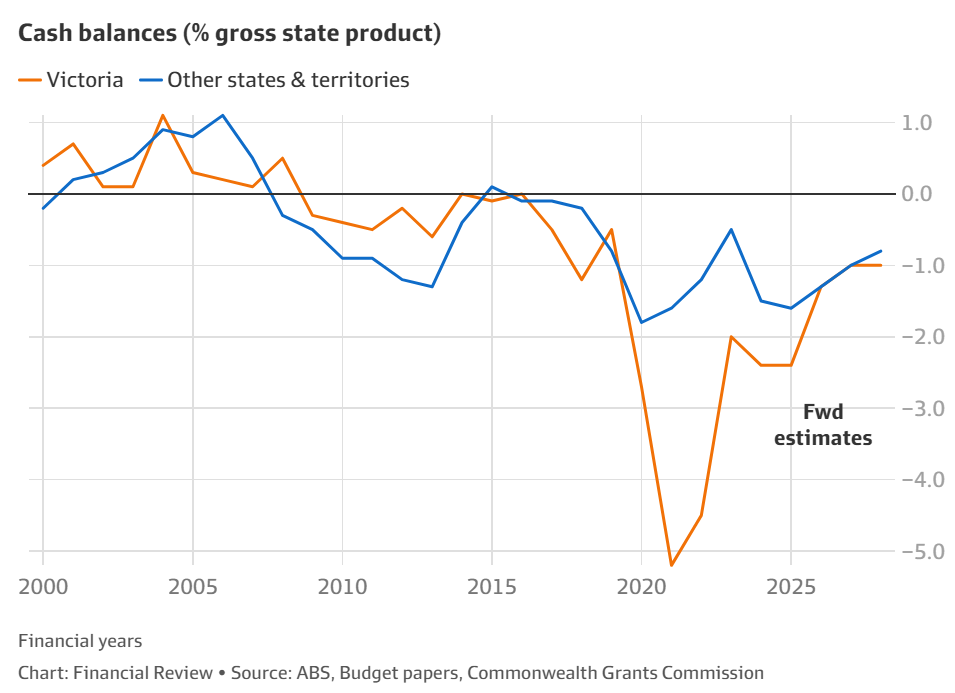

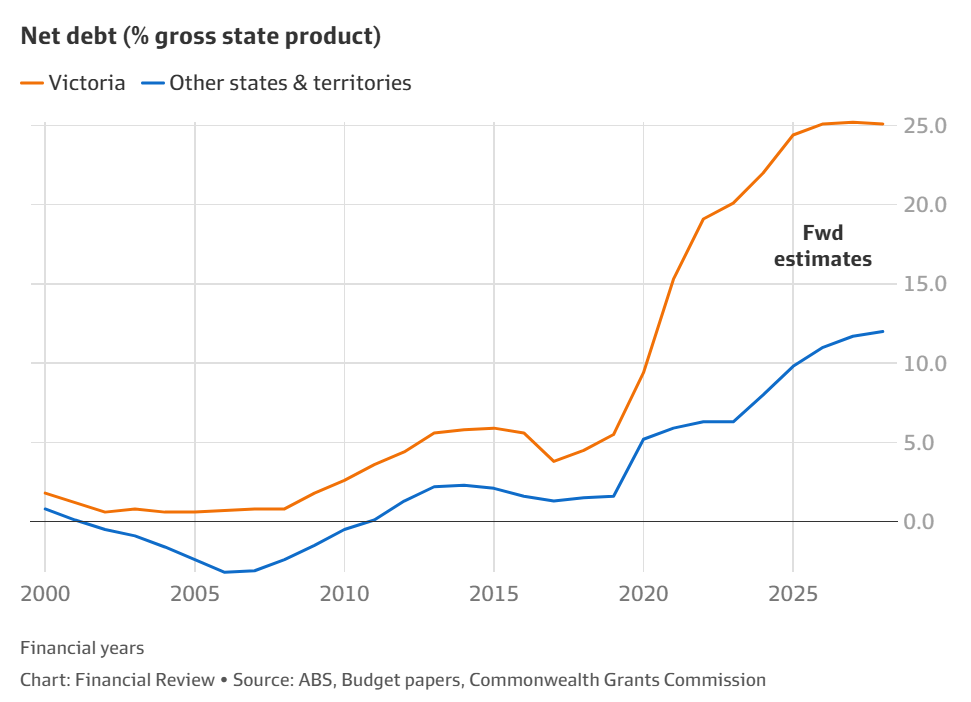

Meanwhile, poor financial management has resulted in Victoria running “persistently larger cash deficits over the past decade than any other state or territory. Victoria has run up the highest level of general government sector net debt of any state or territory, relative to the size of its economy”.

Eslake attributes the explosion in Victorian debt to three main factors:

- Spending on pandemic lockdowns.

- Bloating of public sector employment and generous wage rises.

- Wasteful infrastructure spending.

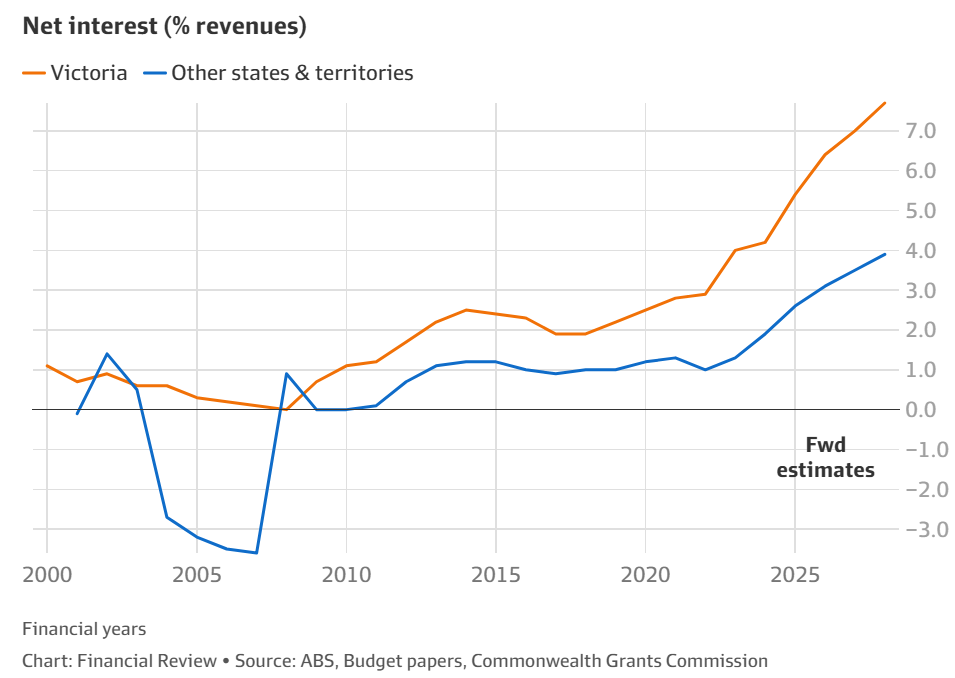

As a result, Victoria’s net interest payments have soared:

“As a result of having run up so much debt over the past decade, net interest payments accounted for 4.2¢ of every dollar of Victorian government revenue in 2023-24, compared with 1.9¢ of every dollar of other state and territory governments’ revenue”, Eslake notes.

“And on current forward estimates, that’s set to rise to 7.7¢ out of every dollar of Victorian government revenue by 2027-28, compared with 3.9¢ in every dollar of revenue for the other seven state and territory governments”.

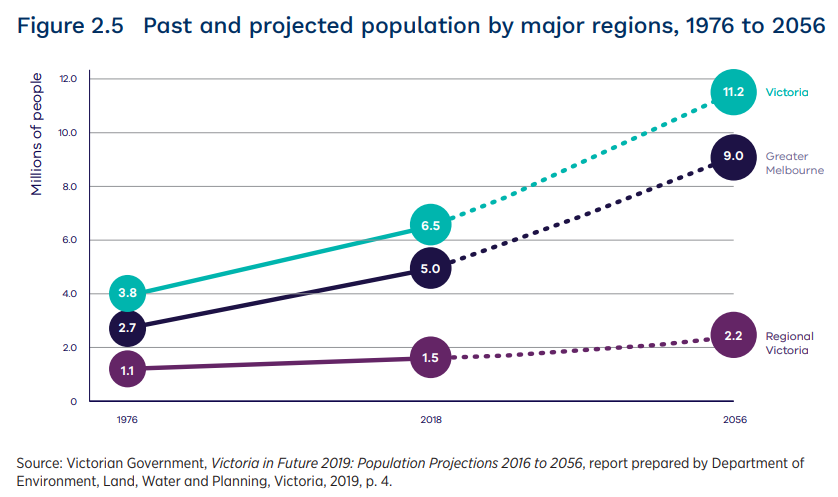

As I noted on Friday, Victoria’s economic growth model effectively revolves around importing masses of people to build housing and infrastructure for, as well as provide services to.

The state’s population has swelled by an insane 2.3 million people this century and is officially projected to add another 4.2 million people over the next 32 years:

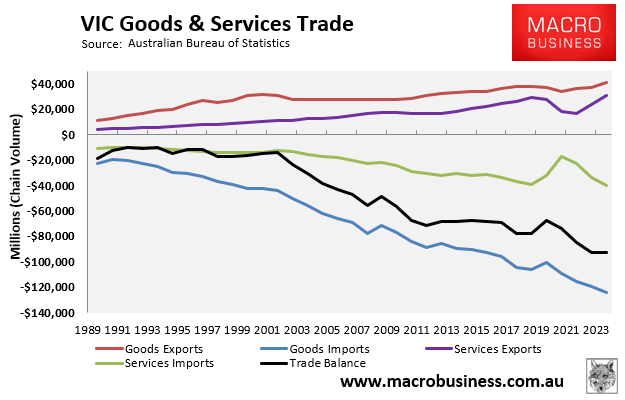

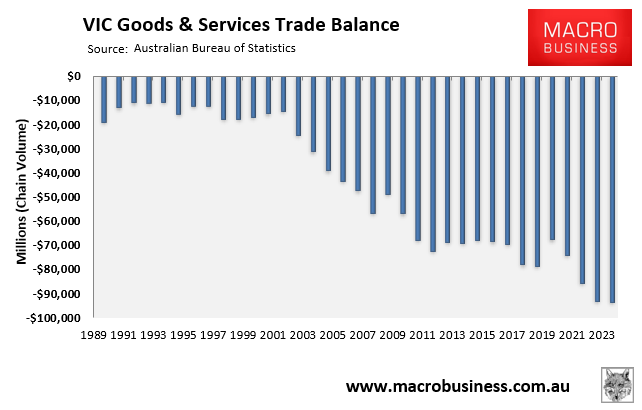

Evidence of this false economy is found in Victoria’s trade performance.

Exports have recorded slow growth over the past 20 years, whereas imports have doubled.

Accordingly, the state’s trade deficit has blown out to a whopping $92.9 billion in the year to June 2024:

Victoria (read Melbourne) is essentially sucking financial resources from mining states to fund its population Ponzi scheme and growing for the sake of growth through mass immigration and debt accumulation.

This growth model has resulted in perpetual infrastructure bottlenecks and lower living standards for incumbent residents due to rising congestion, reduced amenities, and deteriorating housing affordability.

It has also plunged the state deeper into debt as it frantically tries to build its way out of the never-ending population crush.

Now some commentators are calling for a federal government rescue package to relieve Victoria of its crushing debt load.

Australian Industry Group boss Innes Willox said, “The sense of despair from businesses is palpable. It is becoming more likely that Victoria will need some form of federal assistance to pay its way. The state is now clearly the sick economy of Australia, needing intervention to help it return to health”.

Victorian Auditor-General Andrew Greaves added that the “prolonged operating losses and ongoing fiscal cash deficits are not financially sustainable, largely because they lead to higher debt levels than otherwise and indicate underlying structural risks”.

“If these issues continue, it could pressure Victoria’s AA credit rating”, noted S&P Global Ratings analyst Anthony Walker.

Victoria’s problems will eventually become Australia’s problems.