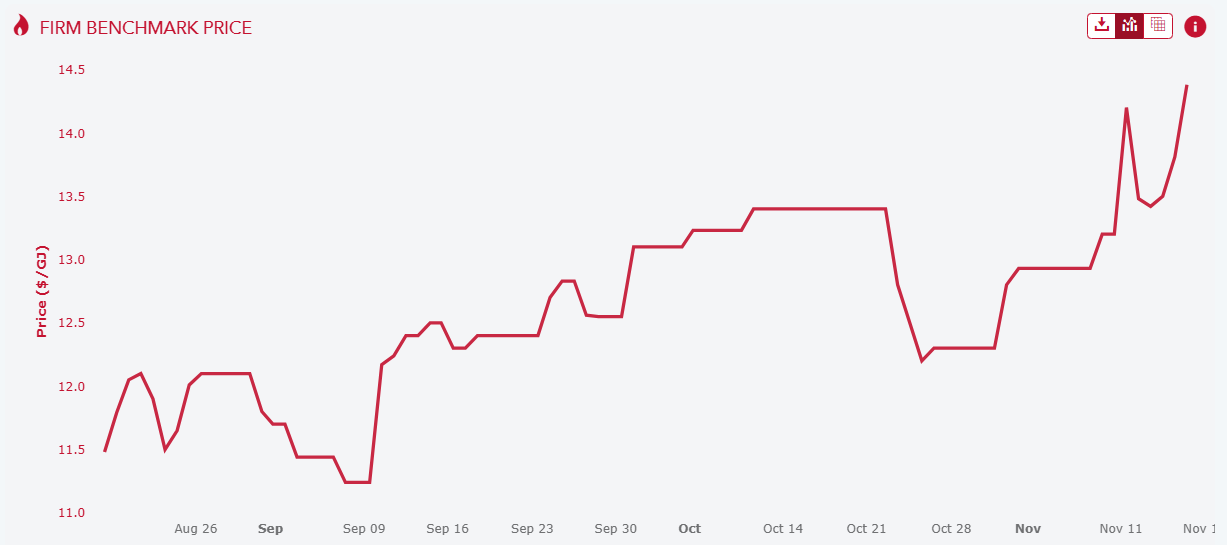

The East Coast gas cartel is busy unleashing a new price shock as nobody watches.

We are in off-peak season and these prices are far above where they should be, let alone rising instead of falling.

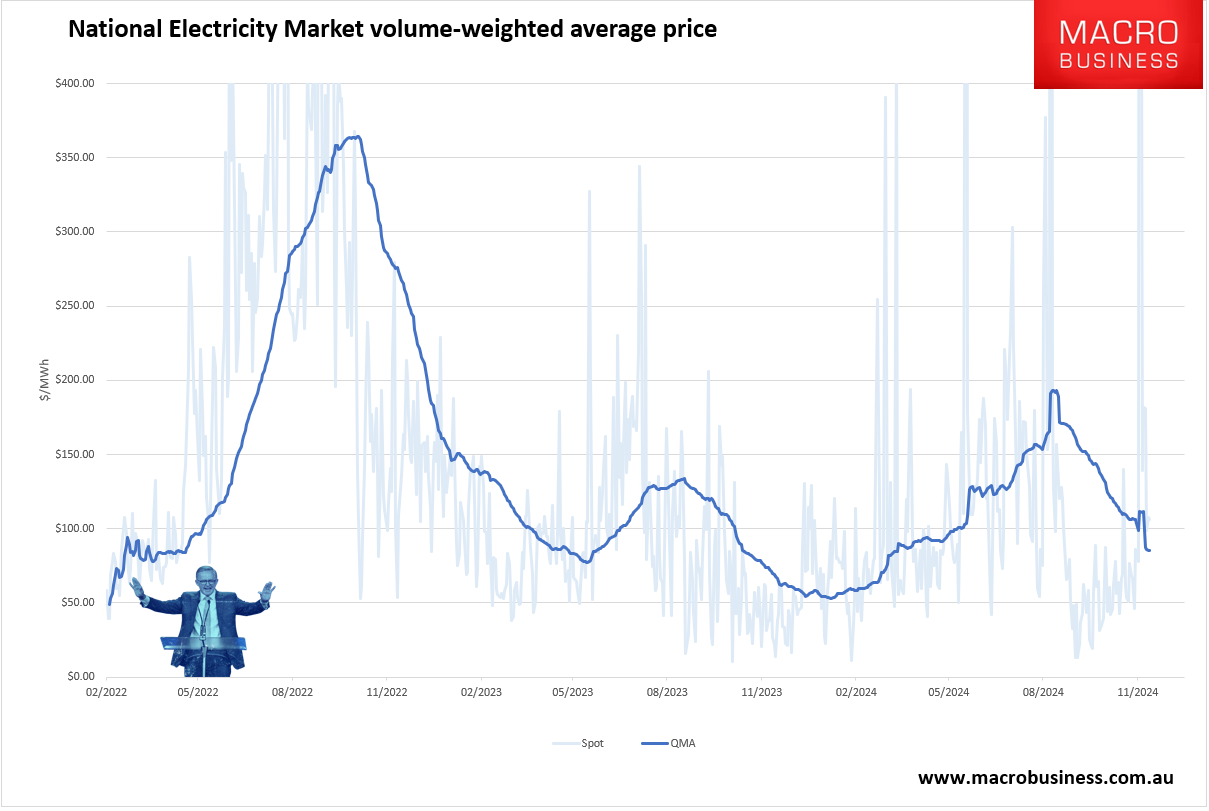

As a result, NEM prices are 10% above last year and the price falls have called out on spot with the QMA not far behind.

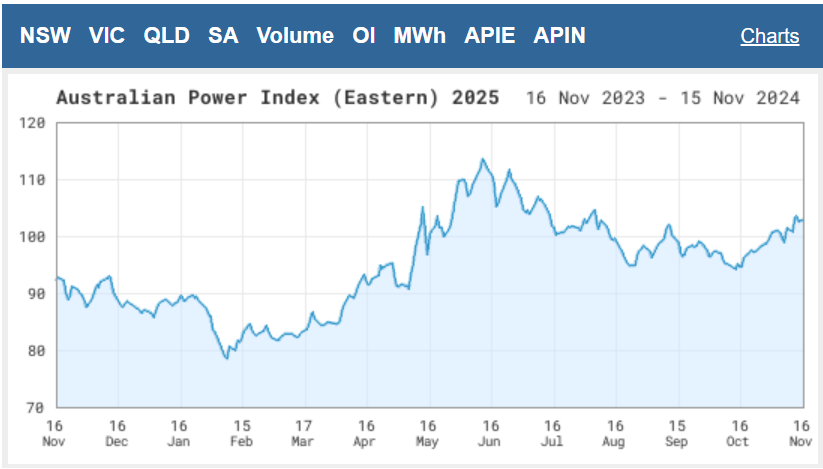

Power futures are likewise piling it on year on year.

Power futures are likewise piling it on year on year.

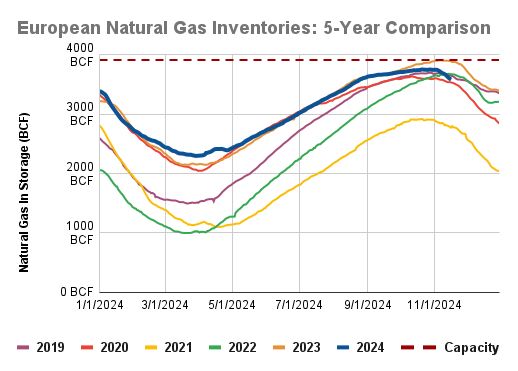

There is no local reason for this. It is all about fears of European shortages if transfer agreements fail. Inventories are OK so far but drawing fast.

This is spilling over into Asian prices.

Albo’s $12Gj gas price cap has been acting as a price floor all year, from which a new shock is beginning to launch.

The odds are rising that when the AER determines retail bills in March 2025, it will drop another bill shock on everybody.

Energy rebates aren’t going to shrink; they will grow.

Why nobody even talks about the gas cartel menace is beyond my understanding.