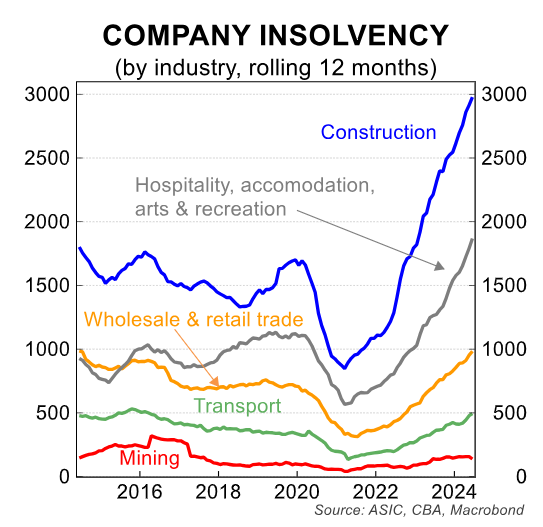

Last financial year, a record 3,000 construction firms in Australia were declared bankrupt (insolvent).

At the end of the financial year, Gayle Dickerson from KPMG warned that insolvencies probably had not peaked.

“We haven’t hit the peak yet and how long until we do remains a question, which will be driven by broad economic circumstances”, she said.

CreditorWatch CEO Patrick Coghlan predicted that insolvency records would continue to be set each month for the remainder of 2024.

“It’s hard to find an industry that hasn’t been significantly affected. You’ve got reduced discretionary spend, you’ve got inflation, which has pushed up all of their input costs. A lot of industries will struggle to increase their pricing to levels that make them profitable”, he said.

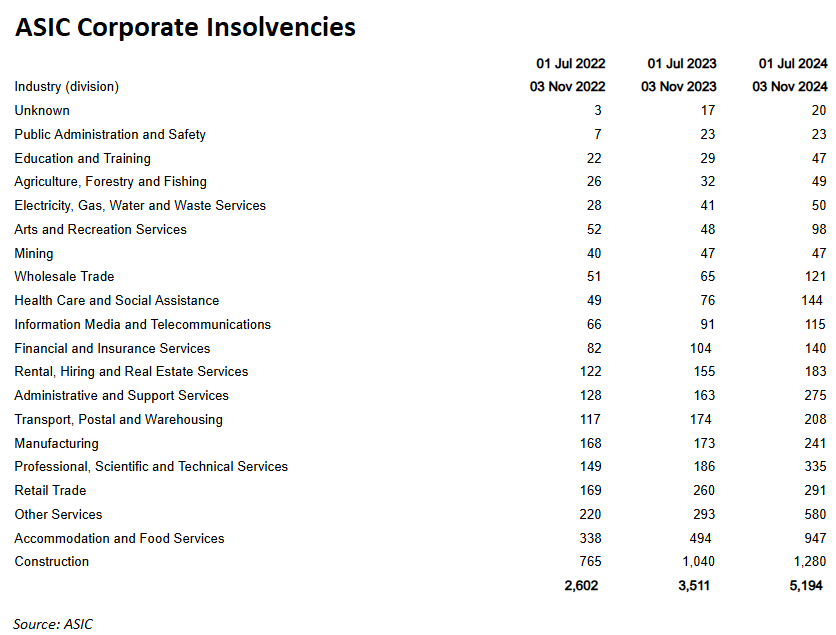

Their predictions have proven prophetic, with new data from the Australian Securities and Investments Commission (ASIC) showing strong growth in insolvencies in the financial year to 1 November.

A total of 5,194 firms were declared insolvent in the first four months of the year, an increase of 1,683 (48%) on the same period last year.

The construction sector has led the way, with 1,280 firms declared insolvent, an increase of 23% on the same period last year.

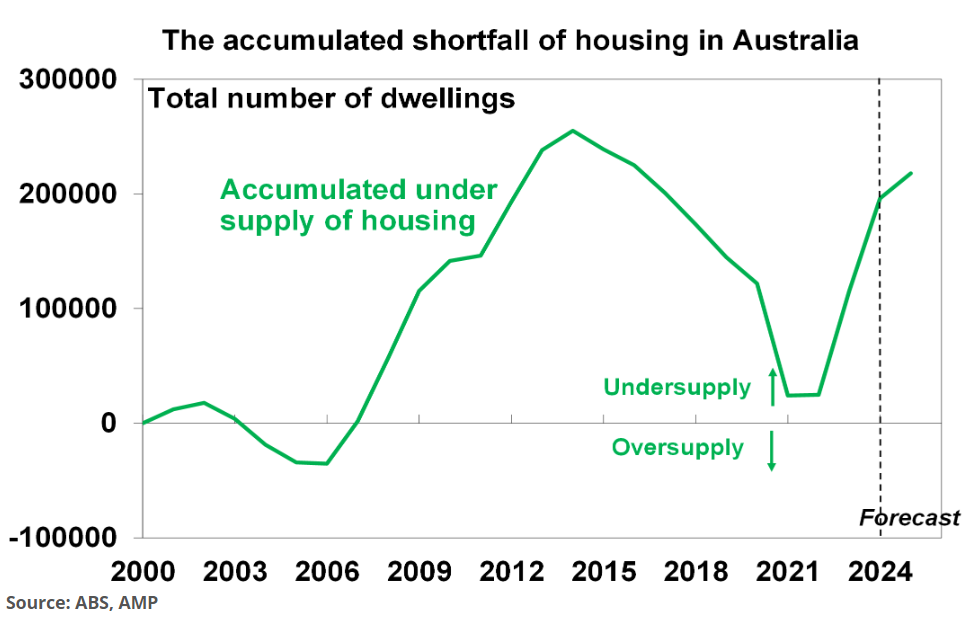

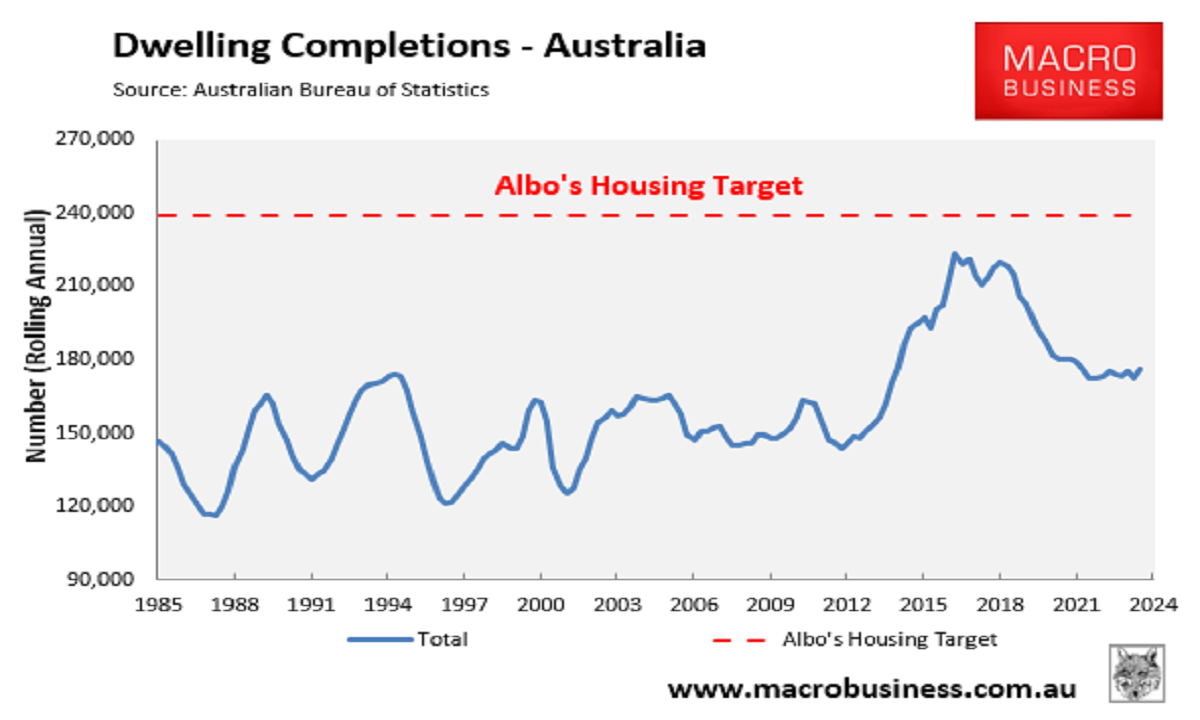

The large number of construction insolvencies adds another impediment to the Albanese government’s goal of building 1.2 million homes in five years—a level of construction that Australia has never reached.

When combined with structurally higher construction costs and interest rates, as well as labour shortages, capacity across the homebuilding sector has been significantly reduced.

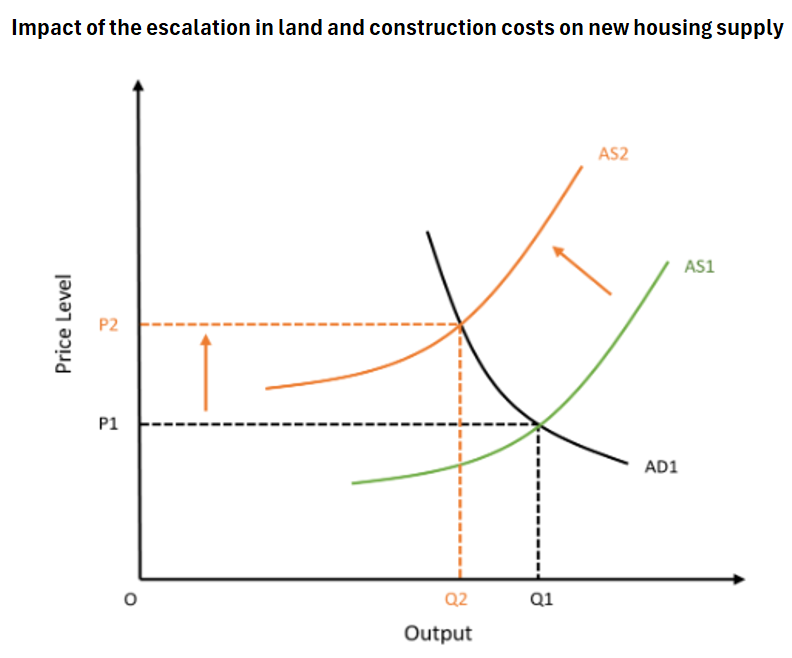

In basic economic terms, the supply curve for housing construction has shifted to the left, reducing the quantity that can be built at each price point.

The federal government needs to dramatically cut demand via lower immigration to restore balance to the market.

Otherwise, Australia’s housing shortage will continue to grow.