Chanticleer’s advice is a great contrarian port of call.

Economist calls for the Reserve Bank of Australia to cut the cash rate early next year are dropping like flies. Even the ones left in the February 2025 camp are warning their calls may be too early (again).

RBC Capital Markets’ Su-Lin Ong pushed her rate cut forecasts back to May from February over the weekend. NAB did it last week, while UBS’ George Tharenou capitulated on November 5. ANZ and Citi’s economics teams stuck with February but warned the risks of delay were rising as of last week. HSBC, already aiming for “second quarter”, worried the RBA may be unable to cut rates at all.

It is one-way traffic to higher-for-longer.

Not, it isn’t. Smarter outfits are asking why wage growth is so weak when unemployment is so low.

All recent inflation reports—headline inflation, wage growth, and leading indicators like the MI gauge and NAB survey—have been softer than the RBA outlook.

Sure, employment has been stronger than most expected, but how is that an inflation issue if wage growth is falling so sharply?

The mistake economists make is that they watch the RBA or its models rather than the economy and where it diverges from the models.

As discussed previously, the key error is missing the impact of mass immigration, which is disinflationary over the long run because weak wages outweigh firmer rental growth as an inflation input.

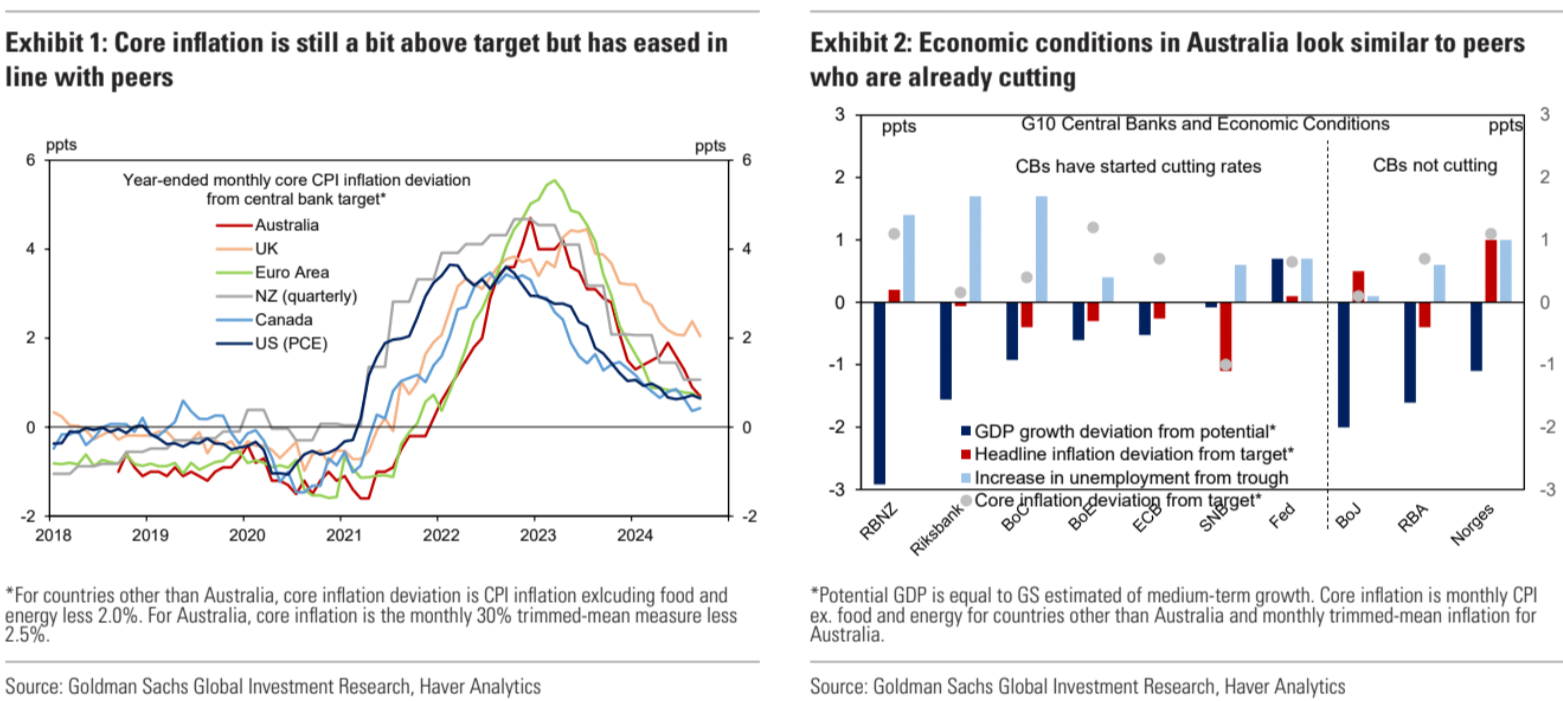

The RBA should already be cutting rates based on the economy being as disinflationary as everywhere else, with a worse outlook owing to weaker-than-most wage growth.

Ross Gittins wirtes one of his occasional useful pieces today.

I think the Reserve’s reluctance to cut is driven by its (undisclosed) calculation that the NAIRU is well above 4.1 per cent. But earlier this month, Treasury secretary Dr Steven Kennedy told a parliamentary committee that, though such calculations are “uncertain”, Treasury estimates that the NAIRU is “around 4.25 per cent, close to the current rate of unemployment.”.

The NAIRU is more like 3% and maybe lower with mass immigration off the chart, smashing productivity, wages and inflation all in one fell swoop.

Instead of reading the tea leaves of a politically correct central bank, economists should be asking why the economy is not reacting as it expected.

The RBA is risking an inflation undershoot, not an overshoot.