The energy superidiot had better brace.

“That’s the near-term dynamic, given this vulnerability of Europe, the lack of spare capacity, the loss of the residual Russian volumes currently going through Ukraine, and I should say, a colder than average start of the winter,” said Samantha Dart, co-head of global commodities research at Goldman Sachs.

There will also be delays in the upcoming LNG supply projects across the Americas, so Europe and Asia will have access to less LNG next year than originally expected, added Dart.

Residual Russian gas flows going through Ukraine are also scheduled to stop after the current transit deal expires at year-end.

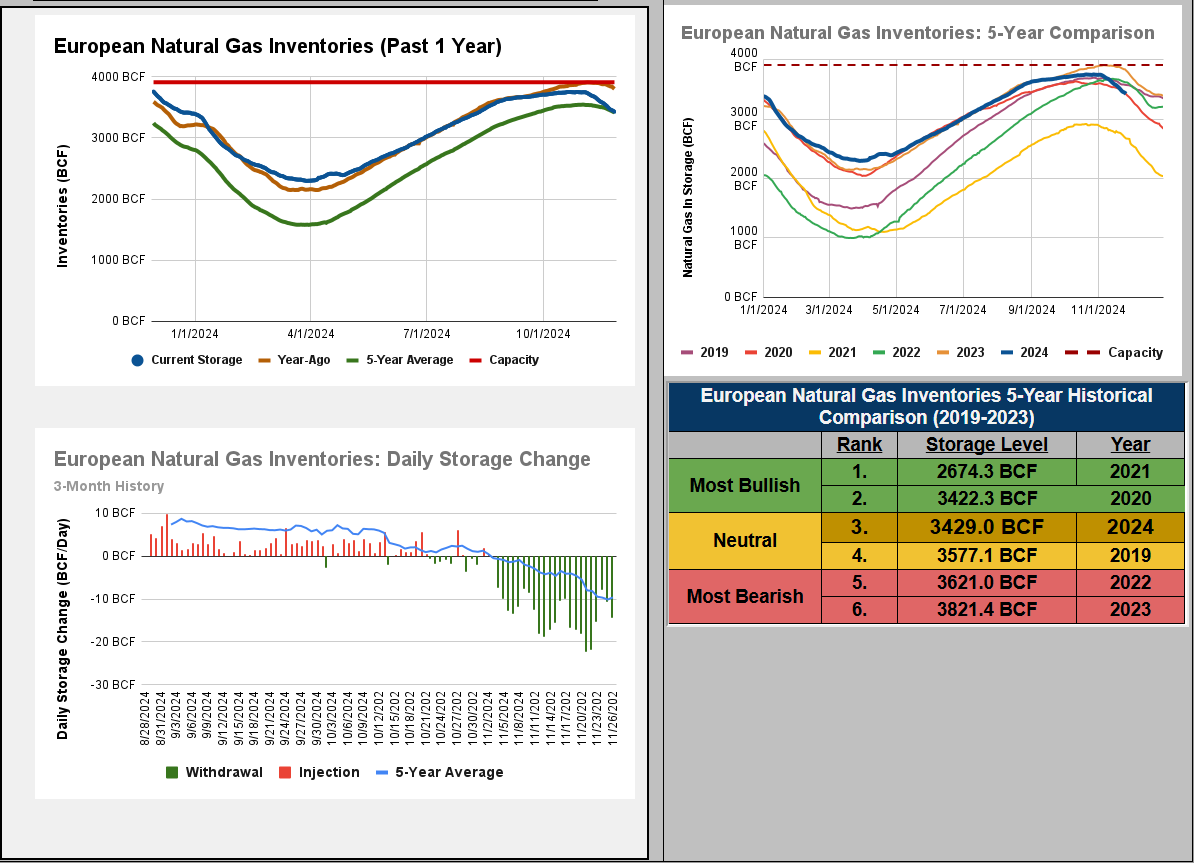

“Europe is going to start next summer a lot tighter than this past summer.”

“All the LNG that Asia needs to buy to fill this deficit comes from the Atlantic basin, so Asia prices have to compete with European natural gas prices…if Europe is tight, then Asia LNG prices will be elevated as well.”

The East Coast gas cartel has only partly brought the shock home so far. The rest is coming.

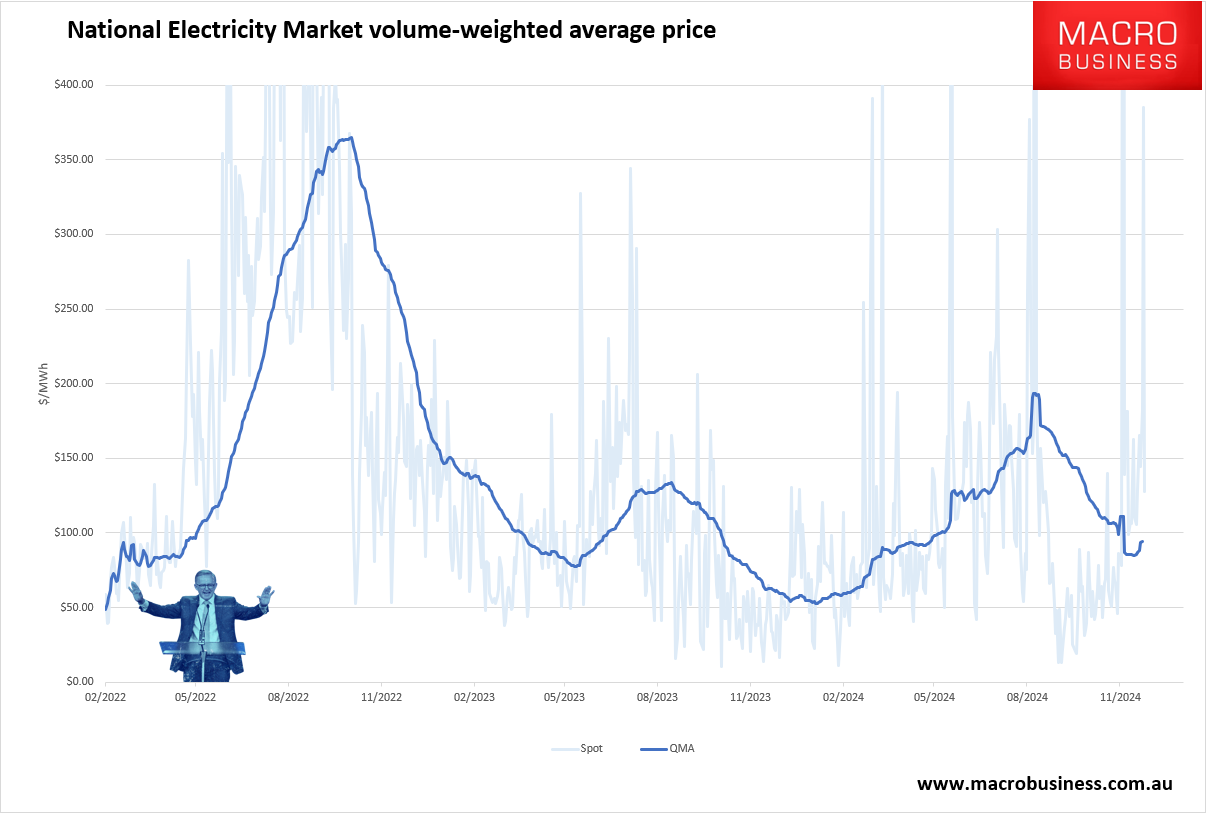

As a result, shoulder-season electricity prices have already bottomed 60% above last year.

The shock will be repeated over and over.

The problem of course is that supplies of natural gas earmarked for domestic use are declining, a fact the AEMO has acknowledged though EnergyQuest thinks things are worst then officially forecasted.

In a recent report, the energy consultancy said the east coast would experience shortages from 2026, calculating that there was only enough gas to meet 70% of NSW and ACT’s needs in the winters of 2026, 2027 and 2028.

Matters aren’t any better for Victoria, which has been reliant on ageing oil and gas fields off its coast, with EnergyQuest saying the state would need to source 32% of its gas from LNG imports from winter 2028.

Not great news for consumers as it will expose them to more expensive LNG export pricing but music to the ears of Andrew Forrest’s Squadron Energy, whose Port Kembla LNG import terminal near Wollongong is nearing completion.

If we install LNG imports as a solution, the local price would be…wait for it…$23Gj, 50% higher than it is today.

If we step back for a moment, we can see a very nasty death spiral forming.

Rolling energy inflation shocks for the next three years collide with iron ore collapses to form an external crisis that crunches the budget, monetary policy, and currency all at once.

This will be the end of the great Australian housing bubble.

The only rational answer is domestic reservation or export levies applied to the East Coast gas cartel.

Anything else, the national economy dies.