The absolute madness of Australian energy policy is about to mug the Albanese government again.

Its failure to tackle head on the East Coast gas cartel has left Australia exposed to any and every gas shock worldwide.

And another is underway. Bloomberg has more.

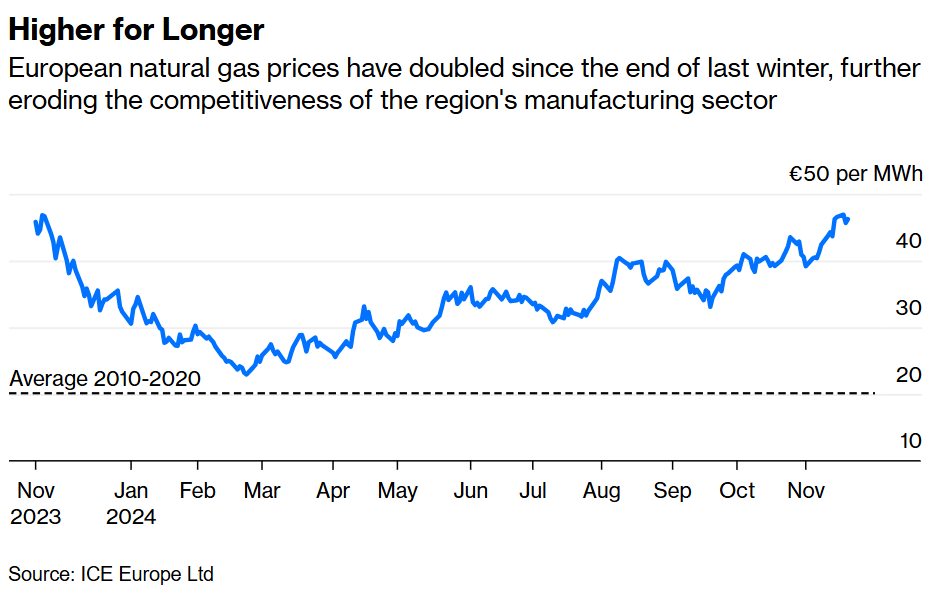

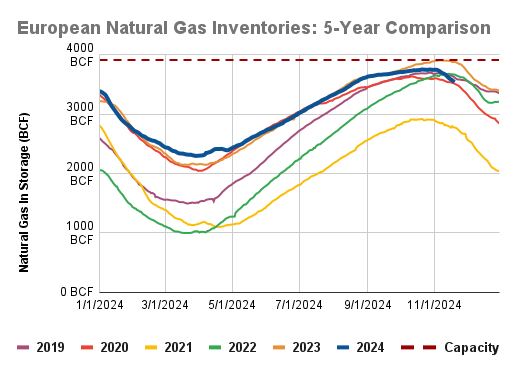

The luck has run out. The weather has turned cold, calm and dry. The Germans have a word for it: dunkelflaute—a period of windless and cloudy weather that results in little renewable production. Europe suffered a long dunkelflaute in early November, and another is likely next week. And Asia is importing more LNG, pushing up prices. In turn, Europe has been buying about a fifth less LNG than it did during the last two years. The result? Europe is dipping heavily into its gas storage. During the first two weeks of November, gas withdrawals from inventories were the second largest for that period in data since 2010. On current trends, storage levels in November will see their largest drop since 2016 for that month, double the fall seen in both 2022 and 2023.

Last winter, the season ended with storage at 60% full; the previous year, the figure was 55%. It’s very early days, but on current trends, a typical winter would leave inventories in spring 2025 at just under 50%. A cold winter would reduce them to as little as 35%-45%. Whatever the outcome, one thing is clear: Europe will have to buy a lot of gas next spring and summer to rebuild its buffer ahead of the 2025-2026 winter.

That’s the reason why European gas prices from April 2025 to October 2025, typically the shoulder demand season which sees cheaper gas, are trading at unusually elevated levels compared to the November 2025 to March 2026 period. For consumers, the trend in the wholesale market means higher-for-longer retail prices.

It is also Australia’s best off-season for gas prices. Prices should be falling now and bottoming out later in the European winter. Instead, they have already bottomed out, roughly 400% higher than is typical.

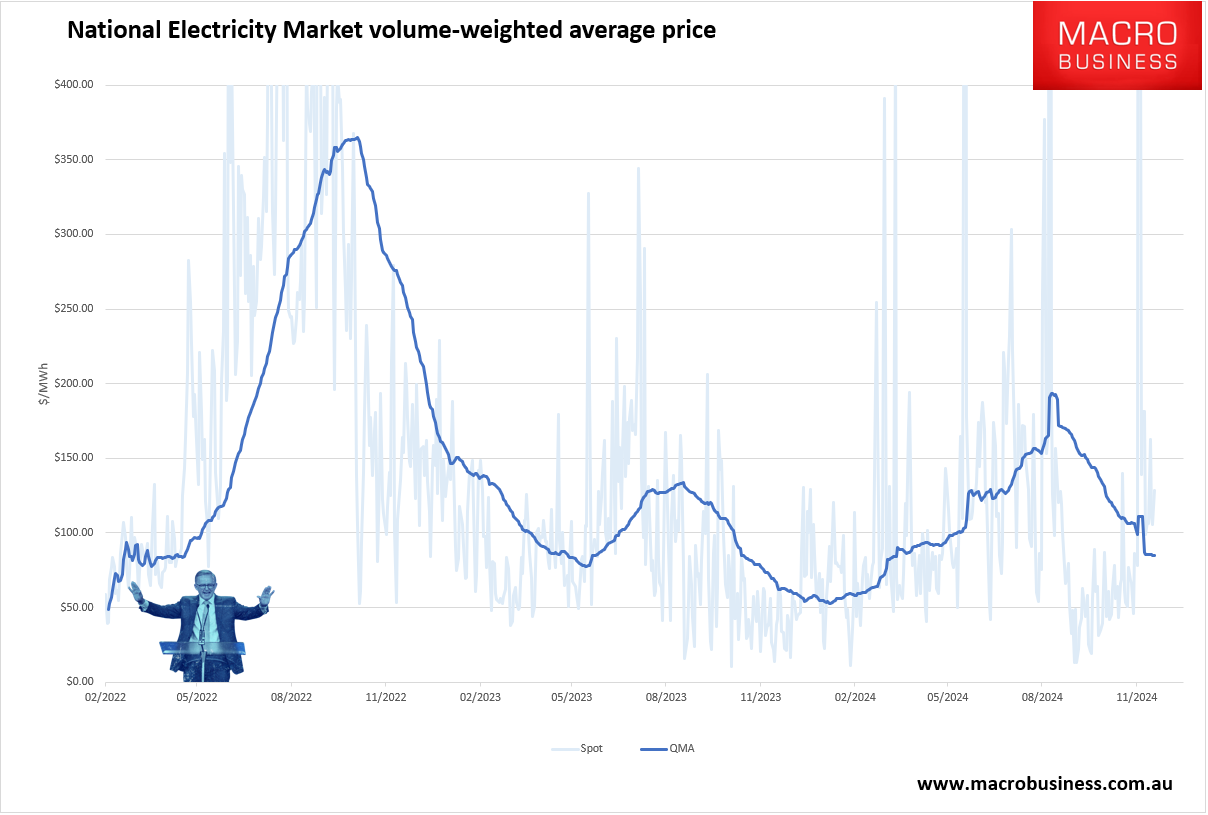

Of course, because gas-fired power is the marginal price setter in the National Electricity Market, power prices are doing the same.

Futures prices are up 20% year-on-year and it is getting worse fast.

These are all the price signals that the AER uses when setting the year-ahead pricing benchmarks in March each year.

Unless something changes, there will be a new round of bill shocks in July 2025.

Australia’s energy winter now runs 365 days per year and will keep doing so until somebody grows a pair and breaks the East Coast gas cartel with domestic reservation or export levies.