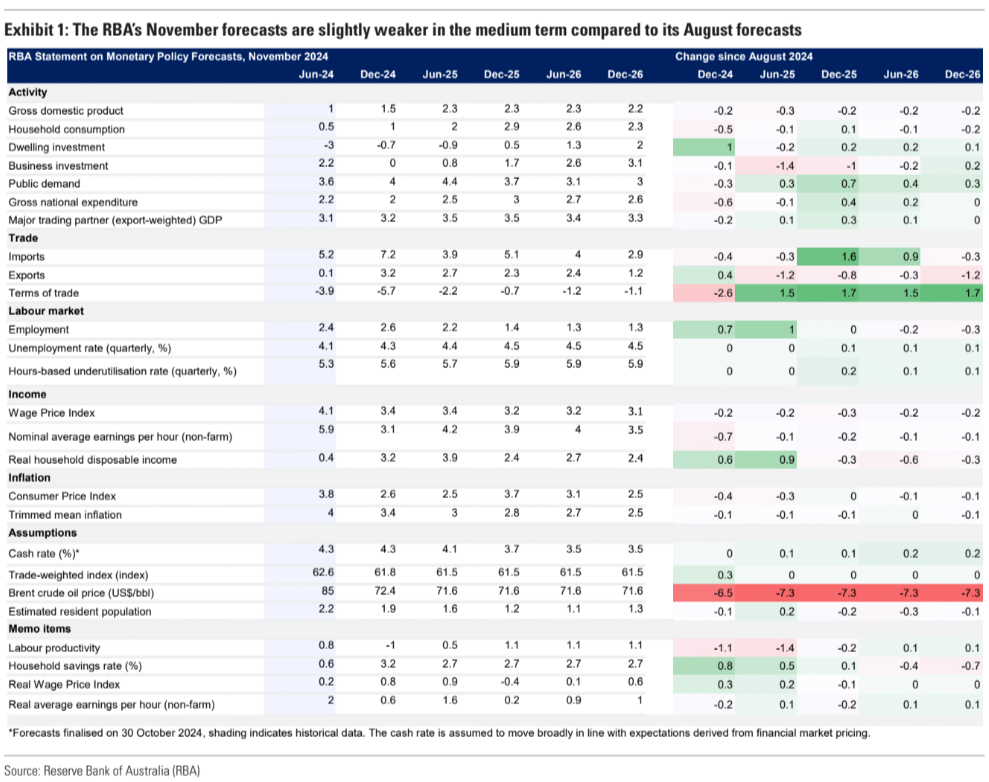

The RBA was firmly neutral yesterday, but it cut its outlook for growth, wages, inflation, and real household disposable income materially.

In fact, just about the only measure it increased was public spending leading to better jobs.

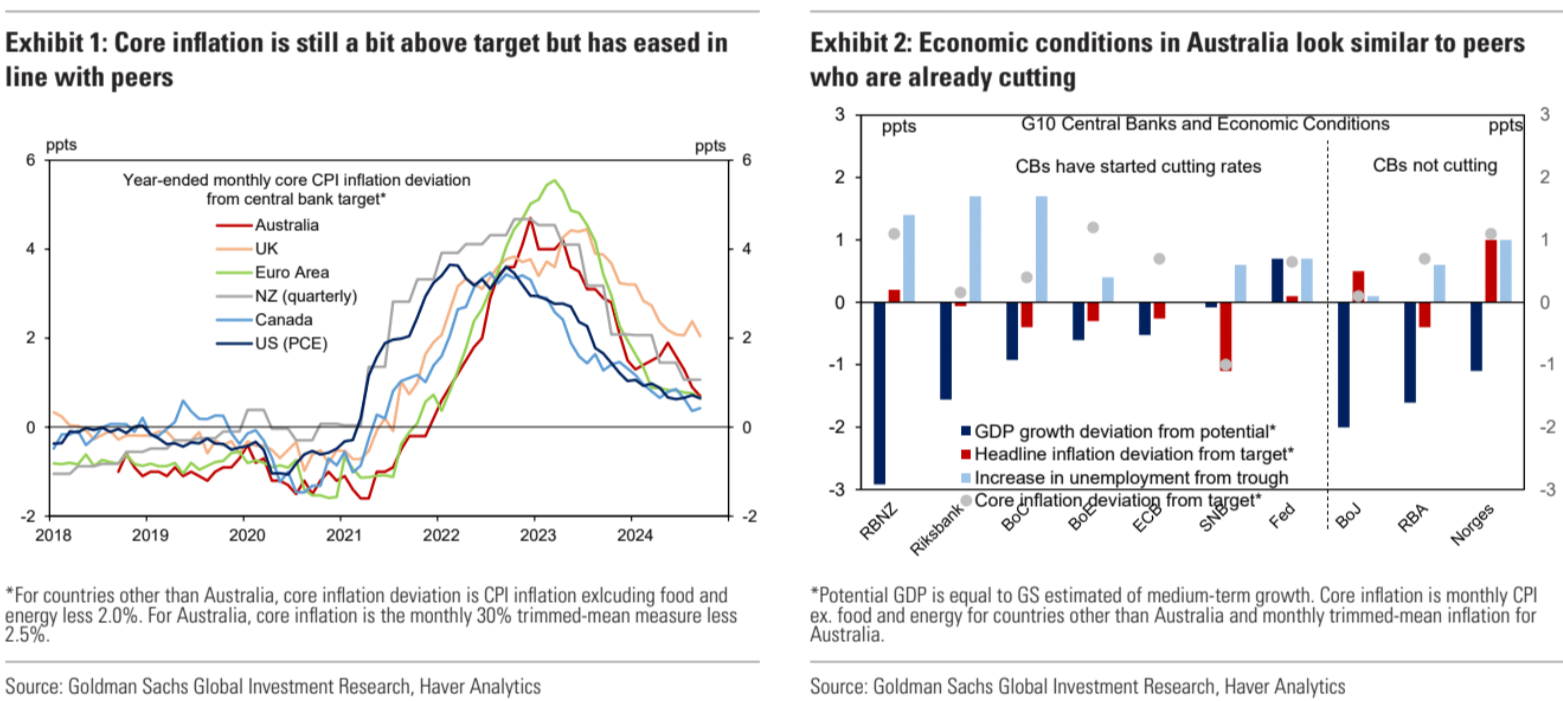

However, this is clearly a zombie economy operating without dynamism and far below potential, equal in weakness to many other developed markets already easing interest rates.

Andrew Boak at Goldman with the chart:

The RBA is only refusing to cut because it is making political judgments about the temporary nature of energy rebates, arguably outside of its charter.

Moving into an election year, the great likelihood is that the rebates will be renewed, and both headline and trimmed mean inflation undershoot the RBA’s outlook.

Australia has some sticky services inflation but worrying about that as everything else collapses is pretty stupid.

Especially when that service inflation will come down with wage growth anyway, and worrying about wages in Australia is ridiculous given it is a labour-supply-led immigration economy.

The evil RBA is pointlessly torturing households.